Significant growth in Bitcoin is now considered highly unlikely. What’s stopping the major cryptocurrency?

One of the expected developments this week is Bitcoin’s rise to the $20,000 level. So far, the main cryptocurrency has been trading below this line, which was previously considered by many to be a very important support level and simply a psychological marker. That said, BTC is now dependent on the dynamics of the DXY index, which is a representation of the strength of the US dollar against a basket of the world’s other six most weighty currencies and is breaking records. Let us tell you more about the current conditions in the coin market.

It should be noted that most experts really don’t expect any dramatic change in what is happening in the coin industry at the moment, as inflation continues to pick up in various regions and geopolitical issues have not yet been resolved. However, this does not mean that the growth phase for the cryptocurrency niche will never come.

According to experts, there could be several reasons for coins to shift to growth. The main one is a policy change by the Federal Reserve, whose representatives should sooner or later leave the key rate alone after its long rise. Also the adoption of a spot ETF for Bitcoin would have a good effect. Other points can be found here.

Bitcoin stocks by the hodlers

That said, there really isn’t much to expect from the coin market in the short term.

Why Bitcoin is not rising

The DXY index is near its all-time highs at the moment, which shows the strength of the dollar against other assets, although it has seen a slight correction over the past few days.

DXY index

Even such a slight drop in the index is a very sensitive indicator for the price of Bitcoin, says trader Daan Crypto Trades. Here’s a rejoinder in which the expert shares his view of what’s happening.

It’s worth noting how quickly risky assets rise when DXY dips by even the lowest value. They react much more strongly precisely to a fall in the index than to its rise. When the DXY falls even lower, I expect more notable bounces in the crypto market.

In other words, the analyst is betting on a weakening of the dollar against other assets. Such a situation usually creates conditions for investors to be active, as they face the need to invest their own capital. And cryptocurrencies are an attractive niche given their fundamentals.

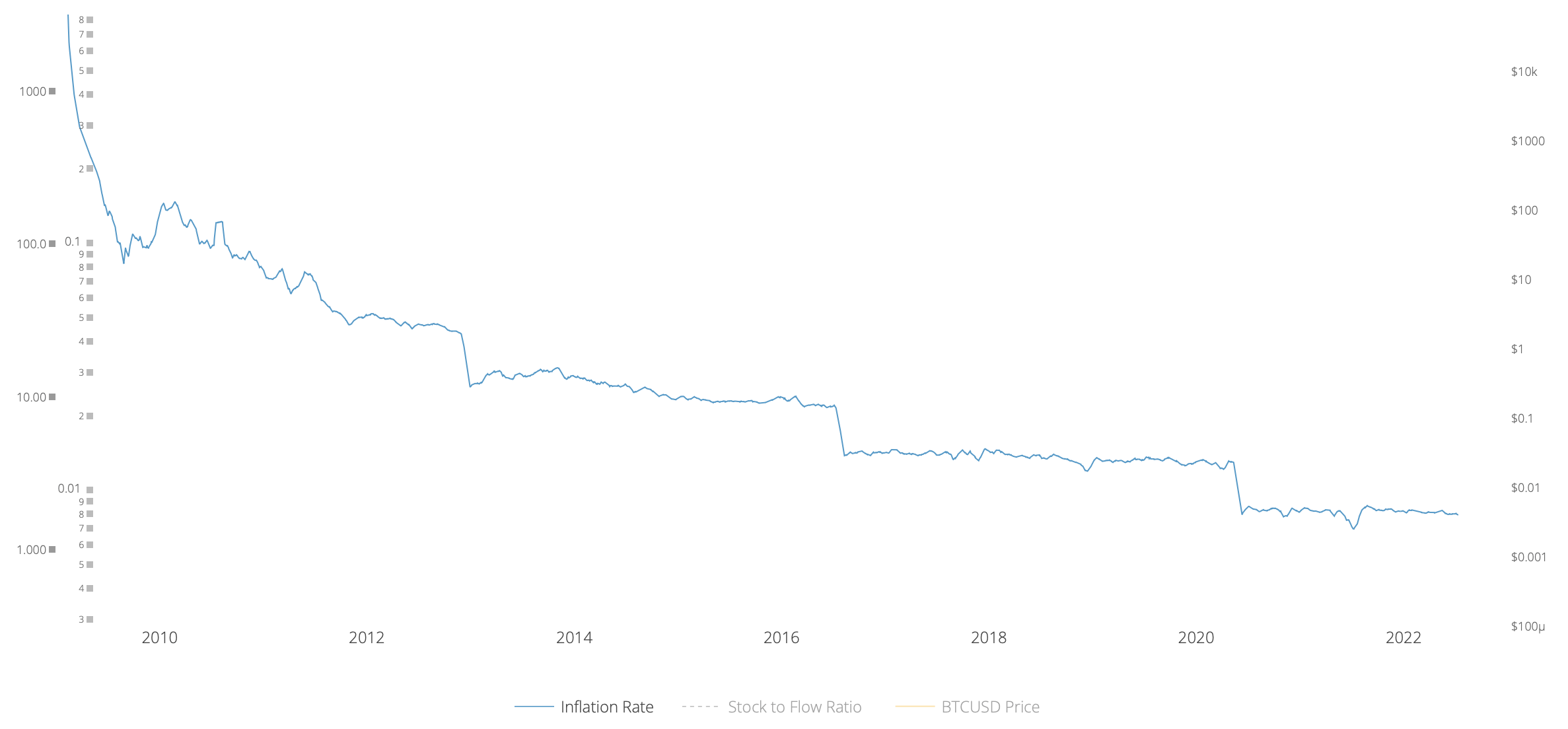

It's primarily about a fixed rate of inflation that can't be influenced. As of today, this Bitcoin rate stands at 1.68 percent p.a. - that is exactly the proportion by which the total Bitcoin supply increases over the course of a year. At the same time, in the overall economy of various countries, this figure exceeds 10 per cent annually.

Bitcoin inflation graph

But the trader under the nickname Crypto Ed has a much more pessimistic outlook. In his recent YouTube video, he stated that the probability of Bitcoin rising to at least $24,000 in the near future is “quite low”. A similar situation is also seen in the stock market – investors should allegedly prepare for a new wave of correction, rather than aiming for higher levels.

Bitcoin exchange rate

It should be noted that Bitcoin does indeed show very little sign of any upside. After falling below $20,000 this week, the major cryptocurrency has not even demonstrated an attempt to approach the aforementioned level. At the same time, any serious drop from the current values could mean much bigger losses for investors, as the scale of this correction is already unprecedented.

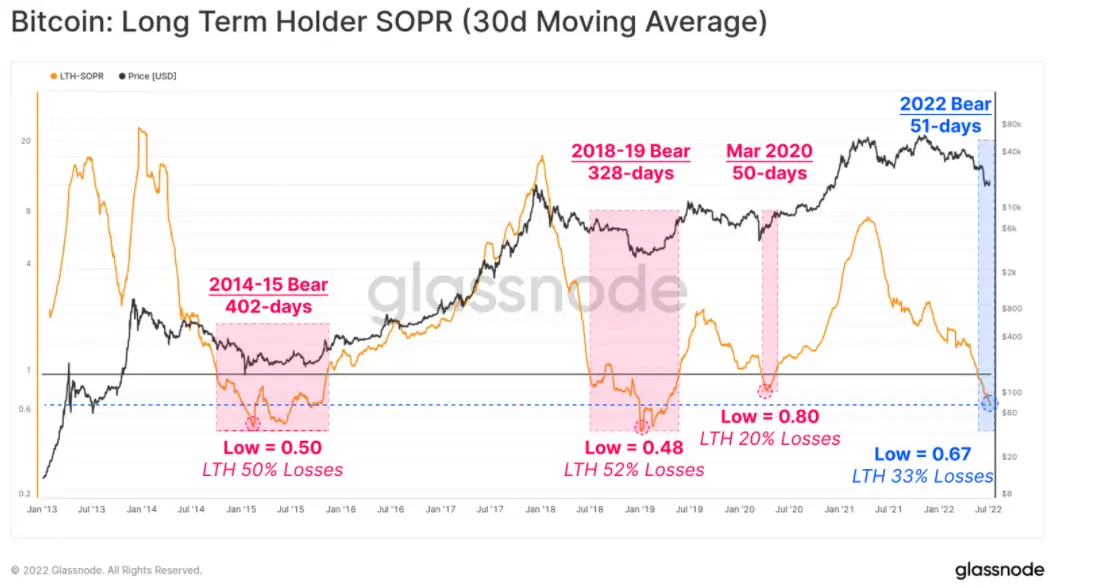

Bitcoin bearish trends and their duration

According to Cointelegraph sources, analysts at Glassnode have noted a trend of “heavy pressure” on long-term Bitcoin holders. Unfortunately, this does not yet mean that the current bearish trend is even close to its bottom, and in fact it only lasts fully for just over 50 days. By comparison, the bear trends of 2015 and 2018 lasted 402 and 328 days respectively. Although if we consider the market peak to be November 2021, when Bitcoin reached $69,000, then the final current interval turns out to be longer.

So there is a possibility that true fans of digital assets have yet to prove their unwavering faith in the industry. And Glassnode analysts are also making it clear that it’s too early to expect the industry to finally turn bullish.

We believe that significant growth in the cryptocurrency industry will be more likely once the Fed stops raising the benchmark interest rate so sharply. If that happens, there will be more money in the industry and investors will be more likely to invest in risky assets. For this to happen, experts suggest we must first wait for inflation to stabilise.

What do you think about the situation on the market? Share your opinion in our millionaires’ cryptochat. We discuss other important developments there as well.