The head of FTX has been accused of self-promotion on the bankruptcy of cryptocurrency companies. How has he responded to the criticism?

The day before, billionaire Sam Bankman-Frieda was being hailed as a true “saviour” who has protected the digital asset industry from the more serious consequences of the bearish trend. As a reminder, a few weeks ago he announced that his company Alameda was ready to financially help cryptocurrency firms that were on the verge of bankruptcy given what was happening in the coin market. However, one such firm, represented by cryptocurrency broker Voyager Digital, has now officially rejected an offer of help from the billionaire. It turns out his intentions are not as unambiguous as they may seem at first glance. We tell you more about what’s going on.

It should be noted that Sam Bankman-Fried has been really actively exploring the takeover of certain companies recently. For example, over the weekend, Bloomberg’s sources have stated FTX’s interest in acquiring the South Korean trading platform Bithumb, which has at least 8 million registered users. According to the sources, negotiations are in the final stages.

What cryptocurrency exchanges are being criticised for

Voyager representatives called Alameda’s offer a “cheap deal disguised as good intentions”, which is the wording that appeared in new bankruptcy documents filed with the Southern District of New York bankruptcy court on Sunday. The deal from Bankman-Fried allegedly should “give it more publicity rather than benefit Voyager’s customers”, company officials believe.

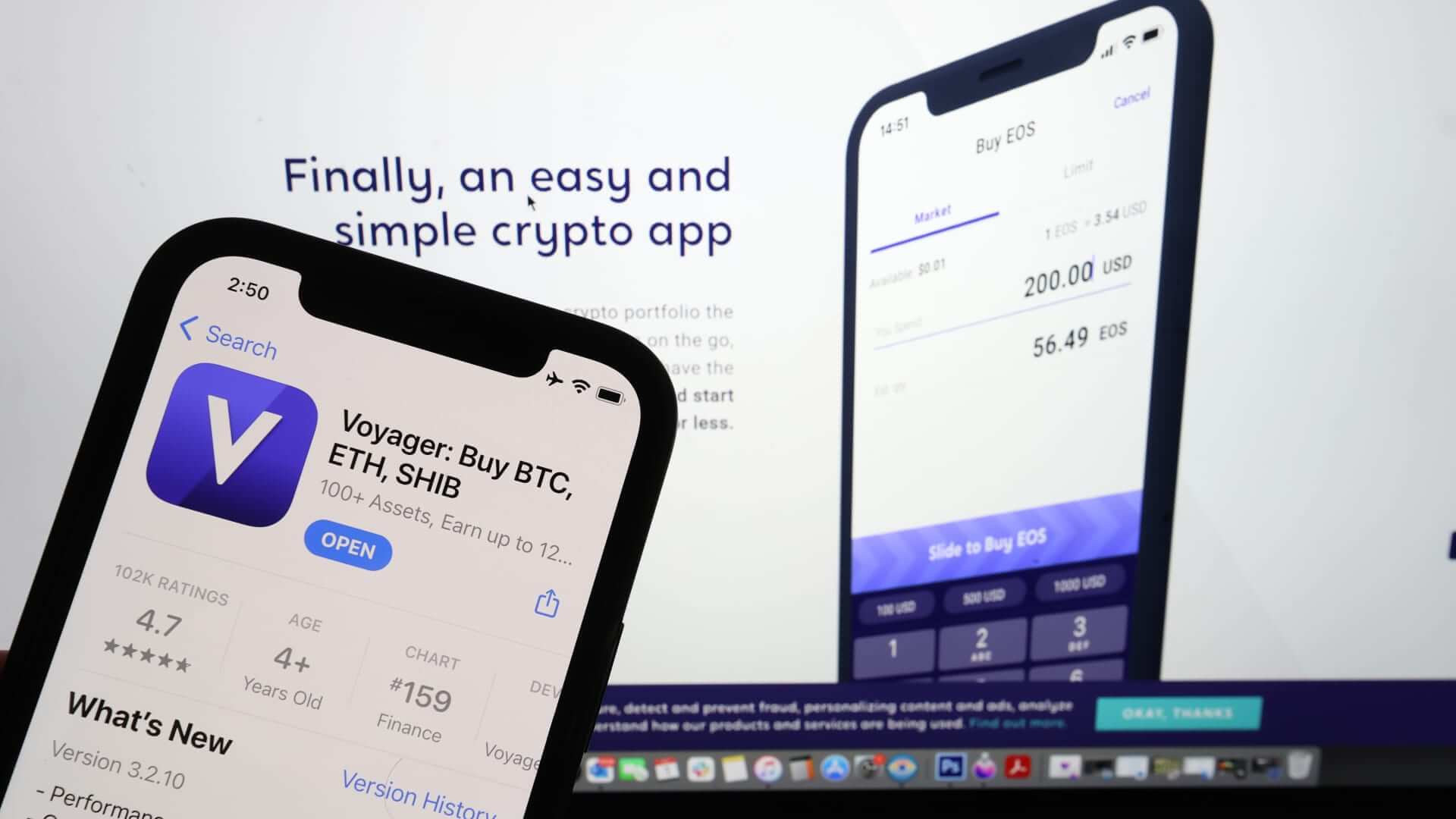

Voyager Digital

The cryptocurrency broker’s management has also criticised the way the offer of help was submitted – via a public press release rather than directly to company representatives. According to Decrypt’s sources, this could jeopardise the company’s separate asset trading process, which takes place behind closed doors. Indeed, Bankman-Fried first publicly announced its intentions, even when no cryptocurrency “rescue” deal had yet been agreed.

Here is a relevant quote from Voyager representatives criticising Bankman-Fried’s actions.

The Alameda and FTX proposal is nothing short of a liquidation of cryptocurrencies on a basis that benefits only that party.

One point of contention in the proposed deal is Alameda and FTX’s claim that Voyager customers are only entitled to a fixed amount of compensation based on the value of their wallets as of July 5, the day of the bankruptcy filing. But Voyager’s management disagreed, pointing out significant differences with its own reorganisation plan.

A “rescue” deal would also effectively liquidate the VGX platform’s native token, which Voyager estimates would wipe out about $100 million worth of capital. Other claims include a tax burden on customers wishing to withdraw funds, as well as confusion over FTX’s claim that the Voyager brand allegedly has no individual value.

Sam Bankman-Fried has already responded to the criticism. He has a very different version of what happened: it turns out that Voyager still has about 75 per cent of the cryptocurrency broker’s assets in reserves. It supposedly can and should return these funds to affected customers, but instead chooses to drag out the bankruptcy process, destroying its last avenues to salvation. His retort is cited by CryptoPotato.

You see, here’s if a customer had 1 BTC on the platform when Bitcoin was worth $30,000. Then the bankruptcy process begins, which drags on for years. What kind of compensation will the client end up getting, 1 BTC or $30,000? Probably the one worth less. In other words, the longer the litigation lasts, the more clients lose.

FTX CEO Sam Bankman-Fried

Another pitfall is that Voyager clients have to pay for legal fees and everything associated with litigation out of their own pockets. That’s why Bankman-Fried considers his own proposal to work with Voyager to be the most advantageous just for clients – so they’ll just stop losing money.

As a reminder, Voyager filed for bankruptcy on 5 July and at the same time put forward a plan to reorganise the broker to return cash to investors. In parallel, the company was also exploring alternative proposals, discussing them with more than 80 third-party investors. So bankruptcy is not yet the only option. It is now hoped that there will be those willing to invest in Voyager for long-term returns.

Sam Bankman-Fried, head of the FTX platform

We think Sam's response was too harsh, as companies do not have to agree to any bailout schemes he offers. And since Voyager's management responded to the FTX executive's idea in this way, they must have had reason to do so. Obviously, Bankman-Fried was simply hurt by the harsh rejection - although the other company still had a right to it.