Yuga Labs has refunded money to some participants in its new NFT project. Who was compensated?

Developer studio Yuga Labs, which is behind the popular NFT collection Bored Ape Yacht Club (BAYC), has announced a “refund of gas fees” for all users whose transactions were not validated during the recent issuance of Otherdeed tokens and ended up losing money. Otherdeed itself is the rights to a virtual land in the Otherside meta-universe, which combines several well-known NFT-series at once. This way the developers tried to improve their reputation and at the same time to get rid of the criticism from the project’s users. We tell about the situation in details.

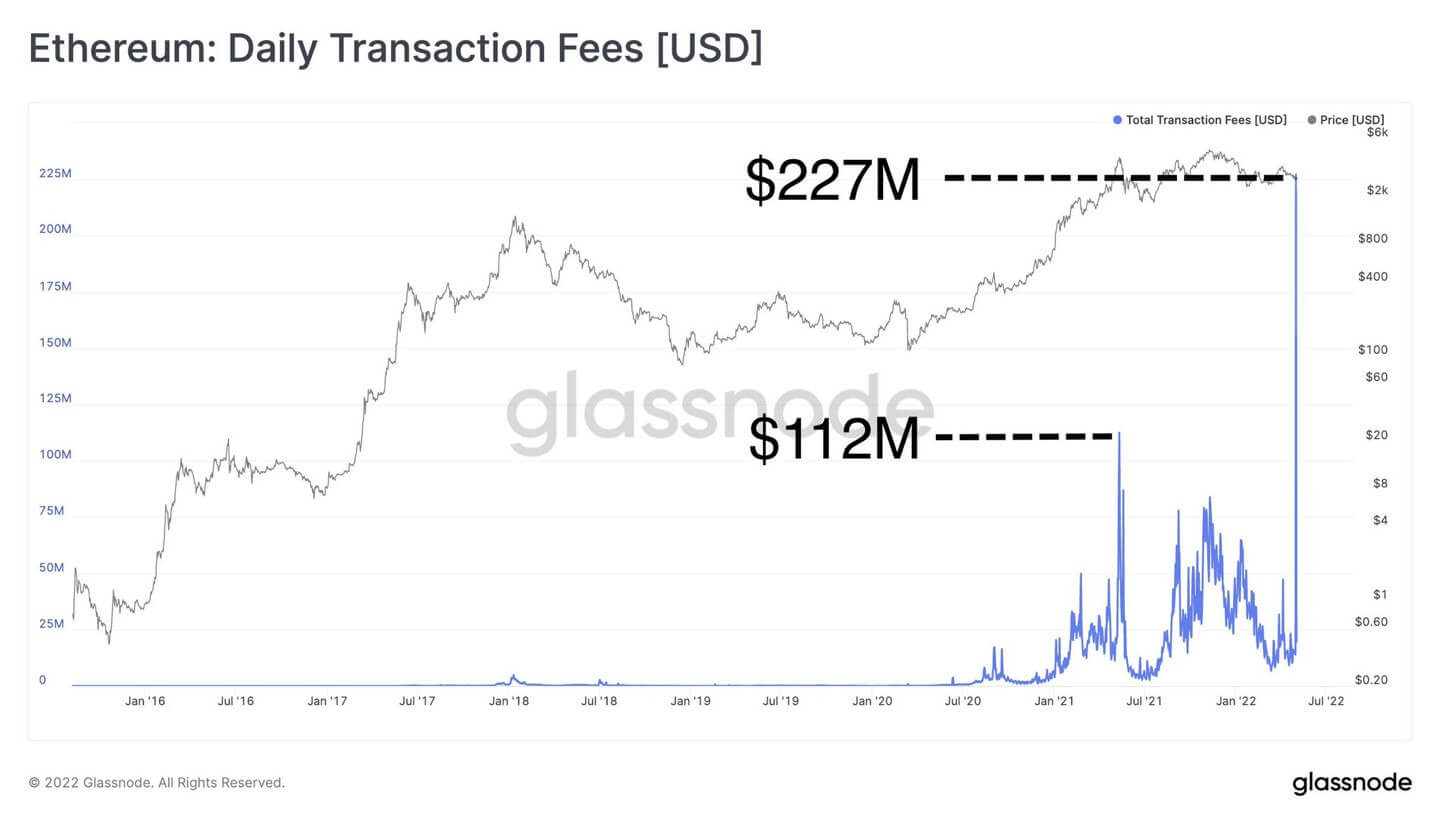

The launch of the new NFT collection ended with a new record of spent commissions on the Etherium network. Specifically, the figure reached $227 million in 24 hours – that’s how much blockchain users spent on the first of May 2022 to conduct transactions on it.

The amount of commissions spent on the Etherium network

The previous high was $112 million, with it being recorded in May 2021 during a grand market crash.

What’s happening with NFT from Bored Ape Yacht Club

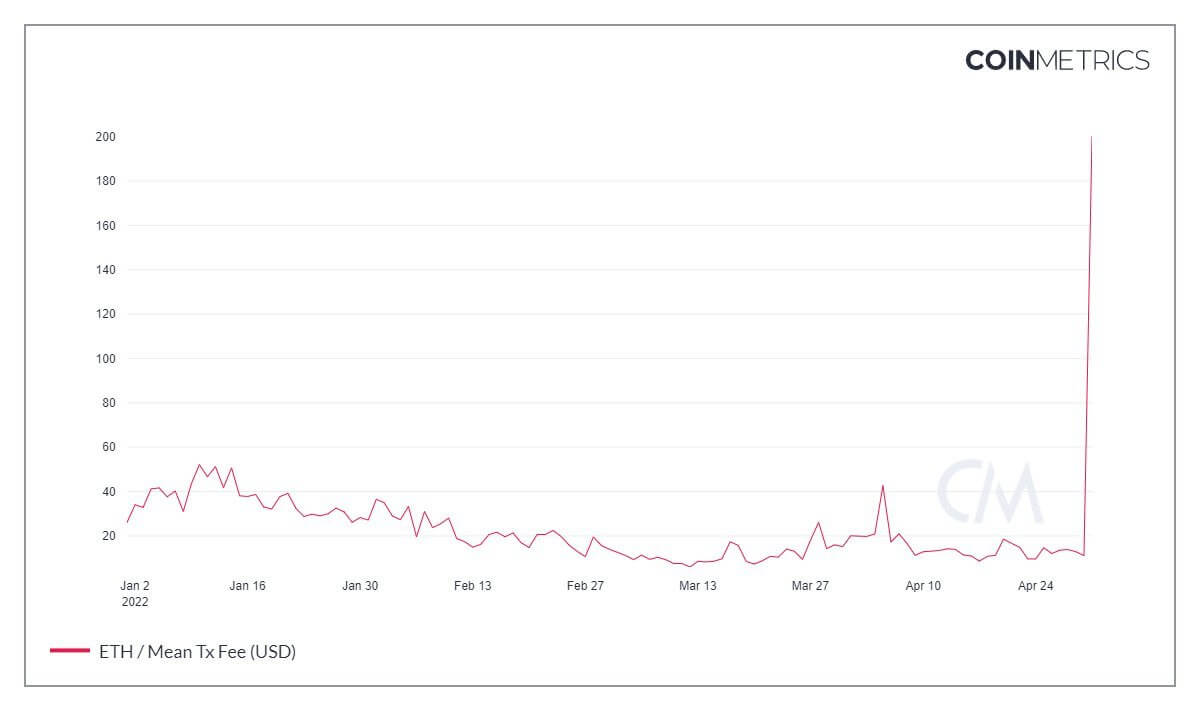

During the release of the Otherdeed tokens, over $157 million was spent on commissions on the Etherium network. This led to a short-term increase in the cost of average transactions on the Ether network to an all-time high. Such big numbers are due to the general hype surrounding Yuga Labs and the studio’s new projects.

Graph of the average commission on the Etherium network on the first of May 2022

As a reminder, for any interaction with the cryptocurrency network, the user has to pay a commission, which is measured in gaz. The higher the amount of commission he pays to the miners, the higher his transaction will be in the queue to be added to the block. Since the issuance of Otherdeed was limited, cryptocurrency enthusiasts tried to be the first to get their hands on the coveted NFTs and were therefore willing to pay thousands of times the average transaction fee.

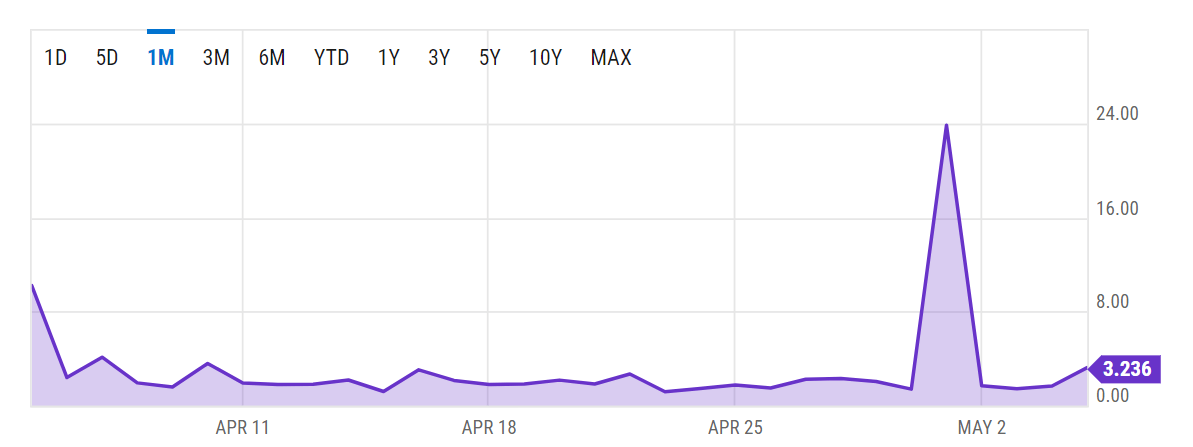

A short-lived increase in commissions on the Ether network

In particular, some sellers reported that they paid a commission of at least twice the value of the NFTs themselves, which were valued at 305 ApeCoin (APE) or approximately $5,800 at the time the tokens were issued. Often, even these amounts were not enough, but the funds for the gas were still charged – because that’s how the blockchain works.

As a reminder, the transaction will be translated into the network even if the price of gas is low. As a result, the latter could be used up, causing the transaction to fail. However, because the gas will be burned, the user will lose money on the transaction. And during the blockchain overload, the amounts could be quite large. This is exactly what the Yuga Labs project reimbursed.

Measure for yourself the scale of what happened: between April 25 and May 2, 56 percent of all the Etherium burned was accounted for by the Otherdeed issue alone. In other words, it was this project that contributed the most to the destruction of the Ethers that were burned as commissions.

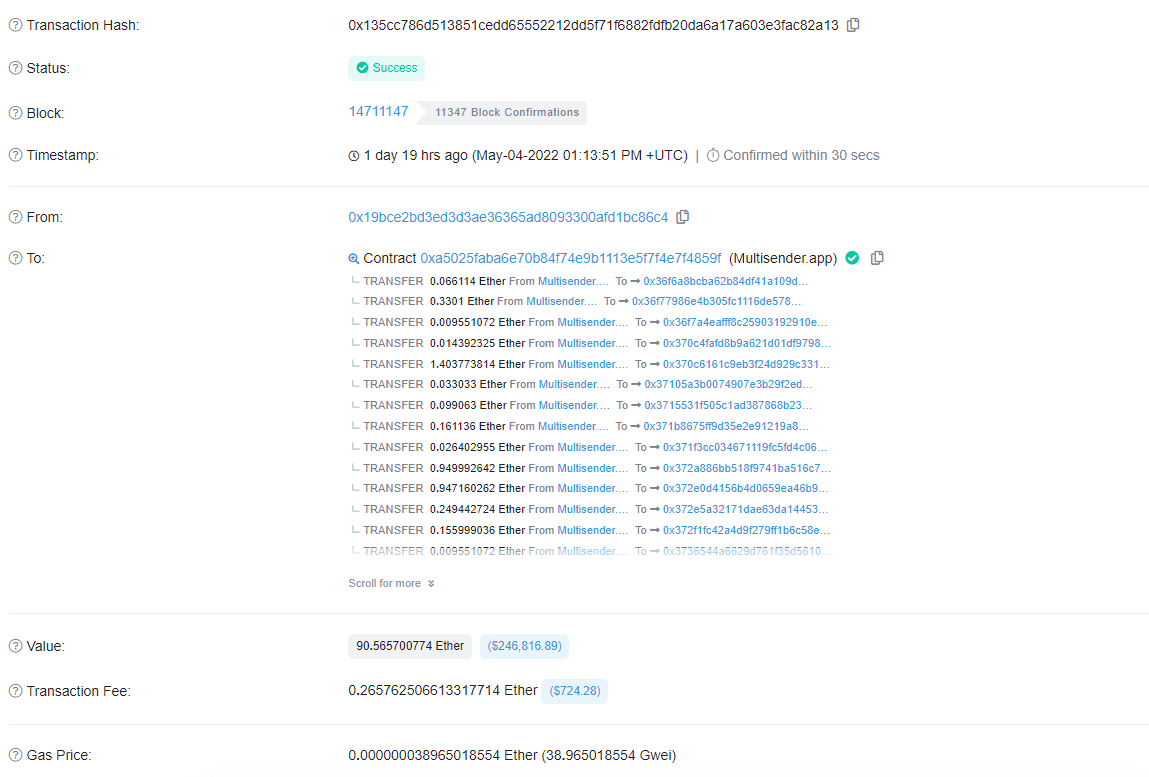

Transaction in the Ethereum blockchain reviewer with refunds

One user was so eager to participate in the sale that he spent more than $44,000 on commissions. According to Decrypt’s sources, his transaction “went through” to the blockchain, so he received no refund. In total, developers from Yuga Labs spent 90.57 ETH to compensate other participants in the safe. The largest amount of compensation was 2.6 ETH or $7,500.

In just one year of its existence, the Bored Ape Yacht Club collection has already become a well-known brand in the crypto market. The top three NFT projects to date belong to BAYC developers. In third place is a separate collection called Mutant Ape Yacht Club (MAYC). In second place is the original BAYC range. But first place is currently held by Otherdeed, with a transaction volume of $50 million in the last 24 hours.

While BAYC and MAYC are essentially unique digital avatars, the concept of Otherdeed is a bit more complex. It’s 55,000 unique tokens that entitle their holders to own virtual property in the Otherside meta universe.

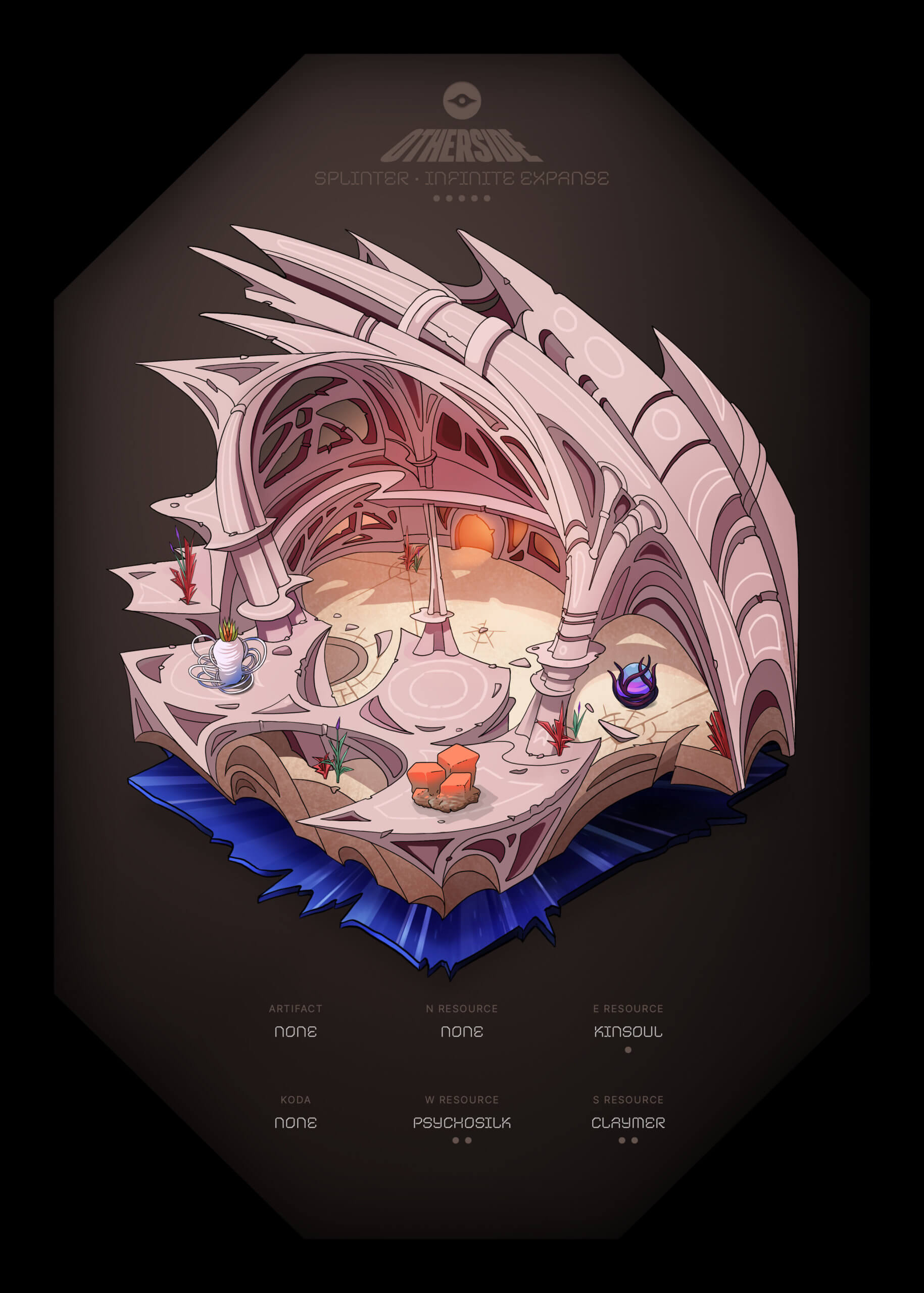

This is what one of the Otherdeed tokens looks like

Incidentally, after the Otherside issue, Yuga Labs was hit with a wave of criticism. Many suggested that the company could have chosen a more efficient format for launching the project. Later, Yuga Labs representatives hinted that they might well move the BAYC ecosystem’s native ApeCoin token to their own blockchain. It would probably be more centralised than Etherium, but it would solve the problem of huge commissions. Therefore, there is a possibility that the project’s ecosystem will evolve further, including reaching the scale of its own blockchain.

We believe that such a move by the developers is unnecessary, but understandable. By doing so, they wanted to retain the loyalty of fans who wanted to connect with the project but were unable to do so. Still, the average transaction fee on the Etherium network that day was the equivalent of $193, so the bonus is quite nice. Apparently, this will make some investors reconsider their attitude to Yuga Labs, which may have been tainted by a failed transaction and loss of money.

You can follow the development of the situation in our millionaires’ cryptochat. There we also discuss other popular NFT tokens, which bring huge profits to their investors.