Just 3 per cent of the top cryptocurrencies set new price records during the new bull run. What does this mean?

The cryptocurrency market is usually associated with cycles of ups and downs: that is, while crypto is going down, investors and digital asset enthusiasts expect it to rise in the long term anyway. But how can that growth actually be defined? Digging a little deeper than the usual dollar rate of altcoins reveals one interesting fact. It turns out that the vast majority of digital assets from as far back as the previous bull run of 2017 never made their new highs. We tell you more about what’s going on.

Which cryptocurrencies are growing stronger?

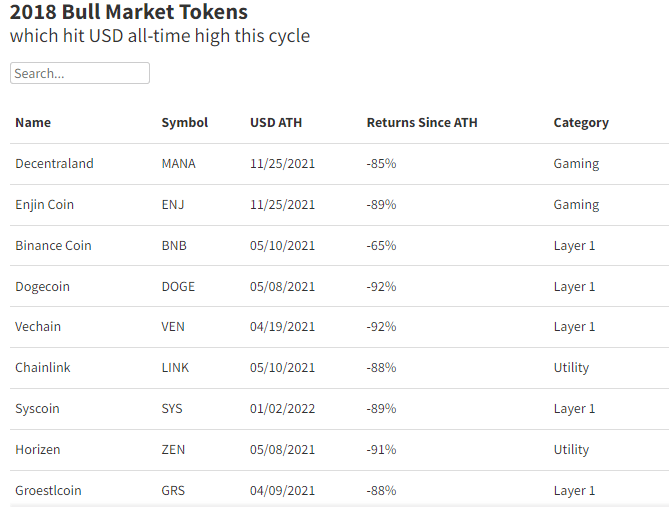

A study on this was published the day before by news portal Blockworks. The article notes that in dollar terms, only 26 coins out of the first 200 cryptocurrencies by market capitalisation have set a new price record since January 2018. Half of them are tier one cryptocurrencies like Etherium and Cardano.

We are talking about native tokens for Tier 1 networks. These are blockchains that are the basis for transactions - and they are the basis for second-tier solutions like Polygon, Arbitrum and Optimism. Examples of Tier 1 networks are Bitcoin, Etherium, Solana, Avalanche, Aleph Zero and many others.

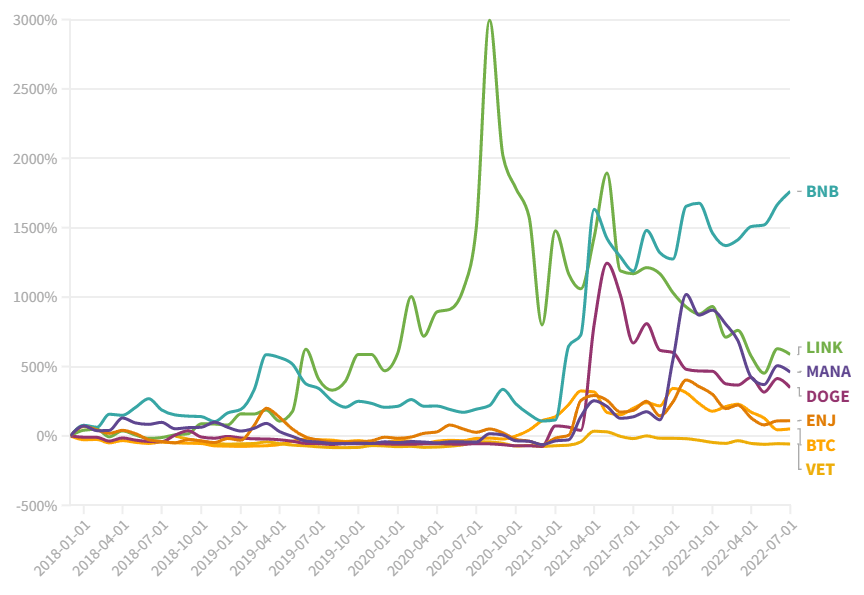

However, if you switch the chart of these alts to a trading pair with BTC – that is, to see how their price changes specifically to Bitcoin – only 6 coins reached an all-time high relative to the main cryptocurrency: Dogecoin, Binance Coin, Chainlink, Decentraland, VeChain and Enjin Coin. That’s just 3 percent of the top 200 cryptos by capitalisation, which is an extremely small proportion.

Note that many traders do trade in tandem with Bitcoin and evaluate what is happening with the individual cryptocurrency specifically in relation to BTC, as they want to increase the volume of the first cryptocurrency at their disposal. If a coin shows some growth in terms of dollars, but is stable or declining in comparison with BTC, it would be more profitable to hold Bitcoin during this period, and BTC is stronger in this case.

Profitability of the most “successful” coins in the crypto market

If you look closely, each of these coins has its own patterns for “rocking” the price, which have positively impacted the exchange rate. Dogecoin – memes and Elon Musk, Binance Coin – regular token burning, as well as overloads of the Etherium network in 2021, which forced many traders to use the Binance Smart Chain (now BNB Chain). That said, Decentraland and Enjin Coin have found themselves in the spotlight thanks to the popularity of metaclasses and the hype surrounding the decentralised finance industry in general.

However, even these "champions" among altcoins quickly began to fall with the arrival of the bearish trend. Which is another reminder that trying to survive a bear market in open positions is fraught with financial losses - albeit unrealised ones.

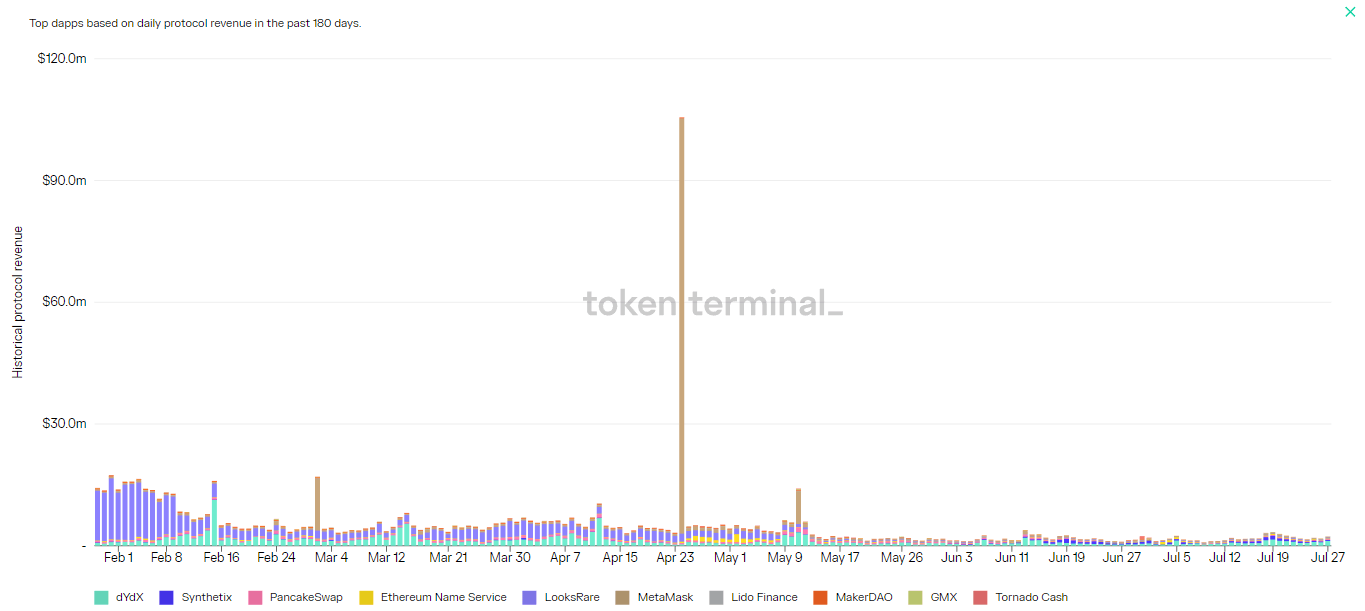

To achieve some sort of equivalent in the valuation of crypto projects, one could try to apply traditional company valuation techniques to them. To that end, a service called Token Terminal has been created that applies metrics to assess the profitability of various cryptocurrency protocols. However, according to the platform’s head of growth, Oskari Tempakki, even such methods are not very helpful. Here’s his rejoinder.

In hindsight, especially comparing the bullish trend of 2018 to the situation in 2021, it is very difficult to build any system that can display the fundamental success of certain tokens.

Some of those coins that managed to set an all-time high in this bullrun (2021)

The platform evaluates revenue-generating protocols and blockchain start-ups that run exclusively on blockchain. During the last bullrun, it was impossible to accurately value altcoins based on the aforementioned factors, as DeFi-protocols started actively generating revenue at all in mid-2020, affecting their popularity. Hence, experts conclude: A fundamental assessment of the “usefulness” or “value” of certain crypto projects in a single frame of reference is almost impossible.

In general, the crypto market is more valuable when it shows growth dynamics: the faster Bitcoin and altcoins rise in value, the more attractive they become for most investors. And there’s no need to try to apply any logic from traditional markets here. The cryptocurrency industry, which has already crossed the trillion-dollar capitalisation line in the past, is still an irrational phenomenon in and of itself.

DeFi-protocols profitability

Hassan Bassiri, vice president of Arca, supports a similar view. Here’s his rejoinder, in which the expert shares his view of what’s going on.

Crypto doesn’t need fundamentals in the traditional sense. The nature of cryptocurrencies is such that they depend on growth potential. Let’s say something like Aave or Yearn trades at a 1000:1 price to DeFi-protocol sales or revenue ratio. Fintech rival Neobank shows a similar ratio of 200:1. Should cryptocurrency be worth five times as much?

Cryptocurrency analysts

We think that assessing the cryptocurrency's potential for further growth when paired with Bitcoin is really important. After all, it is usually BTC that leads the bullpen and other coins. This means that if a digital asset shows a negative performance relative to Bitcoin, it would be more profitable to go with the latter in that case. That being said, targeting different trading pairs would come in handy first and foremost for traders, as such changes allow them to switch cryptocurrencies and make the most of a rising market. Accordingly, such an approach will hardly suit those same long-term holders.

What do you think about this? Share your opinion in our Millionaires Crypto Chat. There we will discuss other important developments in the blockchain and decentralization industry.