A Tether spokesperson has accused funds of attacking the USDT stabelcoin. What is happening to the coin?

Some funds are deliberately engaging in a “coordinated attack” on USDT to undermine its parity with the US dollar, a statement made the previous day by Paolo Ardoino, CTO of Tether. According to him, funds are borrowing millions of dollars to open short positions with USDT in an attempt to undermine its liquidity. Such actions have increased markedly since the collapse of the TerraUSD algorithmic stackcoin nearly two months ago. Naturally, its collapse was profitable for the parties concerned. We tell you about the situation in more detail.

It should be noted that the whole story with the possible problems of Tether USDT began precisely with the collapse of UST from the Terra ecosystem. Against this background, some crypto-industry representatives began to fantasize about whether a similar situation is possible for the world’s main stackcoin represented by USDT.

Some of them thought that it was, but this view is wrong. It is important to understand that UST was an algorithmic shablecoin, i.e. it depended on its own operating model. USDT, on the other hand, is a secured asset, with dollar equivalent assets behind each coin. As a result, Ardoino made it clear back in mid-May that it was not a scenario that the haters should count on.

USDT is the most popular stabelcoin on the market

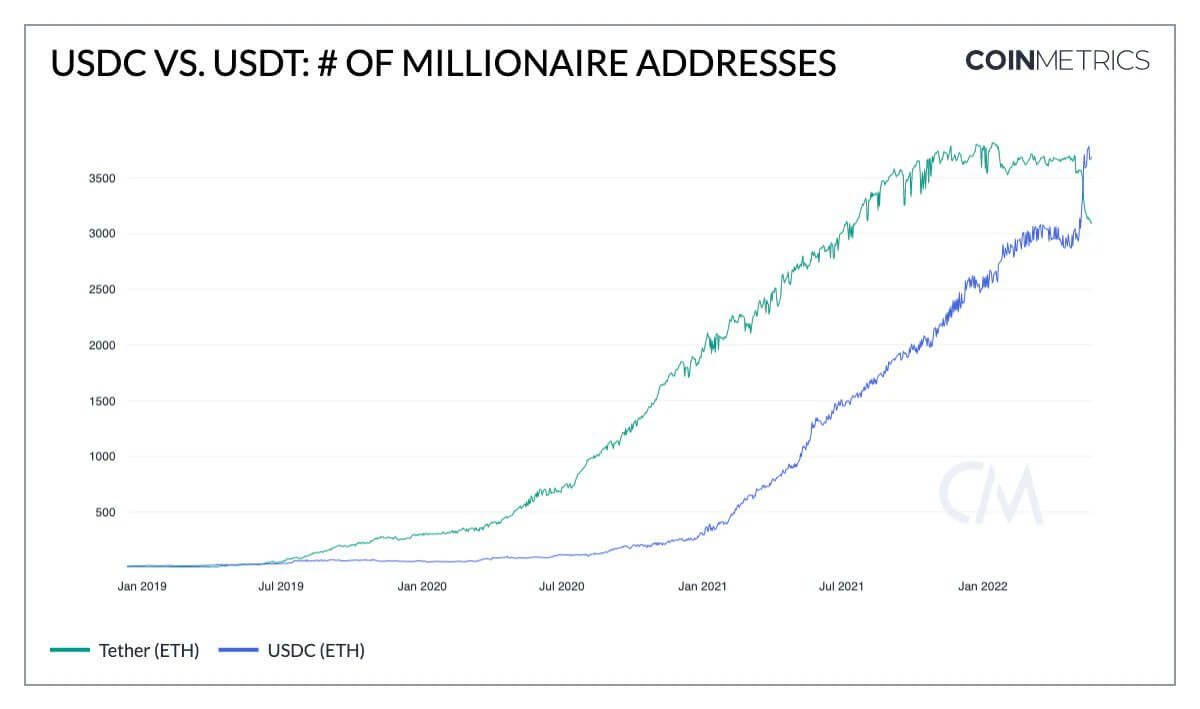

However, some investors decided to hedge themselves. As it became known at the beginning of the month, then several large investors switched from USDT to USDC, the stablcoin from Circle. According to analysts at CoinMetrics, more than 130 coin holders have made a similar transaction of at least a million dollars equivalent since the ninth of May 2022. Here is the corresponding chart, showing the number of millionaires in USDT (in green) and USDC (in blue).

The timing of the transactions is clearly visible.

Graph of the number of millionaires in USDT and USDC

Now the negativity around USDT continues to expand. And there are interested participants of the market.

Who is trying to mess with Tether?

Paolo Ardoino noted on his Twitter that many organizations have joined the campaign to discredit the project, spreading unconfirmed rumors and increasing panic among investors. A prime example of such claims is USDT “allegedly not backed by 100 percent currency”, with “its reserves in trouble” and so on.

Tether technical director Paolo Ardoino

Ardoino rejects any such claims. According to him, Tether is actively cooperating with financial regulators and is doing everything to ensure the transparency of its own transactions. Here’s his quote on the matter, published by news outlet Cointelegraph.

Despite all the public third-party claims, our cooperation with regulators, efforts to increase transparency, and commitment to a gradual transition to US Treasury bonds, they continue to think and assume that we – Tether – are the “bad guys”.

Note that Tether is indeed cooperating with regulators, as the giant would hardly be able to conduct its operations otherwise. Considering this fact, it is obvious that the company at least does not violate established rules and does not overstep its limits. In addition the issuer of USDT has been on the market for a long time - and this is also trustworthy.

Paolo claims that Tether has “never failed to repay its debts” and added that the company has processed 7 billion transactions in a 48-hour period, an average of 10 per cent of its total assets. Something like this is “impossible even for large banking organisations”.

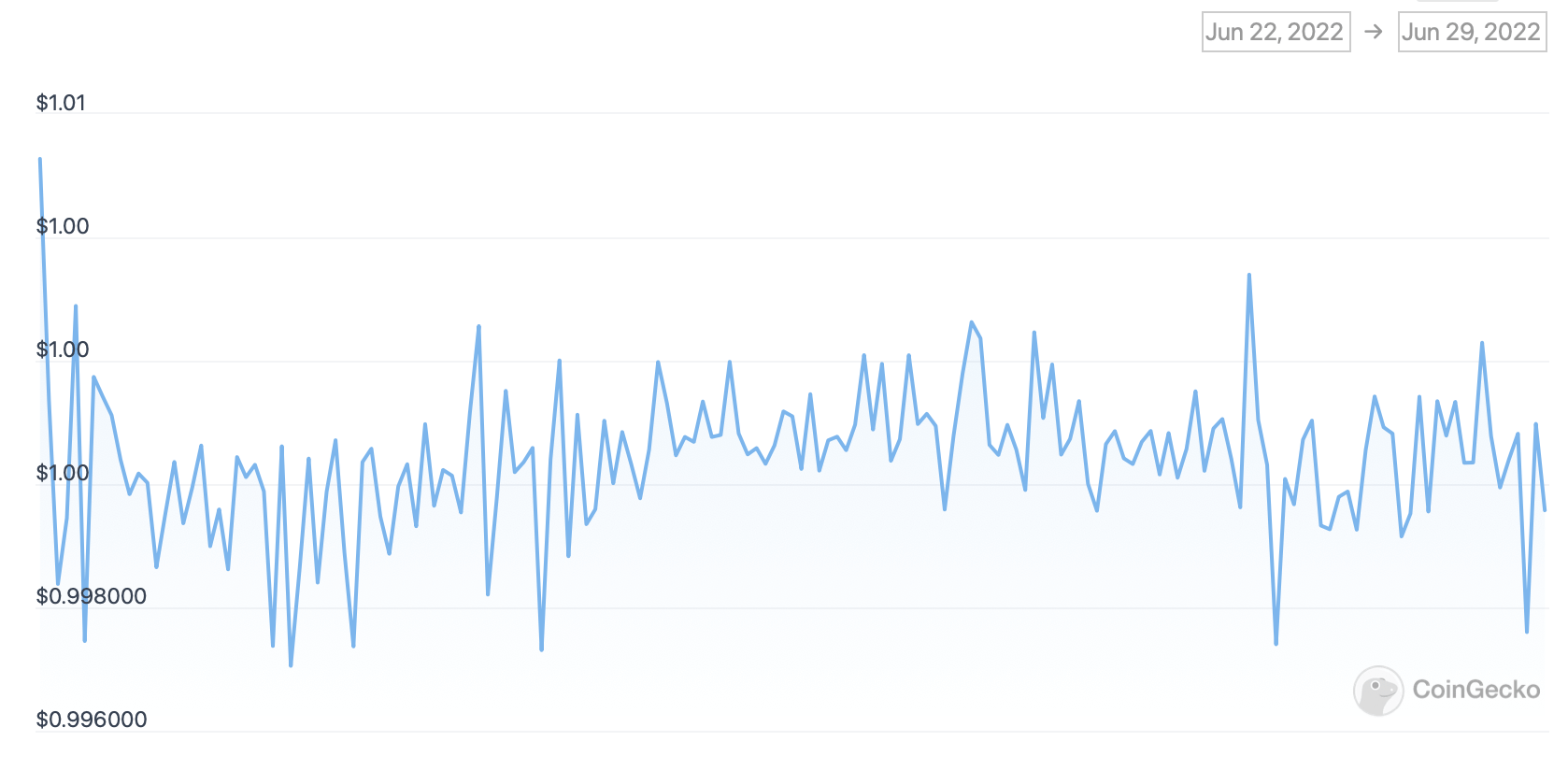

At the moment, Stablecoin’s exchange rate is hovering around $0.9993. As you can see in the Coinmarketcap chart, the exchange rate has actually started to deviate more from the US dollar in the last week. However, there is no reason to panic – USDT is not an algorithmic stablecoin, so a TerraUSD-level crash is unlikely to threaten it.

USDT value chart from Tether over the past week

Ardoino also confirmed that Tether has already reduced its commercial paper holdings from $45 billion to $8.4 billion this month, intending to drop its token collateral entirely “in the coming months”. Mind you, this is an important point, as price fluctuations in such assets amid macroeconomic instability could indeed affect Tether’s solvency. And wanting to get rid of them is the right decision, which will benefit the giant’s reputation.

We think that the desire to bring down the USDT exchange rate and break its peg to the value of the dollar is bad for the whole industry. After all, in that case the owners of billions of dollars will start losing their money and the prospects of such situation are hard to predict. However, criticism of Tether is heard every bear cycle - and experienced crypto enthusiasts are probably used to it. And the best response to it right now is USDT at $1.00.