Some analysts believe Bitcoin has already moved into a new bullish trend. Why?

While everyone has been distracted by macroeconomic problems, Bitcoin has managed to move into a new growth phase – at least that is the conclusion that can be drawn from the dynamics of coin movement on the blockchain. According to independent analyst Miles Johal, one of the key evidences of the beginning of a new bull run is the growth of BTC, which has been sitting unmoved on cryptocurrencies for quite some time. The analyst’s arguments are also backed up by a record drop in bitcoin volume on exchanges. Let’s look at the situation in more detail.

It should be noted that coin hoarding by addresses whose owners do not move cryptocurrency is a regular feature of analysts’ attention. Still, hoarding for them is a long-term strategy that has been used for many years. Therefore, the increase in cryptocurrency volume by such investors means that they are not planning to get rid of the coins they have bought and at the same time counting on the onset of the bull run for the foreseeable future. And at the moment, capital owners are clearly preparing for the latter.

Bulls and bears

How to determine the beginning of a bullish trend?

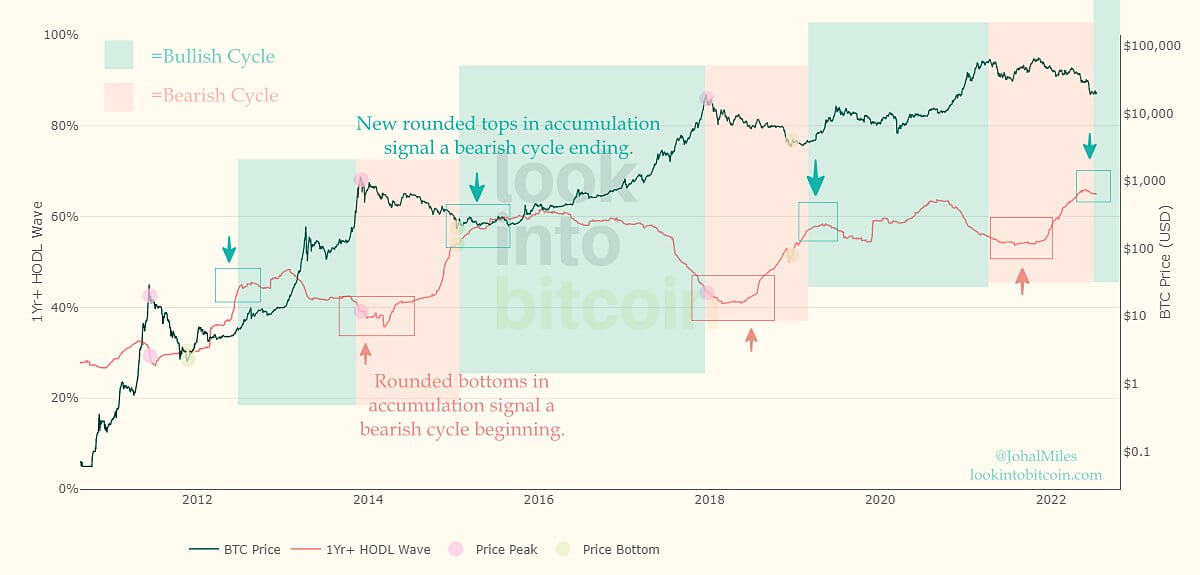

Johal’s analysis is based on the HODL Waves indicator for Bitcoin. Recall, it displays the proportion of BTC supply that was last moved in the blockchain at a certain interval. The expert has taken a one-year interval, meaning that in the chart below, the Hodl Wave line is the number of bitcoins that last moved at least one year ago.

The chart is divided into bullish and bearish trend zones, and the Hodl Wave line itself has one interesting feature – during previous global lows for BTC it formed an accumulation zone near its high. Something similar is happening right now. In contrast, during the BTC Hodl Wave price peaks for a long time fluctuates in a horizontal channel around its minimum.

Hodl Wave indicator

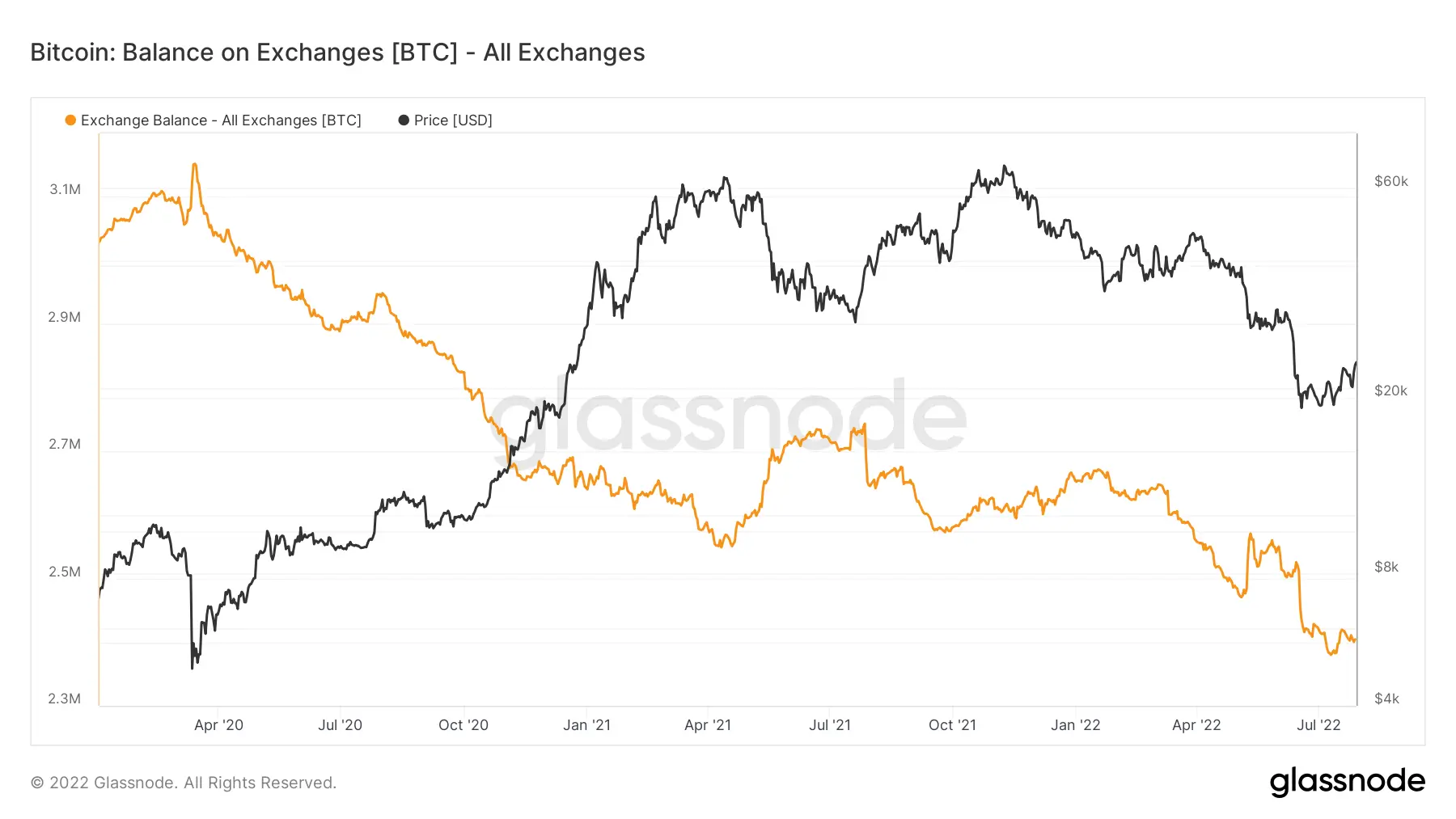

In addition to the above-mentioned indicator readings, the main cryptocurrency has another prerequisite for growth – the decline in BTC volume on cryptocurrency exchanges to a four-year low. At the moment, only 12.6 percent of the BTC supply, that is 2.4 million bitcoins, is available on the trading platforms. To be clear, 4.6 percent of all BTC has been withdrawn from exchanges since the record in March 2020, Cointelegraph reported.

BTC balance on exchanges

The logic here is simple – the less bitcoins on exchanges, the fewer transactions to sell them, that is, the pressure of sellers on the market becomes less strong. Incidentally, there are quite a few big investors or so-called “whales” among them. According to CryptoSlate sources, it is the whales that have been actively selling bitcoins since the beginning of this year.

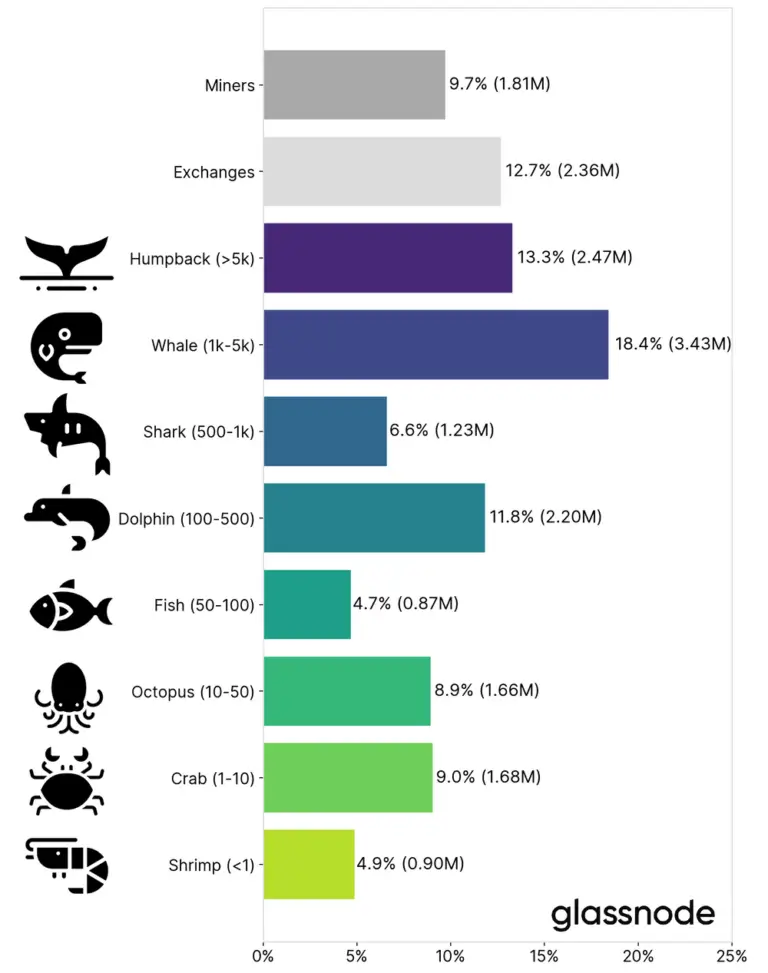

For the record, in cryptocurrency fan jargon, market players are divided into several categories based on the volume of coins in their wallet - shrimp, crabs, octopus, fish, dolphins, sharks, whales and humpback whales. The exact criteria by classification and the amount of BTC in their hands from the total coin supply are displayed below. Also this chart shows the share of bitcoin volume from the total coin supply for miners and exchanges.

Categories of traders

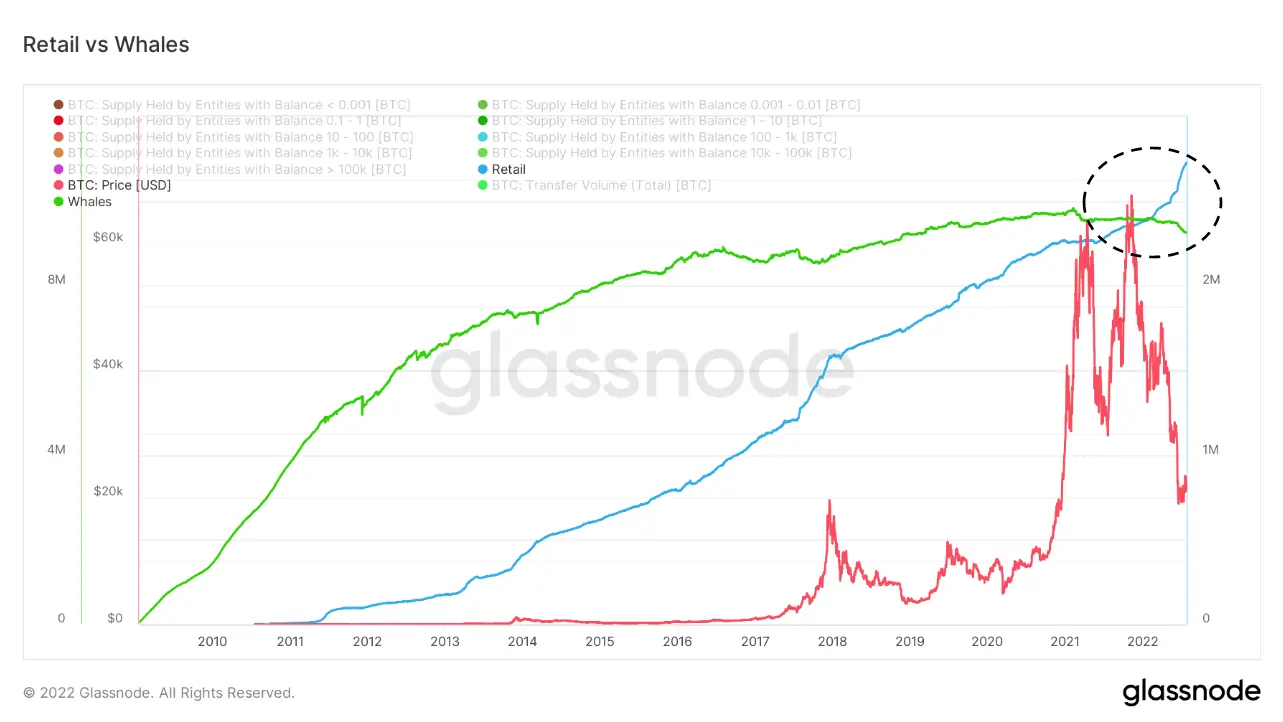

But market players with relatively small capital have been actively accumulating BTC all along. Glassnode analysts found that the share of coins in the hands of the aforementioned category of investors rose from 14 percent to 15.3 percent during the global fall in the Bitcoin price. The chart below shows the rate of bitcoin accumulation by large (green line) and small (blue line) investors, with the latter category already collectively holding a larger supply of BTC than the whales.

Experts note that this is a good trend – the more coins in the hands of investors with smaller capital, the greater the distribution of BTC across all bidders. In the long run, this should lead to a noticeable reduction in Bitcoin volatility, meaning there will be fewer big jumps on the BTC chart. And the less volatility, the more reliable an asset Bitcoin will be considered among most investors, including traditional investors.

Most of the BTC supply is now in the hands of investors with small capital

Admittedly, it’s still hard to say whether a new bullish trend in the crypto industry can be officially announced based on all this data. We didn’t mention macroeconomics for nothing at the beginning of the article – it is still in a deep crisis due to recessionary problems in the US and geopolitical problems in Europe. Another stock market crash could easily bring down the Bitcoin price significantly. So it’s not just the situation inside the coin niche that digital asset lovers should be assessing right now.

We believe that sooner or later the cryptocurrency market will move back to a growth phase, as it will not be possible for the coin niche to miss the radar of investors. The fact is that the potential of digital assets is still huge, and more people are aware of that now than in 2018, for example. Consequently, there will be more people wanting to top up their coin holdings at a relatively bargain price, which will eventually trigger a bull run. The main thing here is to be able to wait and not risk too much money, which an investor cannot afford to lose if anything happens.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important developments in the blockchain and decentralisation industry.