The altcoin LUNA has fallen in value by 99.9 per cent. How is it planned to be saved, and is it realistic?

Terraform Labs CEO Do Kwon is ready to continue “fighting” to normalise the performance of its algorithmic stablecoin UST. Over the past few days, the altcoin LUNA and the TerraUSD (UST) stablcoin have suffered a crushing drop – the value of both assets has plummeted to near zero. All due to the collapse of UST’s parity to $1, meaning that the stablcoin simply stopped fulfilling its primary function. Against this backdrop, the project faced criticism and outright hatred from investors, who lost huge amounts of money. However, the coin’s developers believe it can be saved. Here are the details.

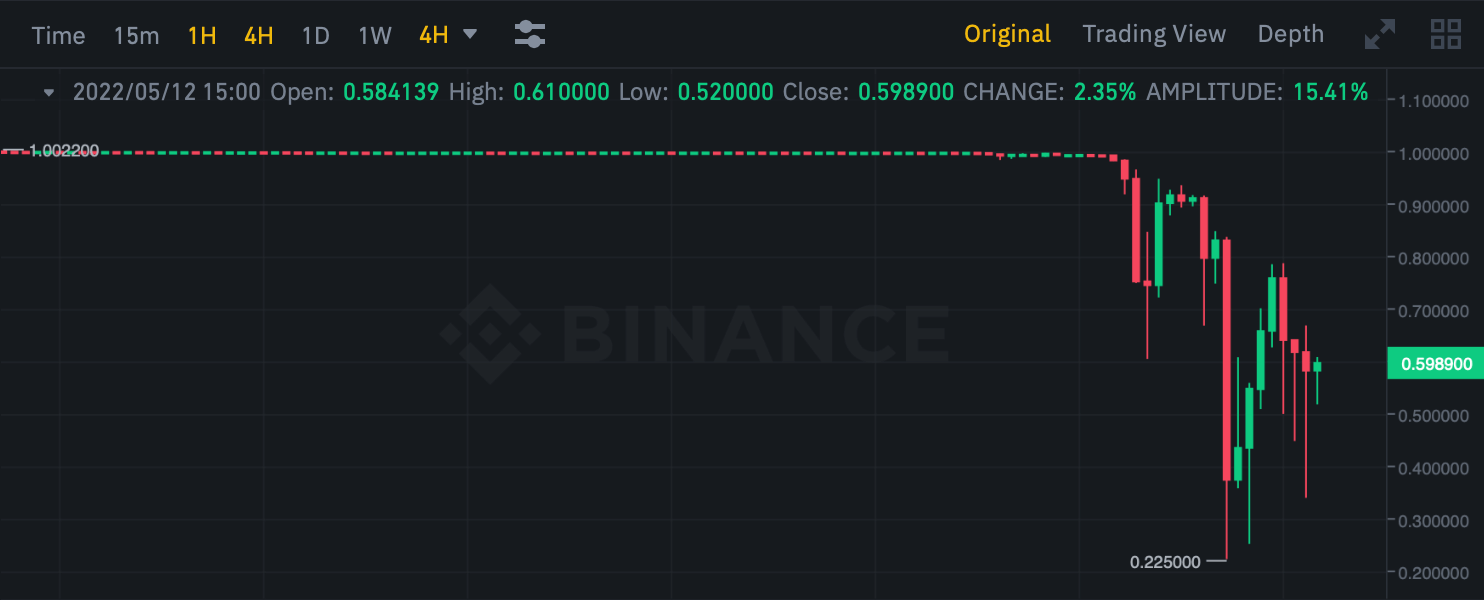

We’ve clarified the latest data: today Luna is trading at 2-3 cents, and not so long ago the coin was trading at around a hundred dollars. Here’s the four-hour chart.

Four-hour chart of the LUNA exchange rate

UST is lagging behind the required $1 level by almost a factor of two. Here’s his rate.

The four-hour chart of the UST exchange rate

We tell you about what is happening and the project management’s plans to save it.

This is interesting: How investors can best protect themselves against inflation

Why did UST and LUNA fall?

UST is the most popular algorithmic stablecoin at the moment. It theoretically maintains its peg to the dollar with an algorithm that encourages traders to “hold” the UST price around $1 with trades. To maintain its peg to the dollar, the entire system relies on traders burning or creating tokens for profit. This process is done by pairing UST with the cryptocurrency Luna.

Every time a UST token is mined, the equivalent of $1 in LUNA is burned - and vice versa. Therefore, when the price of UST falls below $1, traders are encouraged to burn USTs, or withdraw them from circulation, and receive LUNA tokens at a reduced rate. If the UST price exceeds $1, traders have an incentive to burn LUNA in exchange for an equivalent in UST, which increases its supply and theoretically eventually brings the price down to the same one dollar. That's how it worked until recently.

On Saturday the UST lost its peg to the US dollar and on Monday the situation became disastrous. As of today, the stabelcoin is 46 cents behind its peg, meaning it is trading at 54 cents instead of $1. Many experts agreed that the root of the problem lay in the Anchor Protocol, which saw UST deposits shrink from $14 billion to $11.2 billion over the weekend.

Anchor Protocol is a savings and cryptocurrency platform built on Terra Blockchain.

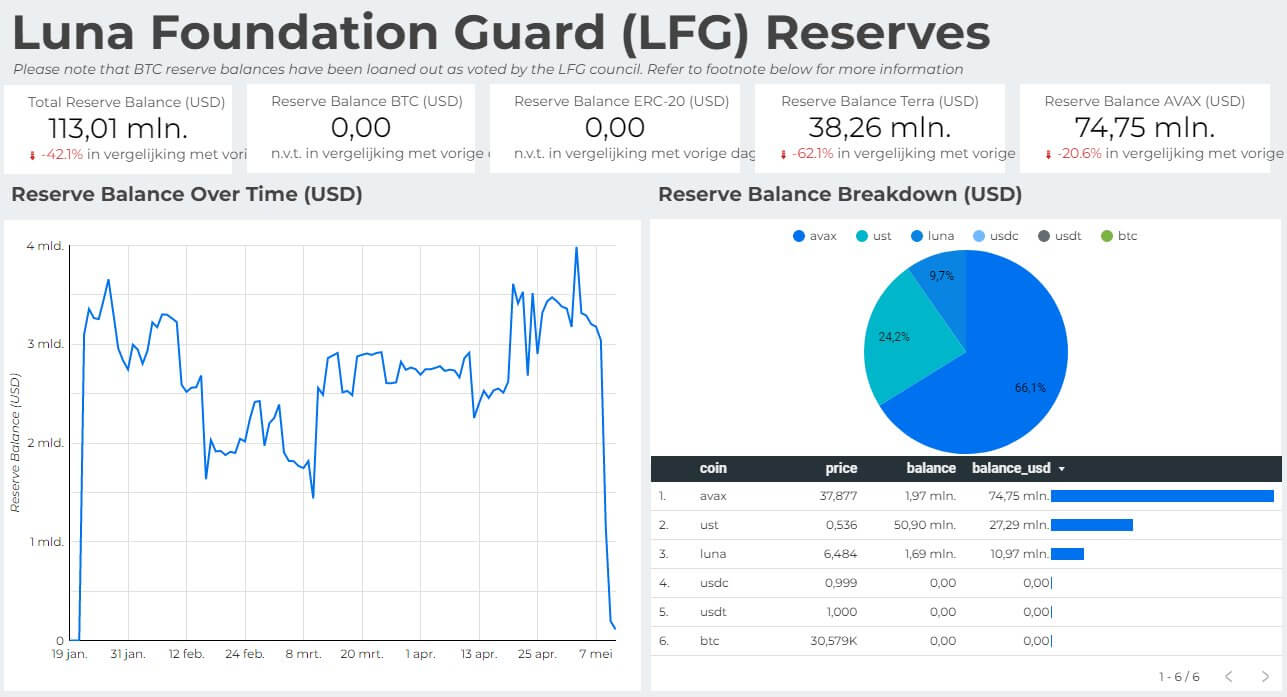

Falling reserves to secure UST

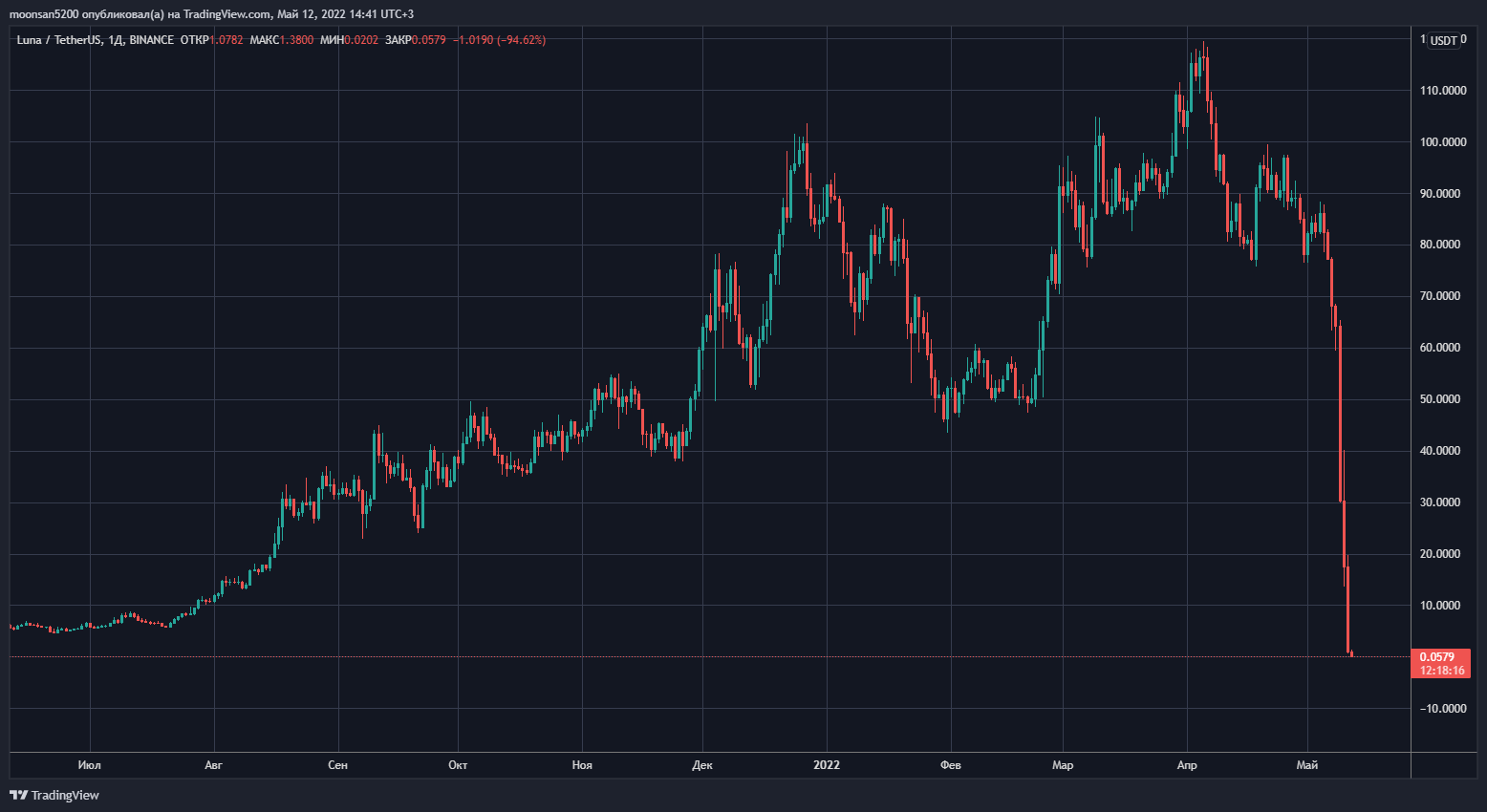

UST’s heavy reliance on Anchor has previously drawn criticism in the cryptocurrency community, as Anchor’s returns could well be inflated by sponsors, including Do Kwon himself. As UST Stablecoin has fallen, the price of LUNA has also fallen with it, according to Cointelegraph. As a result, large UST outflows from DeFi platforms led to LUNA falling 99.9 percent from its all-time high point.

LUNA’s fall chart as a horror story for every trader

Not only LUNA suffered: the altcoin Avalanche (AVAX) also fell by almost 30 percent in value in a very short time.

AVAX chart

According to Cointelegraph’s sources, it’s all about the fact that AVAX is part of a pool of assets to back up UST. In other words, investors are wary of massive sales of the cryptocurrency by Terra representatives, who will need liquidity to bail out their own project.

What will happen to UST?

Terraform Labs’ solution is to increase the UST issue to $1,200 million. By the way, there is another interesting point here: Do Kwon for some reason wrote the amount in this very strange format, not as 1.2 billion. Many people thought he was trying to “smooth over” the panic.

So here is how Kwon himself explained the problem on his Twitter account.

Overview of the current situation: UST is currently trading at 50 cents, which is a significant deviation from the planned peg of 1 dollar. The price stabilisation mechanism is absorbing UST’s supply – more than 10 per cent of the total supply – but the cost of simultaneously absorbing so many coins has stretched the exchange spread in the blockchain to 40 per cent, and the Luna price has fallen sharply. That is, the arbitrage process essentially came to a halt.

5/ The price stabilization mechanism is absorbing UST supply (over 10% of total supply), but the cost of absorbing so many stablecoins at the same time has stretched out the on-chain swap spread to 40%, and Luna price has diminished dramatically absorbing the arbs.

– Do Kwon 🌕 (@stablekwon) May 11, 2022

This means that Do Kwon's team will release almost four times as many USTs in order to offset all the costs of commissions on the blockchain and streamline the process of pegging the stabelcoin. In addition, the developers plan to add coin collateral, essentially abandoning the stabilisation algorithm. Accordingly, the entire scheme outlined above could well be considered a failure. Unfortunately, the cost of the experiment was a huge loss for investors.

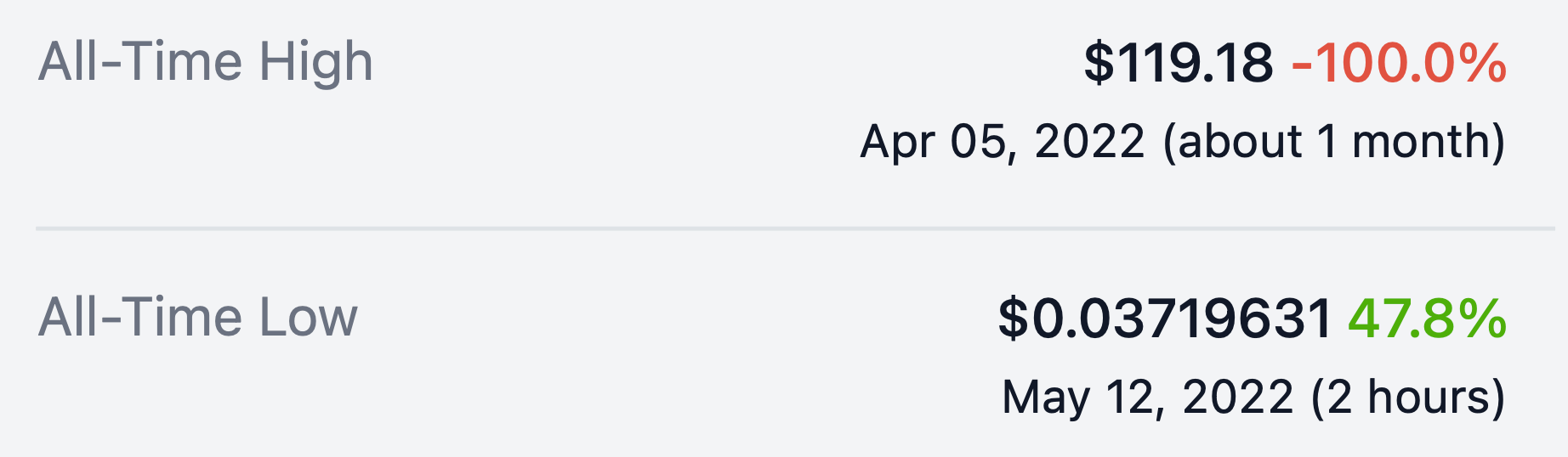

And the losses are definitely big. Luna itself set the record at $119 at the beginning of April – that is, very recently. Obviously, such a fresh haip has caused some investors to enter the position late and not have time to get out of there.

The highs and lows of the LUNA exchange rate

Will it all come to fruition? Do Kwon has no doubts about his strategy: according to him, LUNA’s return to the pedestal of high-capitalisation altcoins will be a historic event for the entire industry. However, members of the blockchain community do not seem as optimistic. They believe that the project has simply lost its reputation and fans. So even if UST magically rises to the dollar and gains a foothold there, investors will be trivialized by fear of messing with Do Kwon’s product. And it is absolutely easy to understand them.

We think the prospects for a bailout of the two Terra tokens are simply negligible. Obviously, the market can recover and show growth, but the company's reputation is unlikely to be saved. Still, price collapses by leaps and bounds are something investors and traders remember for life. And that is exactly the situation here.

Follow the development of the situation in our millionaires’ cryptochat. Many other developments from the blockchain world are discussed there as well.