Tether representatives have talked about changes to the USDT stablocoin’s collateral. What are they?

The issuer of the largest crypto-industry staple called USDT, represented by Tether, has published its quarterly attestation report on the token’s backing reserves. According to the document, the amount of commercial paper in backing decreased by 57.5 per cent from the previous quarter, from $20 billion to $8.5 billion. The company plans to further reduce the share of commercial paper in the reserve to make USDT backing more stable. We tell you the details of what is happening.

As a reminder, commercial paper is short-term, fixed-income debt issued by non-bank financial institutions. The value of commercial paper largely depends on the financial stability of these institutions. Accordingly, reducing their share of Tether reserves makes USDT less vulnerable to possible price fluctuations.

How is Tether’s staplecoin backed?

The USDT staplecoin is backed predominantly by the US dollar. This means that holders of the token will be able to redeem their assets for an equal amount of USD at any time, and this mechanism is indeed widely used in certain countries. Tether representatives say that there shouldn’t be any problems with this, because the scheme essentially defines the stability and reliability of the coin. It is important to note that the company’s consolidated assets even exceed its total liabilities.

According to Decrypt’s sources, the report mentioned in the news is compiled by new audit firm BDO Italia. The data it contains is updated as of June 30, 2022. Tether CTO Paolo Ardoino commented on the publication of the report with the following remark

We are fully committed to maintaining our role as the market-leading stabelcoin. The utility of the Tether token continues to be supported by the transparency of reserves and is a leading source of stability, allowing us to create a tool for the global economy.

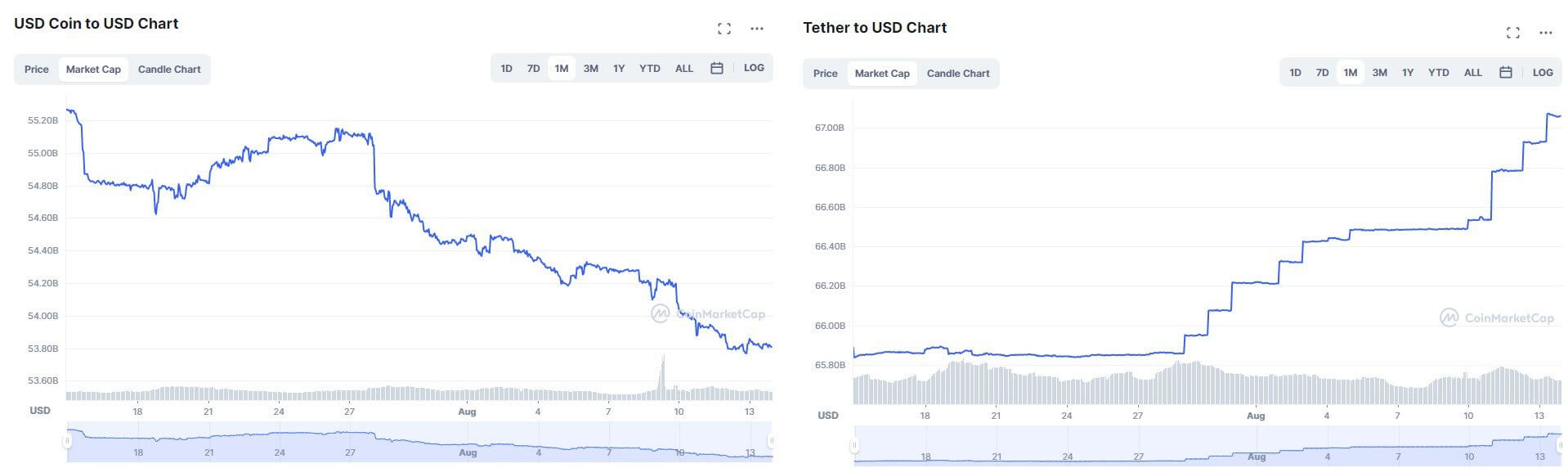

Note that Tether USDT's capitalisation has risen in recent weeks, while the stabelcoin's main competitor USDC from Circle has sagged. Paolo Ardoino also tweeted about this, asking why no one is talking about this trend? Apparently, such a change could be due to the recent Tornado Cash mixer situation. It was the subject of US government sanctions, after which the aforementioned Circle blocked addresses associated with the platform. Apparently, against this backdrop, some investors may have wanted to exit USDC to USDT. However, Tether is also subject to the decisions of the authorities, so address blocking with USDT could also easily happen.

Comparison of USDC and USDT capitalization

FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Reducing the share of commercial paper in Tether’s reserves is part of the company’s strategy. The figure is expected to drop to $200 million by the end of August altogether. By the end of 2022, Tether plans to completely abandon commercial paper as a means of backing USDT. The company also reported that it increased its cash and bank deposits for reserves by 32 per cent during the reporting period.

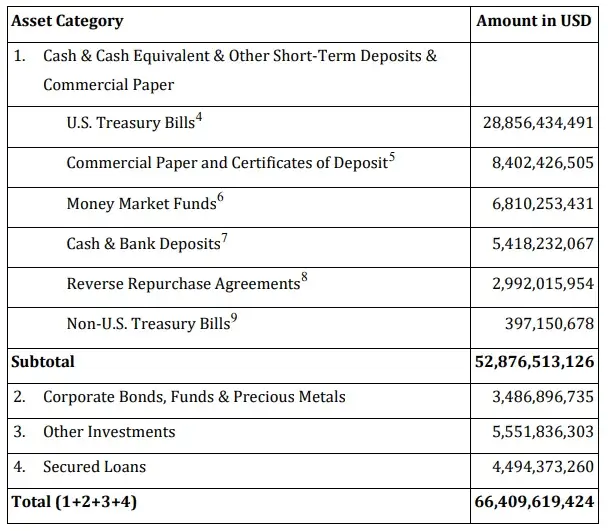

Data from Tether’s report

Recall that according to Tether’s first quarter report this year, published in May, the company held about 86 percent of its reserves in cash and short-term deposits, 4.5 percent in corporate bonds, 3.8 percent in secured loans and 6 percent in “other investments,” including “digital tokens.”

Earlier this year, rumours began to circulate heavily that part of Tether’s commercial paper portfolio was “85 per cent backed by Chinese or Asian issuers and traded at a 30 per cent discount”. Tether has denied this information, stating that the rumors were fabricated to “cause panic in order to generate additional profits in an already tight market.”

Incidentally, the incorrect information was popularised by other stakeholders in May. At the time, the cryptocurrency community promoted a version that USDT could supposedly collapse in the same way as Terra's UST did. However, such a view is wrong, as USDT is not an algorithmic stackcoin, but is secured by assets.

Tether CTO Paolo Ardoino

We believe that this trend in USDT's collateral system will benefit cryptocurrencies. Still, stabelcoins have become particularly popular in recent years because of their ability to preserve the dollar value of digital assets. As such, the reliability of this coin category will help improve the reputation of the entire crypto niche.

You can learn more about USDT from our cryptochat subscribers. There we discuss other important news from the coin world that affects the digital asset industry.