How many more days of cryptocurrency market collapse: forecast by Grayscale Investment analysts

June 2022 can now be considered the official start of the current bearish trend. At least that is what analysts at Grayscale Investment said in a recent report. Given historical trends in crypto market cycles, and if the trend reference point is indeed around the aforementioned date, the so-called crypto-zima could last another 250 days or so. We tell you more about the situation.

When will cryptocurrencies start rising again?

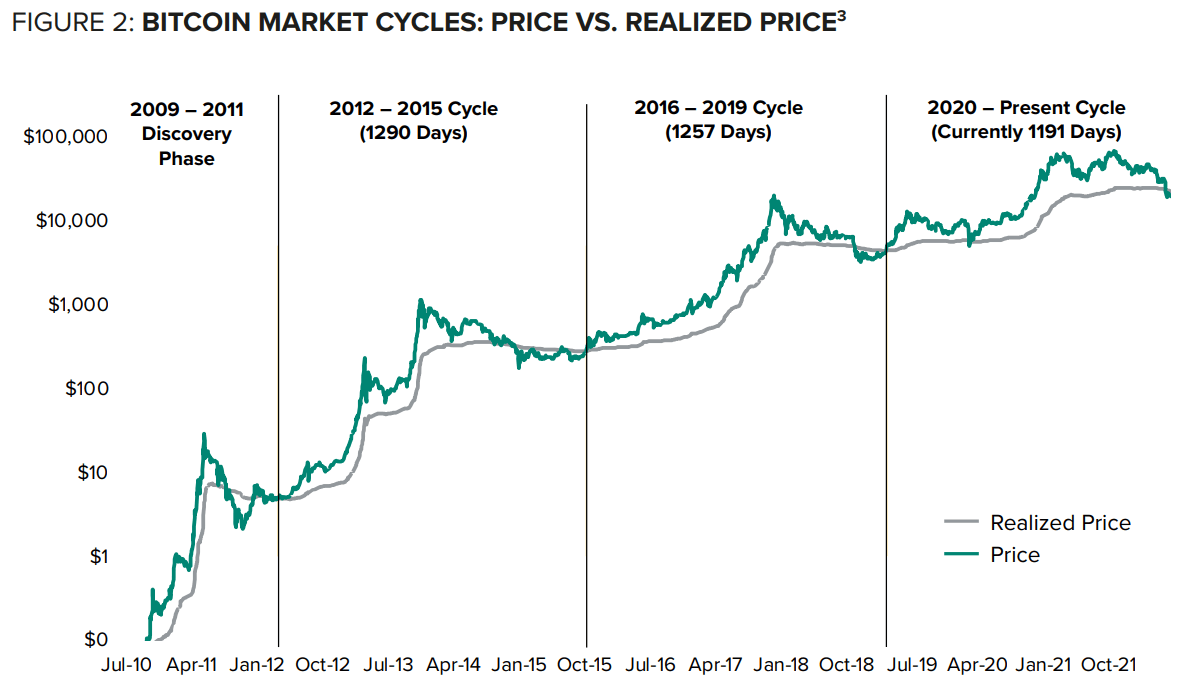

According to Cointelegraph’s sources, the cryptocurrency market is just as cyclical as traditional markets. Each cycle lasts an average of four years, or approximately 1,275 days. Grayscale analysts start counting down a new cycle when Bitcoin’s realised price falls below its market value.

Recall, the realised price of BTC is the average price at which each bitcoin last moved online. That is, it is the average value that investors assigned to a BTC according to their last movement on the network. Through this metric, it is possible to determine how much of investors' positions are in profit.

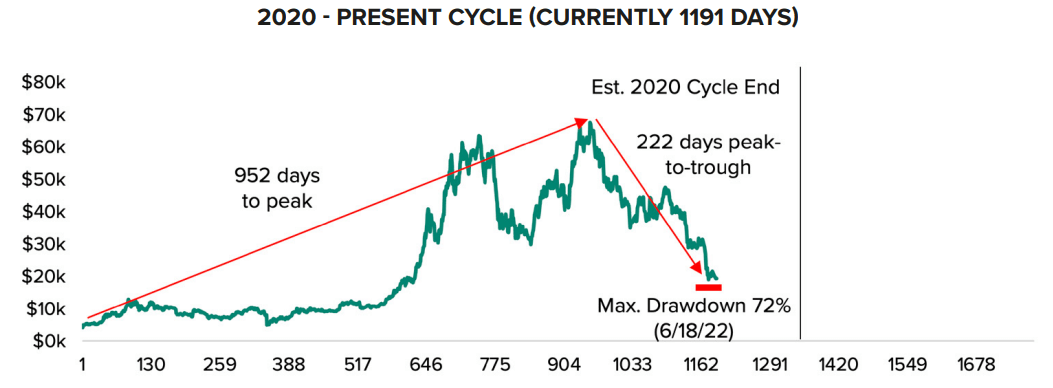

Current Bitcoin market cycle

On June 13, the realised price of Bitcoin fell below its market value, so Grayscale chose this particular timeframe as the start of a bearish trend. And given the average cycle length, the “cryptozyme” should take about 250 more days. That is, the next bull run will begin sometime in March 2023, experts say.

It should be noted right away that this prediction does not mean that the cryptocurrency market will behave this way. In other words, this expert statement should only be taken as a possible scenario, which might not come true.

In addition, some industry representatives believe that there is no reason to expect a prolonged collapse in the coin market, as the digital asset niche has become much larger and more popular over the past few years. As a result, cryptocurrencies and various blockchain solutions have attracted interest from large companies and professional investors. This is exactly the view expressed by Avalanche creator Emin Günn Cyrer. In other words, according to his view, a bearish trend of great depth, following the example of 2018-2019, is unlikely to occur.

Bitcoin market cycles

So the analysts’ version does not at all mean that a noticeable rise in the Bitcoin chart will be that month. During a bear cycle, the cryptocurrency’s value usually fluctuates in a horizontal channel, which can be quite wide. That is, volatility in the market is likely to be there – as well as opportunities for short-term traders and investors to make money.

Read also: Financial TV star predicts more panic in cryptocurrency market. What does he expect from Bitcoin?

Ripple’s XRP token may not have too much pressure from sellers even during the ‘crypto-zima’. The fact is that former Ripple Labs co-founder Jed McCaleb has finished selling billions of XRP from his stock, which lasted about eight years.

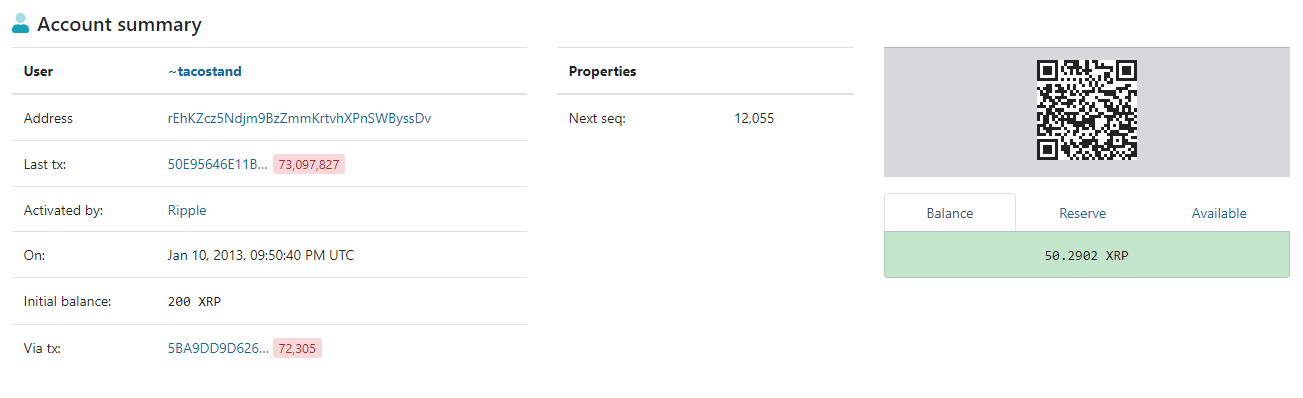

Former Ripple Labs co-founder Jed McCaleb

The last transaction from McCaleb’s wallet, signed “~tacosand”, was sent this Sunday 17 July. The value of the 1.1 million XRP transfer was $394,742 at the altcoin exchange rate. Hours later, McCaleb’s wallet sent an “ACCOUNT DELETE” transaction, meaning it now no longer exists on the XRP network.

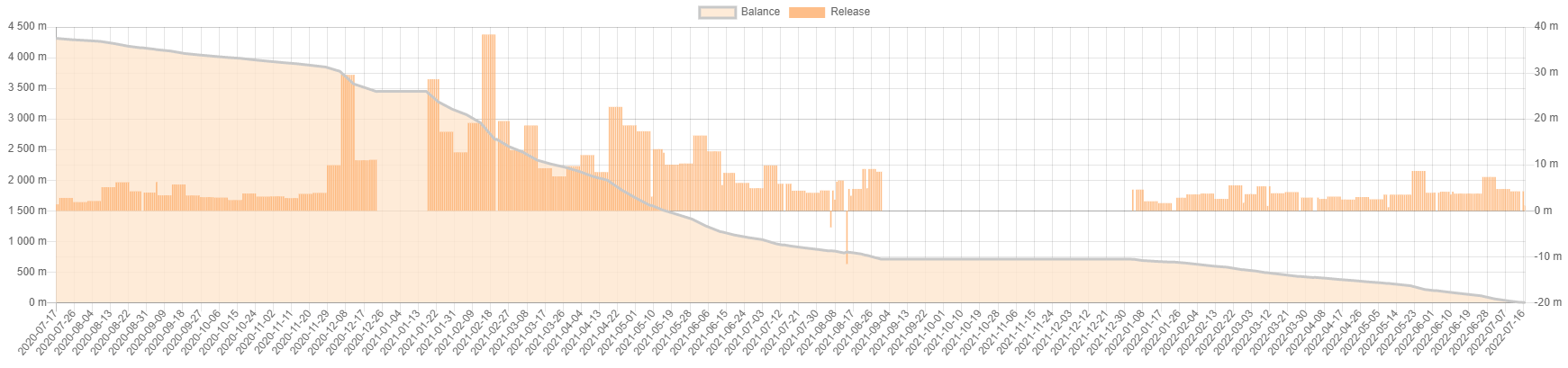

Jed McCaleb’s wallet

As a reminder, Jed McCaleb got his share of coins back in 2014 when he left the company to found co-found startup Stellar. Over the past eight years, he has sold around 18.6 per cent of XRP’s circulating supply. Unsurprisingly, the news of the end of the sale was warmly received by the cryptocurrency community. Still, the XRP project has now lost a major seller – and that’s minus one reason for the market to collapse on a local scale.

Jed McCaleb’s wallet balance dynamics

Here’s what a cryptocurrency enthusiast called XRP whale tweeted about it

Breaking News: Jed McCaleb has sold his remaining 5 million XRP. You now have more XRP than he does.

By the way, Ripple has been involved in litigation against the US Securities and Exchange Commission (SEC) since late 2020. The SEC, as plaintiff, is claiming that XRP tokens are in fact unlicensed securities, for which Ripple should allegedly receive certain sanctions.

We think Emin Gun Sirer's point does sound logical. Obviously, the cryptocurrency industry has never been as popular and developed as it is today. Accordingly, there should also be more willing to buy back coins at low prices - well, that could in theory lead to a shorter collapse phase. However, it's hard to be sure of anything in the cryptocurrency industry, so investors should still be prepared for anything.