Investors of all sizes are actively buying up Bitcoin. What does this mean for the cryptocurrency?

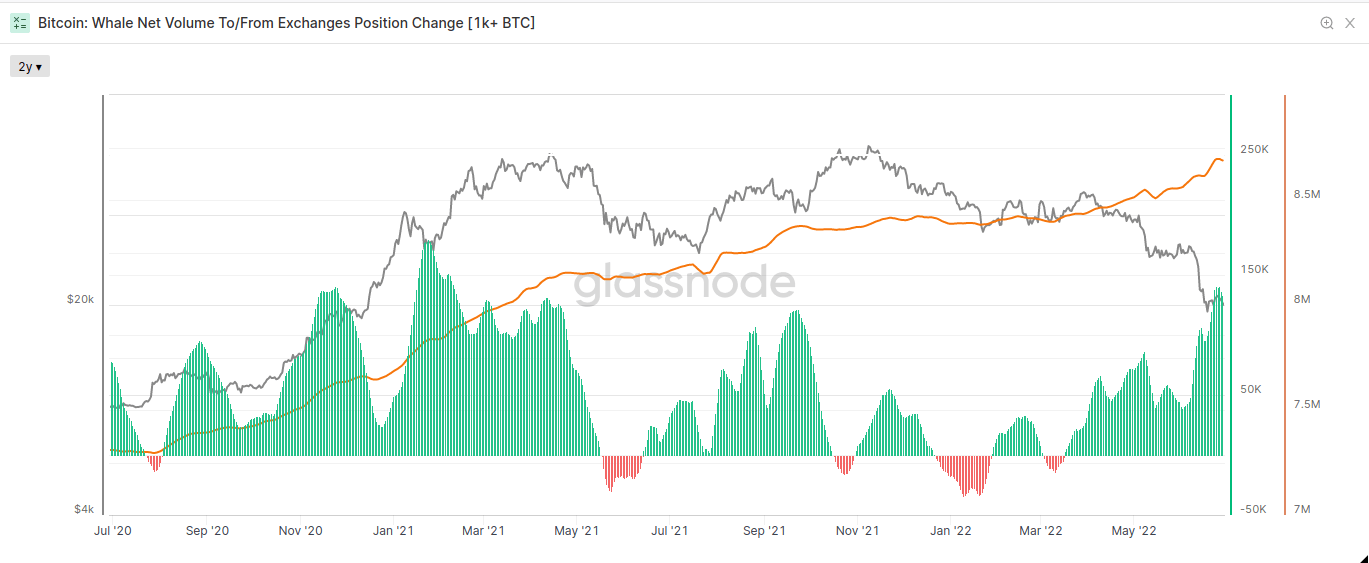

While Bitcoin periodically dips below $20,000 and most traders anticipate another wave of cryptocurrency collapse, some indicators suggest large BTC purchases by market players have begun. According to analytics platform Glassnode, “whales” – owners of cryptocurrency wallets with at least 1,000 BTC on their balance sheet – are actively involved in this process. Let us tell you more about the situation.

It should be noted that there are plenty of people willing to buy Bitcoin even now. Specifically, MicroStrategy’s head Michael Saylor announced on Wednesday that he had purchased 480 bitcoins worth $10 million. As a result, the company now has 129,699 BTC, for which it has spent $3.98 billion. That means the giant owns every 161st bitcoin that will ever exist.

MicroStrategy head Michael Saylor

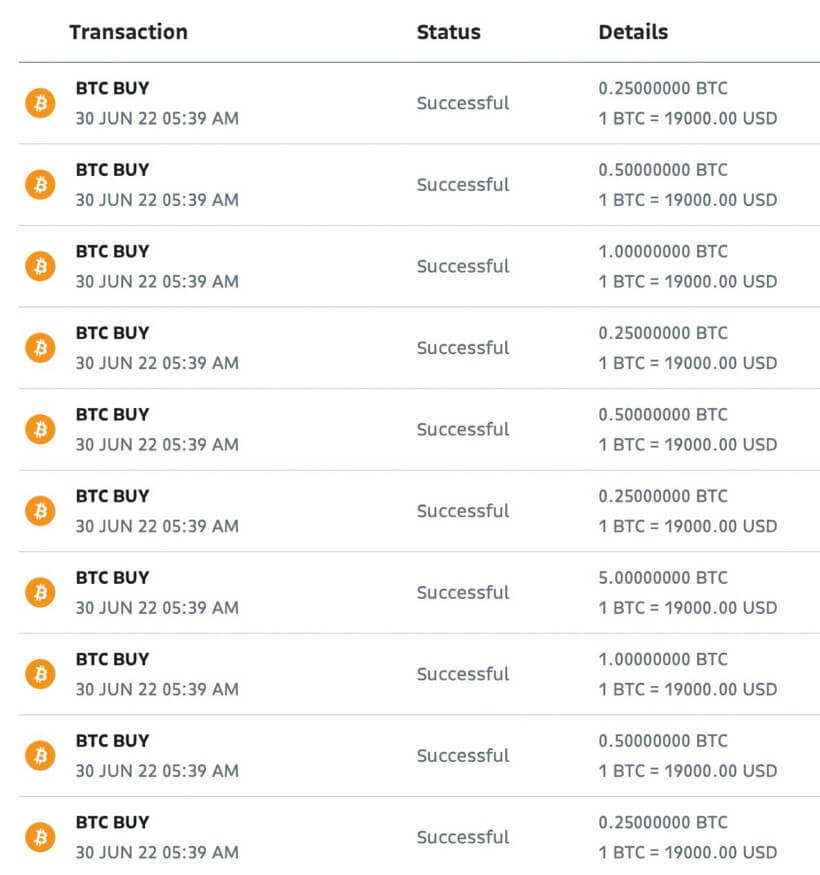

Also tonight, the purchase of 80 BTC worth $1.52 million was announced by Salvadoran President Nayib Bukele. Each coin was purchased for $19,000. Which means the country’s leader has no plans to get rid of the idea of investing in Bitcoin, even despite the current losses on the position.

Bitcoin purchases by representatives of El Salvador

These are not the only cases of buying the first coin. Analysts confirm this information.

What is happening to Bitcoin’s exchange rate?

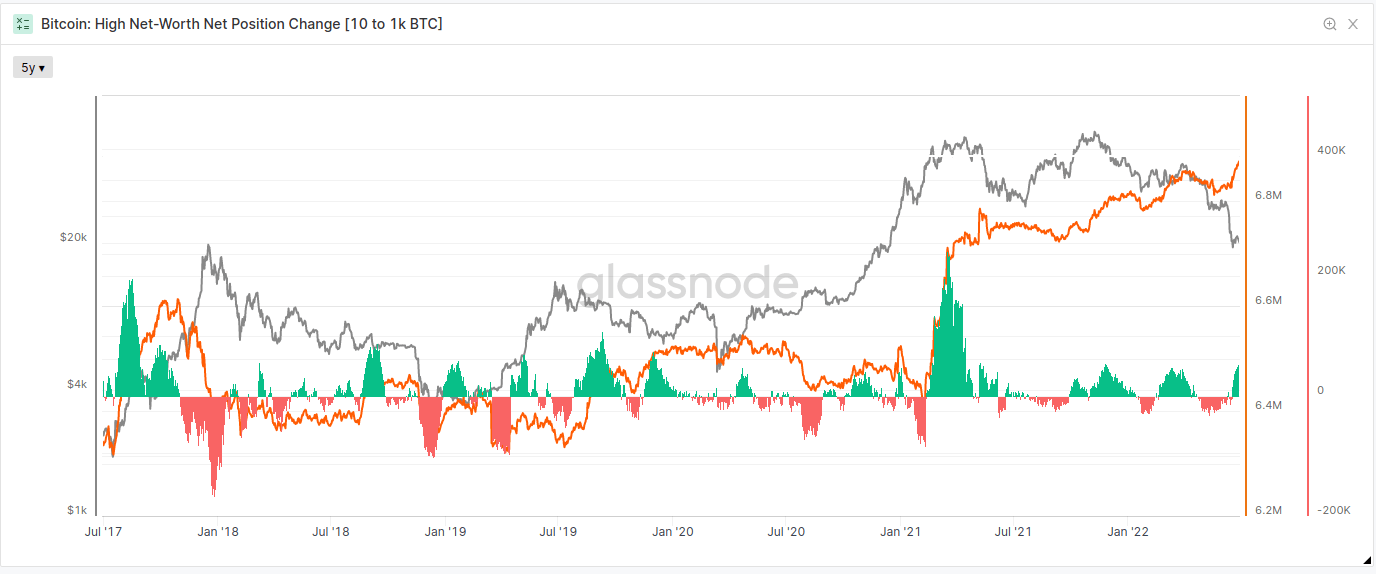

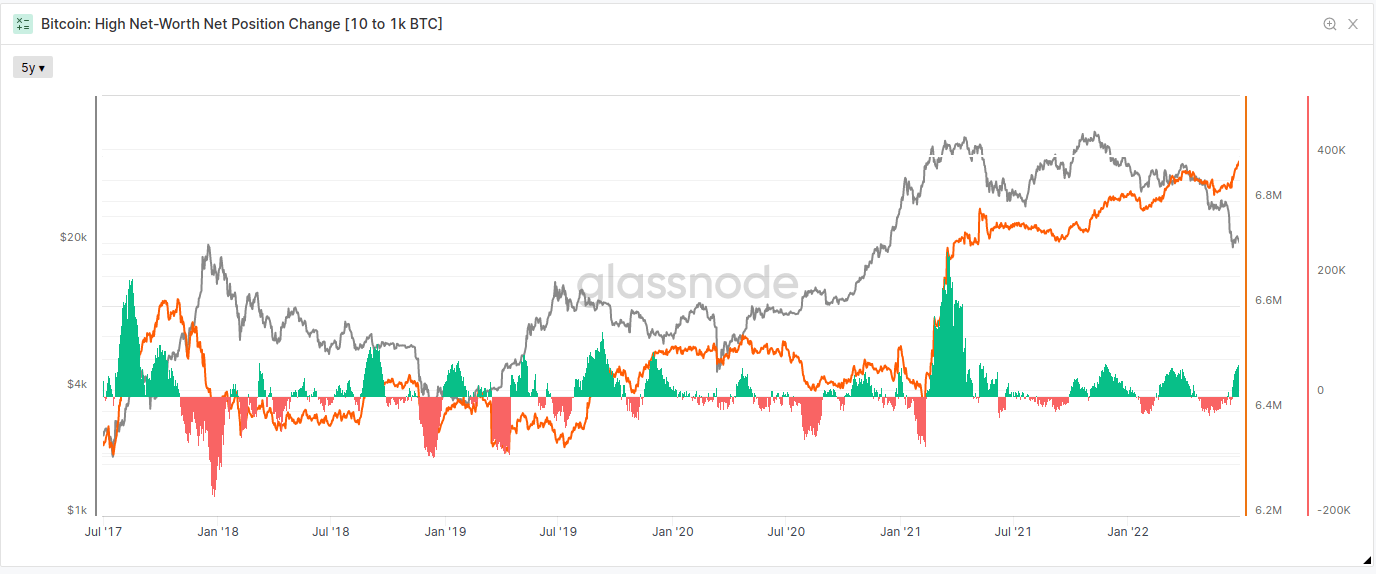

The main cryptocurrency has been falling in value for months now, but contrary to popular belief, buying activity is becoming more apparent in the market. Glassnode analyst Checkmate said this on Twitter. He divided traders into four categories – “shrimp”, “crab”, “shark” and “whale”.

The coins in their wallets are up to 1, 10, 1,000 and over 1,000 BTC respectively. So, the first two categories have set records for buying activity back from 2017, analysts report. Here’s their cue.

They can’t and won’t stop. Shrimp are adding to their BTC balance at the fastest rate since the all-time high in 2017. Same Bitcoin price, just a different trend direction. I don’t underestimate the intelligence and conviction of small players in the crypto market.

In other words, relatively small investors are actively adding to their own Bitcoin holdings. Apparently, they are convinced of Bitcoin's bright future and therefore have no doubts about the advisability of buying crypto at all right now. And for them, the current deals are a real "sell-off" of coins at discounted prices.

Coin purchases by cryptocurrency wallets with balances under 1,000 BTC (Sharks)

“Sharks are also adding to the volume of their cryptocurrency wallets – albeit at a relatively low rate, experts note.

Coin purchases by cryptocurrency wallets with balances up to 1,000 BTC (sharks)

But the “whales” are buying BTC in noticeably larger amounts, the last time such activity in their ranks was back in March 2021. Recall that Bitcoin was rising rapidly towards its new all-time high at that time.

Coin purchases by cryptocurrency wallets with balances over 1,000 BTC (whales)

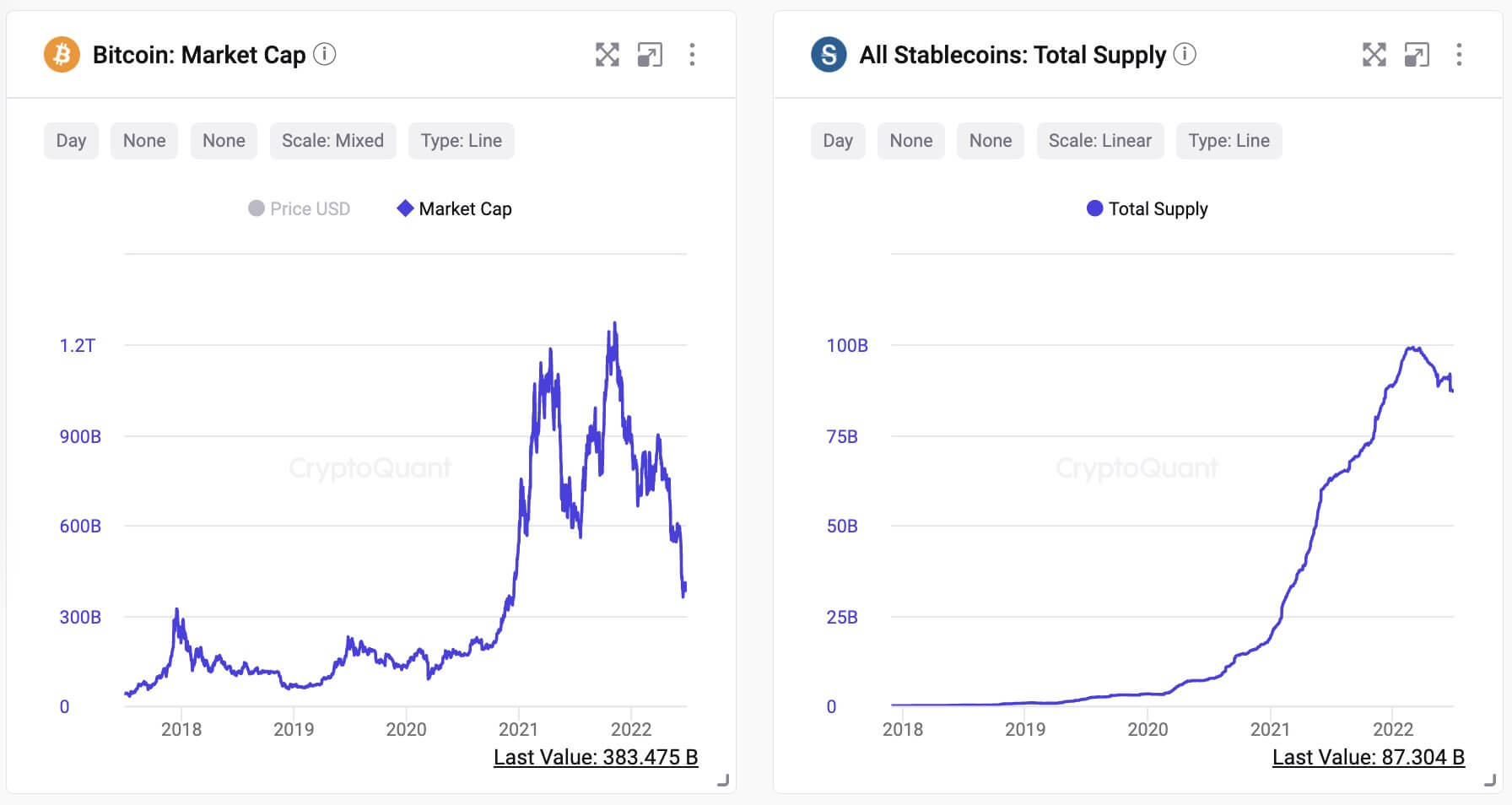

According to Cointelegraph sources, CryptoQuant’s head of analytics, Ki Young Joo, said that investors are also holding capital in staplecoins for fear of a rebound in the Bitcoin chart, i.e. a move downwards. Here’s his quote.

The balance of Stablecoin on the exchanges is about half their reserves in Bitcoin. We have $25 billion in Stablecoin at the ready, which will lead to a rise in digital assets. The only question is when it will happen.

So investors have more than enough money. However, some of them continue to wait for a better opportunity to add to their own asset holdings.

Bitcoin price and balance of staplecoins on exchanges

Unfortunately, another local wave of BTC growth could be hindered by negative news. The day before, the Monetary Authority of Singapore (MAS) published a notice that major crypto fund Three Arrows Capital (3AC) had provided the regulator with “false information”. 3AC allegedly set up a company in the British Virgin Islands and, according to MAS, “transferred the management of its fund to an unrelated offshore company”. However, “the move is misleading” as one of the fund’s founders, Soo Joo, was also a shareholder in the British Virgin Islands, Decrypt reported.

The MAS reprimanded 3AC’s management for failing to notify the regulator of “changes in directors and management shareholdings” and for breaching the allowable amount that 3AC can manage. The crypto fund exceeded the $250 million asset limit under management during two periods – July to September 2020 and November to August 2021.

Three Arrows Capital co-founder Su Zhu

Three Arrows Capital is currently hanging by a thread from bankruptcy – the rapid fall of the crypto market has “uncovered” numerous internal problems of the crypto fund, including misuse of funds and including leverage too high to borrow them. Liquidating the company in bankruptcy would mean it would have to sell some of its crypto reserves – which would also negatively impact digital asset prices.

We think such investor activity is logical. And while Bitcoin, along with the rest of the coins, could still see a marked decline given the geopolitical and economic problems around the world, buying the asset after its price collapse looks adequate in any case. The main thing is that crypto lovers should have money to average their positions in case of another wave of collapse. Or at least a willingness to wait out the tough times.

Let’s hope that investors will stand the test of hardship and prevent another plummet on the BTC chart. What do you think about it? Share your opinion in our millionaires’ cryptochat.