Mastercard does not consider Bitcoin a convenient means of payment. But does that make the cryptocurrency a bad investment?

Cryptocurrencies should not be considered a suitable medium for making payments, as they have another role – a full-fledged asset class. Mastercard CFO Sachin Mehra said this in a recent interview. According to him, crypto is still too volatile, but central bank digital currencies (CBDCs) and stabelcoins could well be considered as suitable payment instruments. We tell you more about what’s going on.

It is worth noting that Mastercard has been actively engaging with the blockchain world despite its core business. In particular, at the end of July it became known about the launch of an NFT collection from Miami, which will be held in cooperation with TIME magazine, among other things. Read more about the initiative in a separate piece.

Why cryptocurrencies are needed

Mehra doesn’t see Bitcoin or altcoins as anything bad in this context. The fact that they are not suitable as a sane means of payment does not make them worse than CBDC or Stablecoin. They just have fundamentally different applications and should not be constantly compared to each other, Mastercard says.

In addition, the concept of digital currency does not necessarily have to be associated with crypto. Here is the expert’s rejoinder, quoted by CryptoPotato.

Globally, there is still an enormous amount of cash currency that needs to be digitized.

We don't agree with that view. Obviously, Stablecoins retain their dollar value better than conventional BTC, ETH or SOL, but many cryptocurrency enthusiasts may aim to accumulate as many coins as possible - especially given the current market situation. Therefore, for them, paying in SOL will be more suitable than getting USDC. However, if anything, just a few clicks will be enough to exchange SOL to USDC - and vice versa - so this issue is hardly a matter of principle.

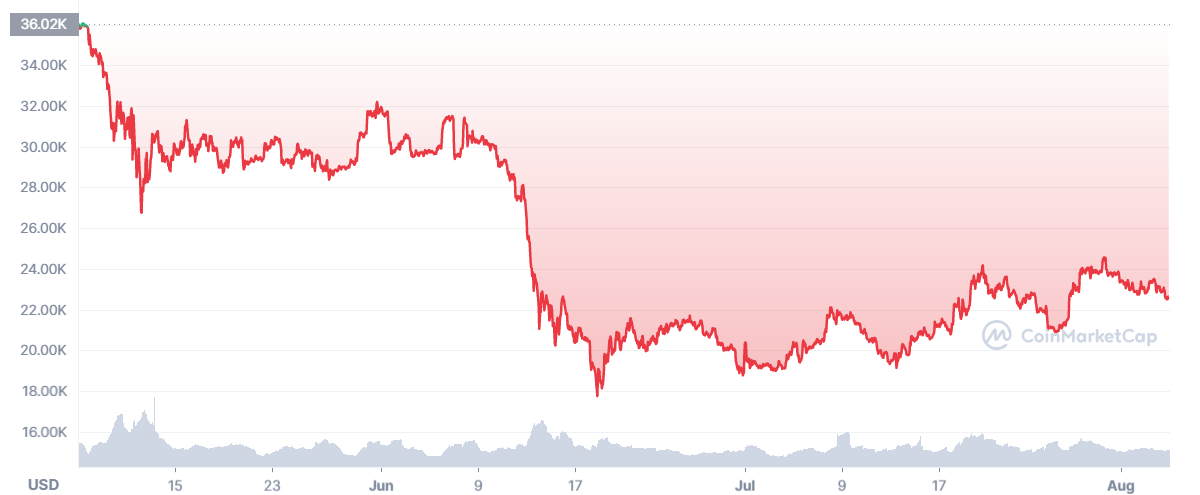

Bitcoin exchange rate

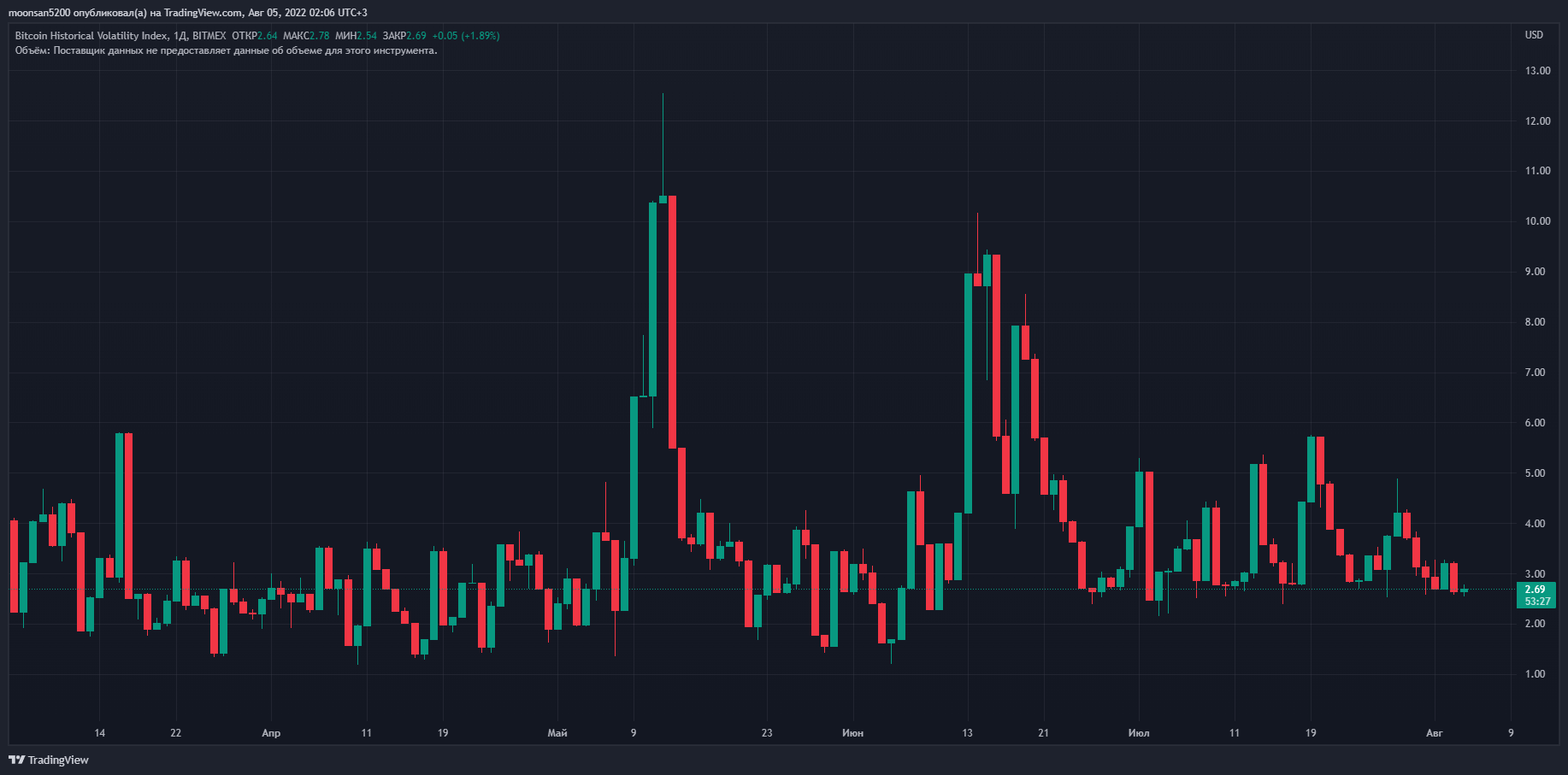

According to a Mastercard spokesperson, it is the volatility that determines whether or not a certain currency can be considered a suitable payment instrument. He continues.

If something changes in price every day, for example, your coffee at Starbucks. Today it costs $3, tomorrow it will cost you $9, and the day after tomorrow you will pay a dollar. This is a big problem from the consumer’s point of view.

Here the expert has clearly exaggerated the rate of change in the cost of the product, but his logic is clear. In any case, he does not mention the subject of inflation, which is now breaking records in some countries. It makes regular money cheaper, so the coffee shop analogy in this case looks like a permanent and gradual rise in the price of the drink. And that might be enough for someone to get in touch with coins.

Bitcoin volatility index

The expert believes that Bitcoin is better seen as a means of capital accumulation, that is, as an investment asset that can bring an investor profit in the long run. Even in that role, though, BTC is undervalued, says SkyBridge Capital founder Anthony Scaramucci. A more appropriate mark on the BTC chart right now is at least $40,000.

And while “the worst is over,” Scaramucci warned that it could take quite a while for BTC to recover to its “fair” value. Here’s one of his quotes published by sources

We are confident that a huge number of leveraged positions have been knocked out of trading. Bitcoin could still fall, but I don’t think it will go below the low set in this cycle of $17,500.

SkyBridge Capital CEO Anthony Scaramucci

The expert also believes that a “fair price” for Etherium should also be higher, around $2,800, although Ether is currently trading at the $1,600 line. The main triggers for cryptocurrency growth should be “acceptance, growth of active cryptocurrency wallets, and practical application” of digital assets.

We believe that Bitcoin is far from being the best payment instrument, except for slow transactions, as it can sometimes take about an hour to confirm a deposit. In this case, a more convenient payment tool is modern and fast blockchains like Avalanche and Solana, which, among other things, support stackablecoins and allow switching to them in a matter of seconds.

With that in mind, Mastercard's reference to so-called CBDCs from central banks seems a bit of a stretch. It seems as if traditional finance deliberately wants to blur the concept of cryptocurrencies and equate banks' digital currencies with them.

So now is a good time to keep a close eye on the market. To make it easier for yourself, join our Millionaire Crypto Chat. There we will discuss other important developments related to the blockchain and decentralisation industry.