The founder of one of Europe’s oldest crypto funds has criticised Bitcoin. What didn’t he like about the cryptocurrency?

Justin Bones, founder of crypto fund Cyber Capital, gave a rather unexpected opinion the day before: according to him, Bitcoin is “one of the worst cryptocurrencies”. BTC should allegedly be considered a “purely speculative asset” with no fundamental technology advantage over other cryptocurrencies. Against this backdrop, Bitcoin is noticeably lacking in technological advancement, i.e. development. We tell you more about what’s going on.

Bones' opinion is notable because he owns one of the oldest crypto funds in Europe. As a reminder, Cyber Capital was founded back in 2016, with the company still "staying afloat" when many crypto firms in this bearish trend have already filed for bankruptcy. Bones himself has been actively exploring the crypto market since 2014, and has kept both Bitcoin and Bitcoin Cash nodes operational, essentially contributing to the security of those blockchains.

The main disadvantages of Bitcoin

The Cyber Capital founder posted his opinion on Twitter, with the quote also appearing in an issue of Cointelegraph. Here is the expert’s relevant rejoinder.

Bitcoin is unique in that it is one of the worst cryptocurrencies in terms of technology. It has a poor long-term security system. It lacks bandwidth, programmability and interoperability. Bitcoin has relatively weak economic qualities. BTC is essentially a purely speculative asset with no utility.

Note that Bitcoin does remain the largest cryptocurrency in terms of market capitalisation, despite the lack of serious technological progress. In other words, it is essentially holding on to its own authority, and so far other cryptocurrencies have failed to displace BTC from first place in the overall ranking.

In general, there are updates to the Bitcoin network. For example, the last major update to the blockchain was the so-called Taproot, activated in November 2021. In general, however, many investors perceive BTC as digital gold, which works simply but reliably. Accordingly, a certain backwardness of BTC in technological terms against the background of modern coins on the PoS consensus algorithm does not embarrass representatives of the cryptocurrency community in general - because this is essentially the cryptocurrency's chip.

Cyber Capital crypto fund founder Justin Bones

The founder of the crypto fund admitted that back in 2014, he had a very different view of Bitcoin. However, in the end, the cryptocurrency failed to meet expectations about its own progress. Bones continues.

The world is not standing still either. I remember it used to be said that BTC would be adopting the best technology. That thesis has obviously completely failed, as Bitcoin has no smart contracts, no privacy technology, and no breakthroughs in scaling.

Regarding scaling, the expert is absolutely right. The Bitcoin network is still capable of handling about seven transactions per second, which is certainly not enough for the title of world payment system. And barring the capabilities of the Lightning Network, there are no serious improvements planned to increase this figure in principle.

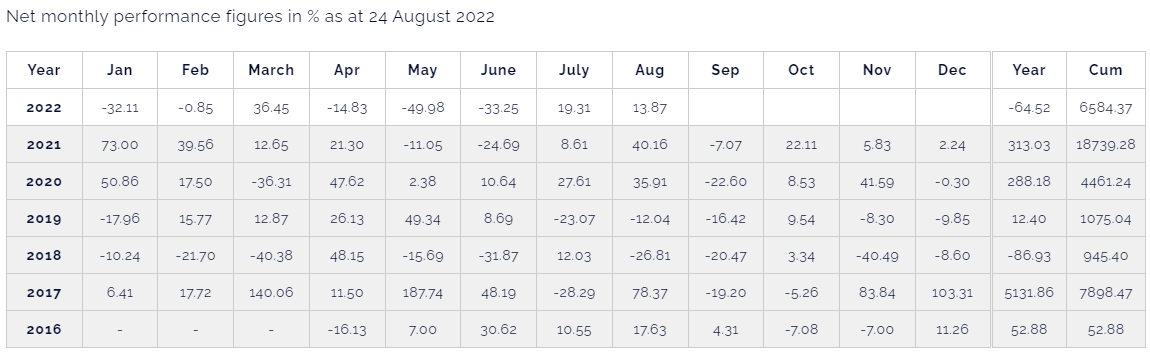

Profitability of Cyber Capital investments

In terms of coin distribution economics, Bitcoin also supposedly does not follow all other projects.

Bitcoin has failed to live up to expectations in terms of its own economic qualities. BTC competes with cryptocurrencies that can achieve negative inflation through fee-burning, high power and high utility. We’re talking about projects like post-merger Etherium, as well as altcoins like AVAX, NEAR and EGLD.

Note that in the Avalanche network, all transaction fees are burned off. Thus, the cryptocurrency may be deflationary.

Bitcoin exchange rate over the past month

Overall, this approach to assessing Bitcoin’s “usefulness” is not entirely correct. BTC does lag behind many projects in terms of adoption of new technologies, but it still remains the main asset of the market. And that is its most important purpose – “digital gold” does not need significant innovations to remain stable.

🤩🥰MORE INTERESTING READ ON YANDEX.ZEN!

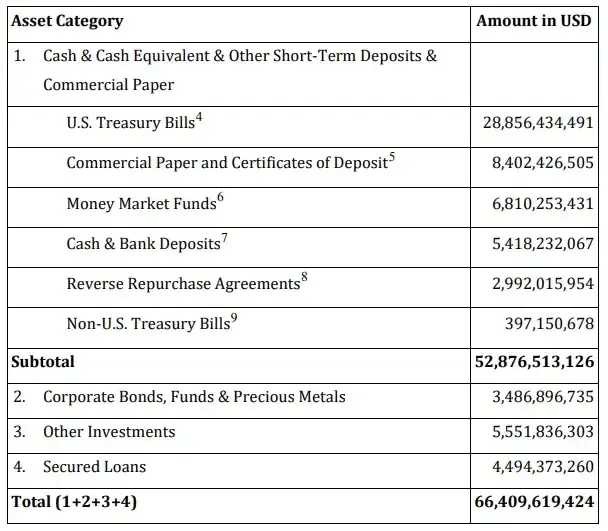

It’s not just Bitcoin that has been criticised this week, but also USDT, the main staple of the crypto market. In a recent Wall Street Journal article, journalists Gene Eaglesham and Vicky Ge stated that a drop in Tether’s asset value of even 0.3 per cent would make the token issuer insolvent. At the time of writing, Tether has $67.74 billion in assets and $67.54 billion in liabilities, meaning the difference between the two is only $191 million.

Tether’s reserve structure

Tether chief technology officer Paolo Ardoino responded to the publication. According to him, the company is not exposed to any systematic risks and is quite capable of paying its obligations.

As a reminder, Tether has recently begun to actively reduce the share of commercial paper in the sum of its assets by switching to cash and cash equivalents. In theory, such a strategy significantly reduces the likelihood of even the slightest fluctuations in the value of reserves and benefits the company.

Finally, Ardoino added that Tether will soon be issuing monthly reports on its financial situation in order to achieve maximum transparency for the cryptocurrency community. Accordingly, there will be fewer occasions for such reputational jabs.

We believe there is little point in reminding Bitcoin of its shortcomings, as the network's technical limitations are a well-known fact. And as some in the blockchain community believe, BTC has a niche of its own, being a simple and robust cryptocurrency, whose network is well protected due to the abundance of hash rate. Obviously, this is the digital gold. But progress, innovation and innovation should be left to next-generation blockchains.

Stay tuned for more developments in our millionaires’ crypto chat.