Analysts explain why they don’t expect anything good from Bitcoin and other cryptocurrencies in September

For the previous five years, September was one of the worst months of the year for Bitcoin. With that in mind, there is every chance that the trend will repeat itself and the value of the major cryptocurrency will continue to fall in a couple of weeks. It set a low of around $17,600 in the summer before a period of local growth as high as $25,000. Despite this, there are unfortunately at least three prerequisites for investors’ pessimistic mood. We tell you more about them.

Bitcoin did jump to $25,000 the day before, but its growth ended there. Moreover, as Glassnode analysts found out with the help of so-called Coin Days Destroyed (CDD) indicator, the main category of BTC sellers in this run turned out to be long-term holders, who had been storing the cryptocurrency for more than six months. Apparently, some of them are hoping for a further decline in coin prices and a repeat purchase.

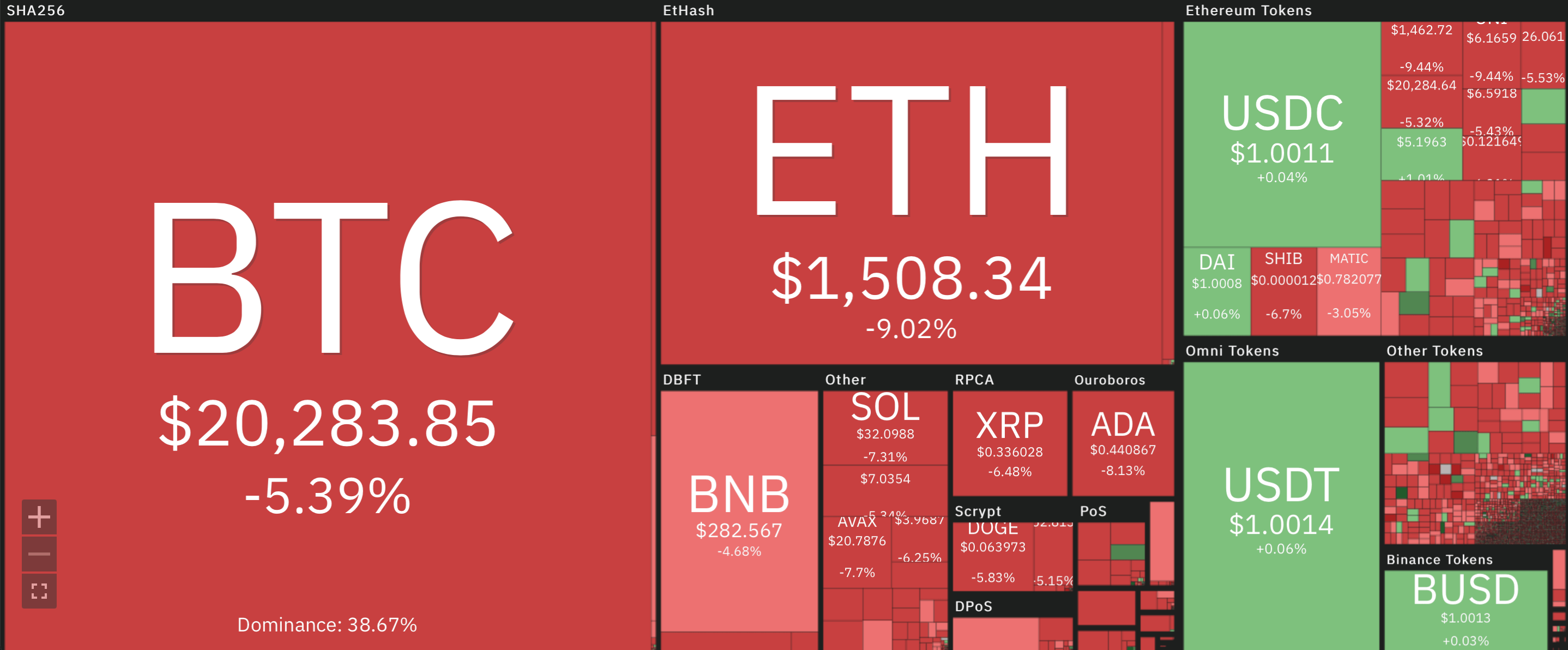

That said, cryptocurrencies have not shown strength over the past 24 hours. Most of them have lost as much as 9 per cent, which is quite tangible on a day-to-day basis. Here is the relevant chart from the Coin360 platform.

Changes in cryptocurrency rates over the past 24 hours

What’s coming for Bitcoin in the near future

According to Cointelegraph sources, September from 2013 to 2021 only brought investors losses, with only 2015 and 2016 being the exceptions. Meanwhile, on average, the cryptocurrency’s price fell by around 6 per cent in September.

Bitcoin returns by month

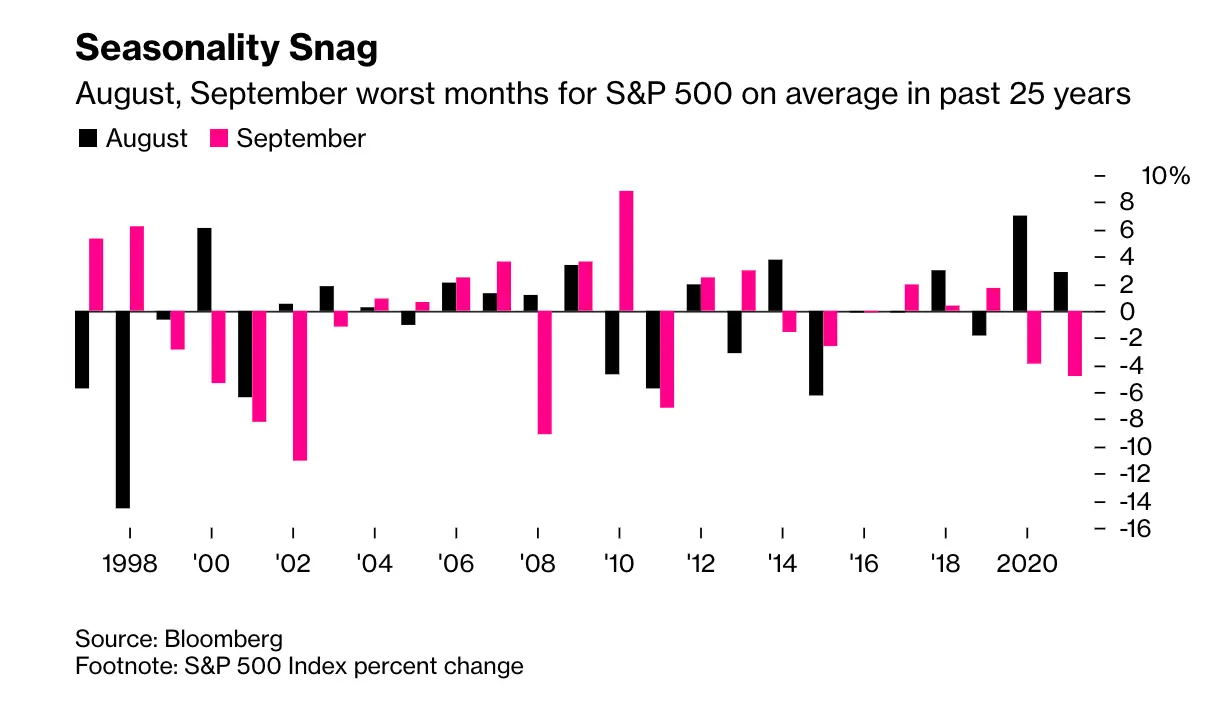

“The September effect is not only noticeable in crypto. The month is also having a negative impact on the S&P 500 stock index. On average over the past 25 years, it has fallen by around 0.7 per cent in September – a serious negative for the traditional finance industry.

S&P 500 returns in September and August by year

Analysts have singled out several reasons for such a poor reputation for this stretch. Some believe that a huge number of investors are closing their positions, thus locking in gains or losses after the summer break. Others insist that the fall is due to an outflow of funds from the markets related to the start of the new school year.

Bitcoin’s fall since the start of 2022 has been triggered mainly by news of a base lending rate hike in the US. The Federal Reserve is now going ahead with these measures to reduce the negative impact from high inflation on the country’s economy. Recall that the higher the lending rate, the worse the conditions for borrowing capital. Consequently, there is less “easy” money, risky investors’ appetite drops, so the increase in the rate leads to a drop in markets.

The US Fed is planning another rate hike in September, with the equivalent of an increase of 75 basis points. However, there were earlier hopes that inflation in America had peaked, as the consumer inflation index was 8.5 per cent in July instead of the expected 9.1 per cent. In other words, some investors are hoping that the Fed will soon stop raising rates so aggressively and move to at least 50 basis points.

For now, crypto is seeing a bad scenario developing, as Bitcoin’s rise to $25,000 under the circumstances looks like a local rebound in a global bearish trend. Typically, such moves do not end with the formation of a bottom for a new bull run, but only lead to a renewal of the asset’s price lows.

Therefore, in theory, the level of $17.6 thousand might not be the long-awaited bottom for this bearish trend. However, time will tell the answer to this question.

Bitcoin rate

The preconditions for that can be clearly seen in the 1-day chart of Bitcoin, where a pattern called an ascending wedge has formed. The lower line of the wedge has already been broken by the price, which means that in the next few weeks we can expect the BTC price to fall to the same $17.6 thousand, according to the expert. According to the rules of technical analysis, the target for breaking through the upward wedge downward is at its base, which is just the above-mentioned level.

News about Bitcoin ETFs

Meanwhile, the US Securities and Exchange Commission (SEC) has delayed a decision on an exchange traded fund (ETF) for Bitcoin, which is to be based on the spot price of the main cryptocurrency, i.e. its market value. This application was submitted in June 2022 by a New York-based investment firm called VanEck. It has been trying since 2017 to get the green light from the SEC for a Bitcoin spot ETF, but so far all attempts have been in vain.

🤩 FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

By the way, Bitcoin ETFs in the US were adopted by the Securities and Exchange Commission last year, but they are all based on cryptocurrency derivatives represented by futures. The adoption of spot ETFs is really important, as it could open the door to an influx of large investments in the industry. We wrote more about the benefits of Bitcoin ETFs in our piece.

Bitcoin ETFs

We believe we should not count on an unequivocally bad scenario for the cryptocurrency market in September, as previous niche changes do not guarantee a repeat in the future. In addition, in the middle of the month, the industry will see a major refresh of Etherium and the cryptocurrency network's move to Proof-of-Stake consensus algorithm, the success of which is sure to be a positive development. So, investors should still assess the situation carefully and not take on more risk than they are willing to bear.

For other interesting news, check out our Millionaire Crypto Chat. There we discuss other important events that affect digital assets and the blockchain industry in one way or another.