The founders of crypto fund Three Arrows Capital are missing. They are being sought for the company’s bankruptcy filing

Three Arrows Capital (3AC) was once the largest crypto fund and one of the most popular companies in the industry, but by today it has almost completely lost its governance vertical. At least none of the liquidators of 3AC’s bankruptcy debt have been able to contact representatives of the fund’s management. This is the subject of a petition filed with the Bankruptcy Court for the Southern District of New York. We tell you more about what is happening.

As a reminder, Three Arrows Capital's problems became known in mid-June. At the time, sources reported that the cryptocurrency fund's positions had been liquidated by the FTX, Deribit and BitMEX exchanges, causing the organisation's position to deteriorate significantly. In other words, 3AC's trading positions did not match the movement of the coin market, causing the organisation's money to evaporate.

Sources said that 24 hours later, Suu Kyu was also reported missing. The entrepreneur has not been in contact with the fund’s staff, among others, it was reported on 18 June.

One of the founders of 3AC Suu Kyu

Since then, the situation around the foundation has only gotten worse. Here are new details of what’s going on.

What’s going on with the 3AC crypto fund

The exact whereabouts of foundation founders Soo Joo and Kyle Livingston are currently unknown. They themselves have not made any public statements even on their social media accounts for quite some time.

Some of the lawyers in the Three Arrows Capital bankruptcy case fear that the missing Zhu and Livingstone may now try to sell the fund’s assets outside the debt liquidation proceedings. In other words, to do so unofficially. Here’s a rejoinder from the lawyers voicing their own fears. CryptoSlate cites the quote.

There is a real and unavoidable risk that assets of a fund debtor could be transferred or otherwise disposed of by parties other than court-appointed foreign representatives to the detriment of the debtor, its creditors and all other interested parties.

Accordingly, the legal representatives are trivialised. As the location of the co-founders of the crypto-fund cannot be ascertained, it is also impossible to predict the future course of events.

Statement of problems with the liquidation of 3AC’s debt

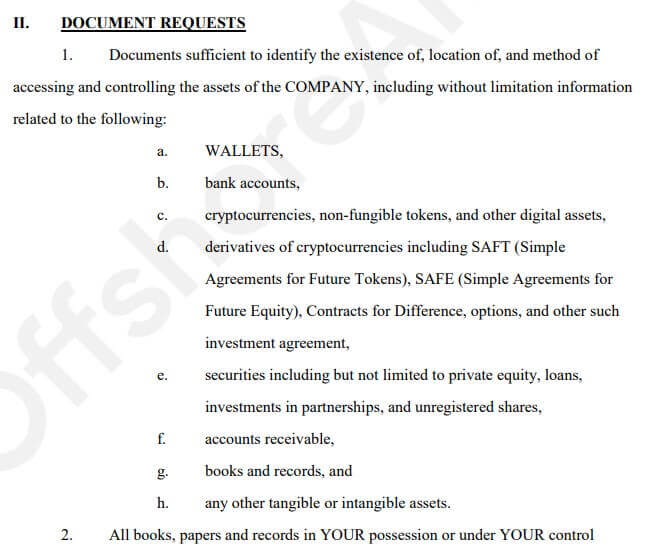

Liquidators noted that due to the nature of 3AC’s business, “risk is heightened” because cryptocurrencies are “easily transferable”. Lawyers should facilitate an “orderly winding down of the company’s operations and begin liquidating its assets”. The missing co-founders of the company were filed with the court on Friday 8 July. It also included a request for “interim relief to mitigate the risk of transfer or disposal of the debtor’s assets by non-foreign parties”.

One of the liquidators, named Christopher Farmer, had earlier travelled to Singapore to visit the 3AC offices. On arrival, he noted that “the premises looked occupied except for a few inoperative computer screens”. Fresh corporate correspondence was also found on some of the computers. One of the offices present in the building told Farmer that 3AC had been working here at least as late as June.

Documents and assets to be provided by foundation co-founders

However, there is still no trace of the founders of the foundation. With every day that goes by, this only escalates the situation: if Soo-ju and Kyle Livingston don’t show up soon, it is possible that they could be pursued by local law enforcement agencies.

Read also: MicroStrategy executive calls Etherium a security. Why are such words hurting the cryptocurrency niche?

It’s not just cryptocurrency platforms that have been causing customer outrage in recent days, but also banks. Recently, there were massive protests in the Chinese city of Zhengzhou over the blocking of a huge number of local bank accounts. Sources estimate that the amount of funds in the blocked accounts could exceed the $1.5 billion mark.

Rumours about the plight of Chinese banks have been circulating online since at least 18 April. At that time, three major banks immediately froze customer deposits, citing an update of their systems. Since then there has been no news about a possible account unblocking and the discontent has only been building up, culminating in the recent protests in Zhengzhou.

CITIZENS STORM BANK OF CHINA IN ZHENGZHOU OVER FROZEN ASSETS pic.twitter.com/DDrKaKTCbF

– FXHedge (@Fxhedgers) July 10, 2022

This whole situation perfectly demonstrates the main flaw of the traditional financial system – complete centralisation. The client, whose funds have been left lying motionless in the bank, is essentially being held hostage by the bankers. And things would be very different if he entrusted at least part of his savings to the cryptosphere by investing them in Bitcoin. However, in the cryptocurrency space, given the activities of funds like Three Arrows Capital, there are plenty of problems as well.

We believe the collapse of Three Arrows Capital is one of the major sensations in the cryptocurrency industry in 2022. It wasn't that long ago, though, that 3AC was seen as a key player in the market, investing heavily in new platforms while Suu Joo was gaining hawkers amid his harsh remarks. Now the fund not only faces a sell-off, but also the prospect of having to track down its founders. Apparently, only in the digital asset industry could this drastically and dramatically change.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we discuss other important news from the world of blockchain and decentralisation.