A Binance executive has criticised attempts to save cryptocurrency companies from collapse. Why?

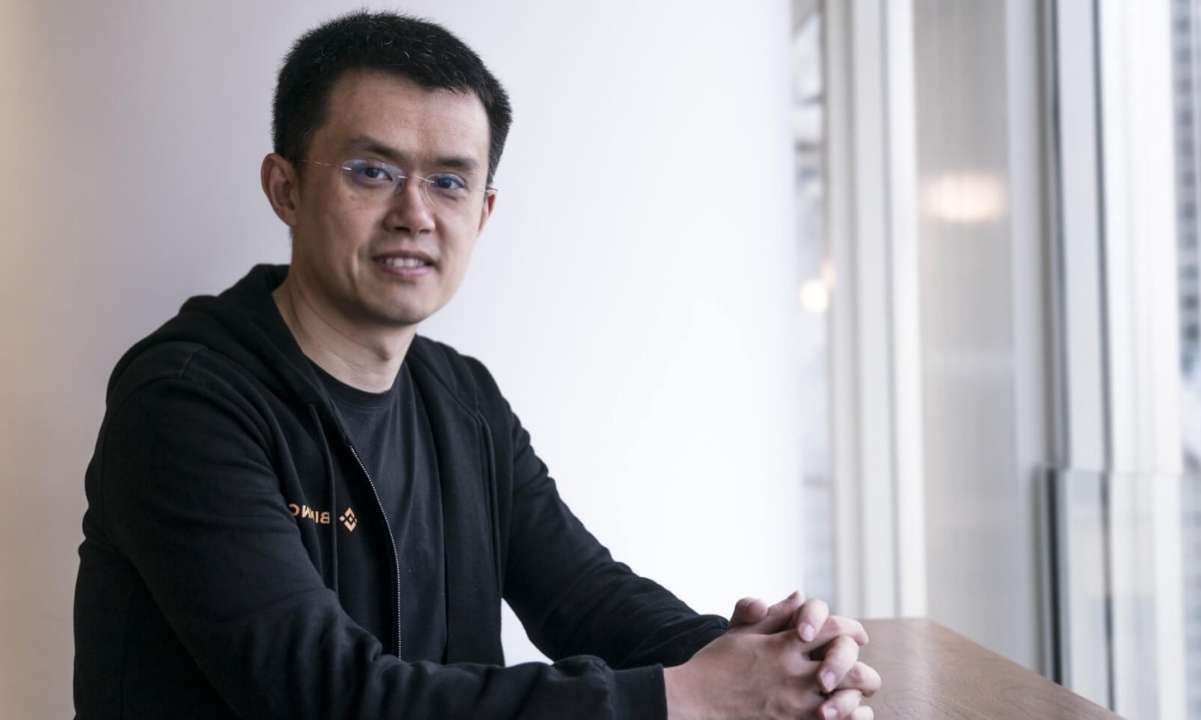

Binance cryptocurrency exchange CEO Changpen Zhao was genuinely surprised by recent statements from billionaire and FTX chief Sam Bankman-Fried, in which he pledged to make efforts and allocate funds to save cryptocurrency companies from ultimate collapse. In the interview, Zhao admitted that he would hardly have done the same in Bankman-Friede’s shoes. Moreover, his policy goes against the principles of Binance. We tell you more about what’s going on.

Are cryptocurrency companies worth saving?

In an interview with news portal Decrypt, Zhao openly criticised the actions of his competitor. Here’s his line.

To be honest, it surprised even me. I try not to comment on our competitors or industry peers. But I would never make such a deal. I would never say: “I will invest in your company and then you will lend me the money”. I just wouldn’t invest in that company and I would keep my money.

Binance CEO Changpen Zhao

As a reminder, Bankman-Fried earlier confirmed the extension of a credit line for cryptocurrency broker Voyager Digital, which has been facing financial shortfalls. By the way, Zhao mentioned an interesting detail: he himself had a commitment to Alameda Research, a company founded by Bancman-Fried, before granting the loan to the broker.

Here’s another quote from Zhao regarding his own strategies.

Personally, and to a large extent Binance, I like very simple deals. We like deals in the context of questions like: “What is your revenue? What is the number of your users?” We don’t like deals like: “Hey, I owe you this money, you pay me back this much money, you invest in me, I lend you more money and then you bail me out.” Why don’t we just return all the money, go back to zero and talk about the net balance of who owes who how much?

In other words, Zhao admits that companies should have a chance at a full-fledged collapse. In that case, the cryptocurrency industry is in for a purge of sorts.

FTX chief Sam Bankman-Fried

This is not the first time Zhao has criticised cryptocurrency bailouts amid a bearish trend. In doing so, he has made it clear for the first time that a $500 million line of credit from Alameda for Voyager is something he would 100 per cent likely never have done.

Meanwhile, the field of decentralised finance itself is gaining momentum – including in the context of employee popularity. In particular, some financiers are now voluntarily leaving their positions to join cryptocurrency companies. Among them, three JP Morgan bank managers are preparing to take their place in the digital asset industry.

Former JP Morgan top executives Eric Ragge, Puja Samuel and Samir Shah have left the financial institution, it was revealed this week. Samuel, for example, has already commented on his decision in a post on LinkedIn.

I am pleased to announce that I have joined Digital Currency Group as head of corporate development. I’m very excited to help forge new strategic partnerships with an energetic team that is driving change in the financial system.

Pooja Samuel’s post on LinkedIn

Prior to joining the cryptocurrency company, Samuel was head of ideas and digital innovation at JP Morgan. Former JP Morgan managing director Eric Ragge has joined the Web3 world at startup Algorand. According to Decrypt, Ragge will head the company’s investment committee and will also lead global initiatives and strategic partnerships in both traditional capital markets and decentralised finance.

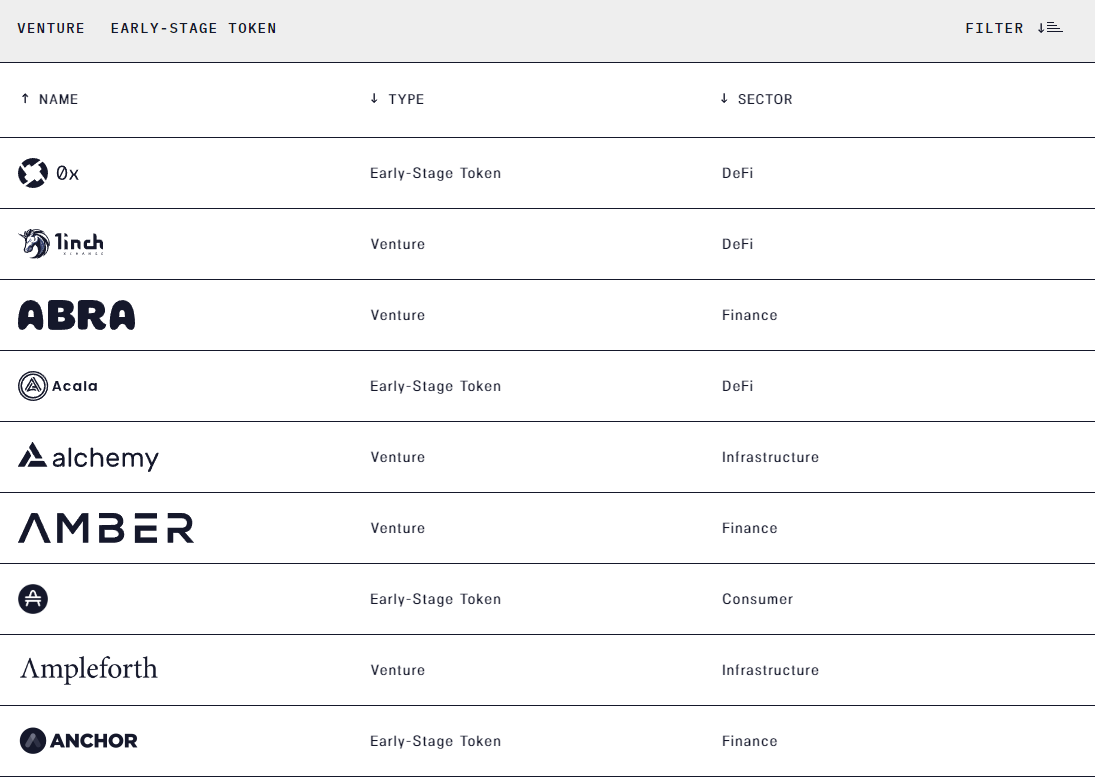

Finally, former JP Morgan employee Samir Shah announced his departure on Monday, saying that he has now become chief operating officer at investment firm Pantera Capital, which is currently focused on investing in new Web 3 startups.

Some of the most prominent crypto projects Pantera Capital has invested in

While JP Morgan is losing valuable staff, cryptocurrency foe Peter Schiff has already managed to lose an entire bank. Following the suspension of Euro Pacific International Bank in Puerto Rico, the crypto community has not tired of reminding Schiff of his mistakes in making negative predictions about the crypto market.

Even El Salvador’s President Nayib Bukele has tweeted his remarks on the matter. In response to Schiff’s archived post criticizing Bitcoin, Bukele ironically asked “how his bank was doing.

Most interestingly, the president of El Salvador himself also has episodes of serious financial missteps. Recall, it was at his instigation that El Salvador first legalised Bitcoin completely, and then began to accumulate it in its reserves. However, due to the fall in the price of the main cryptocurrency, the country’s budget suffered tens of millions of dollars in unrealized losses. Although there is a chance that the country will still wait for a change in the coin market and profits at the same time.

We think there's logic in Changpen Zhao's words, because if companies are facing major problems now, it's not certain that it won't happen in the future. On the whole, however, Changpen simply takes a different approach to investing - and Sam Bankman-Fried's point of view is not close to his. However, this is unlikely to affect the latter's decisions.

What do you think? Share your opinion in our Millionaire Crypto Chat.