Cryptocurrency startup spokesman explains the benefits of a bear market for the digital asset niche

The bearish trend in the crypto market is not just about a steady drop in the price of digital assets. The cycle could well be turned in its favour by spending time creating and improving new projects, as well as learning about the industry as a whole. This view was voiced in a recent interview by Fanny Philippe, chief operating officer of Canadian mining firm Sato Technologies. Let’s take a closer look at the expert’s point of view.

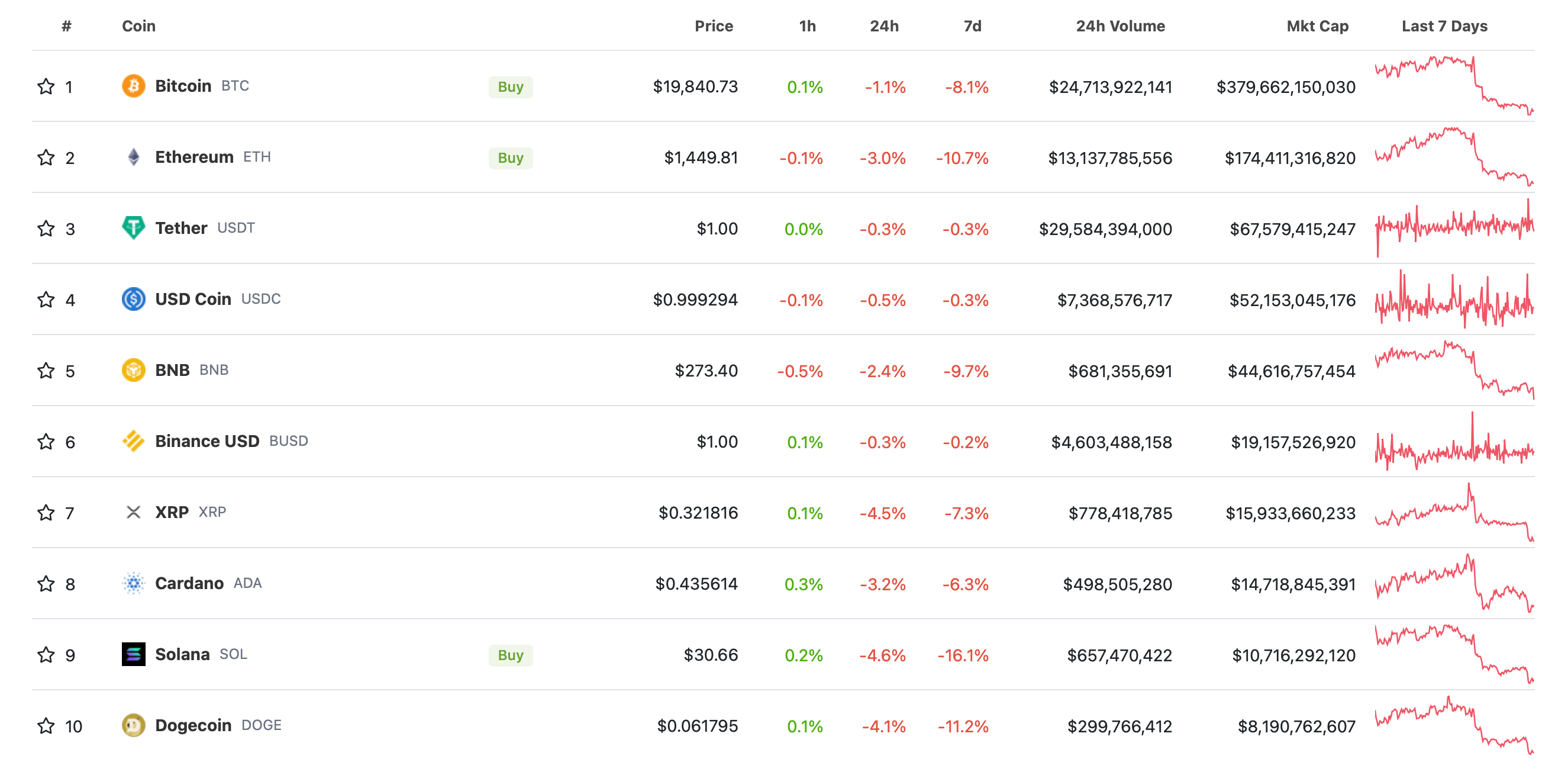

Note that the cryptocurrency market is indeed in the midst of a bearish trend phase. In particular, this is how the situation with the rates of coins in different time intervals of the day before looks like.

Changes in cryptocurrency rates

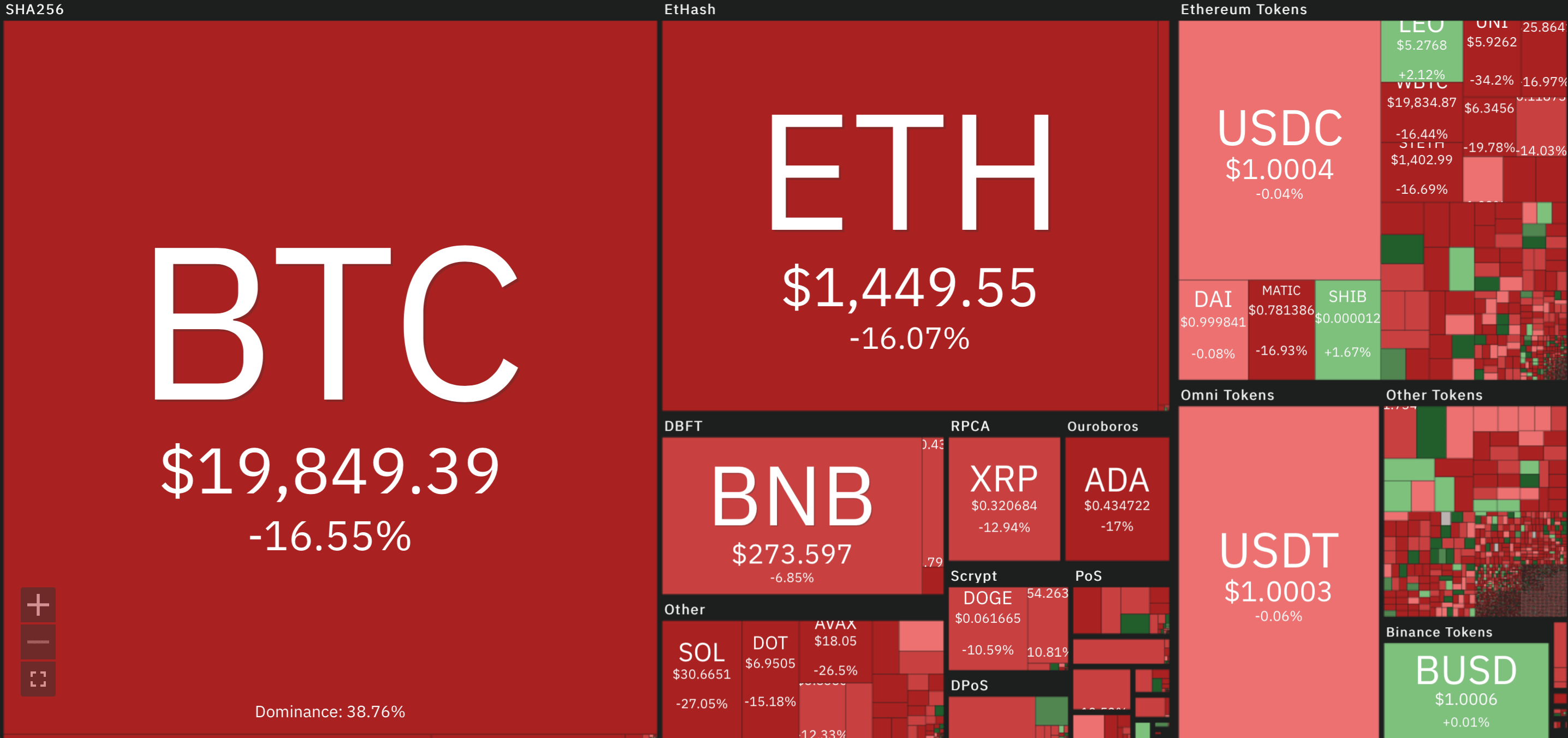

On a monthly scale, it’s even worse: here are the price movements of popular coins over a 30-day time span.

Cryptocurrency price movements over the past month

When best to start investing in cryptocurrencies

During an interview with Cointelegraph at the Surfin’ Bitcoin 2022 event in France, Philippe spoke more about the impact of the bearish trend on cryptocurrencies. She believes miners and investors should pay as much attention as possible to creating something new and learning about the market at this time.

Sato Technologies opened its first mining centre in Quebec, where a few years earlier local authorities had imposed a moratorium on the business of miners. The ban was later lifted, however, due to the high popularity of the activity.

The current bearish trend has its own problems, but it can be used in a positive way. Here is an expert comment.

“Cryptozyme to create something new? Great. The bear market for us is a period of painstaking work on new projects.

Note that some experienced developers and entrepreneurs are indeed using bearish trends to develop their own projects, platforms and services. As a result of attracting attention and funding, they are usually the ones at the forefront of growth when the bullruns come.

That said, the characteristic feature of bear markets turns out to be a lack of humorous projects. In particular, you must have noticed the almost complete disappearance of various Dogecoin clones, Shiba Inu and other "dog" coins, which were a hit in the previous bull run and showed incredible growth in 2021. Obviously, investors don't have much spare cash right now, so they can't invest in anything frivolous. It is too much of a risk today.

Bitcoin price chart for 180 days

In addition, the current environment has its own advantages specifically for miners. For example, the cost of equipment for crypto-farms drops significantly, and if it is possible to buy large quantities of hardware, even on the secondary market, the company can significantly increase its profits. For amateur investors, the “crypto winter” is also able to be a very fruitful period. After all, market downturns last for months, and during this time you can thoroughly prepare for the new bull run – learn basics of technical analysis and find promising crypto projects to invest in.

🤩 FIND MORE INTERESTING NEWS ON US AT YANDEX.DEN!

“The perks” of the falling crypto market are understood even by billionaires. For example, Sarath Ratanawadi, CEO of Thai energy company Gulf Energy Development, announced the day before that his firm would be investing in blockchain ecosystems to diversify its profits. Ratanawadi himself is the second richest person in Thailand with a fortune of $12 billion, so this news is really good reputational news for the digital asset industry.

Gulf Energy Development has also partnered with the largest cryptocurrency exchange, Binance, and right now the company is in talks with local regulators to get its own cryptocurrency platform licensed. According to Ratanavadi, crypto will play an important role in Gulf Energy Development’s future business model. Here’s a quote from the entrepreneur.

The recent problems in the crypto market are a local phenomenon. Overall, it still looks very promising and has high potential.

Thai billionaire Sarath Ratanawadi

This isn’t the first time the Thai billionaire’s company has been mentioned in crypto news headlines. Back in March this year, its representatives announced plans to invest directly in digital assets. The energy giant even formed a separate unit called Gulf International Investment Limited to achieve this goal.

A month later, the company did make an investment in Binance US and acquired the Binance Coin (BNB) native token exchange. Unfortunately, Gulf Energy Development never disclosed the exact amount of this investment. But on their own, they are a positive sign for the crypto market. Although it is “not in great shape” at the moment, the emergence of institutional investors of this scale indicates that crypto has high potential in the long term.

As a result, seasoned entrepreneurs and investors are proving by their actions that they find the digital asset market extremely attractive during the collapse phase. Yes, the current link to digital assets seems too risky, but over the long term, buying cryptoassets in the reddest stretches of time somehow offers the greatest potential rewards. However, there is indeed danger here, so investors traditionally need to do their own research and only invest what they are theoretically prepared to lose.

What do you think about this? Share your opinion in our millionaires’ cryptochat. There we will discuss other important news related to the blockchain and decentralisation industry.