A JP Morgan bank executive has called most cryptocurrencies “rubbish”. What is the problem?

JP Morgan’s Head of Digital Assets, Umar Farooq, said that most cryptocurrencies are “rubbish”, with the real use of crypto only to be seen in the future. The day before, Farooq was speaking at the Green Shoots Seminar event in Singapore, where during his speech he also shared his views on the state of regulation of the crypto industry. We give more details about the banker’s point of view.

It should be noted that the prejudice against cryptocurrencies and vociferous criticism of digital assets is causing dislike for them from new entrants in the industry. Proof of this was the famous “Wolf of Wall Street” Jordan Belfort. He admitted the day before that his misconception of the niche was due to general disapproval. You can read more about this in a separate piece.

Why do bankers dislike cryptocurrencies?

The expert believes that only a small part of the crypto market actually provides something useful to its users. Here’s his rejoinder, cited by Cointelegraph.

Most cryptocurrencies are still rubbish – with the exception of some coins, of course. Everything else is “background noise”, which fortunately will go away in the future. So in my view, cryptocurrency scenarios haven’t yet shown their full potential, and market regulation hasn’t had time to catch up with innovation. That’s why investments from traditional finance have been slow to migrate to crypto.

Why the "background noise" should disappear is unclear. Yet new projects in the cryptocurrency industry appear regularly, and this phase is particularly active during the bull run. And supply is emerging against a backdrop of strong demand, so it is at least complacent to make such a prediction, given past market behaviour.

Umar Farooq, head of digital assets at JP Morgan

In other words, large financial institutions cannot yet fully rely on Bitcoin or some altcoins, the banker said. That is, to conduct transactions in them among themselves and build financial reserves mainly from crypto. Farooq also said that the crypto market is now an area with a huge amount of speculation at its current stage of development. Here is his rejoinder.

It takes all these things to mature so that we can actually do something with digital assets. Right now, we just haven’t gotten to that point yet, and most of the money that is being used in Web3 today in the current infrastructure is for speculative investments.

It's worth noting that cryptocurrencies have been used for years to transfer value anywhere in the world, because the fees for such transactions are usually much lower than bank fees. Of course, there is a speculative component to the niche, but to say that there is no benefit to the coin niche is wrong.

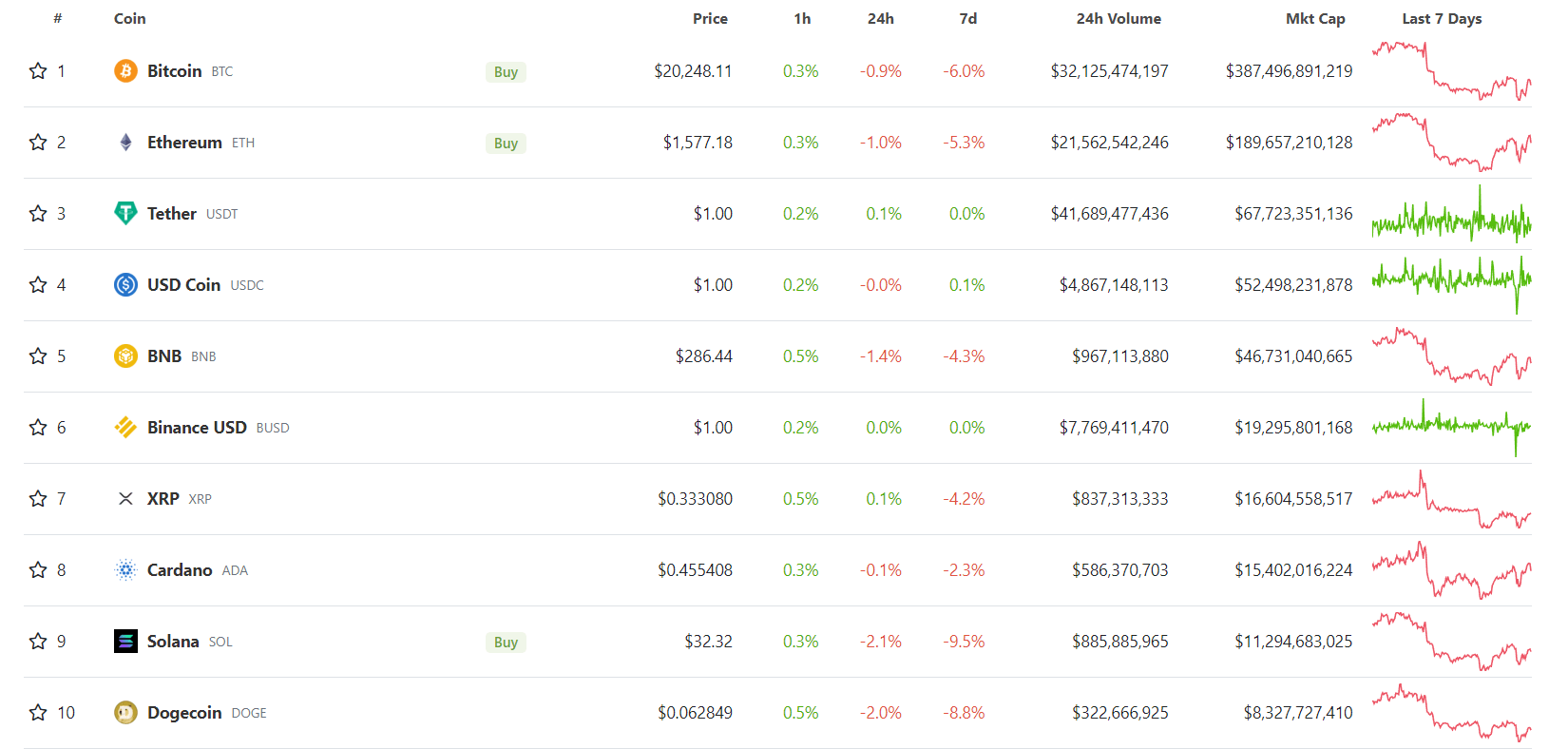

The top 10 cryptocurrencies account for about 75 per cent of market capitalisation

Incidentally, JP Morgan, even in defiance of its CEO James Dimon, is actively exploring the use of blockchain in traditional finance. Recall that Dimon criticised Bitcoin a few years ago, although he later admitted he was wrong.

🤩 FIND MORE INTERESTING NEWS ON US AT YANDEX.ZEN!

Another opinion – this time on the policies of the US Federal Reserve and the US Securities and Exchange Commission – was recently voiced by the CEO of crypto platform Bitfury, Brian Brooks. According to him, US regulators are taking the wrong approach to anti-inflation and regulatory issues. According to CryptoPotato sources, the US Federal Reserve’s monetary policy has been the subject of serious debate over the past few years. The Fed began printing trillions of dollars during the COVID-19 pandemic to prop up the economy during such a difficult period.

While this move had a positive impact on markets in the short term, it was also the reason why inflation in America rose to a record high as early as 2022. Recall that in June 2022 the US inflation rate reached 9.1 per cent – the highest rate in 40 years. The Fed has tried many tactics to curb it, including raising interest rates by 75 basis points or 0.75 percent. Earlier this month Fed Chairman Jerome Powell said they intend to return inflation to 2 per cent, even if it comes at some “unfortunate economic costs”.

US Fed chief Jerome Powell

Brooks said in a recent interview that all these moves are not good for Bitcoin and the entire crypto market.

We talked about Bitcoin being an inflation-proof tool. The more the markets expect tight policy from the Fed, the more people believe that the Fed will actually take an aggressive stance on the lending rate. And that tends to hurt Bitcoin.

Bitfury CEO Brian Brooks

The Bitfury CEO also criticised the US Securities and Exchange Commission, saying that the regulator prefers to sue companies instead of creating the infrastructure to properly monitor the crypto market.

Regulation does not mean suing people for nothing. The approach of the US Securities and Exchange Commission over the past couple of years has been to not tell anyone in advance about its own rules, and then sue anyone who wanted to set up a project, company or token.

What is likely at issue here is the long-running legal battle between the SEC and Ripple, which is the issuer of the popular altcoin XRP. The regulator’s main claim is that XRP is allegedly a security and must be controlled under the relevant rules. Much of the dispute stems from the lack of well-defined rules for regulating cryptocurrencies.

It is not advantageous for bank representatives to recognise the benefits of decentralised systems, because it essentially calls into question the reputation of classical financial institutions. Therefore, we should not expect bank officials to give unequivocal approval to coins. However, it is not without progress, as a JP Morgan spokesperson agreed that some coins do benefit the world. So we wait for this trend to continue.