The behaviour of Bitcoin holders is reminiscent of previous periods of cryptocurrency market bottoms. But how exactly?

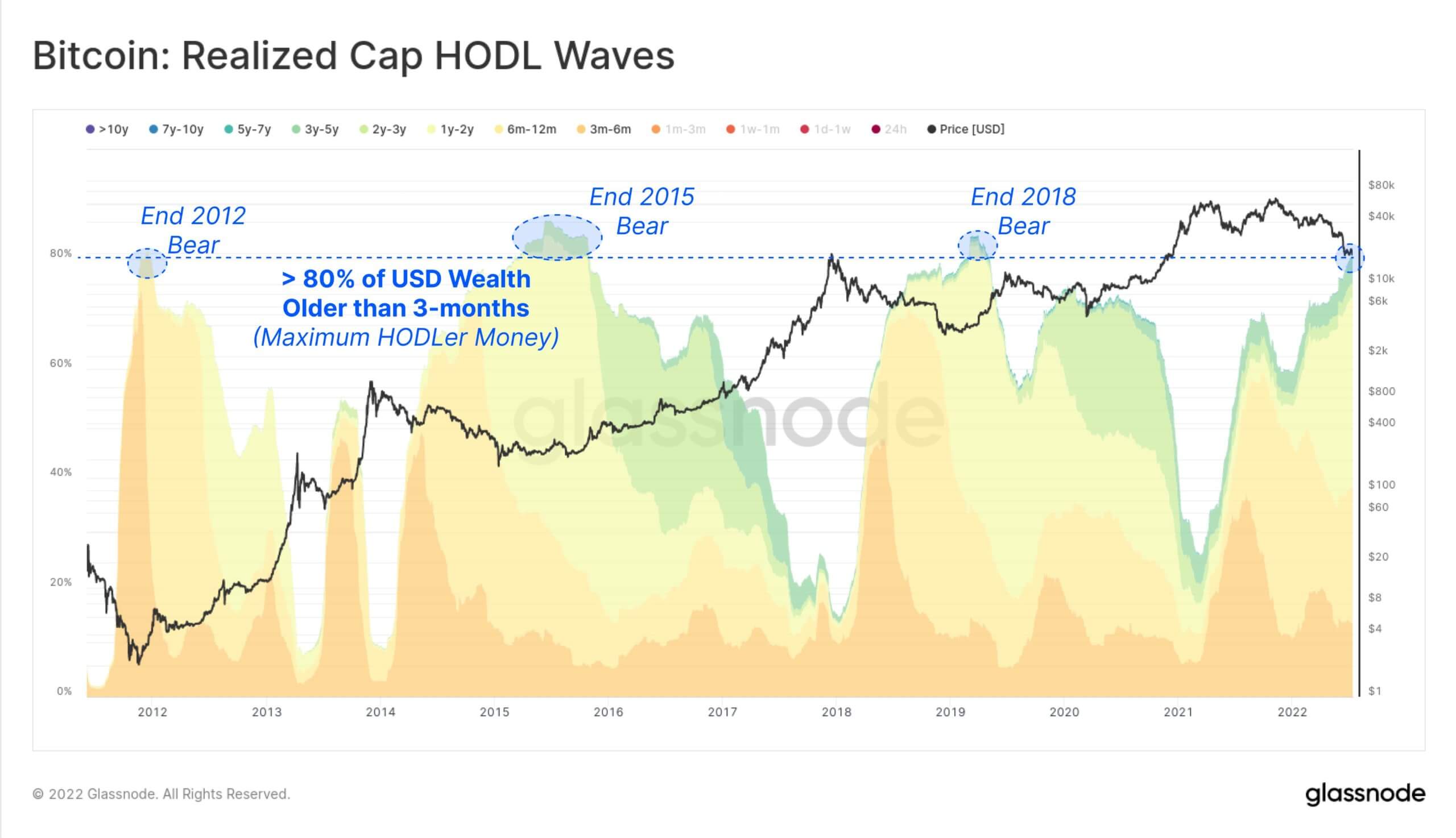

The behaviour of most Bitcoin holders over the past three months is noticeably similar to the dynamics of the crypto market, which formed the bottom during its previous bearish cycles. Experts at the Glassnode platform highlighted in a recent report that more than 80 per cent of the capital invested in Bitcoin in the form of dollars has not moved by investors over the past three months. This suggests that coin holders “definitely don’t want” to sell bitcoins at such a low price. In other words, they are deliberately entering positions and plan to hold the cryptocurrency for as long as they need to. We tell you more about what’s going on.

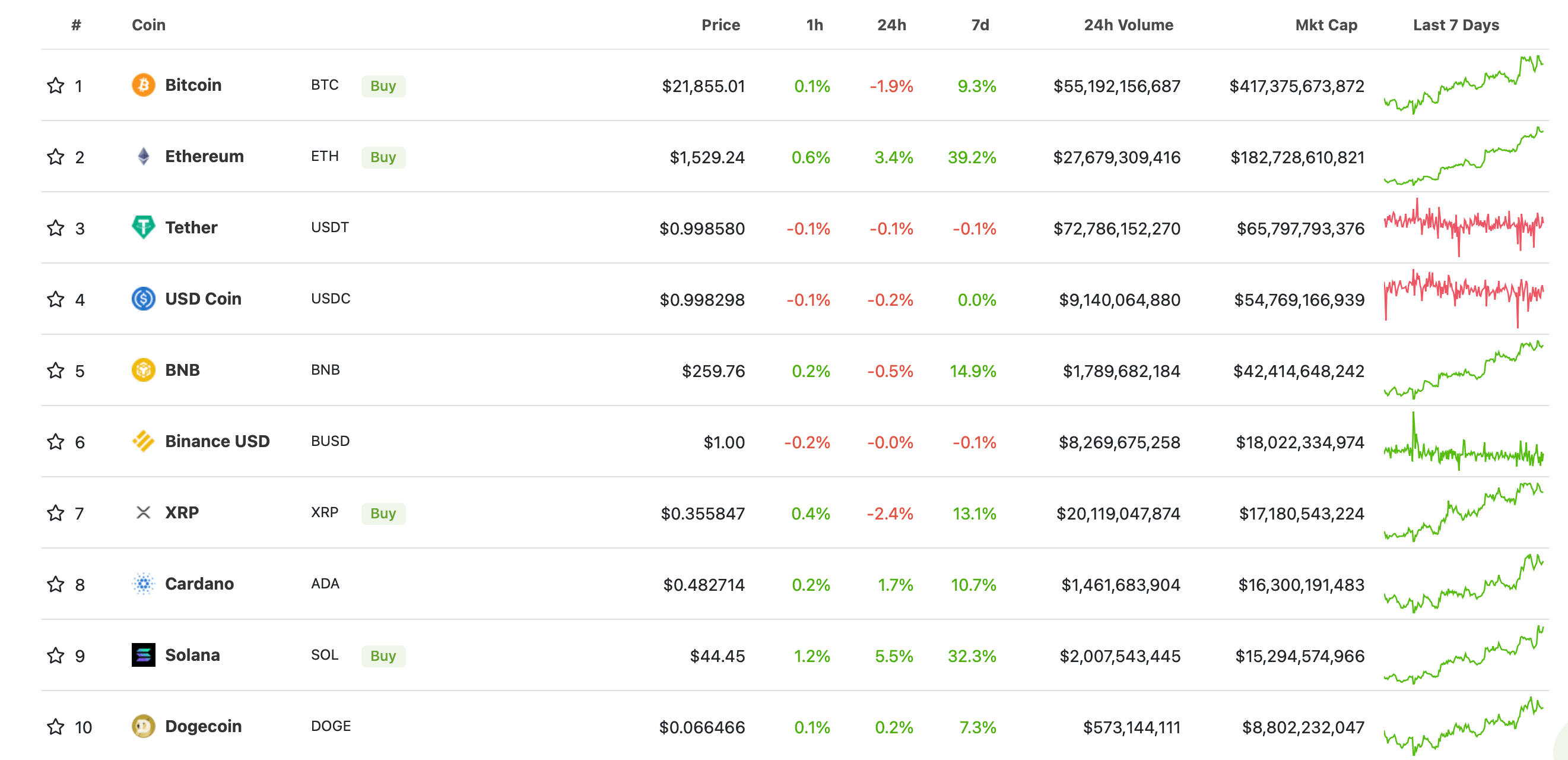

Note that the situation in the cryptocurrency market has started to improve recently. To make it clear, here is a graph of top coins by market capitalization over the last hour, day and week.

Changes in the rates of the top cryptocurrencies by market capitalization

As you can see, the leader on a weekly scale was Etherium with a 39 per cent increase. Second place belongs to Solana SOL – the coin has a 32 per cent increase over the last seven days.

What’s next for Bitcoin?

Bitcoin is trading just below $22,000 this morning. Meanwhile, the cryptocurrency’s price is still 68.3 percent below its all-time high of $69,000 set in November 2021. According to Cointelegraph sources, about 45 percent of BTC hodlers are now carrying unrealised losses.

As a reminder, a hold or hodl is a long term buying strategy for a cryptocurrency. Usually, fans of this tactic just buy the coins and don't really look at the charts, because they will be sold after a few years at best. The name of this type of investor behavior comes from a typo of an early Bitcoin fan. Read more about this story in a separate piece.

Dynamics of BTC holdings by different categories of investors

Crypto investors are really reluctant to sell their bitcoins so far, as also discussed in a report by David Duong, head of analytics at cryptocurrency exchange Coinbase. In his publication, he noted that short-term traders have been making the vast majority of BTC sales in recent weeks, while long-term investors are not eager to shed their coins. Here is a relevant quote in which the expert shares his view of what is happening.

These holders hold about 77 percent of the total BTC supply in their wallets. This is slightly below the 80 percent supply in their hands at the beginning of the year. We see this as a positive indicator of market sentiment as we think investors are less likely to sell BTC during a crisis.

In other words, the current actions of crypto investors already confirm their reluctance to get rid of digital assets. And such confirmation has been shown since the beginning of 2022, which has proved to be extremely challenging in terms of the global economy.

Bitcoin exchange rate

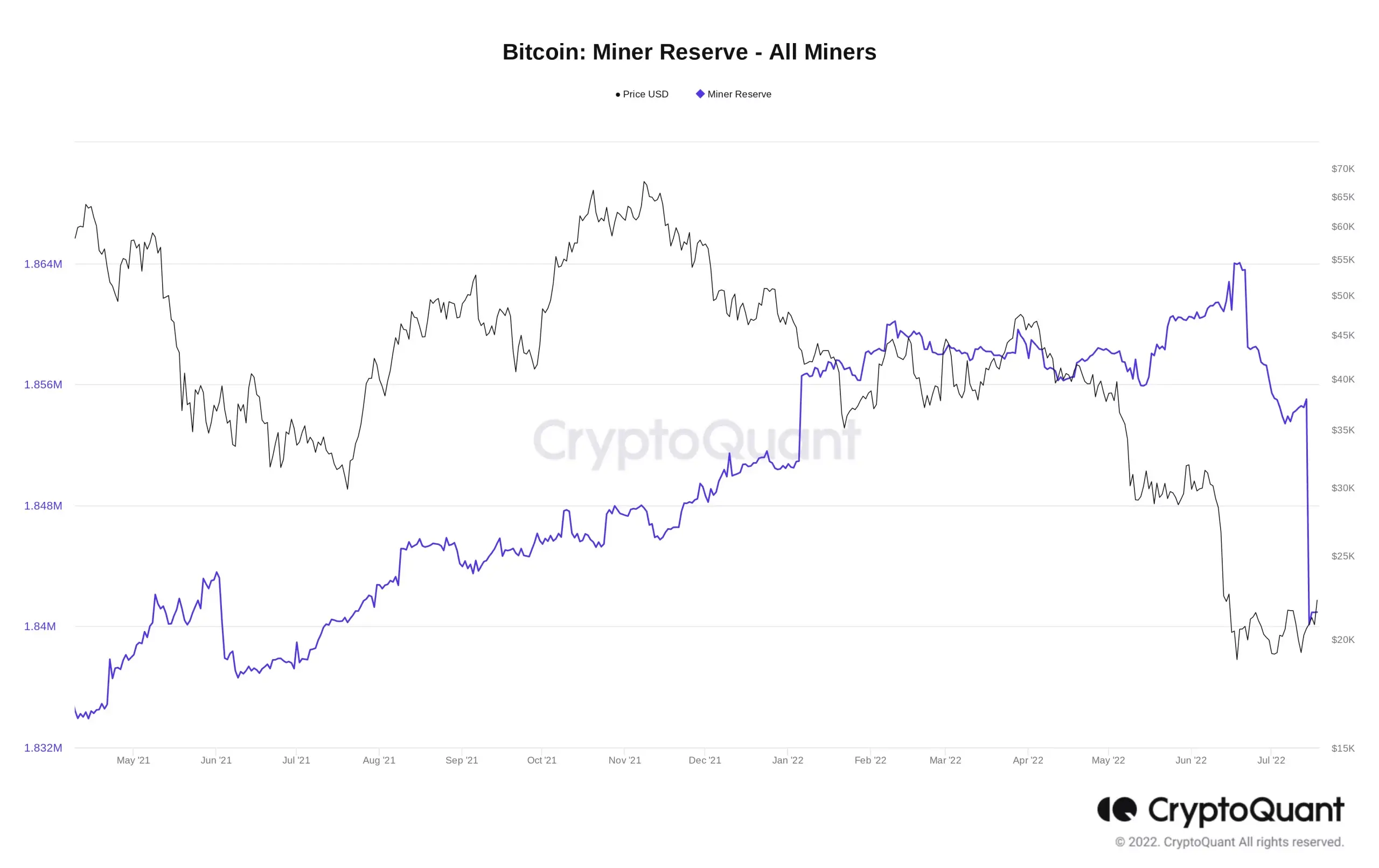

In addition to investor behaviour, the dynamics of BTC sales by miners are also signalling that the bottom may have been reached. As noted by analysts at the CryptoQuant platform, since July 14, miners have sold about 14,000 BTC, with about 1.84 million BTC now in their reserves. The amount of miners’ reserves has reached its lowest since last July – and that’s when the market, by the way, just started to grow.

Here’s an expert comment on the subject.

Bitcoin miners are finally capitulating. The Bitcoin price has been consolidating around $20,000 for the past few weeks, so investors couldn’t figure out if the hoarding phase was now in effect, or if the market had moved back to distribution. Looking at the graph of miners’ reserve dynamics, we can conclude that it is the second phenomenon that is relevant.

Reserves of BTC miners

The last and quite important factor for growth is the state of the macroeconomy. There is positive news on this point as well. Firstly, US inflation has already been announced this month, so this indicator won’t seriously influence markets in the future yet. Recall that the next inflation update will not be until August.

Secondly, the Fed’s Federal Open Market Committee will not make a decision on a rate hike until July 24, with traders already looking forward to it. If the outcome of the meeting is already clear to all, the markets are unlikely to react sensitively again.

Thirdly, the Dollar Index (DXY) has peaked in mid-July and is now falling relatively quickly. This is important because a strong US dollar negatively affects both the stock market and crypto. Therefore, the DXY chart and the support levels on it can be used as a guide in Bitcoin trading for now.

DXY dollar index

We believe that such investor behaviour proves their belief in the bottom coming in the cryptocurrency market. Consequently, even despite the difficult situation in the global economy and other problems, capital owners are spending money to buy digital assets. That means they have no doubts about the prospect of coins growing, increasing their influence in various areas of human activity and popularising blockchain assets in general. And the more investors act this way, the faster this prediction will come true.

Crypto may well show good local growth, don’t miss it and join our Millionaire Crypto Chat. There we will discuss other important developments from the world of blockchain and decentralisation.