Etherium’s creator talks about what could lead to the separation of this blockchain

Etherium creator Vitalik Buterin was a guest at the BUIDL Asia event in South Korea the day before, during which he discussed the prospects for ETH following its transition to the Proof-of-Stake (POS) consensus algorithm. Vitalik paid particular attention to the issue of a possible ETH blockchain unbundling – according to him, this event is heavily influenced by stackablecoins like Tether (USDT) or USD Coin (USDC). Talk about what’s happening and its importance in more detail.

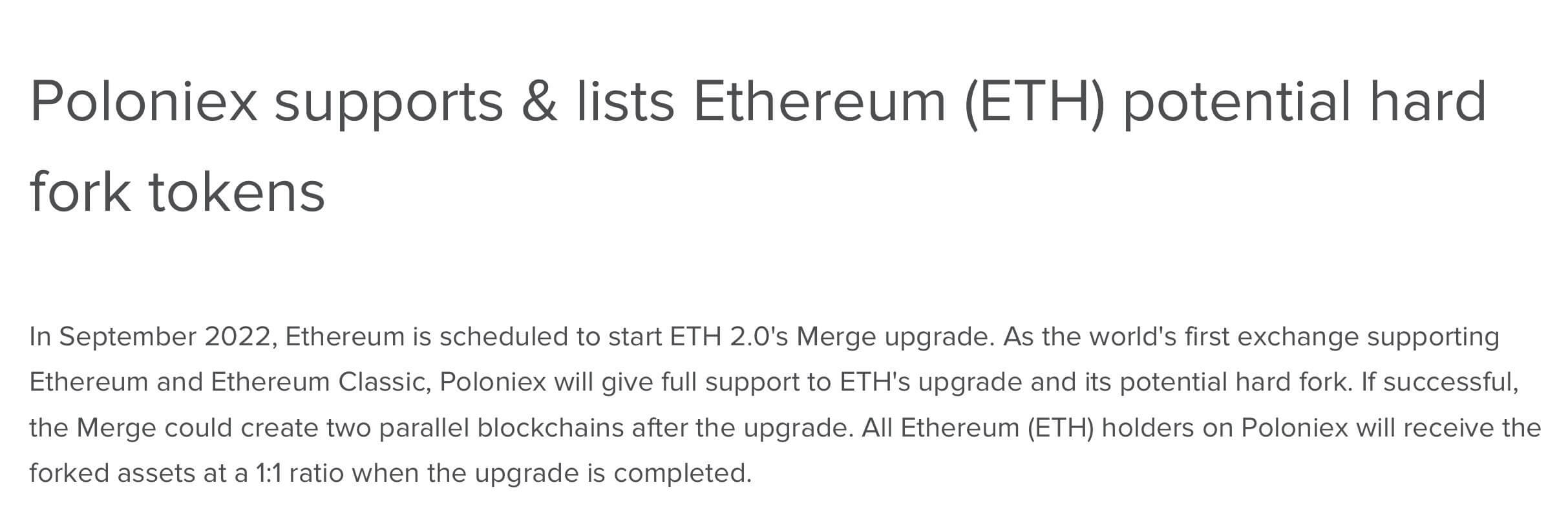

Note that major cryptocurrency exchanges are already preparing for a possible separation of the Etherium network. In particular, on Thursday such a position was voiced by representatives of trading platform Poloniex. In theory, they are ready to support trading of ETHS – that is, the new PoS-based ETH, as well as the current PoW-based ether called ETHW.

Announcement of the listing of two versions of Etherium from the Poloniex exchange

What’s going to happen to the Etherium blockchain?

Earlier, the potential separation of the ETH blockchain was announced by crypto fund experts Galois Capital. Admittedly, in their scenario, the possible formation of new alternative chains would be heavily reliant on miners. With the transition to PoS, miners should be replaced by validators, but analysts suggested that if a significant proportion of miners continue to mine ETH, the altcoin blockchain could split, meaning the Proof-of-Work or PoW-based Ethereum will continue to exist.

That said, Vitalik is confident that the deciding factor in the move to PoS will be the popular stackcoins and whether they will “respect” the transition process, which is also called a merger. As a reminder, a hardforward occurs after a radical change in the cryptocurrency’s protocol, which results in the formation of two blockchains. Typically, one of the blockchains remains preferred by the majority.

This is particularly the case with regular Etherium. In 2016, the equivalent of $60 million in ETH was stolen from users due to the hacking of The DAO project. The developers decided to essentially undo this action and fork the network already without the hacker and the damage he caused. However, some users disagreed with this idea because of their "code is law" approach. As a result, they continued with the original blockchain, which is now known as Ethereum Classic.

Here’s Buterin’s quote on the subject.

At the time of the merger, we will have two separate networks. The exchanges, blockchain oracle providers and stabelcoin issuers will decide which one to support. Because at that point there will be 100 billion USDT on one chain and 100 billion USDT on the other chain, so Tether needs to define one of the blockchains as legitimate.

Why can't the same Tether support two blockchains? Because then they would have to double the security of their own coins - which at today's rates is equivalent to tens of billions of dollars.

Etherium creator Vitalik Buterin

According to Cointelegraph sources, Buterin doesn’t see any significant disagreement on the issue – at least not in the near future. This was also confirmed by Tether CTO Paolo Ardoino on his Twitter, who commented back in late July by tweeting the following quote

Support for ETH2 will be complete.

The merger should go through without any problems, but in the next 5-10 years Etherium may indeed have new hardforces, i.e. offshoots. And that’s where stabelcoin issuers will play a more important role, believes Buterin. He continues.

I think the problem will become more of an issue in the future. In fact, the fact that the USDC issuer’s decision on which blockchain to consider as an Etherium could be an important deciding factor in future controversial hardforces.

The issue here is not even about Ethereum per se, but about the structure of the crypto market in the coming years, Vitalik emphasised.

Perhaps the Ethereum Foundation will be weaker, perhaps ETH2 customers will have more power, and perhaps someone – Coinbase, for example – will simultaneously manage the issuance of large stackablecoins. There could be a lot of things like that happening by then.

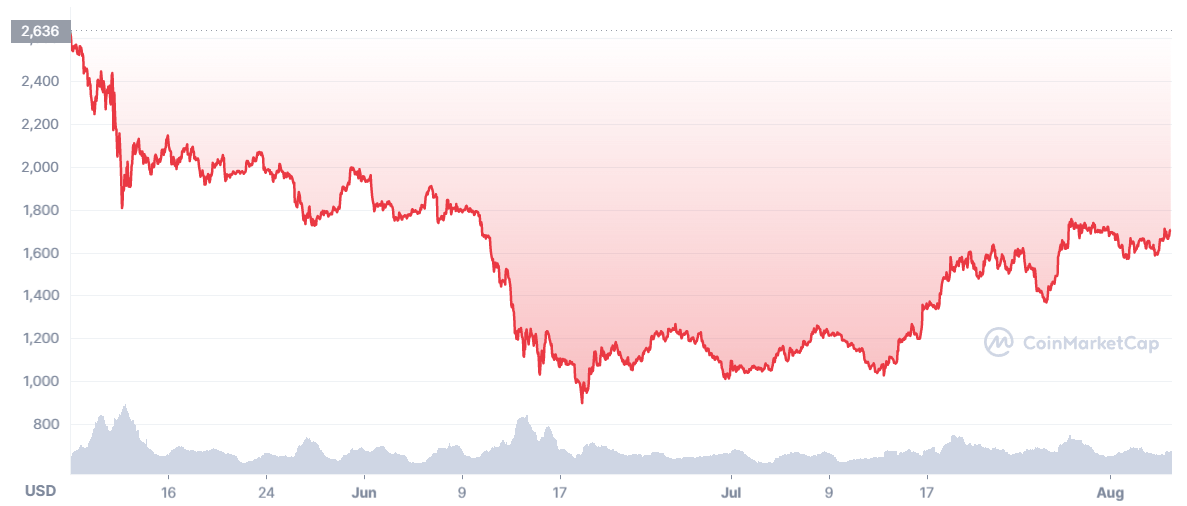

The course of Etherium

In order to avoid excessive centralisation, Buterin suggested making greater use of different types of stablcoins. He particularly singled out an altcoin called DAI, which he believes could be made a digital counterpart to traditional currencies or assets. But the fact remains that in the long term, it’s almost impossible to predict exactly what challenges the Ether ecosystem will face in the context of potential hardforces.

Although in the second half of September, when the refresh of Ethereum is tentatively expected to take place, large companies represented by Tether will clearly support the refresh of ETH. That said, the chances of the current PoW-based chain continuing to exist remain high, as it is primarily in the interest of the mining community.

We believe that given the clear stance of the miners, we can indeed expect the current PoW-based Ethereum chain to continue to exist. Judging by the reaction of large companies like Tether, they will not support the old blockchain, i.e. the capabilities of the Eth network with miners will be more limited. However, this is unlikely to stop exchanges from trading coin and supporting the development of the ecosystem.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will talk about other topics related to blockchain and decentralisation.