Commissions on the Etherium network will not fall after the blockchain moves to Proof-of-Stake. But why?

Investor expectations of an Etherium transition to Proof-of-Stake may not be fully met. This statement was made on Twitter by a trader named Vivek Raman. According to him, the integration of the second version of the Ether protocol does not guarantee a strong reduction in commissions on the network. That said, it is this aspect of the crypto project’s upgrade that is now seen as the main trigger for the future growth of its ecosystem. We tell you more about what’s going on.

Today, ether is valued at $1209. The cryptocurrency has gained 11.2 percent in value in the past 24 hours, bringing its capitalisation to $144.76 billion. At the same time, the rate of ETH is 75.2 percent behind its all-time high.

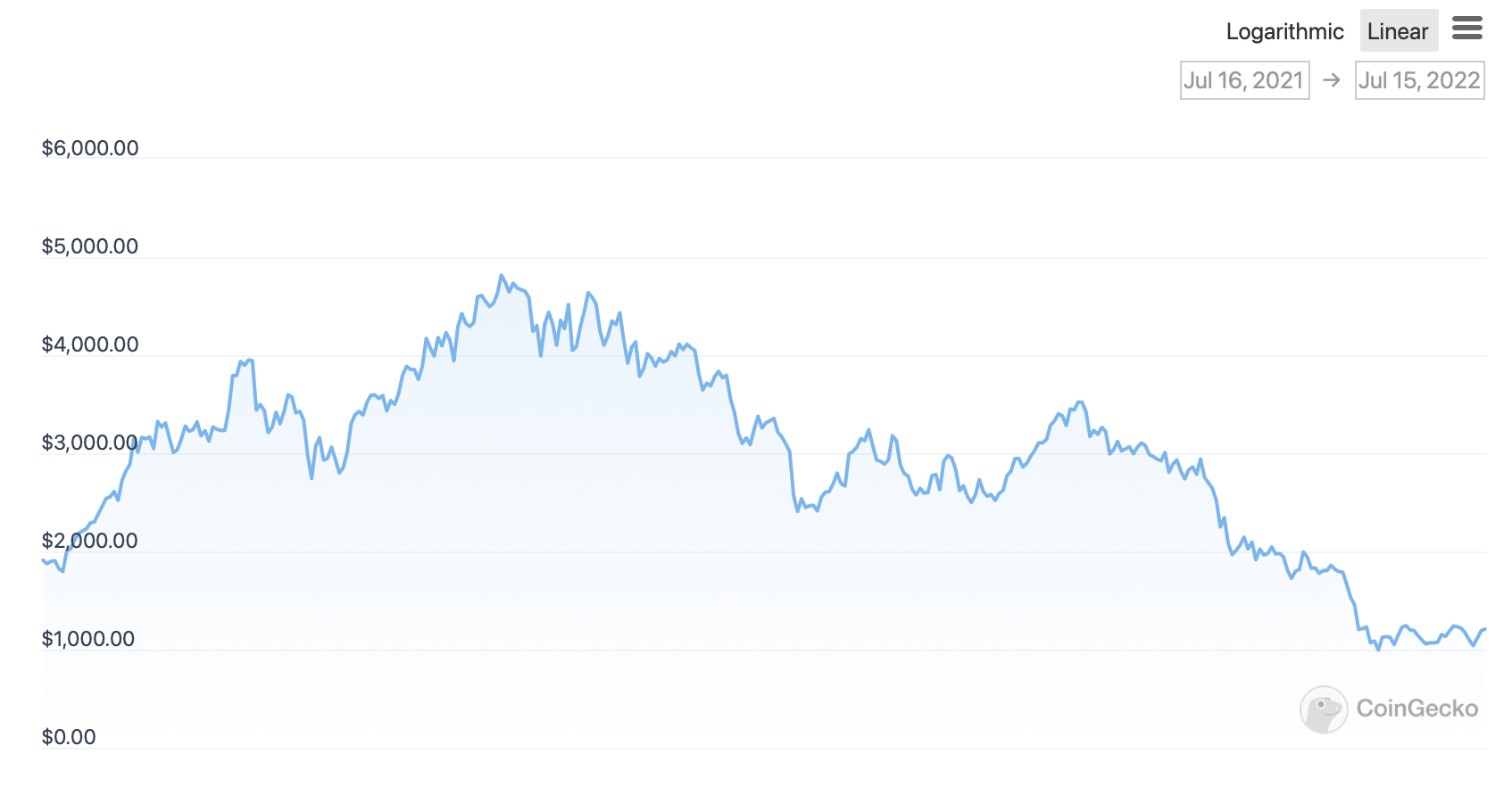

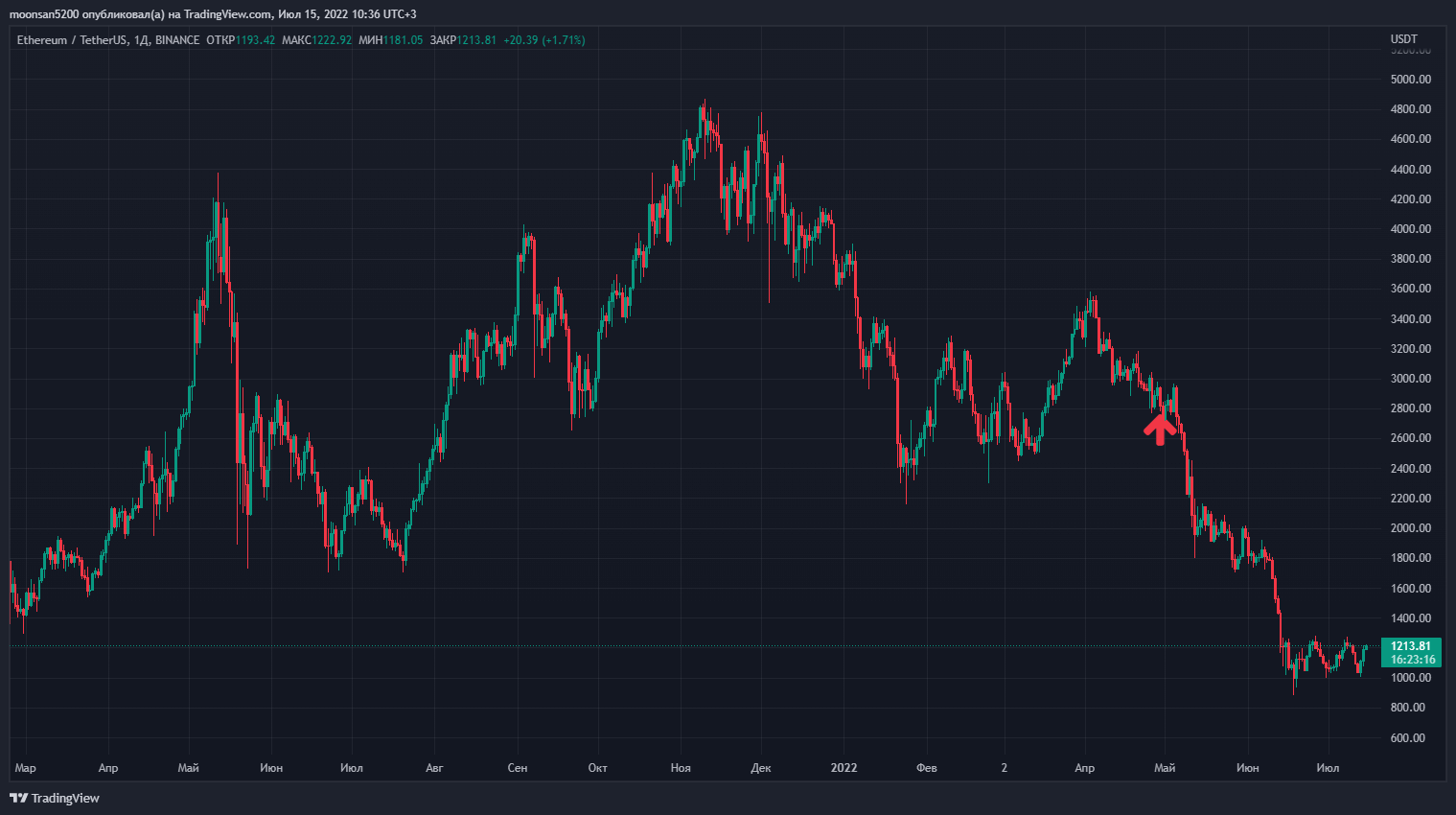

This is what a chart of the coin’s exchange rate looks like over the past year.

Chart of ETH’s ETH exchange rate over the past year

What’s going to happen to Etherium?

According to Raman’s tweet, the high fees on the Etherium network are due to increased demand for space on the blockchain, not a function of the “consensus mechanism”. Here’s his rejoinder, in which the expert shares his view of the situation.

After the merger – i.e. moving to Ethereum version 2.0 – commissions on the Ethereum network will NOT be lower. The purpose of the merger is to abandon the Proof-of-Work consensus mechanism in favour of Proof-of-Stake. Commissions depend on blockchain demand, not the consensus mechanism. To pay less, use the existing tier 2 solutions based on Ethereum.

As a reminder, the merger is the merger of the current Proof-of-Work based Ethereum network, which is powered by miners, and a PoS chain called Beacon Chain, which was launched on the first of December 2020. This event is tentatively scheduled for mid-to-late September, although it has previously been regularly postponed. As a result, after the merger, the core Etherium network will operate on the Proof-of-Stake or Proof-of-Stake consensus algorithm, as well as with the participation of validators and stackers.

As CryptoSlate’s sources point out, the move to Proof-of-Stake is intended for a reason. Contrary to the long heated debate on this issue in the cryptocurrency community, Raman concluded that mathematically a double-spend attack on a PoS blockchain would be more expensive than a Proof-of-Work-based blockchain. Therefore, after the merger, Etherium will be safer in this respect.

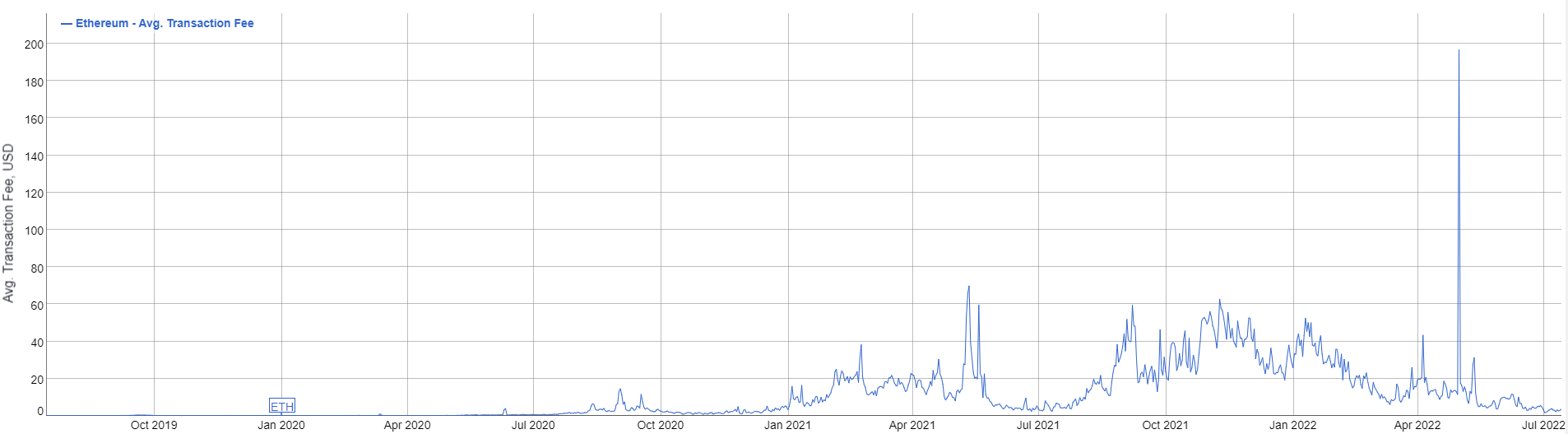

Average commission on the Etherium network in dollars

Another interesting news for investors is that in the 6 to 12 months after the merger, there will be almost no pressure on the market from ETH sellers, according to the expert.

ETH inflation will drop from 4.3 percent to 0.22 percent after the merger. If we assume a total of 500,000 ETH per year, daily issuance will drop from 14,250 to 736 ETH. That’s 95 less than now, which means it’s 95 per cent less coins to sell every 24 hours.

It thus responded to the fears of those users who fear the unlocking of ethers currently in stacking. As a reminder, stackers cannot access them now, but this feature will be added soon after the transition to Ethereum 2.0. Therefore, some in the blockchain community believe that stackers will rush to withdraw crypto once it is unlocked and go to the exchange to sell it. However, due to the reduced issuance of new ETH, there is a chance that the impact of such a scenario, should it materialise, would be imperceptible.

The trader also mentioned the EIP-1559 innovation, which was introduced in the London hardforge in August 2021. This is a mechanism to burn ethers used as commissions for transactions.

Because of the commission burn thanks to EIP-1559, Etherium will be deflationary in most network scenarios.

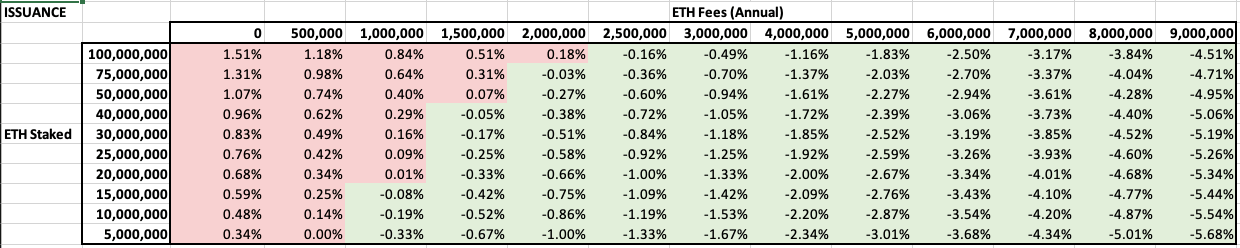

Estimated inflation in the Ether network under different scenarios

One picture in this case clearly demonstrates the coming changes. The screenshot above shows ETH issue patterns under different conditions. In short, even if 100 million ETH were in staking with zero commissions for validators, coin inflation would only be 1.51 percent. Well, burning the commissions would provide an even greater reduction in the figure.

As a reminder, EIP-1559 is a special mechanism by which Etherium is able to become a deflationary asset by burning a portion of the coins in each transaction. We wrote more about the features of EIP-1559 in our article.

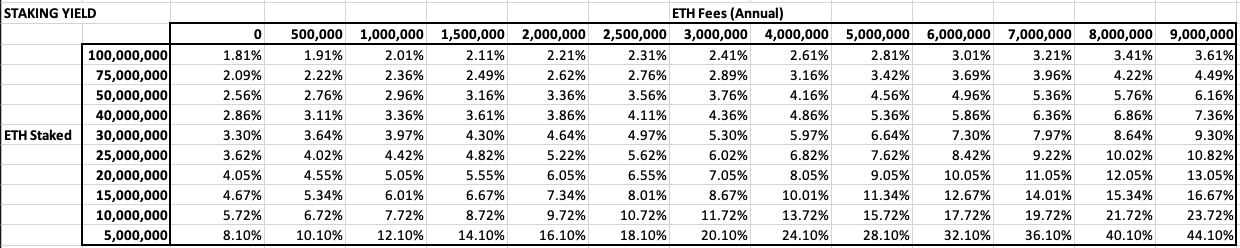

Validators’ earnings on the Etherium network after the transition to Proof-of-Stake will depend on the total amount of commissions per year and the amount of ETH in stacking among all validators. To help guide future returns, Raman has posted another screenshot below.

Estimated yield of validators

In another tweet, the trader made a very interesting conclusion about how the perception of Bitcoin and Etherium will change after the latter’s upgrade. The expert continues.

After the merger, Etherium will complement Bitcoin’s areas of use as pure collateral and capital storage. BTC has cemented its title as “digital gold” – and that’s great. ETH, on the other hand, will become both a “digital bond” (yield on staking = interest on a risk-free deposit) and a major collateral asset in decentralised finance.

Etherium exchange rate

And when will the fees on the Etherium network become noticeably lower? After the introduction of so-called sharding, the concept of which we detailed back in 2018. Basically, we are talking about creating separate PoS chains that work independently of each other. The first phase of the sharding implementation should see 64 shards appear on the Etherium network, which will increase its throughput by a corresponding number of times.

As indicated on the Ethereum website, sharding will be the next major update after the blockchain is migrated to the PoS algorithm. Accordingly, we should probably not expect sharding to launch until next year at the earliest.

Mention of sharding on the Etherium website

We believe that the situation with commissions won't really change after Etherium moves to Proof-of-Stake. Still, the consensus mechanism is not a scaling solution and does not affect the free space within blocks in any way. Accordingly, in this case, for more affordable commissions, ETH enthusiasts should either wait for the implementation of sharding, or explore more modern Tier 1 networks like Solana, Avalanche and others.

Now is the best time to start getting interested in Etherium and sign up for our Millionaire Cryptochat. We will discuss other important developments there as well.