The head of the Securities and Exchange Commission does not see Bitcoin as such. How does this help cryptocurrency?

The head of the US Securities and Exchange Commission (SEC), Gary Gensler, reiterated the day before that the financial regulator considers Bitcoin a commodity rather than a security. However, Gensler did not extend this assertion to other coins. He had previously stated that Bitcoin should be regulated under the authority of the Commodity Futures Trading Commission (CFTC). But then what do altcoin holders have to look forward to? We tell you more about the situation.

Note that the US Securities and Exchange Commission has a knack for causing problems for cryptocurrency projects. Their main complaint about crypto most often comes down to the wording of the companies’ launches. If the sale of tokens can be characterised as an “unregistered offering of securities”, then the blockchain project is sure to be in trouble. This, in particular, is the reason why the SEC filed a lawsuit against Ripple in late 2020.

As Ripple CEO Brad Garlinhouse recently noted, if the company loses the lawsuit, it will leave the US and will not offer its services there.

How Bitcoin is classified

Here is one of Gensler’s quotes from his interview with CNBC host Jim Cramer. The agency head’s remarks are quoted by Decrypt.

Some assets like Bitcoin, and that’s the only thing, Jim, that can be considered a commodity. Because I’m not going to talk about any of these other tokens in any way refuting or confirming the statements of my predecessors.

In other words, Gary has deliberately commented only on Bitcoin and has been silent on other cryptocurrencies. Most likely the reason for that is the specifics of launching the first cryptocurrency, with the network just getting off the ground. There was no raising of capital from early investors and no selling of the coin at the preliminary stage. Accordingly, investors did not purchase BTC in anticipation of profits - an important criterion for Securities Commission officials.

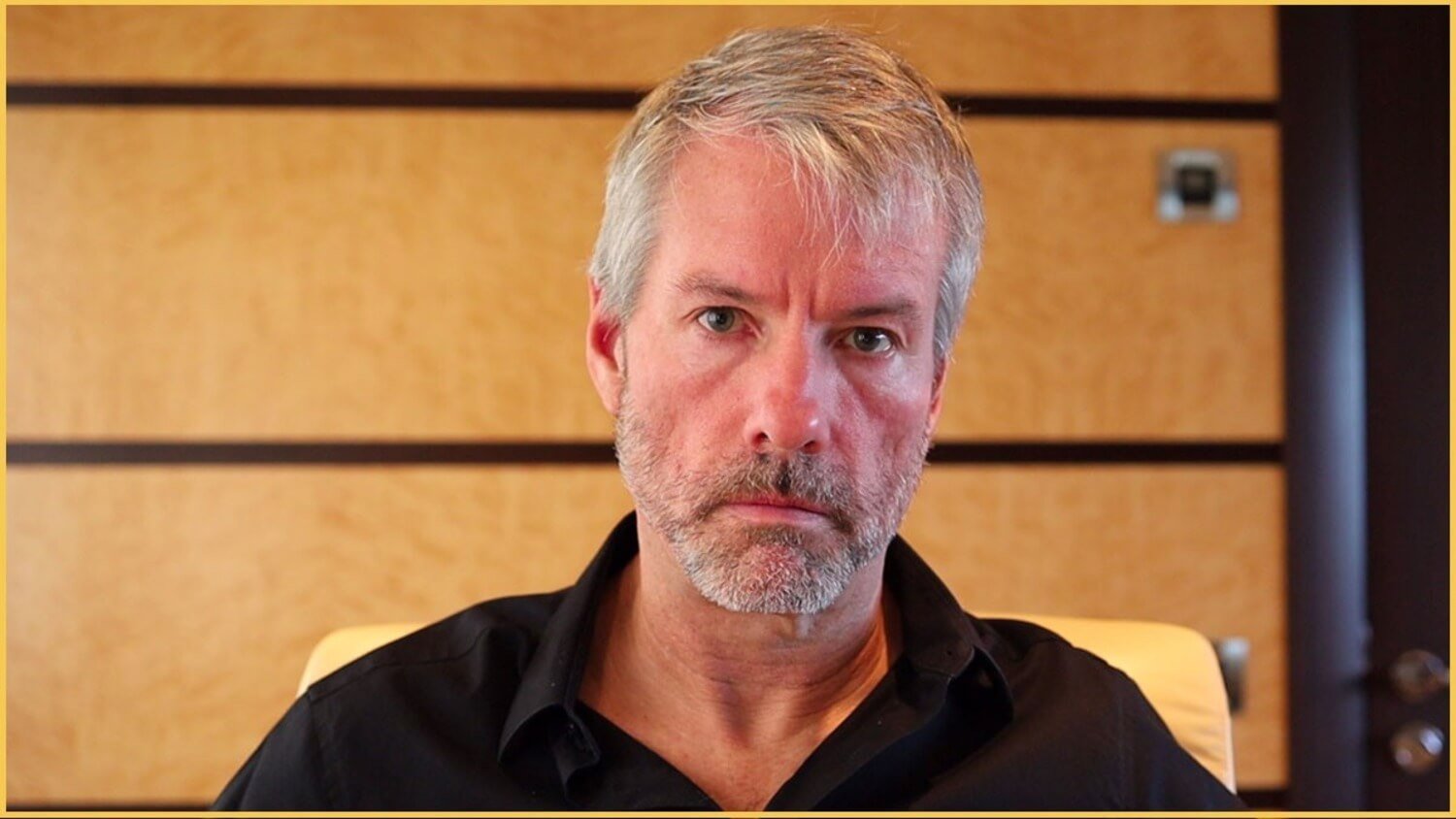

SEC chief Gary Gensler

Gensler also added that many other “crypto-assets have key attributes of securities”. The main commonality between them is investing for profit. As a reminder, the regulatory framework for regulators regarding the crypto market has focused on interpreting which coins function as securities and which function as commodities.

Previous Commission leadership believed that both Bitcoin and Etherium were commodities, but Gensler has only mentioned Bitcoin in his recent statements. In addition, he has consistently avoided directly answering questions that relate to the regulation of ETH specifically.

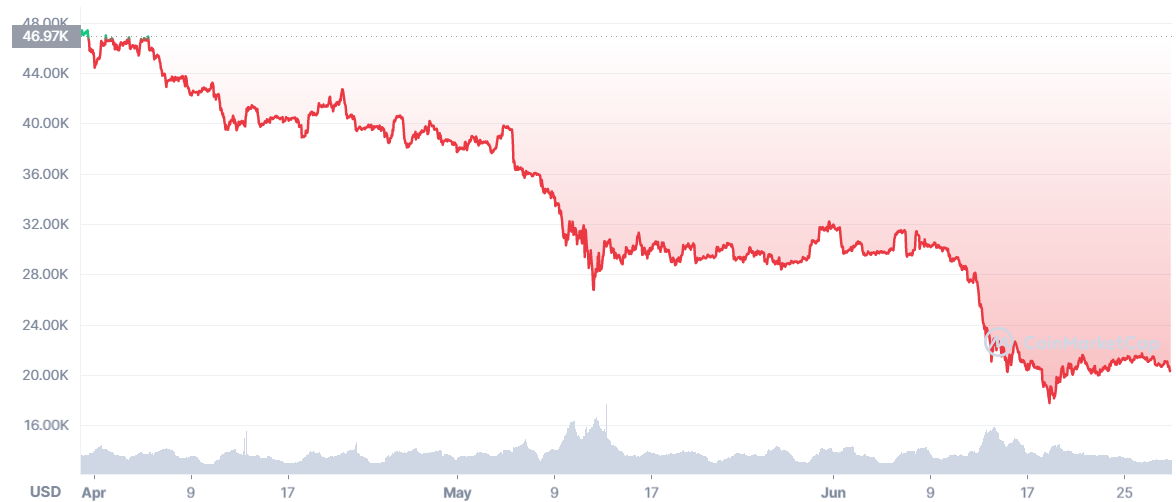

Bitcoin exchange rate

As a reminder, in 2018, William Hinman, director of corporate finance at the SEC, said he believes that Etherium and Bitcoin should be classified as commodities because each cryptocurrency is “fairly decentralised” and has no single stakeholder “whose efforts would be a key determinant of project development”.

Read also: A cryptocurrency enthusiast has recovered a bitcoin wallet from 2016. But the result disappointed him

According to Cointelegraph’s sources, Gensler’s new statement immediately sparked a lively discussion in the cryptocurrency community. For example, Bloomberg Intelligence ETF analyst James Seyffarth noted that the SEC chief’s words could be interpreted in many ways.

It’s not some new statement from Gensler himself, but it’s definitely positive for Bitcoin. Unfortunately, all of this is not enough for Grayscale to accept a spot ETF for Bitcoin. The likelihood of a positive SEC decision on the issue this week or next is close to zero.

As a reminder, a spot ETF is the regular market price of an asset. In the meantime, we answered the most popular questions about ETFs in a separate piece.

Other crypto-enthusiasts are concerned about the fact that Gensler is reluctant to explicitly state the financial regulator’s position on Etherium. Commentator Edwin, for example, has published his version of the real reason for such statements.

Etherium gets hacked too often, which is why Gensler didn’t want to mention it.

ETHEREUM gets hacked too much.thats why he didn’t mention it…

– Edwin (@Edwin2131313) June 28, 2022

Note that the crypto-enthusiast is wrong in this case – it is not Etherium that is being hacked, but the protocols and projects based on it. One of the most recent such incidents was the hacking of the Ronin platform, which resulted in millions of dollars in losses. Yes, it doesn’t directly affect Ether, but it still indirectly damages its reputation. And especially for those who aren’t particularly strong on digital asset theory.

MicroStrategy head Michael Saylor also shared his view on what’s going on. Recall that he has been known for a relatively long time for his sharply positive statements about Bitcoin. This case was no exception.

Bitcoin is a commodity, which is vital as a reserve asset. This fact allows politicians, agencies, governments and organisations to support Bitcoin as a technology + digital asset for economic growth, empowerment and freedom.

MicroStrategy CEO Michael Saylor

The U.S. Securities and Exchange Commission’s opinion excites so many because the financial regulator is very much a determinant in overseeing various markets. Its positive attitude towards crypto in general could open the door to particularly large investments in Bitcoin and altcoins by “whales” in the form of corporations. Right now, only a few publicly traded companies own relatively large holdings of BTC, but with the Commission’s filing, the list could in theory expand considerably.

We believe that even such commentary is generally not a bad thing for Bitcoin's reputation. Of course, the Commission's attitude towards other cryptocurrencies is unknown, but a clear absence of complaints against the industry's main representative is not a bad sign. In addition, it is important to keep in mind that the SEC only determines situation in US territory, so in case of other countries, people will obviously have no problem dealing with coins.

Look for even more interesting things in our millionaires cryptochat. Many other events are discussed there.