A popular cryptocurrency exchange has been accused of problems with traders’ orders. What are we talking about?

The CEO of cryptocurrency exchange Binance, Changpen Zhao, posted a tweet discussing a problematic phenomenon for cryptocurrency traders – so-called “trading jitters” or trading jitters. It’s about problems with the order book, which can cause orders to buy or sell an asset to suddenly freeze, fail to execute or even move down the list of the book. And while Zhao didn’t mention specific names, the cryptocurrency community has clearly taken a hint at the FTX exchange. We tell you more about what’s going on.

The main requirement for cryptocurrency exchanges is high liquidity, i.e. the ability to sell coins at a certain price. If the liquidity is poor, there may not be enough demand for the asset, which means that the owner will not be able to get rid of it at the right time.

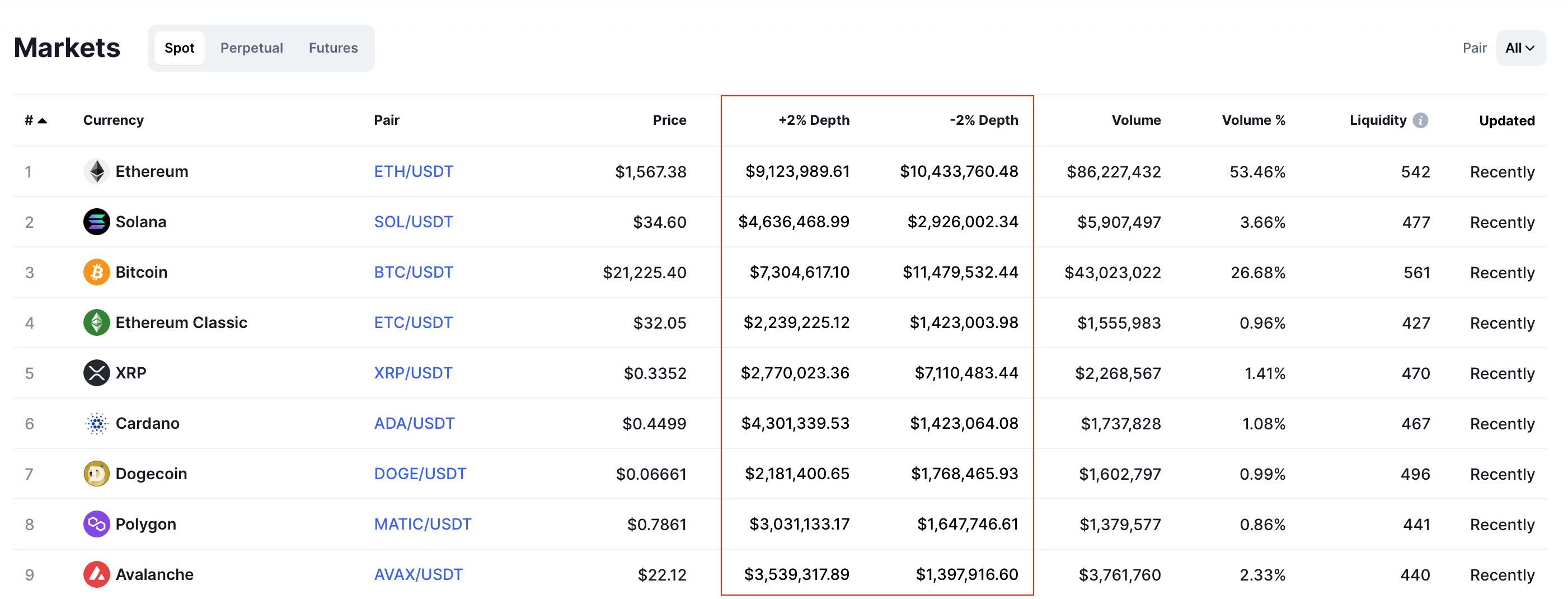

Checking the liquidity is quite easy: you need to go to the page of a certain trading platform on CoinMarketCap. Here you should pay attention to the price change index of 2 percent. This means how much dollar equivalent it would take to change the value of the asset by the said 2 percent in one direction or another.

Woo X cryptocurrency exchange trading metrics

The higher the value, the better.

However, sometimes problems can arise on the other side. In this case, the cryptocurrency community did manage to find the source of the problems.

What’s wrong with the FTX crypto exchange?

Here is Zhao’s quote published by the Cointelegraph news outlet.

I’ve just learned about a new word – jitters. On one particular exchange, your orders sometimes hang up while newer ones fill up. It turns out that the phenomenon is so common that traders have coined a separate term for it.

So the problem is the slow execution of trade orders. Logically, market orders should fill instantly, because a trade in a crypto-asset is done at the market price. However, as it turns out, FTX users have problems with this. And since correct timings are important in crypto trading, such delays could well result in financial losses or unrealised gains.

We note from personal experience that problems of so-called slippage happen on Binance as well - though very rarely. In a particular case, a coin failed to sell at a stop loss after its price fell below a certain level. The funny thing is that the stop loss then triggered in the opposite direction: that is, the cryptocurrency was sold at a given price, but at its rising stage some time later.

The Binance chief clearly hinted that he didn’t want to “point fingers at anyone”, but a great many commenters started mentioning FTX CEO Sam Bankman-Fried’s account under the tweet. He also posted the following message.

I don’t think this is about us. I don’t know, our order stack doesn’t single out specific users and never changes the priority of their orders in trades.

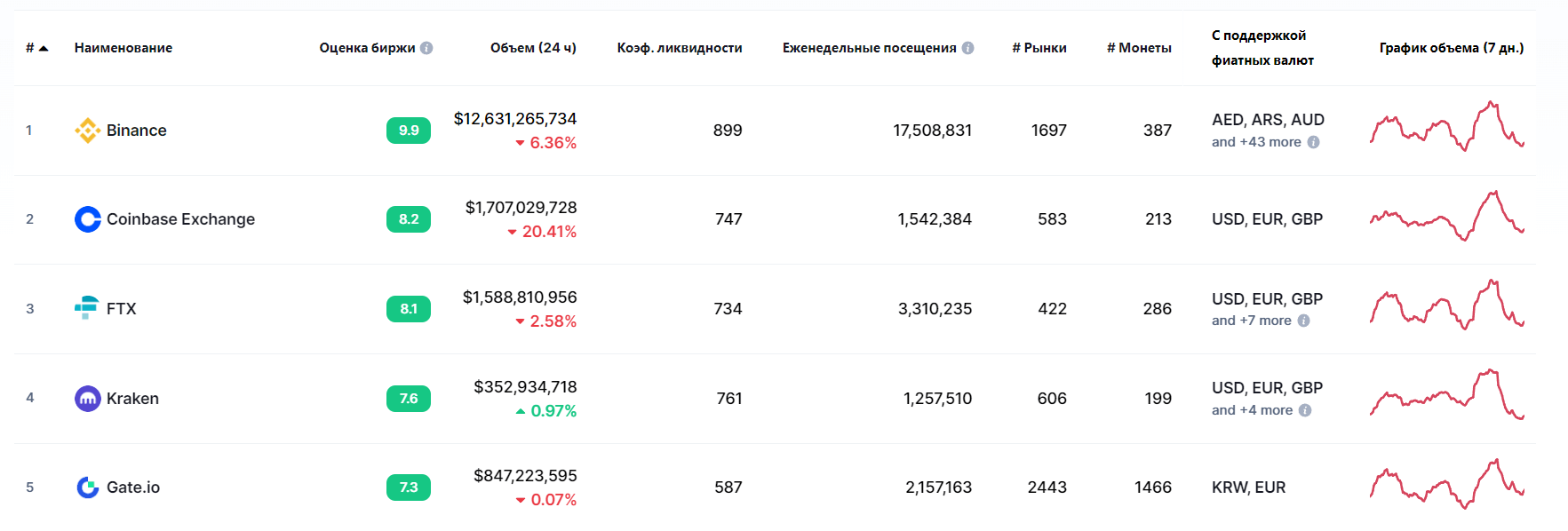

Allegations against FTX is a pretty serious matter, since the exchange is one of the most popular and ranked third among CoinMarketCap trading platforms

The mention of FTX in this context is not accidental: the cryptocurrency exchange is indeed criticized on Twitter because of the problem mentioned by Zhao. A comment by Japjap is a good representation of the situation.

But why does everyone immediately think of FTX when it comes to such problems? When there are a lot of flies around, it means there is shit around, right?

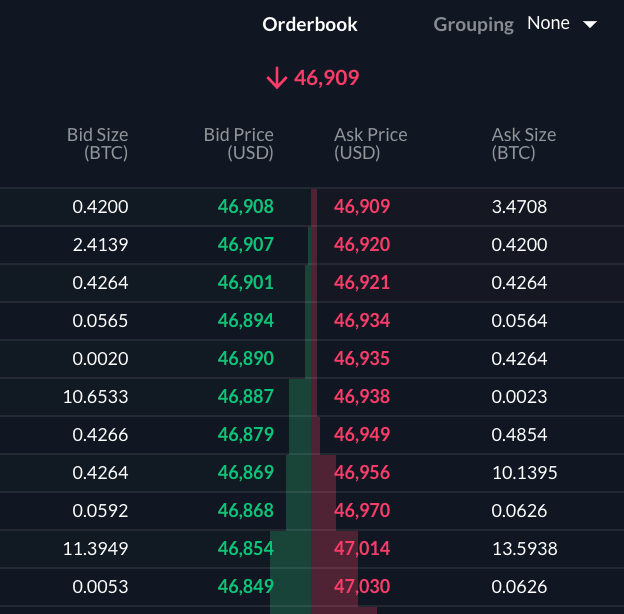

FTX order stack

Incidentally, the Binance CEO thread coincided suspiciously well with a letter from the US Federal Deposit Insurance Corporation (FDIC) to five crypto exchanges, FTX was also on that list. According to the FDIC, FTX US, SmartAssets, FDICCrypto, Cryptonews and Cryptosec allegedly misled investors by claiming that their investment instruments were insured by the FDIC.

It’s worth noting that what’s going on has prompted an entire Twitter controversy. The problem was highlighted by a trader under the nickname Tree of Alpha. He provided a comparison of 5-second charts of BTC-PERP on FTX and BTCUSDT on Binance. In the case of FTX, there were noticeable holes in the chart, which essentially reflects order execution problems.

Data by TradingView.

On the left: 5-second chart for BTC-PERP on FTX.

On the right: 5-second chart for BTCUSDT perp on Binance.Are the holes

:-lack of liquidity?

-spotty data feeds?

-effective altruism? pic.twitter.com/DMVzOEdXZj– Tree of Alpha (@Tree_of_Alpha) August 20, 2022

Here’s another display of the malfunction.

Différence de vitesse d’exécution entre FTX et Binance pour 30 ordres pic.twitter.com/XlE8arricP

– Luchap (@Luchap2BTC) July 21, 2022

A trader under the pseudonym Belatoshi also confirmed the problem. He reported problems filling orders, which had previously cost him half of his trading portfolio.

FTX manager Sam Bankman-Fried came forward to comment on Twitter and asked for a video of the bug to be recorded. According to him, it would have helped a lot. Hsaka, a prominent member of the cryptocurrency community, responded with the following retort.

Do you want to search for information on the query “FTX lag” or read comments on any discussion on the topic, then ask at least a thousand people to send a video?

This line was commented on by a user under the nickname Fett. Here’s his quote.

Lol, FTX is awfully laggy. I wonder if Sam even uses his exchange?

FTX head Sam Bankman-Fried

Sam shared the answer, which in doing so did not satisfy users.

It’s hard enough to debugging through words alone. It’s most likely a browser bug, but to find out for sure, we’ll need to align the state of the orderbooks at the time the button is pressed.

A user nicknamed undefined asked why there isn’t a “browser bug” on Binance and Bybit in that case?

So why isn’t there a “browser lag” on Binance or Bybit?

– undefined (@sayalhumdilah) August 20, 2022

The expert then pointed out that the browser lag was due to a huge number of including unnecessary queries, which was causing a problem in the browser’s performance.

A few hours later Sam asked readers to try trading again, because the FTX team supposedly fixed something. The funny thing is that during this time, the market has dropped significantly. So users took to joking that the exchange representatives tried to find the bug with the sell button. Here are Sam’s two tweets in the background of the ETH Etherium exchange rate chart.

Graph of the Etherium exchange rate against the background of Sam’s tweets

It seems that trading on FTX does present a number of problems for traders of all levels, with the reputation of the exchange itself sometimes suffering due to the aforementioned minor incidents and misunderstandings. Solving such miscommunications on the part of the user is simple enough: ideally, you should have accounts on many popular trading platforms so that you can compensate for them in case of inconvenience. Again, it is crucial not to keep all your coins on the trading platforms, as this is too risky.