The second quarter was the worst for Bitcoin in 11 years. However, analysts are predicting a recovery

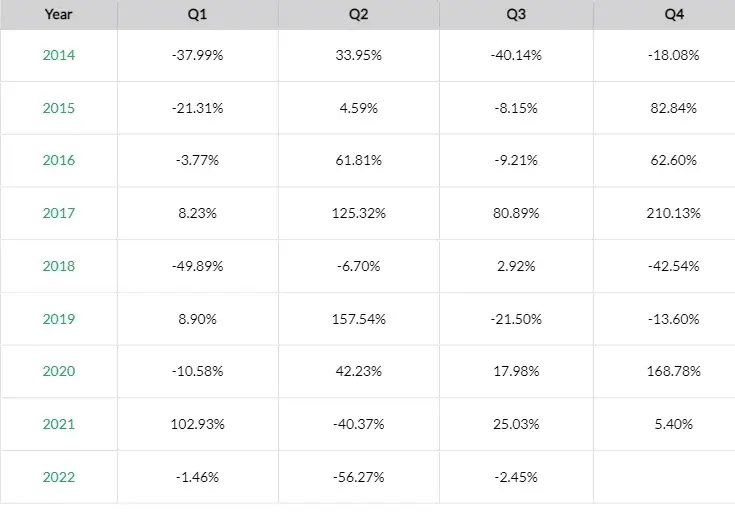

The past three months have been the worst in terms of returns in Bitcoin’s eleven-year history. Between April and June, its value fell 56.27 per cent, analysts at Skew said. A collapse of such magnitude was only seen in the third quarter of 2011, when the major cryptocurrency fell 66.12 per cent. We tell you more about the situation and its importance.

How Bitcoin fell hard

Previously, the year 2018 was considered a “black streak” in the more recent history of the crypto market – that’s when the previous two-year bearish trend began. As a result, Bitcoin fell by 49.89 per cent and 42.54 per cent in the first and fourth quarters of 2018, respectively.

Bitcoin returns by quarter

Most interestingly, the first three months of 2022 were a relatively quiet period – during which the BTC price only fell by 1.46 per cent. Accordingly, investors in the first cryptocurrency didn’t lose much, nor did they gain much.

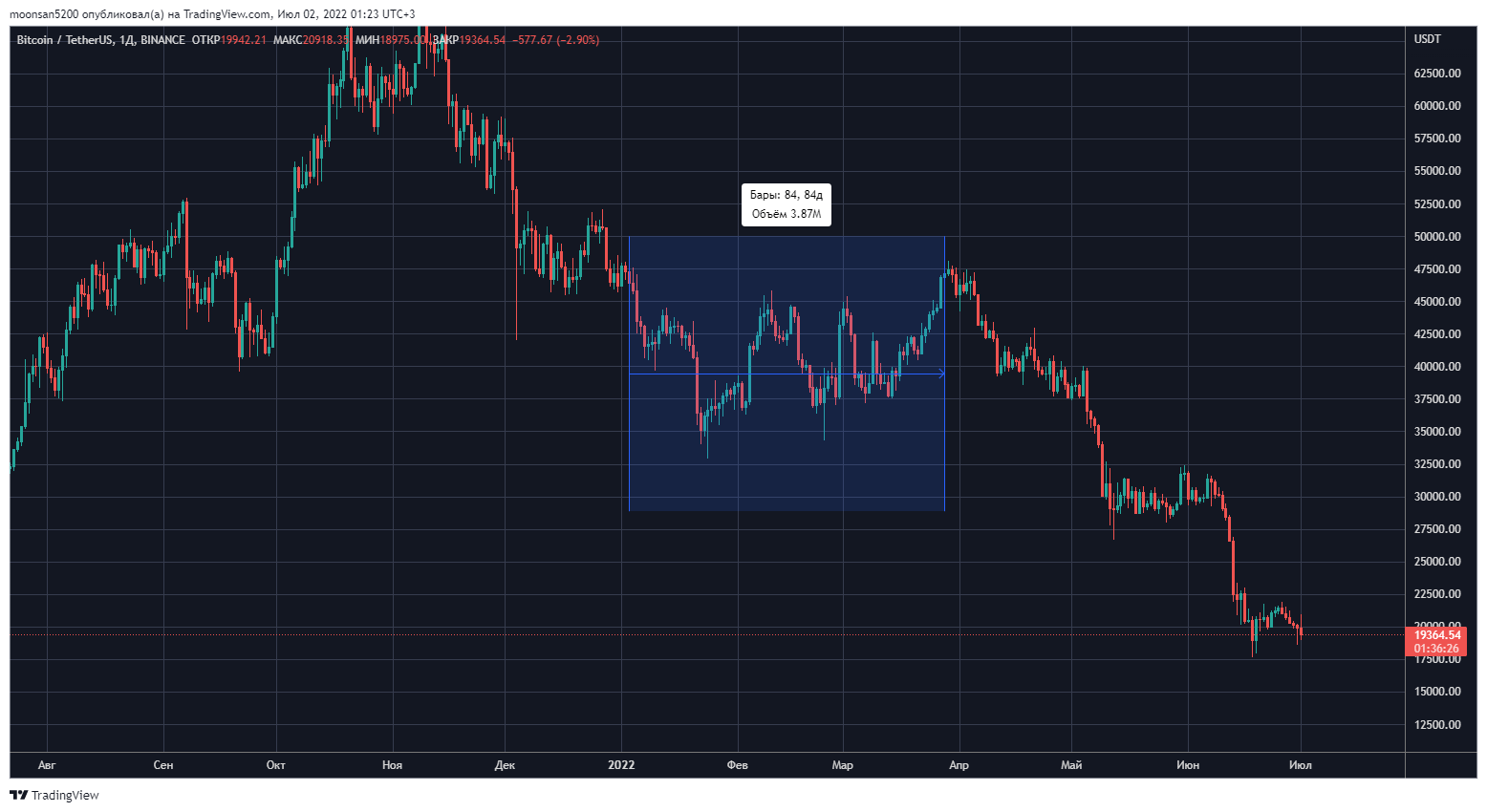

Bitcoin movement in the first quarter of this year

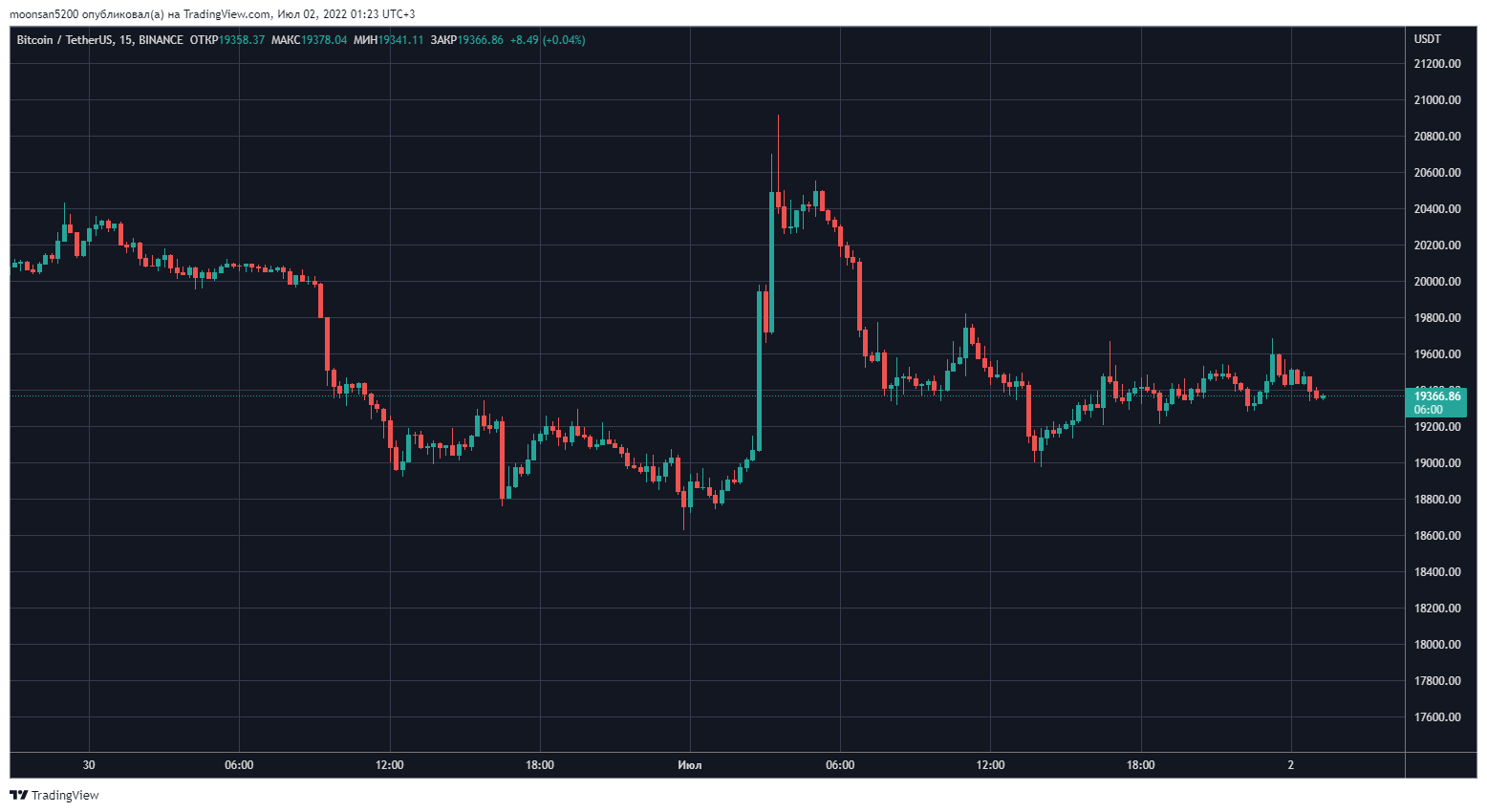

Today, Bitcoin is trading at around $19,000. And it looks like the 20k line is becoming new resistance on the cryptocurrency’s chart.

Bitcoin on the 15-minute chart

The catastrophic collapse of BTC in the past quarter occurred due to a combination of a large number of negative factors – geopolitical instability, falling stock markets, the collapse of major cryptocurrency companies and projects that caused investors billions of dollars in losses. The situation for altcoins is no better overall – the industry’s total capitalisation has fallen below a trillion dollars and now stands at $898 billion.

It is worth noting that comparing the current decline to the events of 2011 may not be entirely accurate. Back then, there were far fewer people trading crypto, so there was hundreds of times less market liquidity. That is, with the current trading activity the collapse by tens of percents in a few months is a negative event of a much larger scale, because before the sharp fall in price could still be put down to low liquidity.

In other words, due to fewer traders and cryptocurrency owners in general, the sale of a certain amount of coins provoked a larger drop in value. Accordingly, a panic on a serious scale would then lead to a more significant drop in the value of the cryptocurrency.

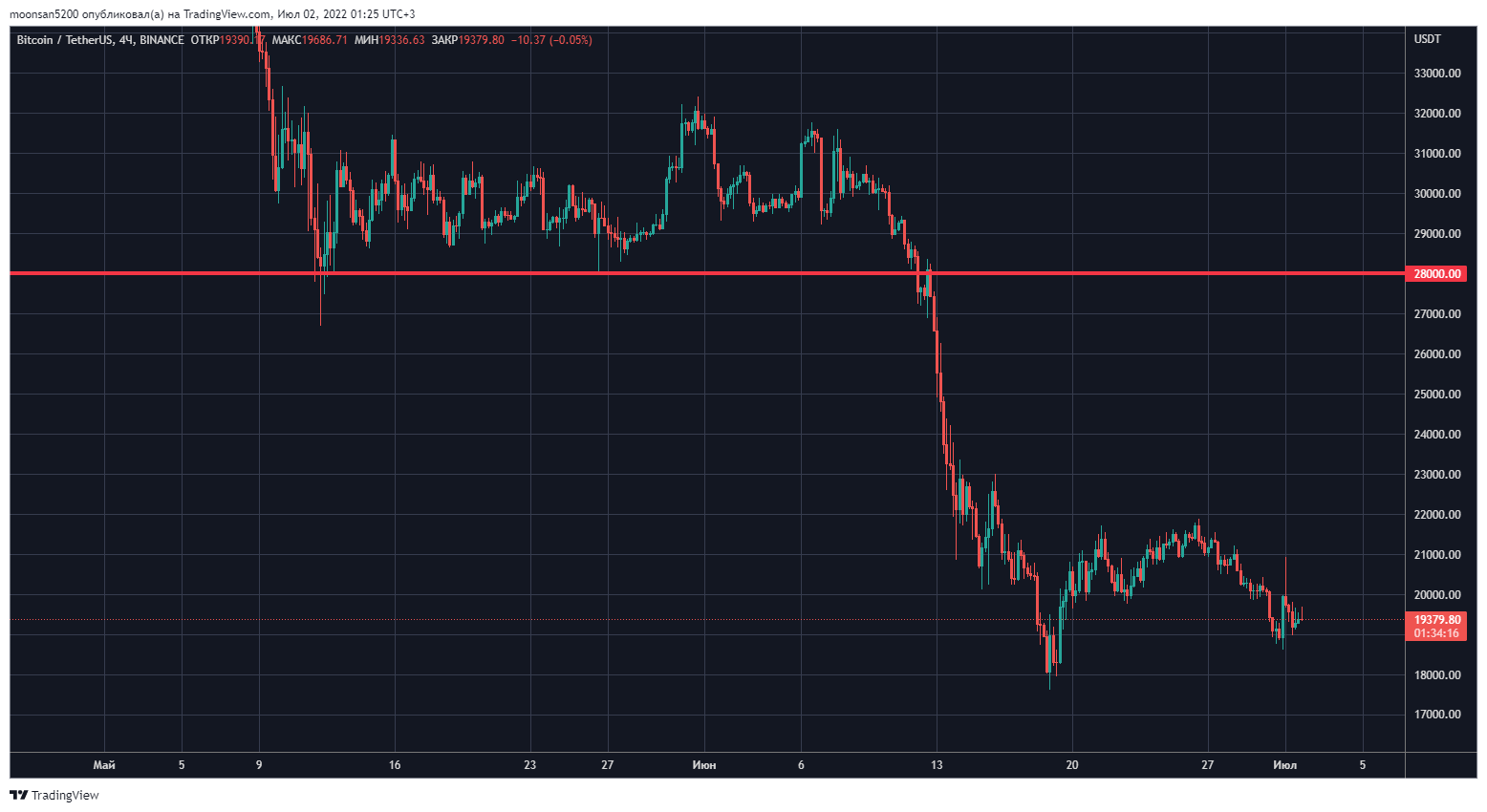

A losing streak for the crypto industry won’t last forever, according to Cointelegraph’s sources. Deutsche Bank analysts said the day before that Bitcoin will rise to at least $28,000, although this will allegedly only happen by the end of the year. The main trigger for crypto’s growth will be a general recovery of stock indices to their January prices.

In the meantime, the medium-term outlook for the crypto market is not the most optimistic. Here’s a quote from a report on the subject.

Stabilizing token prices is difficult because there are no unified valuation models like those used in the public equity system. In addition, the cryptocurrency market is highly fragmented. The free fall of cryptocurrencies could continue because of the complexity of the entire system.

And the scale of the connectivity of the components of the cryptocurrency industry is truly impressive. Last night, for example, the Voyager Digital platform blocked user withdrawals of coins. The reason was the failure to pay the body of the loan by representatives of crypto fund Three Arrows Capital, who are already preparing for bankruptcy proceedings. That is, 3AC owes Voyager money, but due to the current market conditions and activity of the crypto fund, it will not be possible to repay this amount. Therefore, both Voyager and the customers of this platform are suffering here.

The $28,000 line on the Bitcoin chart

JPMorgan Bank experts, on the other hand, believe that the crypto market has already moved into a recovery phase. While large crypto farms are preparing for bankruptcy proceedings, there is so-called deleveraging – a significant reduction in the volume of open positions for borrowed funds – in trading. Here’s a cue from analysts.

The current cycle of deleveraging may not be very prolonged, given that cryptocurrency institutions with more resilient balance sheets are now taking steps to help contain the spread of the negative effect. Venture capital funding of the industry also continued at a healthy pace in May and June.

Deutsche Bank

Throughout its history, the crypto market has developed in bullish and bearish cycles. This alternation is a familiar phenomenon for seasoned investors, so many predictably expect that this time the bearish trend will once again be replaced by a massive bull run. The only question is timing, as large and mid-sized investors will be actively buying coins before the new growth cycle, accumulating them in their cryptocurrency wallets.

We think the bankers' version of a gradual recovery in the cryptocurrency market makes sense. After all, digital assets are helping far more people today than they did in 2018. Therefore, there will also be plenty of people willing to buy coins - especially at current exchange rates. The main thing is to be prepared for any scenario and not to invest something that cannot be lost.

In order not to miss the new bullrun, join our millionaires’ cryptochat. There we discuss other important news from the blockchain world.