Will the collapse of the cryptocurrency market bring down the economy? Goldman Sachs analysts’ version

The US economy will not suffer from the collapse of the crypto market, a statement made by investment bank Goldman Sachs in its latest report the day before. According to them, the decline in the value of digital assets has very little correlation with American household capital, so neither the government nor average Americans will feel any economic deterioration from Bitcoin problems. Of course, this is only true for those who don’t invest in crypto “big time”. We will discuss the analysts’ point of view in more detail.

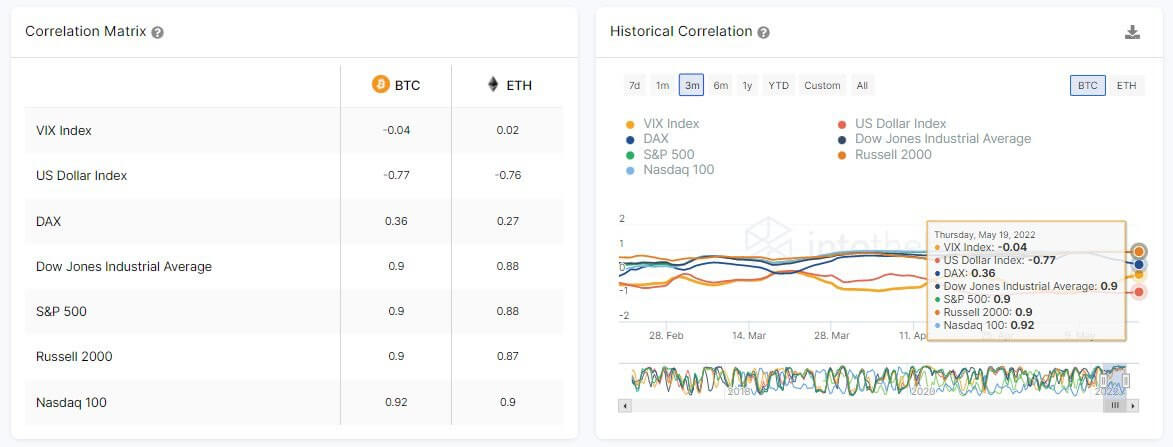

It should be noted that the correlation between digital assets and traditional markets remains extremely high. In particular, as we learned late last week, Bitcoin and Etherium continue to be very dependent assets on equities and other components of the traditional economy. Specifically, the 30-day correlation between BTC and the S&P500 index is 0.9 out of 1 – which is extremely high. The correlation with the Nasdaq 100 is 0.92.

Bitcoin and Etherium correlation figures from traditional markets

At the moment, this at least means that digital assets cannot claim to be a safe haven for the time being. That is, in case of a collapse in the global economy, Bitcoin itself might go down with the rest of the markets, even though it has shown good results in the past when other niches stagnated.

What happens if Bitcoin collapses

Since the beginning of this year, the crypto market has experienced a rather painful fall. This morning, Bitcoin’s price is balancing around $30,000 – roughly 55 percent below the cryptocurrency’s all-time high set in November 2021. The fall in coin prices has only intensified over the past couple of weeks due to the collapse of the Project Terra ecosystem, whose capitalisation was in the tens of billions of dollars.

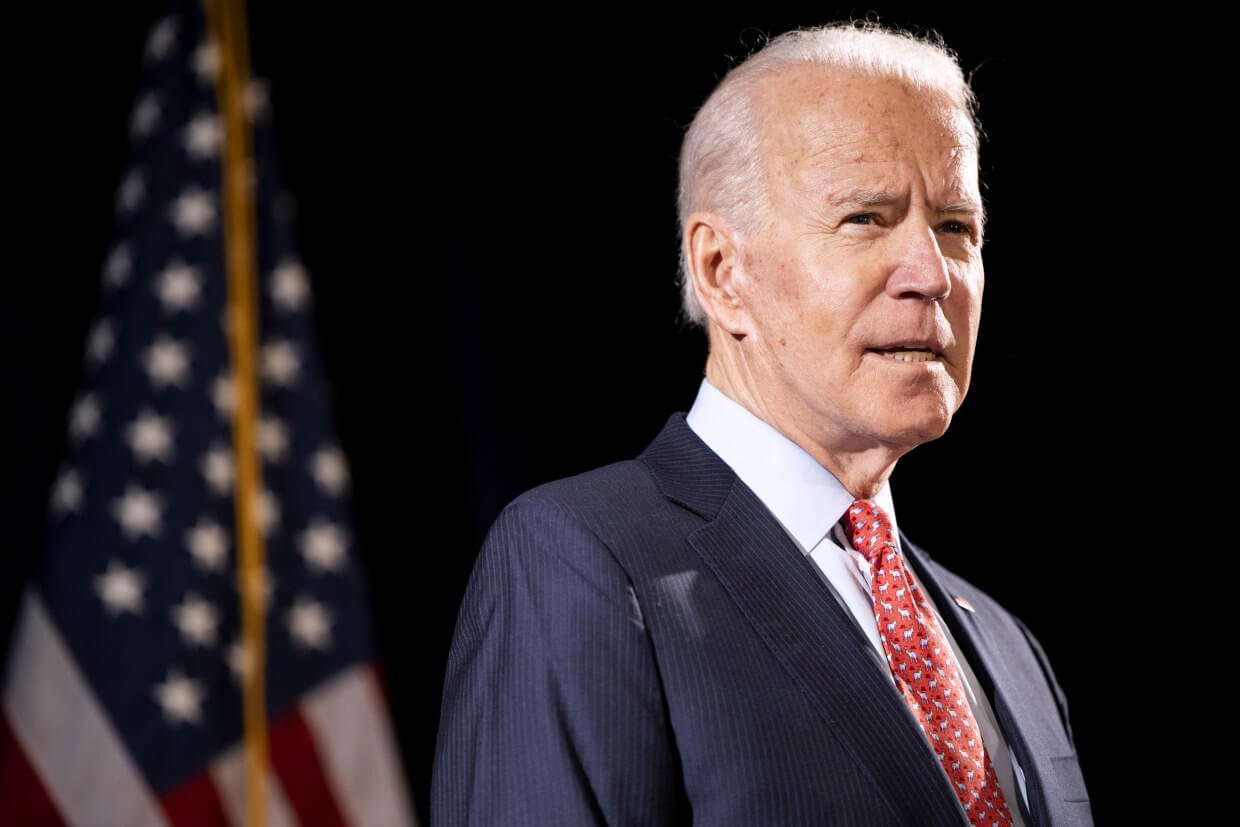

US President Joe Biden

However, Americans should not worry about this – “the fire will not spread” to the state’s economy, experts say.

This collapse of the crypto market has raised questions about whether it could affect other markets in the US. We estimate that US households own around one-third of the global cryptocurrency market. The recent decline in cryptocurrency market capitalisation is small compared to the total wealth of households, which was $150 trillion as of last year. Therefore, we expect any impact on economic processes to be low.

It should be noted that this view can be transferred to the global economy as a whole because of the leading position of the US, as well as the dominant role of the dollar in the world. In addition, the scale of the cryptocurrency industry remains the same and the digital asset sector becomes even less important when compared to the global economy than when compared solely to the US.

Incidentally, one of the latest triggers of the bearish trend – the now “infamous” Terra ecosystem – could well be in the crosshairs of financial regulators. According to Cointelegraph sources, Sarah Pritchard, executive director of markets at the UK Financial Conduct Authority (FCA), has said that the regulator will take the recent volatility in the crypto market into account when creating new rules for the area in 2022. Here’s her point.

This does bring to the fore important issues that exist in crypto, both in terms of a well-functioning market and, obviously, consumer protection.

In other words, the miscalculation by the developers of the Terra ecosystem, which among other things has affected the overall state of the digital asset niche, could also bring further harm to the coin sphere in the future.

FCA

It said the FCA will “absolutely take into account” the loss of parity to the dollar of stackablecoins such as TerraUSD (UST) and Tether (USDT) when drafting regulatory guidance with Her Majesty’s Treasury, to be published later this year. It is worth noting that the USDT token currently matches the value of the dollar, and the loss of parity was only short-lived amid a massive token withdrawal due to the UST collapse, i.e. a trivial panic in the market.

As a reminder, in April the UK's Department of Economy and Finance announced that it would work to include Stablecoins in the regulatory framework for digital assets, given that they could become a "widely accepted means of payment" for consumers. In addition, the government will be pushing additional initiatives related to the cryptosphere, including reviewing tax legislation for crypto-assets, as well as commissioning an NFT token for the Royal Mint and exploring decentralised technology for use in UK financial markets.

Bank representatives and crypto-asset aficionados

All in all, the Terra incident seriously undermined the credibility of stablcoins among many investors – and even more so among governments, who have never been known for their love of digital assets. After all, central banks are not the issuers of the latter, which means that the authorities simply cannot influence the issuance of coins.

We think the findings of Goldman Sachs analysts are very important and relevant. Once again, they remind us that the digital asset industry is still too tiny to have an impact on the world economy as a whole. With that in mind, all the sharp remarks about the need for strict regulation of coins and the dangers of the niche in general from many policymakers seem unwarranted at the very least.

A similar situation can be seen in the criticism of Bitcoin because of the electricity costs of its miners. Yes, they spend a lot, but on a global scale the figure is absolutely negligible. Which means that striking crypto's reputation is simply profitable for its creators.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we discuss the most incredible developments from the world of blockchain and decentralisation.