Cryptocurrencies are promised strict regulation as early as autumn. What are we talking about?

The Financial Stability Board, established by G20 countries, has announced a proposal for rules for “robust regulation and oversight” of cryptocurrencies. The organisation is expected to create a framework for cryptocurrency regulation by October, which will then be submitted for high-level consideration among G20 finance ministers and central banks. Accordingly, the digital asset industry is likely to face new rules when dealing with them in certain regions. Here is a more in-depth look at the situation.

It is not the first time that authorities in different countries and associations have expressed a desire for stricter regulation of the cryptocurrency industry. In particular, back in April 2022, the European Parliament supported an initiative to limit the free withdrawal of funds from exchanges to third-party wallets. More precisely, the owners of the funds wanted to be obliged to indicate the personal data of the recipients of transfers, if the amount of the latter exceeded the equivalent of one thousand euros.

Fortunately, for the time being, this rule has been abandoned. However, regulators do not sleep and are preparing new restrictions.

How the cryptocurrency industry will be regulated

Here’s a quote from the Council’s announcement on crypto regulation, in which the agency’s views were voiced. The replica was published by the news outlet Decrypt.

Crypto-assets, including so-called Stablecoins, are evolving rapidly. The recent turmoil in the cryptocurrency market highlights their inherent volatility, structural vulnerability and the problem of their growing interconnectedness with the traditional financial system.

Note that the argument about volatility - that is, dramatic changes in cryptocurrency rates - is not particularly relevant today. To prove this, just look at how some stocks have moved during the first half of 2022. Apple dropped 23 percent, Tesla and Amazon lost 35 percent, PayPal lost 62 percent, Netflix lost 70 percent, and Shopify lost 74 percent. Clearly, it's time for officials to stop using the hackneyed record of how dramatically coin prices are changing to intimidate inexperienced investors.

The members added that even the collapse of a single crypto market participant of notable scale could not only result in “potentially major losses for investors and a threat to confidence”, but also “quickly transfer risks to other parts of the crypto-asset ecosystem”.

This is indeed the case. In particular, the collapse of the LUNA ecosystem in May ended in serious losses for many cryptocurrency companies - and crypto fund Three Arrows Capital among them. And since the latter has to make loan repayments, it has also led to financial problems for other giants.

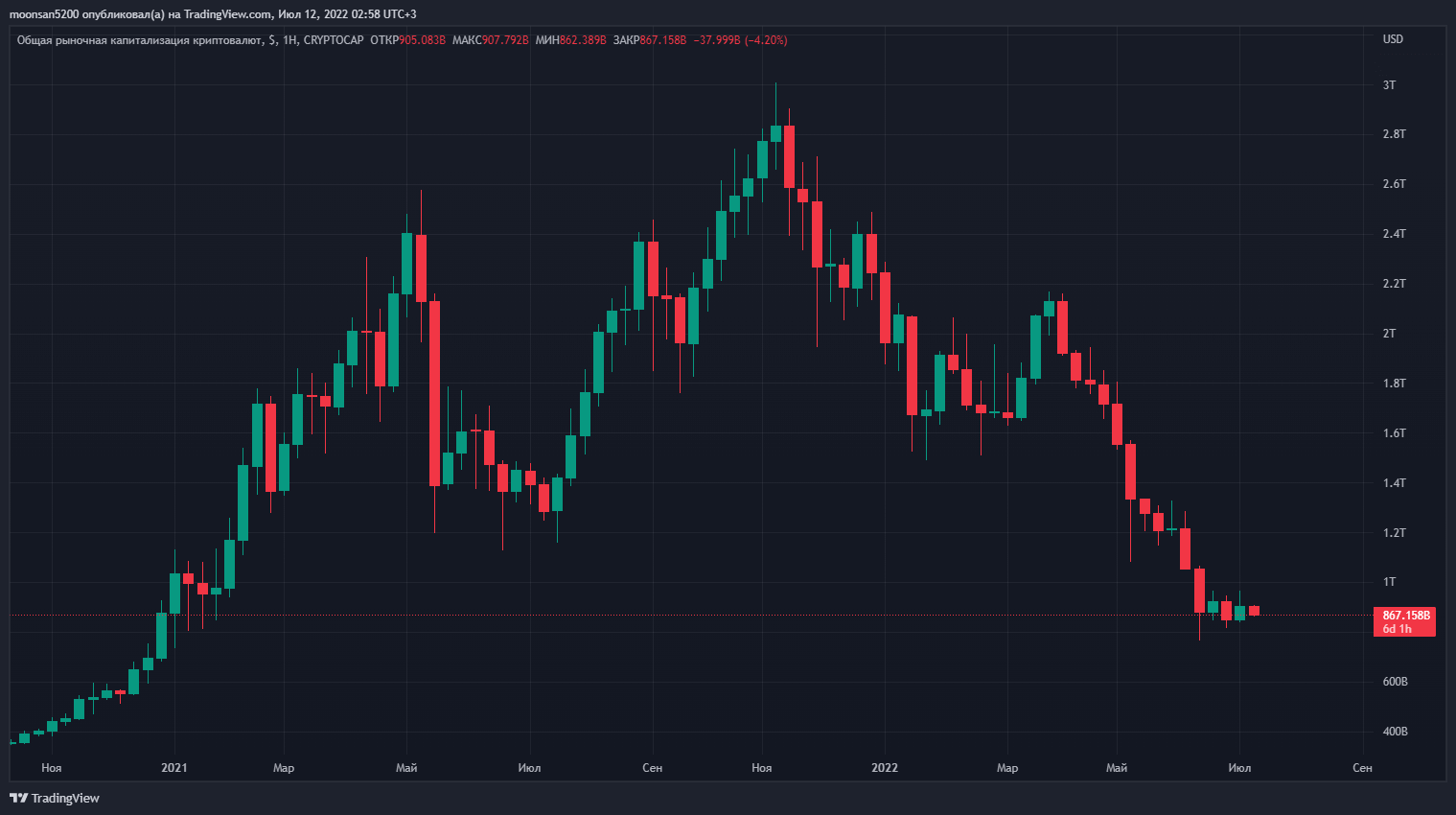

Crypto market capitalisation

All in all, this is a very accurate conclusion from the situation that has developed in the cryptosphere over the past few months. As we have already noted, it has been rocked by a wave of bankruptcies of major platforms and companies over that period, including Terra, Three Arrows Capital, Voyager Digital and Celsius. All of which is billions of dollars in losses for investors, as well as a huge blow to the reputation of cryptocurrencies and the prospects of starting a new bullrun. However, the fundamental values of truly decentralised assets have not been affected in any way.

On topic: What it takes for Bitcoin to rise to a million dollars: BitMEX co-founder Arthur Hayes' response.

The reaction of the cryptocurrency community to this news has been mixed. Here, for example, is what Pedro Herrera, chief blockchain analyst at DappRadar, thinks about it.

Cryptocurrency regulation has always been met with scepticism because it goes against the fundamental principles of digital assets as free and decentralised.

According to Herrera, while some people may see the introduction of clear rules as a “stepping stone to mass acceptance and acceptance” of crypto, for many coin owners any attempts at control and oversight will always be perceived as a deliberate threat to freedom. The expert continues.

It should be noted that while regulation does not guarantee a fraud-free market, it does create a barrier for many criminals from freely exploiting the industry.

Cryptocurrency regulation

Whatever Bitcoin-maximalists may think, the capitalisation of the industry could well increase to trillions of dollars in the coming years. The cryptocurrency industry is simply becoming too big to remain the “Wild West”. Well, some form of regulation is necessary to protect investors’ rights.

We believe that a system of clear regulation is indeed critical for investors who have not yet experienced the benefits of decentralised assets in the form of fixed inflation rates, the ability to quickly transfer value anywhere in the world and the immutability of blockchains. Still, they will feel more secure, which is important enough. But for true fans of digital assets, this topic is not really important because the ability to interact with coins outside of exchanges and other centralized services will still be there.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we discuss other important developments in the blockchain world.