Employees of cryptocurrency exchange Binance speak out about the company’s actions during an update of the Etherium network

Cryptocurrency exchange Binance will suspend deposits and withdrawals of Etherium ETH, as well as ERC-20 standard altcoins during the cryptocurrency network transition to Proof-of-Stake (PoS) consensus algorithm. As a reminder, the transition itself is scheduled to take place in mid-September, with another major exchange, Coinbase, also announcing the suspension of coin deposits and withdrawals at the time of the merger. Here’s a closer look at what’s happening and its importance.

This is not the first time major cryptocurrency exchanges have commented on what’s happening with Etherium this month. In particular, in the middle of the month, Coinbase management decided to present the situation of possible US government sanctions against the Eth network. CEO Brian Armstrong said that in such a case, they would not cause problems for the cryptocurrency network, but would only stop stacking and return the coins to their users.

Armstrong also suggested that in such a case there could be room for a lawsuit against the authors of the decree in question. Read more about his views on the situation in a separate piece.

Coinbase logo in New York

What will happen to ether after PoS

According to Cointelegraph’s sources, the exchange is taking into account the specifics of the merger and the possible scenarios in which the move to PoS will occur. During the upgrade, a new token could be created during the hardforge, requiring measures to mitigate risks to traders and secure user funds.

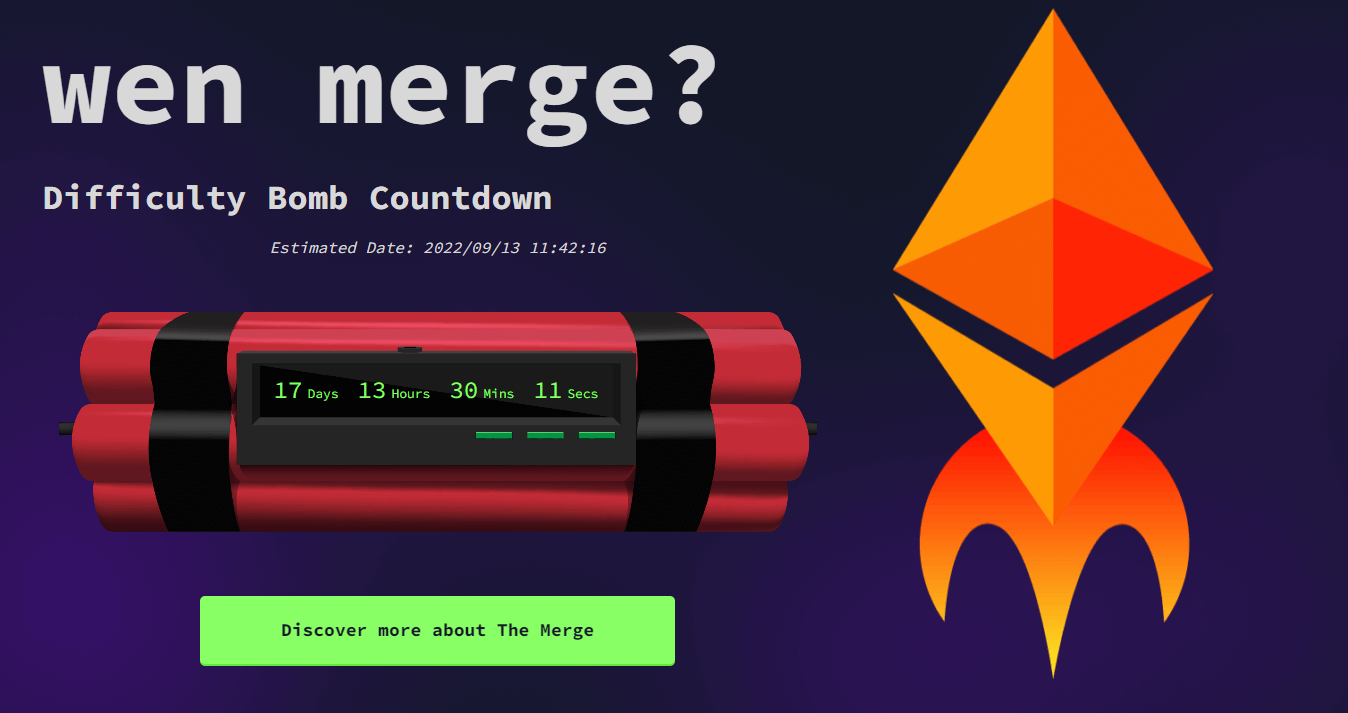

Countdown to merger

Binance will suspend deposits and withdrawals for ETH and ERC-20 tokens on September 6 while the Bellatrix consensus level is updated, as well as on September 15, when the final Paris execution level update is scheduled. Exchange officials also said that Binance has considered two scenarios that could occur during the merger. Scenario A assumes that no new token will be created, resulting in Binance resuming deposits and withdrawals for ETH tokens along with the ERC-20 standard as a priority.

🤩 WE HAVE MORE INTERESTING STUFF ON YANDEX.DEN!

The second scenario considers the possibility of splitting the Etherium blockchain into two competing blockchains, leading to the creation of a new token. In such an outcome, Binance would use the ETH ticker for the PoS-based Ethereum blockchain. The exchange will then automatically credit users’ accounts with the fork token from the other blockchain at a 1:1 ratio.

Incidentally, the possibility of a fork is one of the reasons why some traders are buying ETH. The new tokens in the case of Binance will only go to those who hold ETH on the exchange. This is essentially "free money", and there could be plenty of it if the market appreciates the value of the fork.

It is important to understand that receiving tokens on a possible alternative chain also applies to all cryptocurrency owners on non-custodial wallets, i.e. full Ethical addresses that users control themselves. The cryptocurrency exchange in this case only promises to accrue coins to users, which would also be "copied" to its addresses.

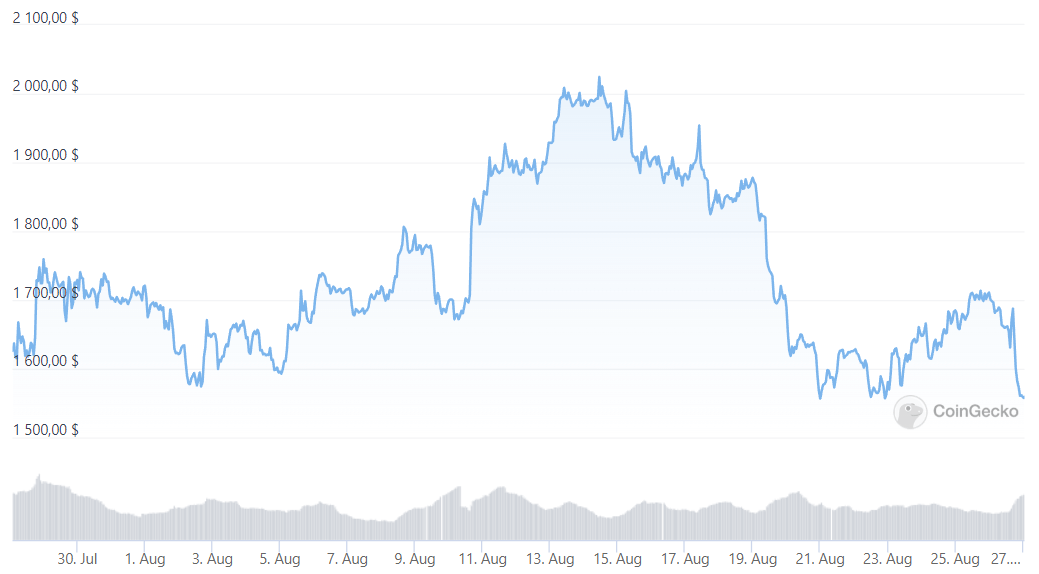

Etherium exchange rate

Spot trading of ETH and ERC-20 tokens will not be affected during the merger, though users are warned to expect high volatility at the time of the procedure. Binance will also suspend cross and isolated margin loans from 14 to 16 September, noting that the relevant ETH trading pairs will remain unchanged.

Trading in ETH USDⓈ-M and COIN-M futures contracts is also expected to continue, but Binance representatives said that additional measures like adjusting margin levels – such as maximum leverage and maintenance margin – may be taken.

Employees at popular cryptocurrency exchange Coinbase also mentioned the topic of an Etherium update. According to Decrypt, the platform’s representatives will consider starting trading a fork of ETH based on the PoW consensus algorithm should it become available. Here’s a relevant quote.

Our goal at Coinbase is to launch trades in every asset that is legal and safe to list. This way we can create a level playing field for all new crypto-assets while continuing to protect our customers. If a PoW-based fork of ETH arises after the merger, it will be vetted with the same care as any other asset on our exchange.

Bitcoin and the dollar

The update of Etherium in September will be an important step in the further development of the project and PoS blockchains in general. As we reported earlier, the new consensus algorithm also means that the new ETH issuance will be reduced by around 90%, which isn't a bad thing for the cryptocurrency while maintaining demand. So the exchanges will clearly support that, as well as the trading of the possible fork, which will somehow provide additional trading volumes and commissions.

For other updates, stay tuned to our Millionaire Crypto Chat. There we discuss other important developments that affect the digital asset industry in one way or another.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. ACEMOON IS COMING SOON!