The financial TV star predicts more panic in the cryptocurrency market. What does he expect from Bitcoin?

“Total panic and huge volatility” – all of which the crypto market has yet to go through before it finally bottoms out in the current bear cycle. That’s the opinion of millionaire and Shark Tank star Kevin O’Leary. In general, even the collapse of big players like Voyager Digital and Celsius doesn’t embarrass him, because the real “big event” is just ahead, O’Leary believes. We tell you more about his point of view.

It’s not the first time Kevin O’Leary has shared his views on digital assets. In particular, in April 2022, he said he does not believe in the prospect of Bitcoin collapsing to zero. According to him, the first cryptocurrency has enough buyers who will accumulate it as its value collapses. And that’s what will keep BTC from slipping to some ridiculous rate.

Early Bitcoin investor

What’s in store for the cryptocurrency market

The millionaire’s forecast looks pessimistic at first glance, but in fact O’Leary expects the cryptocurrency market to grow in the long term. It’s just that the crypto niche has yet to find “its bottom” in this cycle before the bull run, the financier believes. Here’s his rejoinder, in which Kevin shares his view of what’s happening.

This play is being played out over and over again.

That is, according to O'Leary, this time the situation with the cryptocurrency markets will be similar to what has happened before. In particular, Bitcoin did show the final stage of a drawdown to the $3,200 level at the end of 2018. It did not sell again at this price, meaning that it was essentially this particular event that was the final collapse.

Shark Tank star Kevin O’Leary

Many blame the collapse of cryptocurrency companies and various platforms for the fall of the crypto market. The best known of these are cryptocurrency broker Voyager Digital and the Celsius ledger platform. According to O’Leary, the main reason for their bankruptcy was “idiotic managers”. He continues.

It is unfortunate that these companies have ceased to exist, but much stronger players will eventually emerge in the market.

According to Cointelegraph sources, the Shark Tank star described the collapse of the Terra project ecosystem as a “positive” development for the entire industry, even despite the multi-billion dollar losses. However, other similar projects should not go down the same path – especially Tether and the USDT staplecoin.

Tether’s breakaway from parity with the dollar would be a big problem for regulators, as it would force them to completely rethink the concept of stablcoin.

Note that the mention of Tether USDT is not particularly relevant here, as this cryptocurrency is not algorithmic. Accordingly, its stability is guaranteed by the collateral of certain assets.

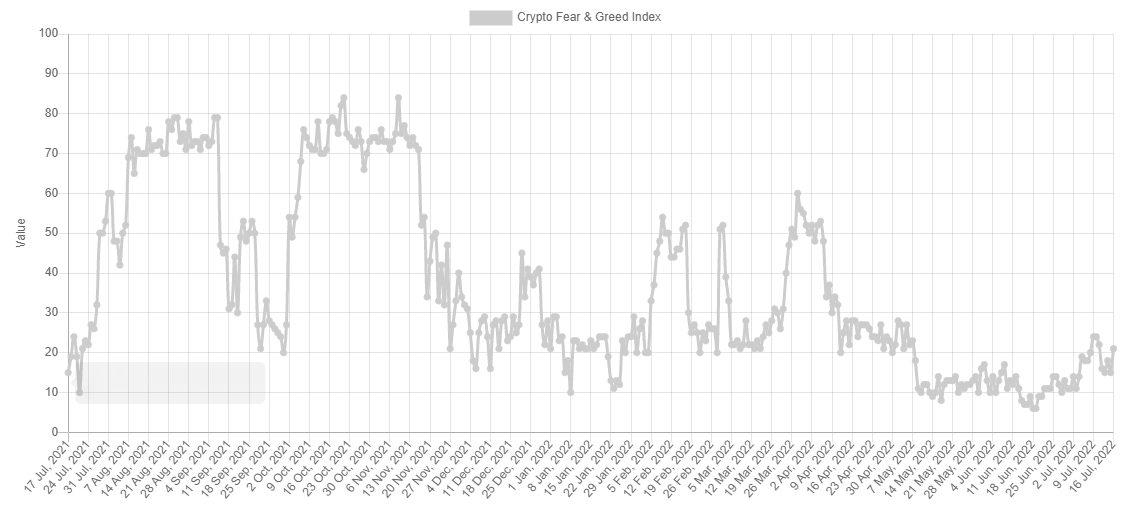

Fear & Greed Index in the crypto market over the year

That is, the problems of cryptocurrency companies would happen at any point in time, because their bankruptcy is primarily due to poor management of their own finances. In a certain sense, their absence from the market will actually be a positive thing, as new firms that prove to be more resilient can take their place.

Read also: Cryptocurrencies are promised stiff regulation as early as autumn. What are we talking about?

Gary Gensler, the head of the Securities and Exchange Commission (SEC), gave another interview on the topic of cryptocurrencies the day before. He stated that the interest rates offered by DeFi-platforms are too unrealistic. Here is his rejoinder, cited by Decrypt.

If it’s too good to be true, it probably is. There could be a lot of risk in that [high interest on deposits – editor’s note].

SEC chief Gary Gensler

The previously mentioned Voyager Digital and Celsius did have relatively high interest rates. For example, withdrawals from Celsius have now been suspended, but the platform’s website still advertises that its clients can earn as much as 18 per cent a year on their deposits in some cryptocurrencies. Voyager also has deposits with yields of up to 12 per cent on its list of services.

Another of Gensler’s claims is that Stablecoins are supposedly very similar to ‘poker chips’, which need a deep regulatory scheme. These assets are also the backbone of decentralised finance. However, it lacks adequate protection and control from regulators, according to a spokesperson.

We believe that the most important thing is for the regulation mentioned by Gensler to actually promote the crypto industry rather than stifle it. In that case, crypto could become a really attractive asset class for big investors, which would not just start a new bull run, but a full-scale popularisation of blockchain technology and digital assets in general. As some experts point out, there are now an estimated one million active cryptocurrency users per month worldwide. So there is still room for growth in the niche.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important developments in the blockchain world.