A popular cryptocurrency platform plans to drop USD Coin (USDC) Stablecoin. What is the reason for the move?

Following the recent blocking of cryptocurrency mixer Tornado Cash by US authorities, the MakerDAO decentralised protocol team has begun to actively discuss the possibility of moving away from Circle’s USD Coin Stablecoin. In particular, MakerDAO founder Rune Christensen is concerned that the US government could too easily and quickly shut down any centralised crypto platform in its jurisdiction, so he feels it necessary to act. We tell you more about what’s going on.

To recap, Tornado Cash is a cryptocurrency mixer, that is, a service that hides users' cryptocurrency sources in the blockchain by mixing them. Tornado Cash has become a handy tool for hackers and other attackers, which prompted such drastic action by the US government.

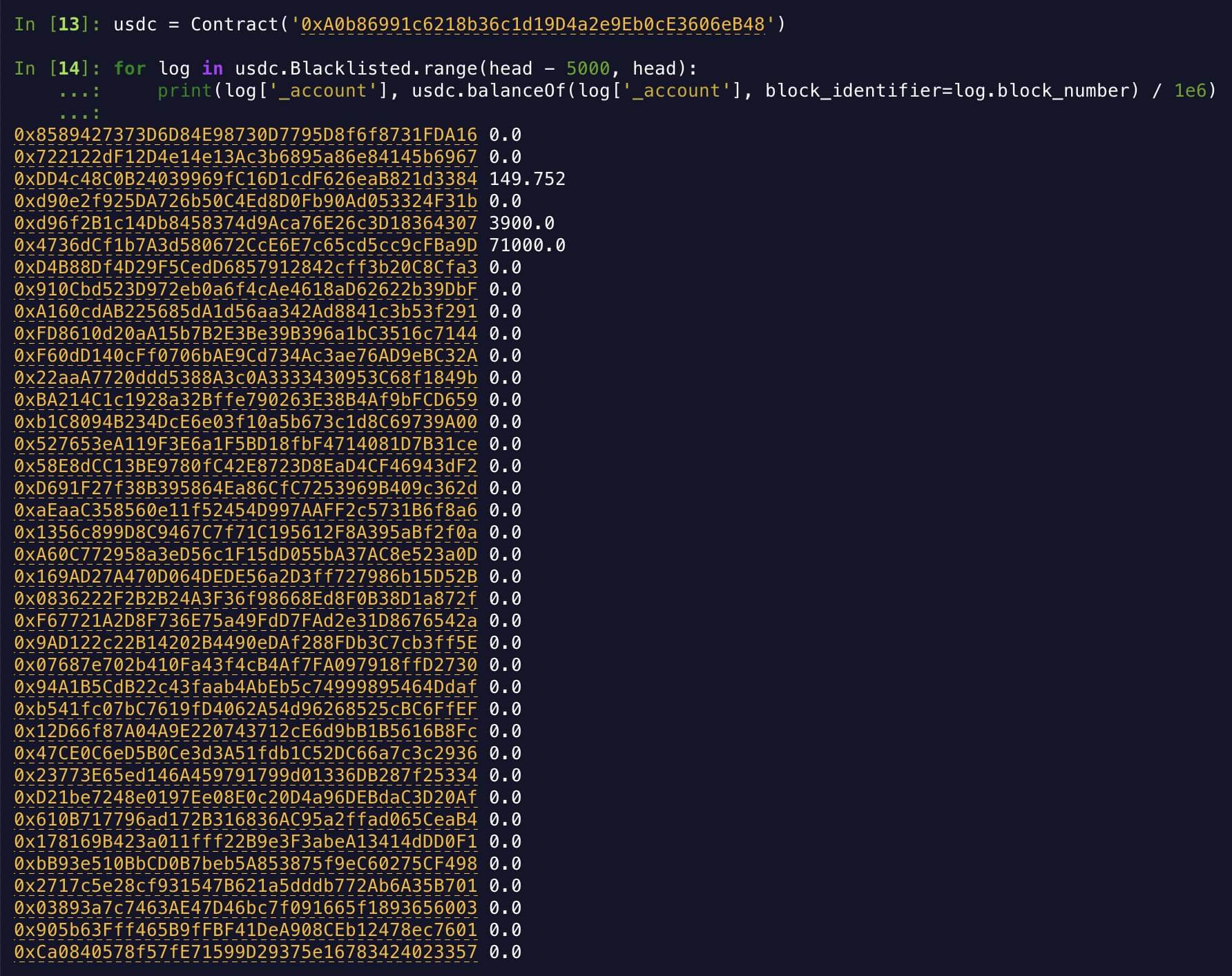

In response to the publication of sanctions against Tornado Cash, Circle representatives froze USDC at the corresponding addresses on the list. Among them was an address with donations to the platform’s developers, which had a relatively small amount of money on it. The blocking of certain addresses among USDC users in this smart contract looked like this.

Blocking cryptocurrency addresses at the smart contract level

How the Tornado Cash ban has affected cryptocurrency companies

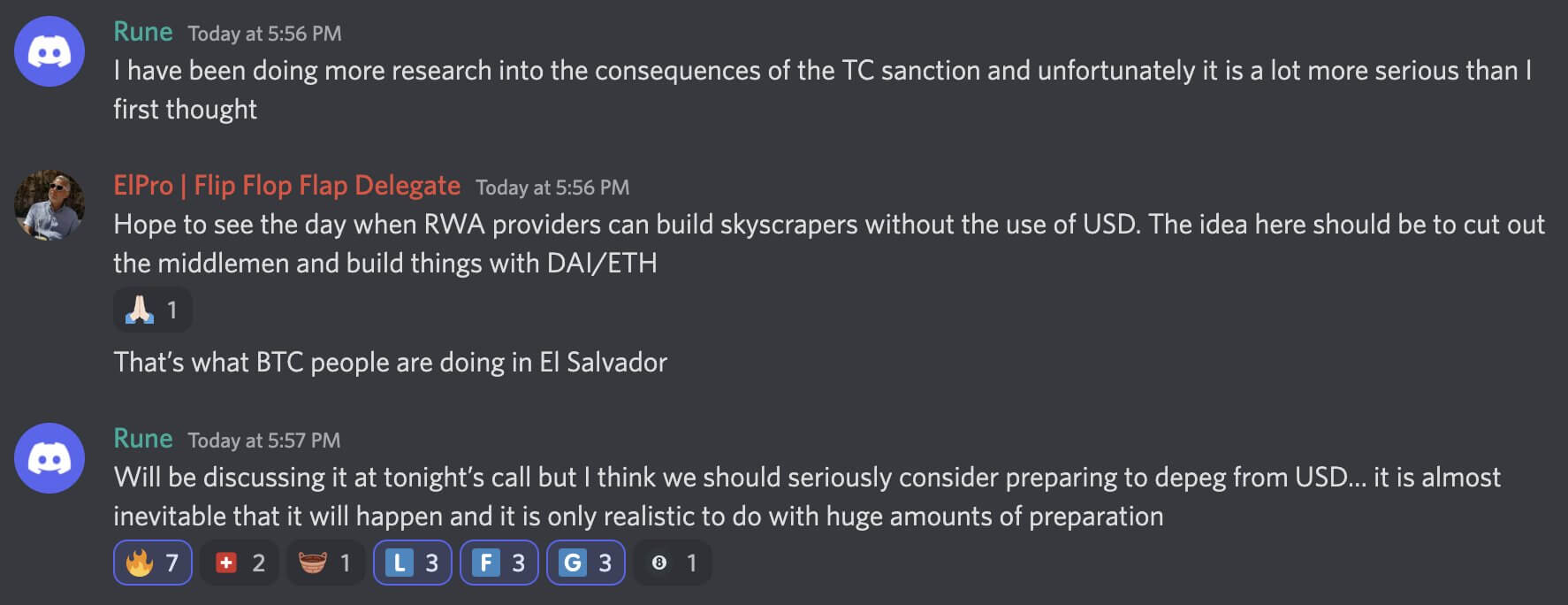

MakerDAO founder Rune Christensen has announced the start of discussions on the USDC issue in the platform’s Discord. It is speculated that the team may move away from native DAI token parity to USDC and the dollar. Here’s a relevant rejoinder in which the developer shared his own idea.

I think we need to think seriously about breaking parity with the dollar. It will almost inevitably happen, and it can only realistically be done with tremendous preparation.

That is, above all, Christensen is concerned about the centralised nature of the USDC stablocoin, which could essentially cause interaction with it to cease at any moment. Note that the centralisation of stakes is nothing new, as the companies behind them are required to both comply with the legal framework of a particular country and provide their own coins with real assets in an equivalent amount.

Discussing the problem in Discord

As a reminder, DAI is a decentralised stabelcoin from MakerDAO, with parity to the dollar provided by users who lock their crypto into the Maker Vault with a set liquidation ratio. For example, a liquidation ratio of 125 per cent would require cryptocurrency collateral of $1.25 per DAI.

Currently, USDC’s volume in the vault exceeds the $11 billion mark, meaning the platform is noticeably dependent on this particular centralised stackablecoin.

Read also: Major misconceptions about the transition of Etherium (ETH) to Proof-of-Stake. What are they like?

As we’ve already noted, Circle has been implicated in blockchain-related wallets for Tornado Cash. Earlier this week, it blacklisted 38 crypto-addresses, with all of them making transactions with the cryptomixer quite frequently. According to Decrypt’s sources, the blacklisting means that the USDCs on these wallets have effectively lost their value, as the tokens will now not be accepted by any other centralised platform.

According to the wording of the sanctions, Circle was not technically forced to freeze these funds, but it is a US company and did so out of caution to avoid further pressure from the US government. In a recent statement, Circle founder Jeremy Allaire commented.

We know that it is our right and responsibility as a regulated financial institution to comply with the law and help combat money laundering. We also know that compliance with the law compromises our belief in the value of open source software on the internet and our belief that the presumption and preservation of privacy should be enshrined as a design principle when issuing and circulating digital currencies at parity with the US dollar.

MakerDAO

The high share of USDC in the MakerDAO vault is no coincidence, as stablcoin is considered almost the most popular collateral instrument in the various DeFi protocols. However, as recent events have shown, USDC’s stability in the eyes of the cryptocurrency community is now significantly sabotaged. It is unlikely that the token will increase its popularity among large companies in the near future.

Note that this is not the first time Circle has been in the news the day before. This week in particular, company representatives officially announced that they will be supporting Etherium based on the Proof of Ownership or Proof-of-Stake consensus algorithm. If the PoW fork Eth continues to exist after the update, the USDC will not be there.

Dollar vs Bitcoin

We think such developer actions are fairly predictable. And while their addresses may never end up in the same Circle or US government ban, theoretical reliance on a centralised asset is clearly not something worth pursuing within the decentralisation industry. So this kind of risk mitigation seems logical. The only question is which crypto-asset will be chosen as the new interaction tool going forward.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we will talk about other topics related to the world of decentralisation.