One of the top cryptocurrency billionaires believes the worst for the coin market is over. Why?

The worst crypto market conditions in a decade could soon be replaced by a more favourable period for investors. That’s the view of FTX CEO Sam Bankman-Fried. The day before, he stated that “the worst is over”, meaning that the toughest wave of Bitcoin’s collapse has come to its logical end. Bankman-Fried is also staying true to his strategy of providing financial assistance to various cryptocurrency companies, as he has stated many times before. We tell you more about the situation.

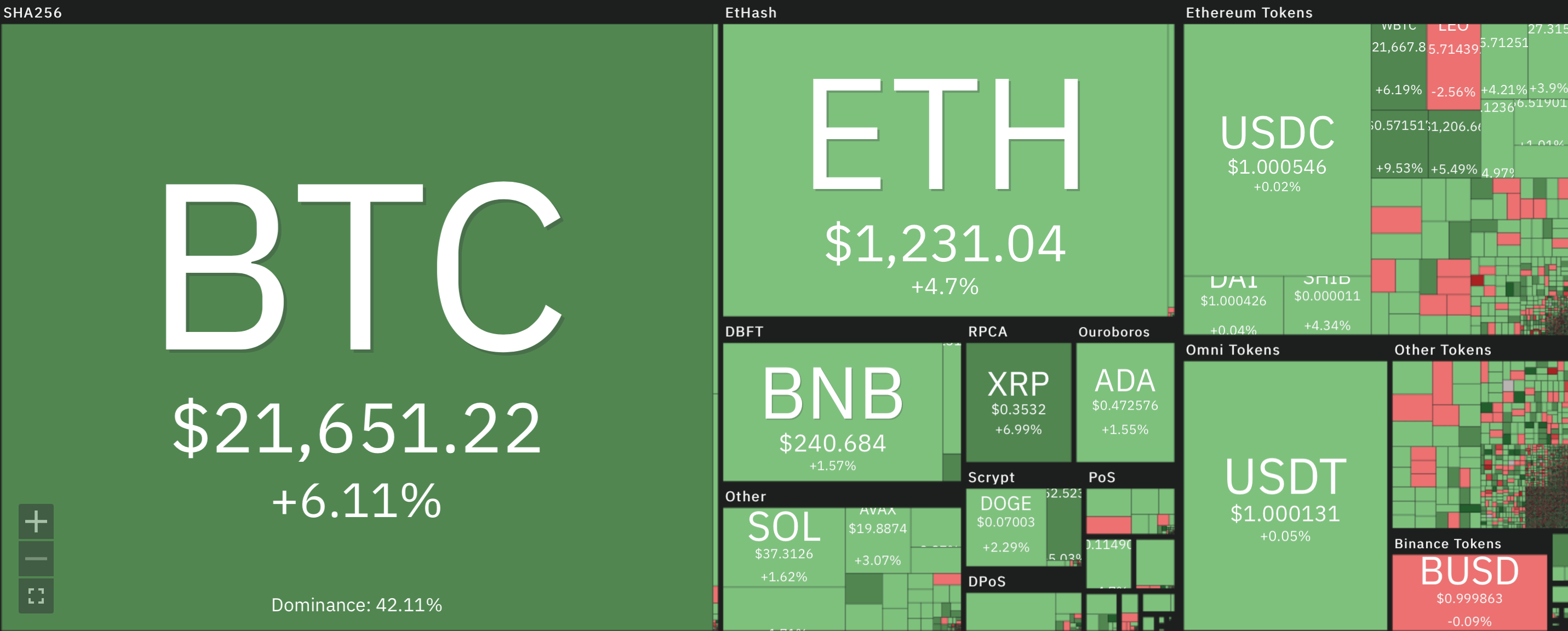

It should be noted that the market situation looks relatively stable lately. Bitcoin never visited the $17k zone after falling there and is now entrenched at $20k. Moreover, this morning it was showing gains as high as $22.5 thousand, which hasn’t happened in quite a while.

15-minute chart of Bitcoin

What has been happening in the cryptocurrency market over the past 24 hours looks like this.

Changes in cryptocurrency rates over the past 24 hours

Against this backdrop, the entrepreneur admits that counting on some new catastrophic market collapses should be a bit more restrained.

When will Bitcoin start rising?

This time around, Bachmann-Fried said FTX still has at least “several billion dollars” of funds that could be spent to stabilize the financial situation of cryptocurrencies hit by Bitcoin’s bearish trend. The head of the exchange stressed the importance of maintaining a healthy state of the entire crypto market ecosystem by handing out large loans and other types of assistance.

As the FTX chief made clear, some crypto firms have sought help directly. Among them is cryptocurrency broker Voyager Digital, which received an extension of its credit line with Alameda Research to $500 million. As a reminder, Alameda Research is the fund founded by Bankman-Friede, which is also behind its exchange.

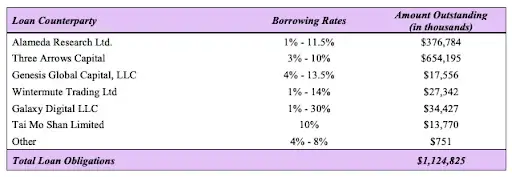

Most interestingly, Voyager Digital's bankruptcy documents show that Alameda Research has $377 million in liabilities to it. Almost twice that - $600 million - Voyager Digital is entitled to receive from Three Arrows Capital, which is also going through bankruptcy proceedings.

Voyager Digital’s bankruptcy filing data

A table on page 13 of the bankruptcy petition filed this week in New York District Court shows that Alameda Research owes Voyager $377 million at interest rates ranging from 1 per cent to 5 per cent. According to the list of Voyager’s largest unsecured claims on page 119 of the bankruptcy filing, the amount owed includes a $75 million unsecured loan.

In fact, however, Alameda Research is now considered Voyager Digital’s ‘saviour’, as its extended credit facility will help the cryptocurrency broker avoid a complete collapse in this bearish trend. Bankman-Fried has so far backed up his claims with deeds – he is indeed willing to financially support troubled companies. Perhaps because of him, this bearish trend will not be so critical in terms of losses for investors, analysts suggest.

Sam Bankman-Fried, head of cryptocurrency exchange FTX

According to Decrypt’s sources, the wave from the collapse of one project could sweep across the entire coin market, as happened with Terra. As a reminder, this project very quickly lost almost its entire capitalisation due to the initial collapse of the TerraUSD algorithmic stackcoin, with the crypto market going into another correction after the incident itself. With economic uncertainty, Bancman-Fried doesn’t want the community to lose faith in the industry amidst all the events. Here’s his rejoinder.

Consumer confidence that things will work as they should is incredibly important. If that trust is broken, it is incredibly difficult to get it back.

So the billionaire is making it clear that relatively new people in the crypto industry need to stay in order for the digital asset sector to continue to grow at the same rapid pace. And that is precisely the aim of FTX's financial aid.

As for Bitcoin’s decline, Bankman-Fried is confident that crypto is already near its global bottom. However, macroeconomic factors will continue to affect digital assets, Sam suggests. Here’s his quote.

I don’t think external influence is an existential threat to the industry. But things have worked out markedly worse than I expected.

That is, the entrepreneur admits that the magnitude of the coin market collapse was more severe than he had anticipated. Accordingly, he probably hadn't previously planned to allocate millions of dollars in financial aid to the coin industry giants. Still, they faced difficulties due to unexpected phenomena like the collapse of the Terra ecosystem, as well as further defaults and insolvencies of the companies that were associated with it.

The fall of Bitcoin and other cryptocurrencies

We believe that in theory the cryptocurrency market may indeed have bottomed out. Still, the current drawdown is caused by massive sales of coins by bankrupt crypto funds and mining companies, which were forced to get rid of their own assets. Accordingly, it is not certain that such transactions will continue. And when the panic wears off, crypto investors will think about the need to buy coins at such bargain prices. At least that's how it used to go before.

What do you think about this? Share your opinion in our millionaires cryptochat. There we will discuss many other interesting news.