Argentina’s central bank will limit crypto-traders’ options. How?

Argentina’s central bank will significantly limit the ability of local crypto-traders to conduct financial transactions with the US dollar. In a fresh announcement, Central Bank officials said that those citizens who bought Bitcoin in the last 90 days for Argentine pesos would not be able to access the only free exchange market, Mercado Único y Libre de Cambio, and buy the dollar at the country’s official exchange rate. And this is a tangible inconvenience for fans of digital assets.

It should be noted that the overall situation in the cryptocurrency market is becoming less panicked. The behavior of traders themselves speaks in favor of this. As we found out last week, they behave more restrained and gradually stop selling.

A good illustration of the traders’ mood is the so-called fear and greed index. Lately it has left the line of “extreme fear” and changed to usual fear. Consequently, investors have more and more reasons to connect with the digital asset market – especially if they recognise its fundamental advantages.

Cryptocurrency investors

However, in some countries, crypto enthusiasts face restrictions, and quite tangible ones at that.

How cryptocurrency users are being restricted

The idea behind the ban is to stop the flow of money out of the country, which can easily be done with cryptocurrencies and the dollar. If a person or company has pesos in their account and they are used to buy US dollars on a regulated exchange, they can then transfer the currency to buy crypto.

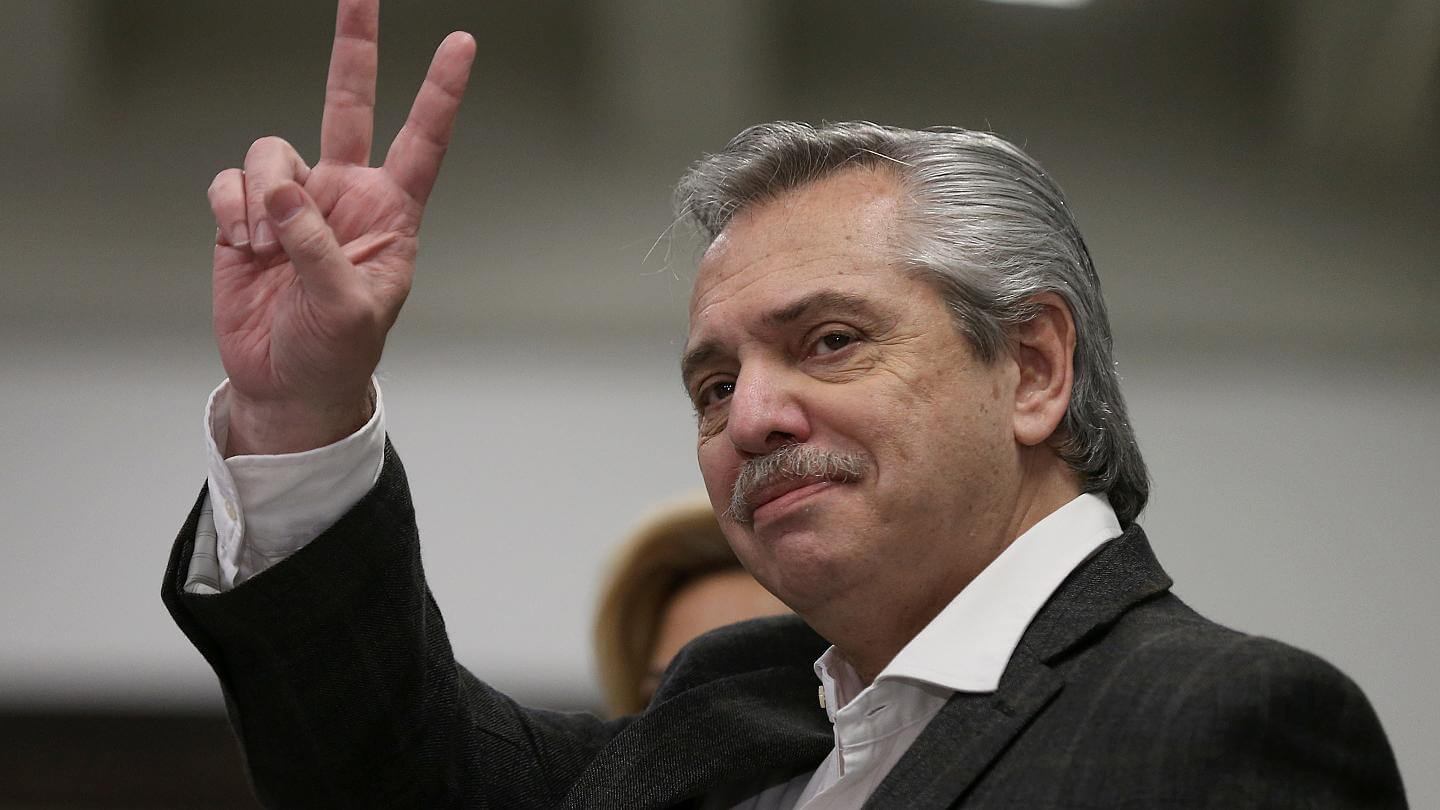

According to Decrypt’s sources, in this way US dollars will in a sense “exit” the country’s economy. Recall that Argentina has the third-largest economy in Latin America, while being hit hard by inflation. The centre-left administration of President Alberto Fernandez is tightening currency controls and raising interest rates to bring inflation under control.

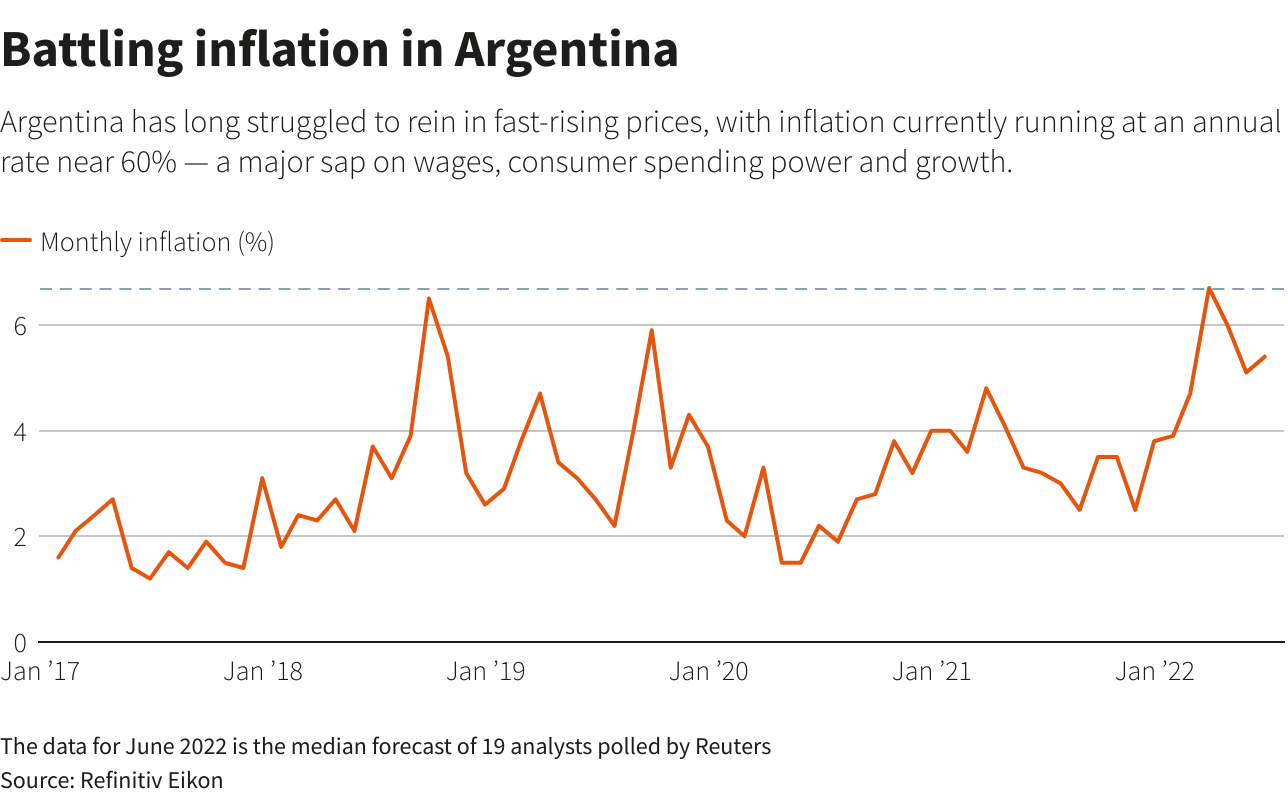

Note that inflation is rising globally as a whole, which could be seen as a consequence of the mass printing of fiat currency after the pandemic begins in 2020. As it became known in mid-July, the US consumer price index, or so-called inflation index, was 9.1 per cent for the year - the biggest increase in the index since 1981. Consequently, goods and services around the world are becoming more expensive.

In such an environment, some people try to buy dollars or euros, while others buy bitcoins or other coins in the hope of long-term growth. In general, buying the dollar or its cryptocurrency counterpart in the form of staplecoins is particularly relevant for residents of countries with relatively weak economies. In this case, the USDT or USDC allow you to lose not so much in terms of national currency.

Argentine President Alberto Fernandez

Argentina has one of the highest inflation rates in the world – last year alone it was 64%. Argentina lags behind Venezuela in this indicator, where, incidentally, cryptocurrencies are also very popular. Unfortunately, Argentinians will now have significantly fewer “loopholes” to save their own savings in pesos.

Inflation in Argentina

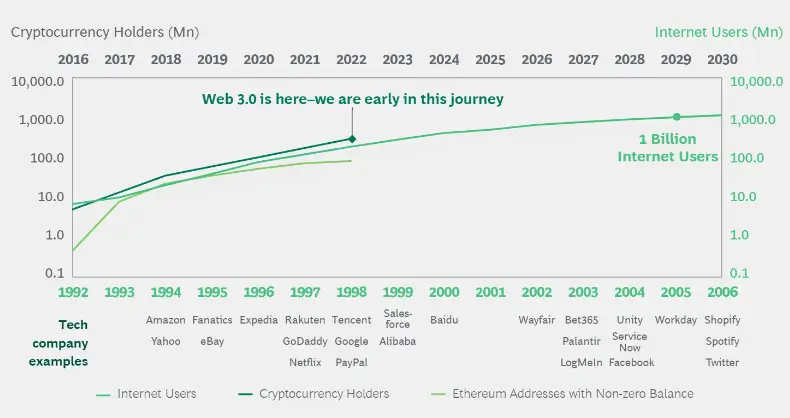

However, local bans in one region of the world are unlikely to significantly affect the popularity of the crypto industry in all other countries. According to a joint report by Boston Consulting Group, Bitget and Foresight Ventures, adoption of crypto is still quite low compared to traditional assets. Only 0.3 per cent of the money supply has been invested in digital assets, while traditional investments have already attracted more than 25 per cent of the corresponding figure.

This means that Bitcoin and altcoins still have a lot of room for growth and adoption among a huge number of people. Analysts believe that the number of active users of digital assets will surpass the one billion mark by 2030. The backdrop is certain to see a rise in coin values as new industry users act as buyers in the first place.

However, this does not mean the cryptocurrency industry's long-awaited "perpetual growth". As current events show, as the coin industry collapses, the number of people interested in cryptocurrencies becomes much smaller. And that's not surprising: the sagging cryptocurrency market prevents newcomers from speculating and making money, and well, the technology component is hard enough to lure them into a niche.

Projected rise in Bitcoin adoption

We believe that such activity by bankers is hardly good for their reputation. Be that as it may, Central Bank officials have made their stance clear: they are not happy to link customers to digital assets. It is to be hoped that this will not greatly affect newcomers who were planning to start interacting with crypto. Still, in this kind of inflation, coins are a pretty good tool for preserving value - especially if you're not buying them at the peak of the market.

Follow our Millionaire Cryptochat. Here we discuss investing, mining, stacking and other essentials of the digital asset niche.