The IMF says the gap between the crypto market and traditional finance is closing. What does this mean?

Before the COVID-19 pandemic, there was little correlation, that is, connection, between traditional markets and the cryptocurrency market. However, after 2020, the situation has changed dramatically: the line between the two has begun to blur quickly. This is especially true in Asia, where acceptance of digital assets is almost at its highest level compared to other regions of the world. The International Monetary Fund (IMF) expressed concern about this trend the day before. Here is a more detailed account of what is happening.

It is worth noting that this is not the first time the International Monetary Fund has voiced its own concerns about what is happening in the digital asset industry. In particular, at the end of January 2022, representatives of the organisation recommended that El Salvador stop recognising Bitcoin as the country’s national currency. The IMF said it wanted to protect the country’s economy, which is becoming more vulnerable due to the volatility of BTC, i.e. sharp changes in the value of the digital asset.

At the time, El Salvador’s President Nayib Buquele joked about such a proposal with a video from The Simpsons.

https://t.co/s1F5kwOBEn pic.twitter.com/LD0I2dBHha

– Nayib Bukele (@nayibbukele) January 26, 2022

However, Alejandro Zelaya, El Salvador’s Minister of Economy, has responded directly that no international organisation will force the authorities to do anything – and that includes putting a stop to Bitcoin links.

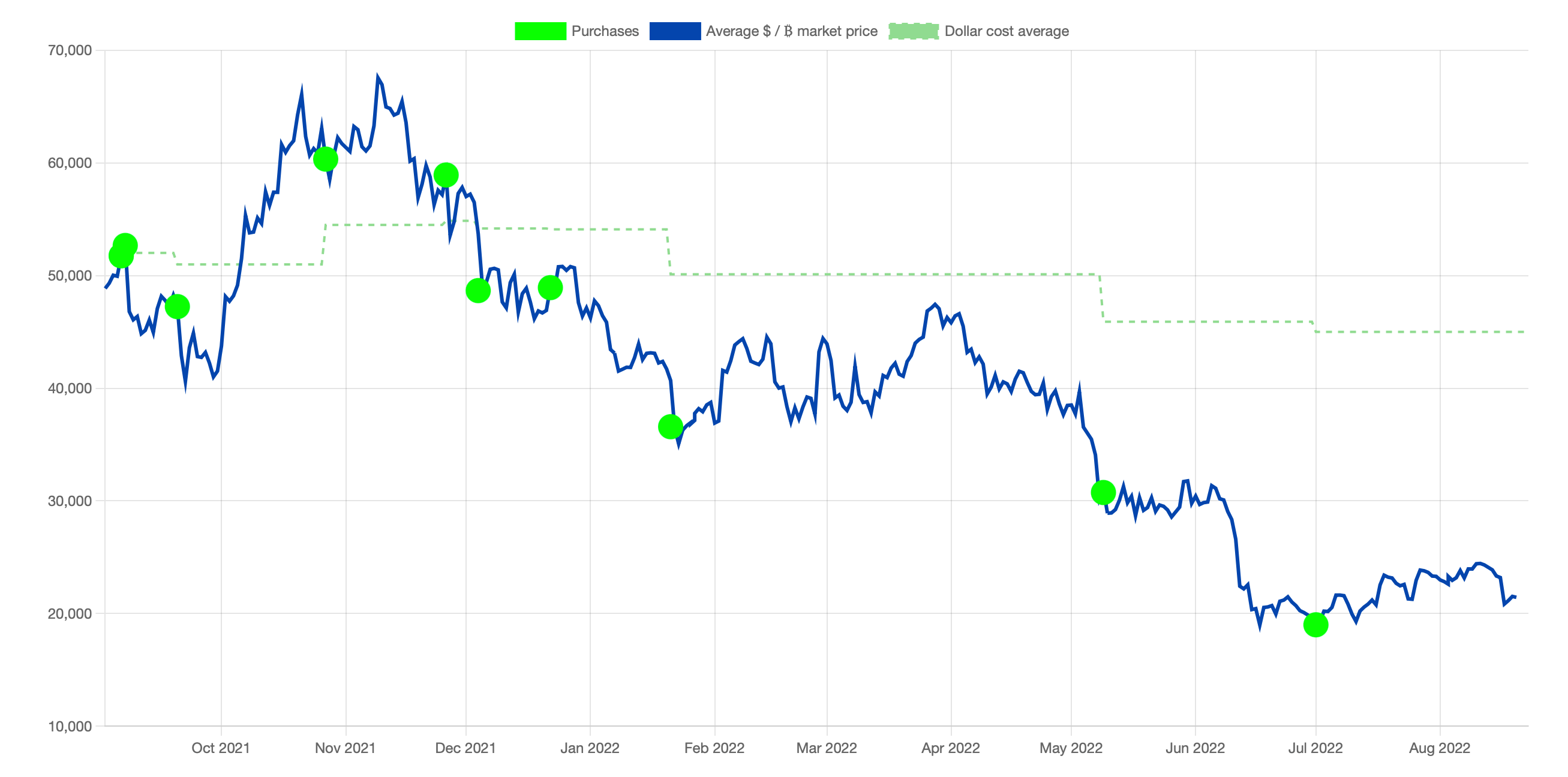

Part of the IMF’s fears have been justified, as El Salvador also invests directly in Bitcoin. Compared to the end of January, when BTC was valued at $36,000 to $37,000, the current rate of the coin is much lower. Well, the country’s total investment portfolio has fallen by 52.37 percent compared to the total amount invested. However, the government is clearly not going to get rid of the cryptocurrency.

Graph of Bitcoin purchases by Salvadoran authorities

Now IMF officials have once again brought up the topic of digital assets, but in a different context.

What are cryptocurrencies being criticised for?

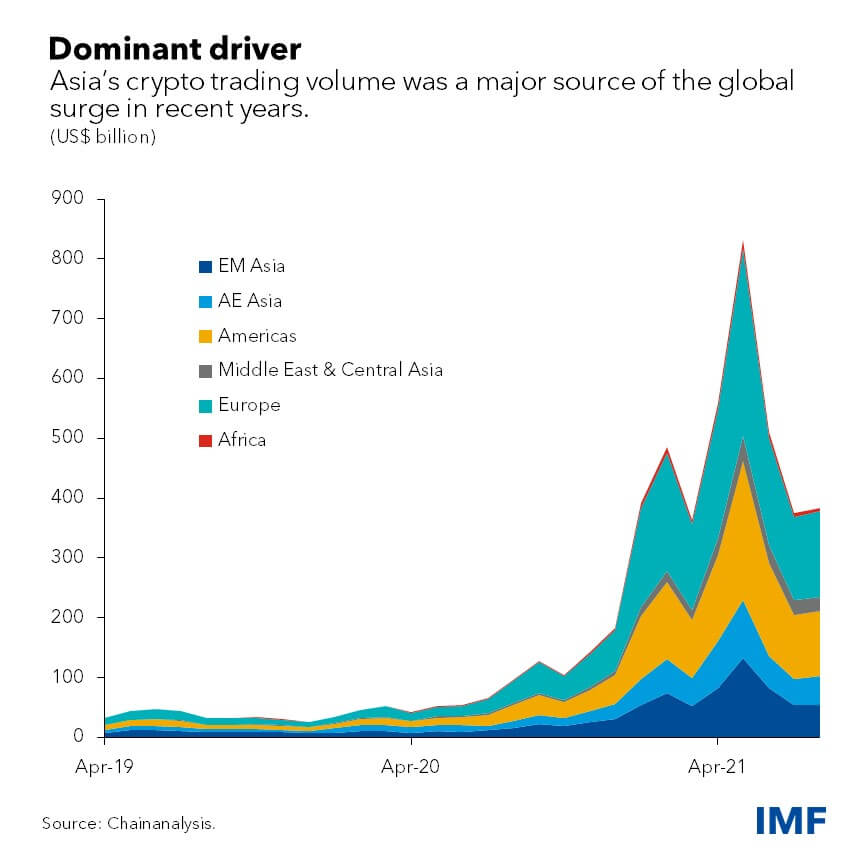

A note on the dynamics of crypto adoption appeared on the blog of IMF economists, who expressed concern about emerging financial stability risks in the Asian region. Here is their point of view.

While the financial sector seems to have been protected from these sharp moves in crypto, it could lose its independence in future cycles of growth and decline of the crypto market. This trend could spread through individual or institutional investors who hold both cryptocurrencies and traditional financial assets or liabilities.

Note that this is not the first time that the traditional economy has tried to discourage people from linking to cryptocurrencies. In particular, in May 2022, European Central Bank officials also claimed that a collapse in the digital asset market could trigger a global financial crisis. This is a strange rejoinder, given the small scale of the digital asset industry.

Crypto trading volumes in different parts of the world

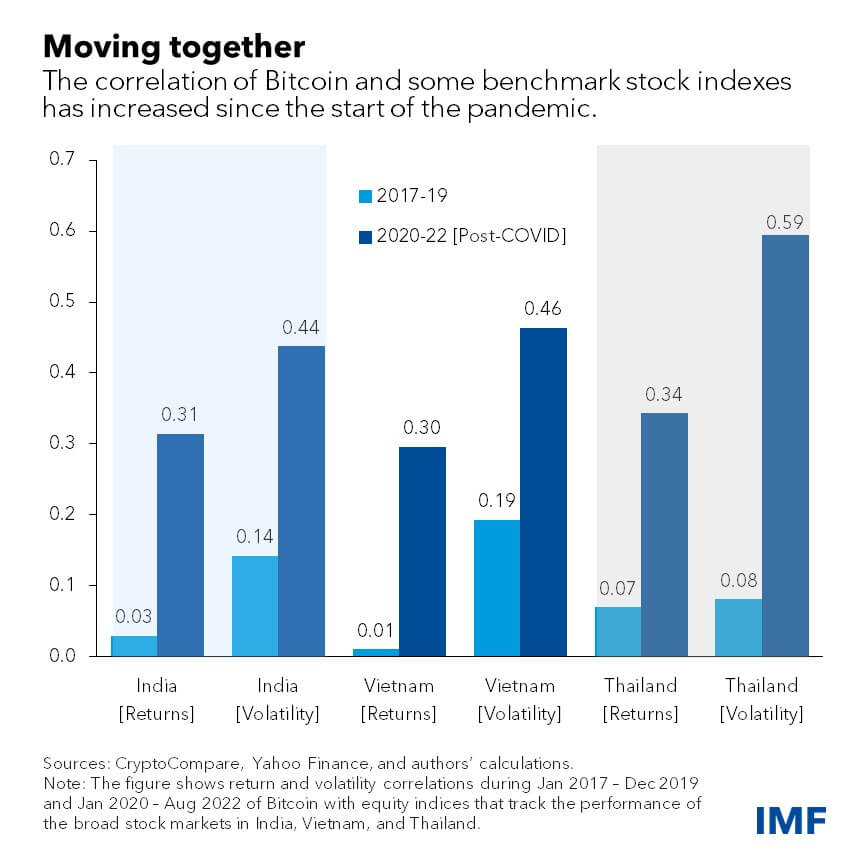

The reasons for the strong correlation between cryptocurrencies and the traditional financial sector include the growing acceptance of crypto platforms and related investment vehicles in the stock market, as well as the rapid adoption of cryptocurrencies by investors of all classes in Asia. The IMF therefore recommends stronger regulation of the crypto market by Asian regulators.

Correlation of the crypto market with major stock indices in different regions of the world

This could indeed work as a mechanism to widen the gap between the cryptosphere and traditional finance. However, Asian countries in this position would benefit from maintaining as liberal an approach to digital asset regulation as possible, as it would encourage new investment.

In fact, Australia is promising to embrace cryptocurrency control with “unprecedented diligence,” according to a recent statement from Australia’s Department of Finance, Decrypt reports. The regulator plans to implement a multi-phased plan to create a regulatory framework for cryptocurrencies. It will, it claims, be more thorough and informed than similar systems previously established “anywhere else in the world”.

Key to the Ministry of Finance’s approach will be a form of market research it calls “token mapping”. Token mapping will allow officials to see and assess nuanced trends in crypto in order to best “determine how crypto assets and related services should be regulated”.

We believe that such statements from the IMF sound like a desire to deliberately damage the reputation of digital assets. Still, the niche of coins is still very small in the global economy. Why it should be blamed in theory for a possible crisis and not, say, rising inflation due to excessive printing of money is unknown. But in this case it looks like a wish to shift the blame from the perspective component of the world of finance.

Look for even more interesting things in our millionaire cryptochat. We will discuss other important developments there as well.