The chess legend urged against panic over the collapse of cryptocurrencies. Why?

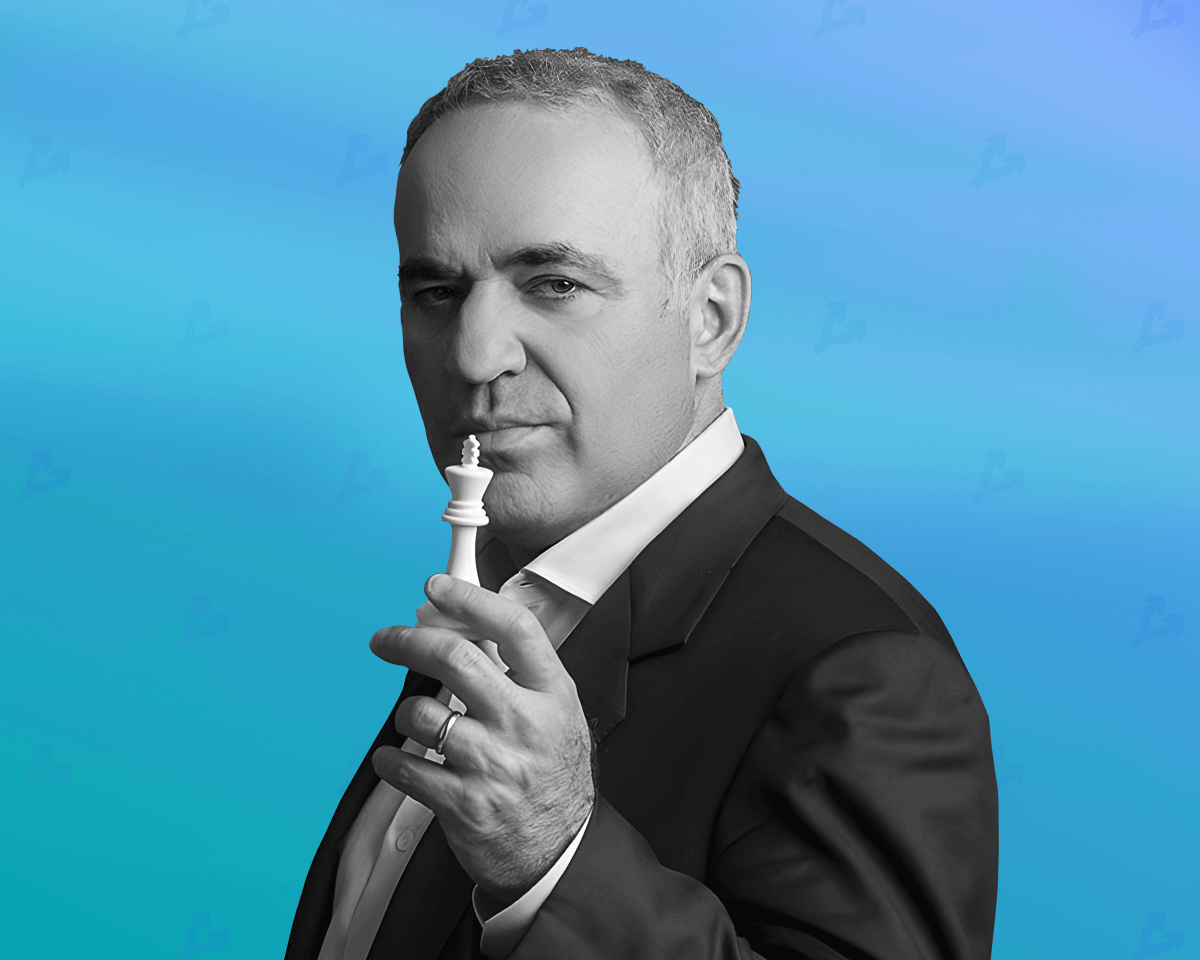

Grandmaster Garry Kasparov attended the Consensus 2022 conference in the first half of June. There he gave an interview to Cointelegraph journalists, where he shared his thoughts on the current state of the crypto market and the digital asset niche in general. According to him, investors should not panic over the bearish trend – the most popular cryptocurrencies are not going anywhere, as they are already integrated into the global financial system. We share the details of Kasparov’s thoughts, which have only just been published.

Note that the situation in the cryptocurrency market was quite challenging this weekend. In particular, Bitcoin, among others, fell below $19,000, which traditionally had a negative impact on other coins. The hourly chart of BTC looks like this.

Bitcoin’s hourly rate chart

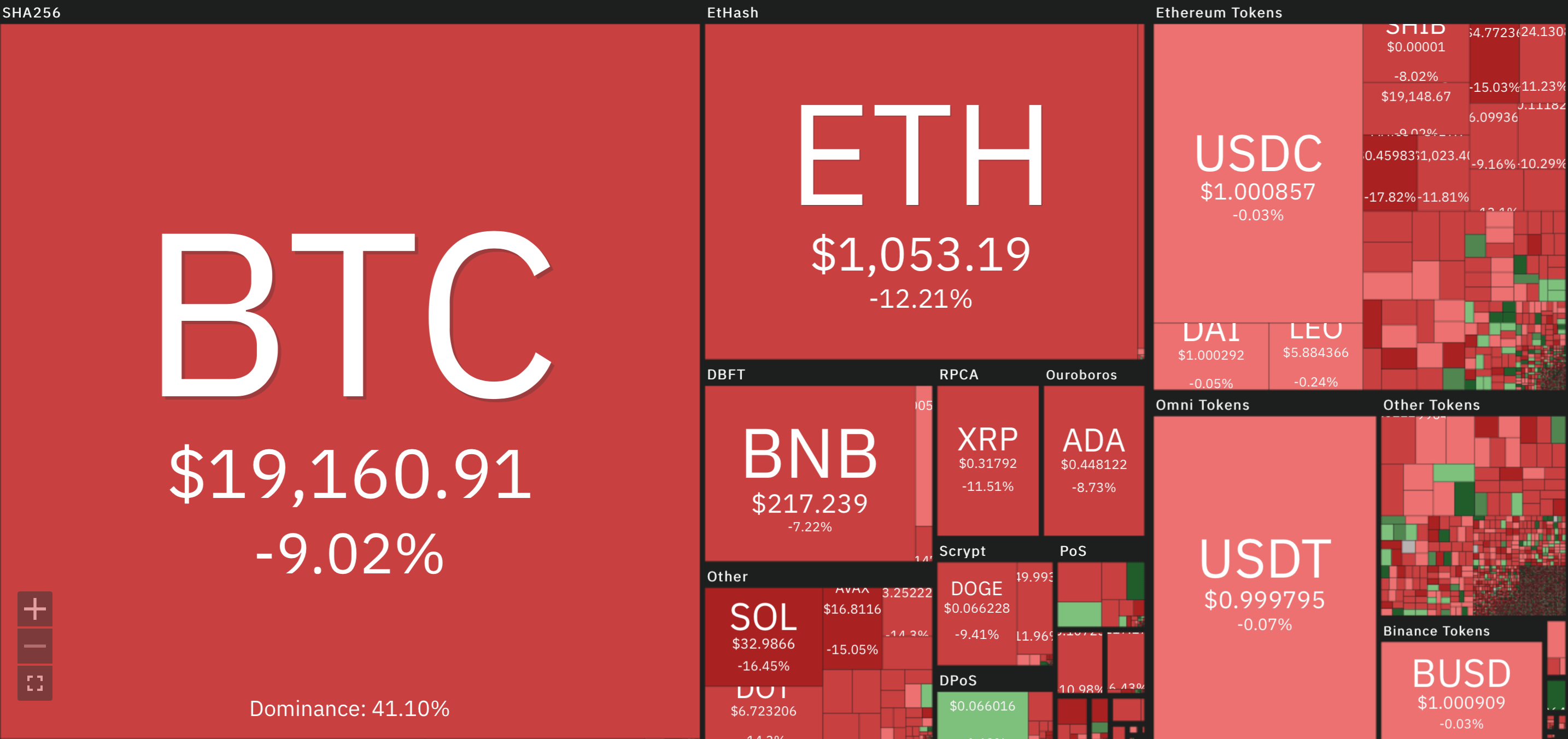

On the whole, at the end of the last week the rates of coins decreased noticeably. The situation with the rates of major cryptocurrencies looks like this.

Changes in cryptocurrency rates over the past week

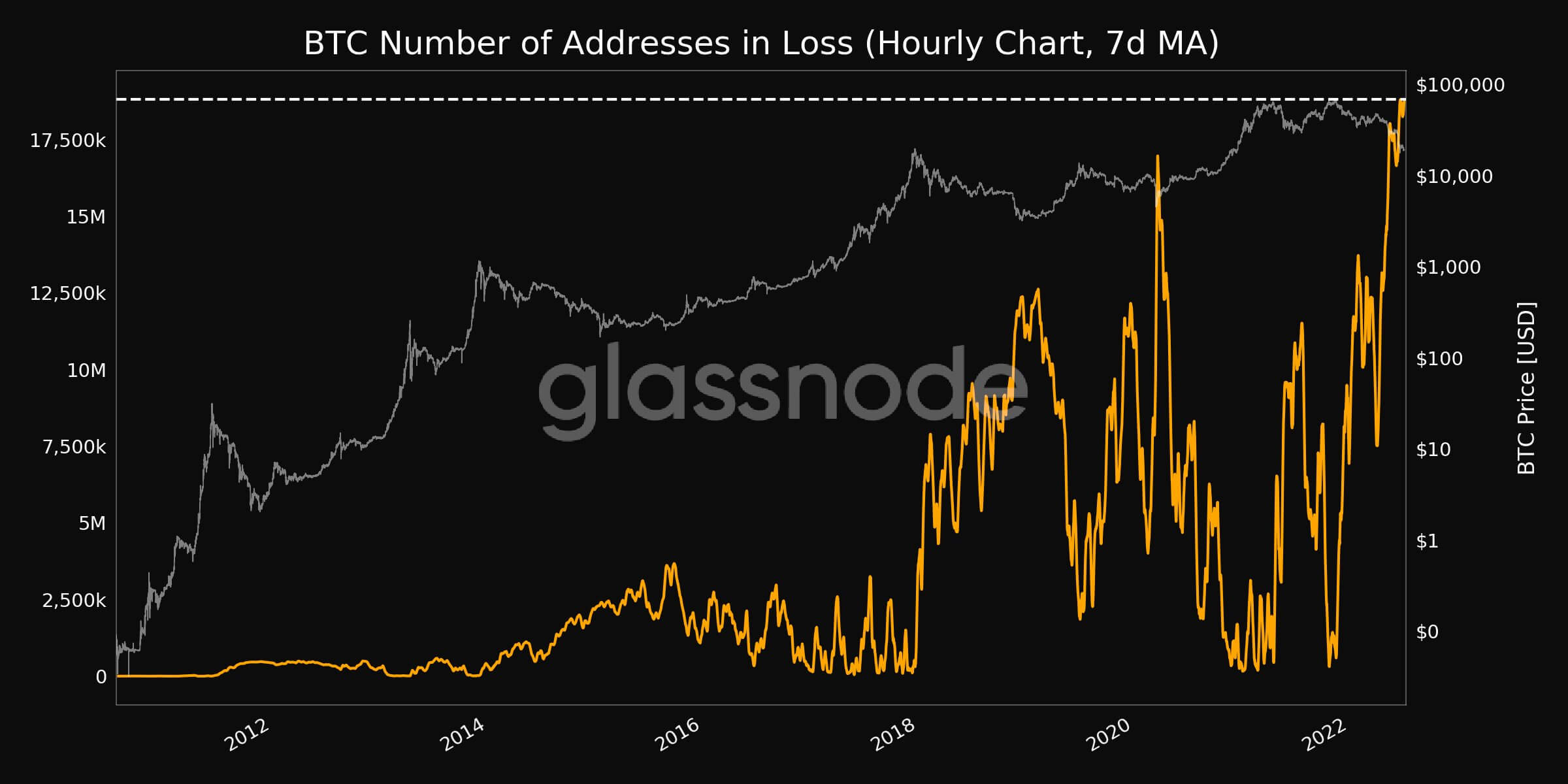

The Bitcoin network recorded a new anti-record amidst the market collapse. According to Glassnode, the number of Bitcoin addresses storing the cryptocurrency at a loss has set a new all-time high. Yesterday there were 18,809,386 units, meaning the owners of all these addresses are now at a loss on their positions.

Number of Bitcoin addresses that are holding cryptocurrencies at a loss

Despite the general negativity in the coin world, Garry Kasparov sees no reason to panic. He believes that sooner or later the situation in the cryptocurrency industry will get better.

What will happen to cryptocurrencies?

Kasparov is confident that 99 percent of cryptocurrency projects are “duds,” but Bitcoin and Etherium are already quite closely tied to traditional financial markets. Partly because of this, their prices react sharply to volatile macroeconomic conditions. Here is a relevant rejoinder from Kasparov, in which he shares his point of view.

Cryptocurrencies are falling in value, but will rise later, which is proof of their integration into the global financial system. This is what the stock market is all about. It’s a story of people making and then losing a lot of money.

In other words, the chess legend considers what is happening in the coin market today to be a normal situation. At least in the stock market this kind of cycle change also happens regularly, with no one saying that the "stock niche is dead" because they form the backbone of the economy and are directly linked to big businesses. But Bitcoin, because of its relative youth, is in a completely different situation. However, eventually cryptocurrencies will be in a bullish trend one way or another, Kasparov suggests.

Grandmaster Garry Kasparov

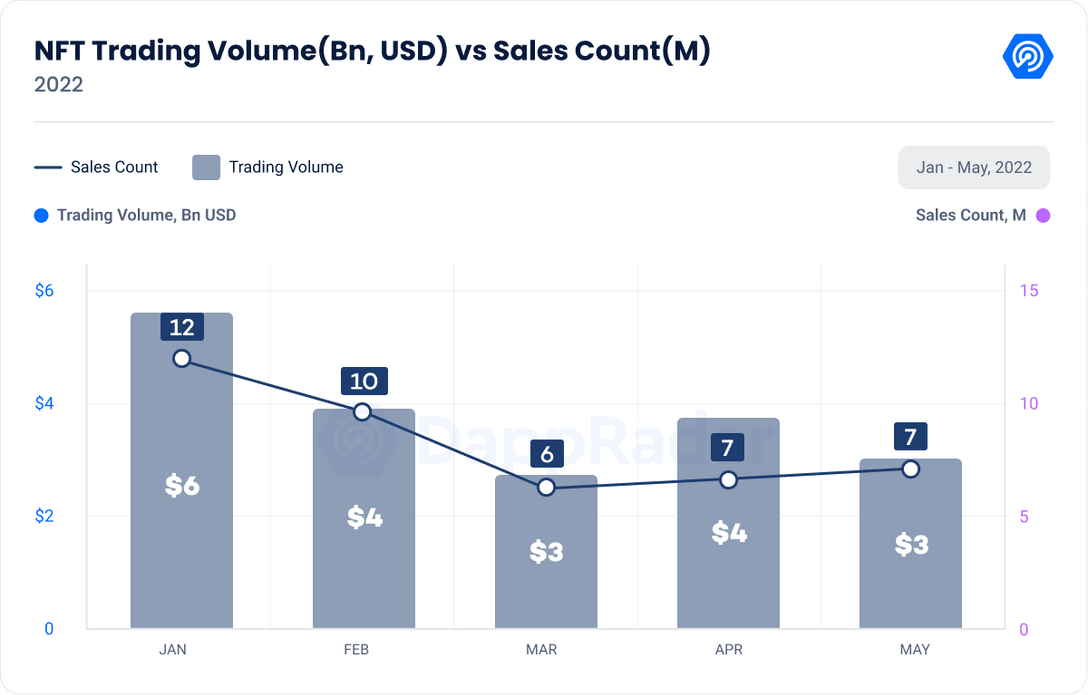

Kasparov is also confident that the field of unique NFT tokens will experience another phase of growth once the world becomes more digital. Unfortunately, for now, the situation doesn’t look comforting for NFT holders. According to Cointelegraph, the trading volume of unique tokens fell to $3.7 billion in May, down 20 percent from its April value.

Decline in NFT trading volume

Most interestingly, the famous chess player openly criticised the crypto industry almost five years ago. Back then, he called Bitcoin “pure speculation” and noted that there was supposedly no fundamental value behind digital assets.

As you can see, Kasparov's views on crypto later changed radically - he even co-signed an open letter to the US Congress, in which activists asked officials to regulate the crypto industry more liberally.

Last week, Bitcoin failed to rise above the $20,000 line – the local upward price movement of the coin was immediately nullified by sellers. According to some analysts, such weak activity on the part of buyers indicates that the current bearish trend is far from over.

Bitcoin exchange rate

Bitcoin’s fall is correlated with the Dollar Index – it shows the ratio of the US currency to a basket of six other major currencies, including the euro, yen, pound sterling, Canadian dollar, Swedish krona and Swiss franc.

Dollar index

An analyst nicknamed Altcoin Sherpa is confident that the market situation will be unsatisfactory for investors for almost the rest of the year. Here is his rejoinder, which at the same time is only the viewpoint of one expert. Accordingly, it should not be taken as the only possible way forward.

It will take months to accumulate BTC and find the bottom in a horizontal price movement. The floor may be set not even now, but in a few more months. I think we should prepare for a long bearish trend.

Leading analyst Glassnode under the nickname Checkmate has published some sound advice for many cryptocurrency holders, i.e. long-term holders.

Don’t play with borrowed funds. Move your bitcoins into cold storage. Sit back and wait.

Cryptocurrency investor with Ledger hardware wallet

We think such a viewpoint is quite relevant for cryptocurrency fans who have had time to consider the benefits of decentralised digital assets and realise it properly. And since this is not the first year Kasparov has been on the crypto side, such comments from him sound logical. One would like to believe that sooner or later Garry's prediction will indeed come true.

Read more about what’s happening with the coin market in our Millionaires’ Crypto Chat. We will discuss other important developments there as well.