Cryptocurrency enthusiasts can now find it easier not to fall victim to scams. What will help them do that?

The success of Dogecoin, after it was frequently mentioned by billionaire Ilon Musk back in 2021, has led to the emergence of hundreds of similar projects. Alas, many of these coins carry significant risks for ordinary investors. On the eve, more than 50 such tokens were recently identified by a special tool based on BNB Chain, a blockchain from cryptocurrency exchange Binance. We tell you more about the situation.

The fact is that BNB Chain has a feature called Red Alarm, designed to protect investors from investing in dummy projects. Their confirmation is based on two criteria. The first is that the token’s smart contract does not have the feature set that the developers promise. The second is that the smart contract has vulnerabilities that could potentially cause investors to lose money.

That is, if the system identifies certain risks to users, they will know about them. That means there will be far fewer reasons to lose money because of the activity of dishonest developers.

How can a fraudulent crypto project be identified?

In an interview with Cointelegraph news outlet, BNB Chain Investment Director Gwendolyn Regina said that Red Alarm analyzed more than 3,300 smart contracts in July alone. Meanwhile, the platform’s team continues to improve its algorithms for identifying unreliable cryptocurrencies.

Accordingly, in the future, cryptocurrency investors can be even more cautious and selective when choosing coins to link.

BNB Chain Red Alarm

Even if some tokens tested by BNB Chain show no direct signs of a fraudulent scheme, the platform will still flag them to investors on any suspicion. Regina continues.

We tend to move such projects to the Red Alarm list so that users either don’t invest in them at all or do so with extreme caution.

Obviously, developers will not be happy with such a tag and will therefore make efforts to avoid being on this list. And if investors end up bypassing scam projects, developers will lose the excuse to create them - at least in that number.

Naturally, BNB Chain cannot be an ultimative measure to protect the investments of market players. Regina points out that investors themselves must be responsible for their investments. That is, before buying any token that is not on Red Alarm’s list, the crypto-enthusiast should do in-depth research on the project in any case. This means searching for information about its team, deciding on the fundamental value, analyzing the token price chart, tokenomics, and so on.

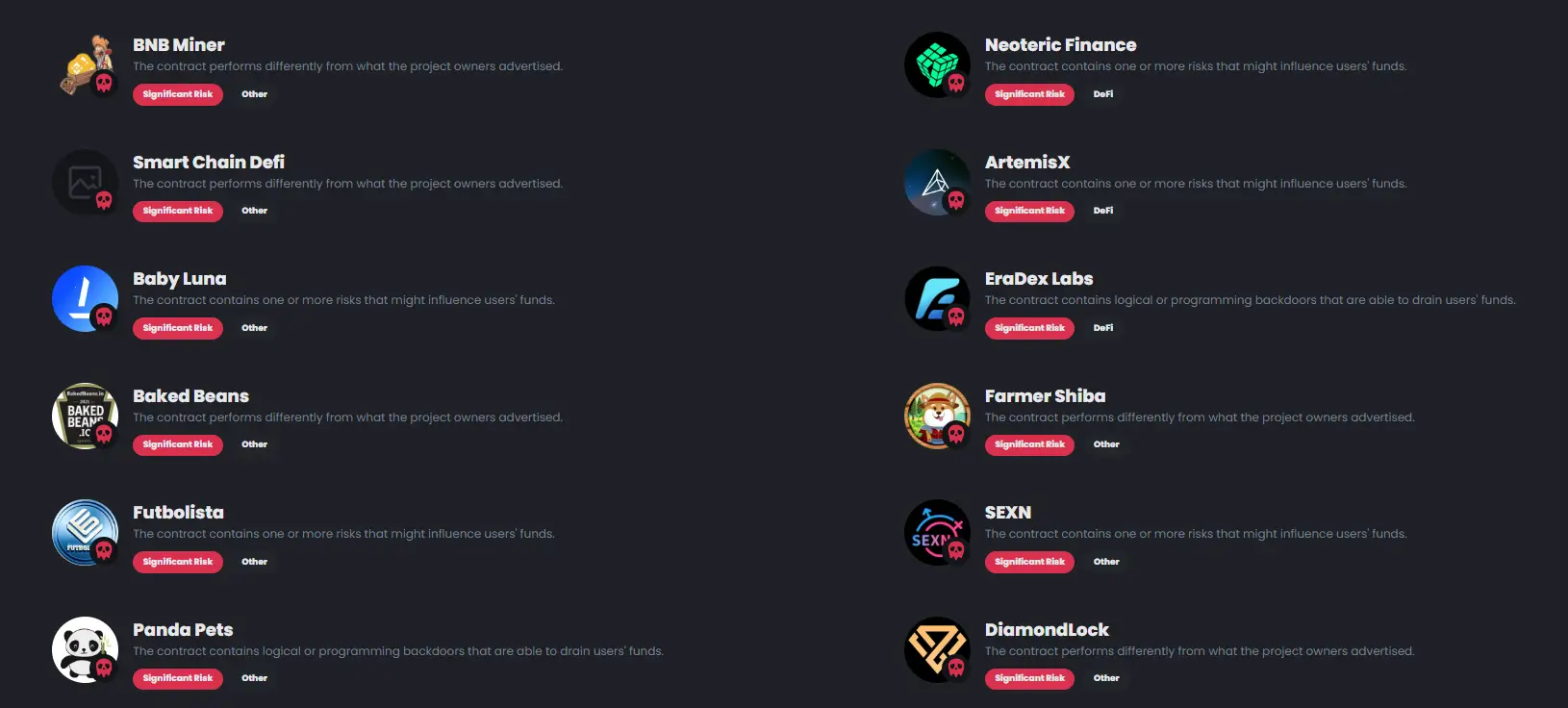

Some of the coins on Red Alarm’s list

You can find many projects in Red Alarm that are clones of the aforementioned Dogecoin or similar meme tokens. For example, in the screenshot above from the “animal theme” you can see projects like Panda Pets or Former Shiba. There is even a copy of the infamous LUNA token belonging to the Terra ecosystem called Baby Luna. As a reminder, the price of LUNA plummeted to near zero a few months ago – and now the coin is definitely not salvageable.

Read also: Elon Musk tells us how Dogecoin is better than Bitcoin. And it's hard to agree with him.

One of the factors that has done irreparable damage to Terra has been the breakdown in parity of the ecosystem-linked algorithmic stackablecoin TerraUSD. The concept of such a decentralized steblycoin itself was later criticized by many crypto-enthusiasts, and more recently it received another blow to its reputation, this time due to the collapse of aUSD token in the Acala ecosystem. The day before, it went down in price by more than 99 per cent after hackers discovered a vulnerability in the liquidity pool.

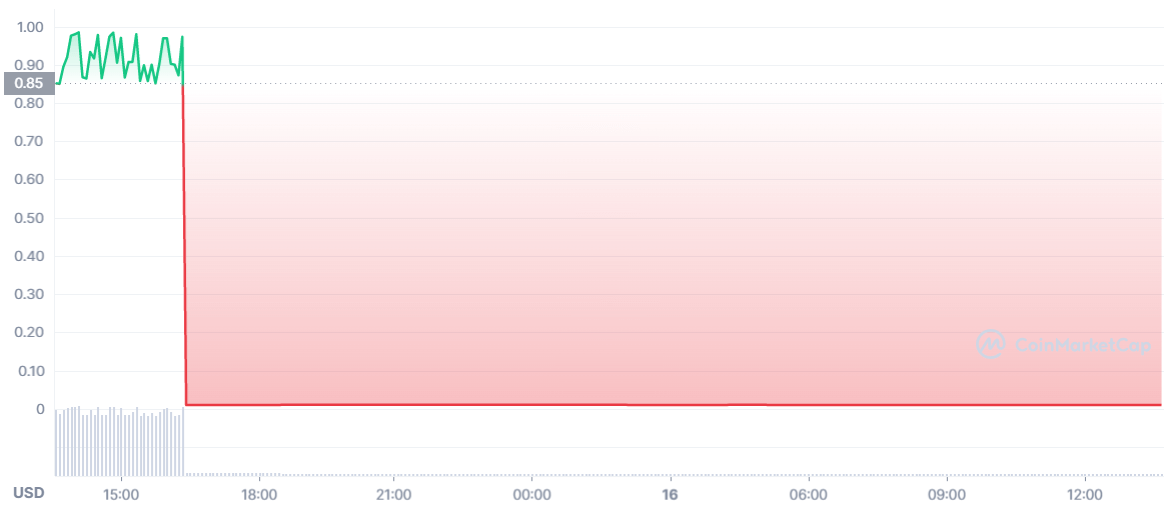

Falling price of aUSD

The Acala Network team has already claimed that hackers were able to emit 1.28 billion aUSD due to the “misconfiguration” of the recently launched iBTC/aUSD liquidity pool. The sudden spike in the token’s supply led to a collapse in its value in a matter of minutes.

iBTC is an inverted synthetic Bitcoin token that can be used in DeFi-platforms and is traded paired with aUSD on Acala. The inverted synthetic tokens themselves display inverse prices of the underlying cryptocurrencies. For example, if the price of BTC falls by $500, the price of iBTC should rise by $500 and so on.

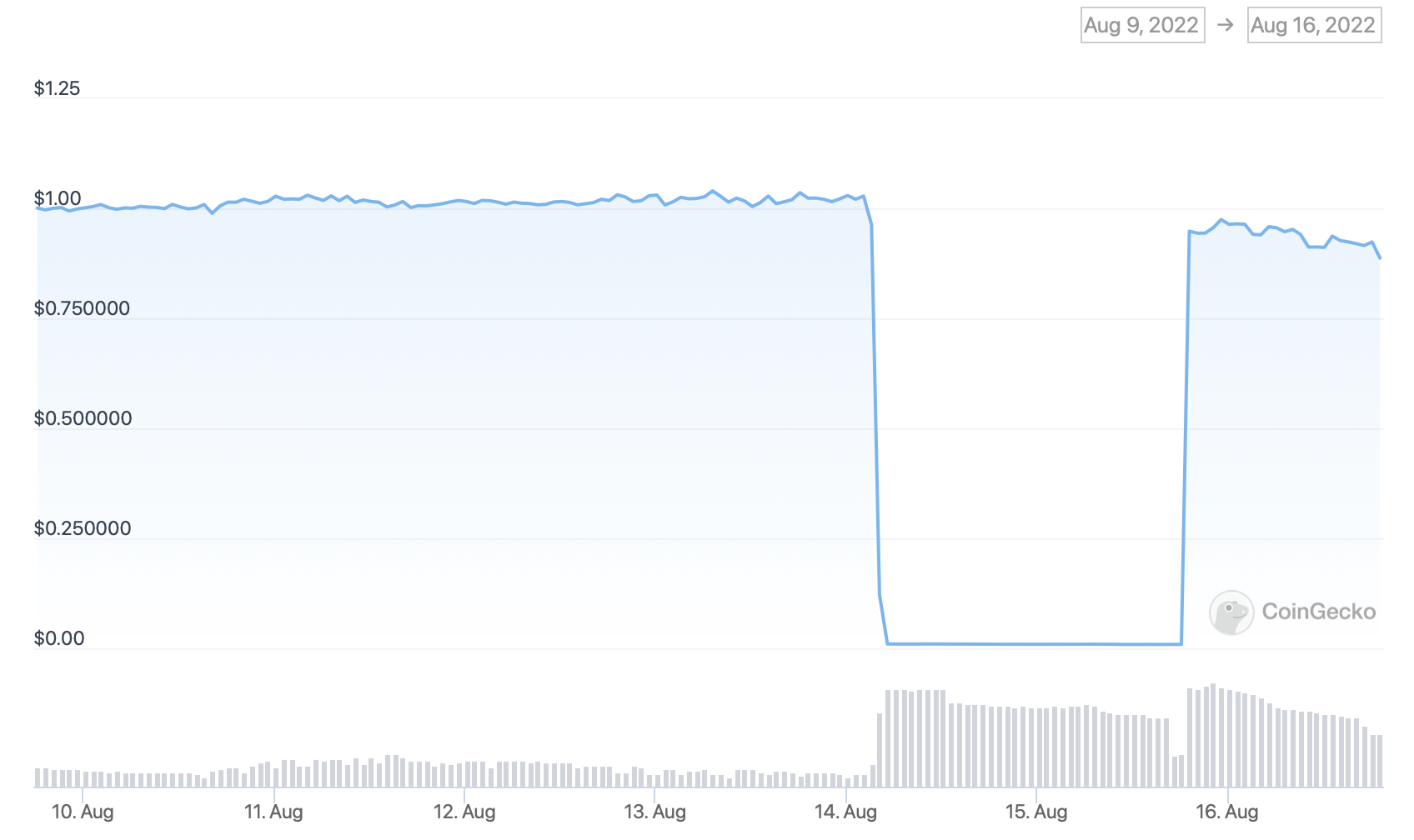

Acala Token chart

The Acala platform suspended trading after an urgent vote by the development team. At the time of writing, the vulnerability has already been fixed.

The vulnerability has been fixed and the addresses of the wallets that received the emitted aUSD have been identified.

Well, the subsequent burning of 1.29 billion coins led to a relative normalisation of the aUSD exchange rate. Today, the coin’s price jumped to 88 percent, the equivalent of almost 10,000 percent growth overnight.

A chart of the Acala Dollar (aUSD) cryptocurrency rate over the past week

We believe that the existence of this instrument and its further popularization will benefit the coin industry. Firstly, fewer people will become victims of scammers. Secondly, scammer developers may also reduce their interest in defrauding cryptocurrency industry participants over time. However, as the popularity of such platforms grows, their "earnings" are likely to decrease.