The last month for Bitcoin turned out to be the best since October 2021. What does this mean for the cryptocurrency?

August started on a relatively positive note for Bitcoin, with the major cryptocurrency managing to hold the $20,000 level by the end of July and even jumping up slightly. The local bull run has lifted positive sentiment among traders, but so far the rise looks more like a rebound after a long fall than a new trend. So what will happen to Bitcoin next? Let’s analyse the situation.

What will happen to cryptocurrencies?

July ended with Bitcoin up 16.8 percent. June, on the other hand, was the worst month in BTC’s history since 2013 in terms of returns – the main cryptocurrency fell 37 percent in value. As you can see from the table below, the last month was the best month for Bitcoin in terms of yield since October 2021.

Bitcoin’s yield by month

Popular crypto analyst Josh Rager noted on Twitter that the last candle on Bitcoin’s 1-month chart turned green for the first time since March this year. Here’s the trader’s rejoinder, in which he shares his view of what’s happening. The quote is cited by Cointelegraph.

After closing the monthly candle above the 2017 all-time high from last year’s bull cycle, the price is slowly moving upwards. So far things are looking good and even if it’s a bear market, I’m happy to buy out the pullbacks on the BTC chart right now.

In other words, the investor is pursuing a strategy of accumulating coins at lower price levels. Accordingly, the recent local high of BTC above $24,000 is hardly suitable for accumulation. Before that, however, the cryptocurrency was around $20,000, which is a much more attractive area to buy.

Hourly chart of Bitcoin exchange rate

Morgan Creek Capital Management fund CEO Mark Yusko also believes that the worst for Bitcoin may be over. Here is his quote from a recent interview published by CryptoPotato.

I believe the “cryptozyme” is over. If you look at the last two market cycles, we are just at the point where the period of big market crashes is over. But the “crypto-spring” can last for months. A new bullish trend may not emerge right away.

Consequently, the market may predictably need time to accumulate. We're talking about mass purchases of coins at low prices by those investors, who are ready to take risks already. Naturally, this is done in anticipation of a new bull run and further price increases accordingly.

CEO of Morgan Creek Capital Management Mark Yusco

Yusko is confident that the next global bull run will not happen until 2024, which is when the next halving in the Bitcoin network will take place. To recap, a halving is a procedure for miners to reduce their reward for a block of BTC by exactly half. Traditionally, halving is associated with new bull cycles, as this procedure significantly reduces the supply of new BTC on the market.

Countdown to the next Bitcoin halving

From a macroeconomic perspective, August should not be too bad a period for the crypto market. Still, crypto reacted positively earlier to a rise in the US benchmark lending rate. Equity markets are also up, which gives hope for a positive outlook at least in the short term.

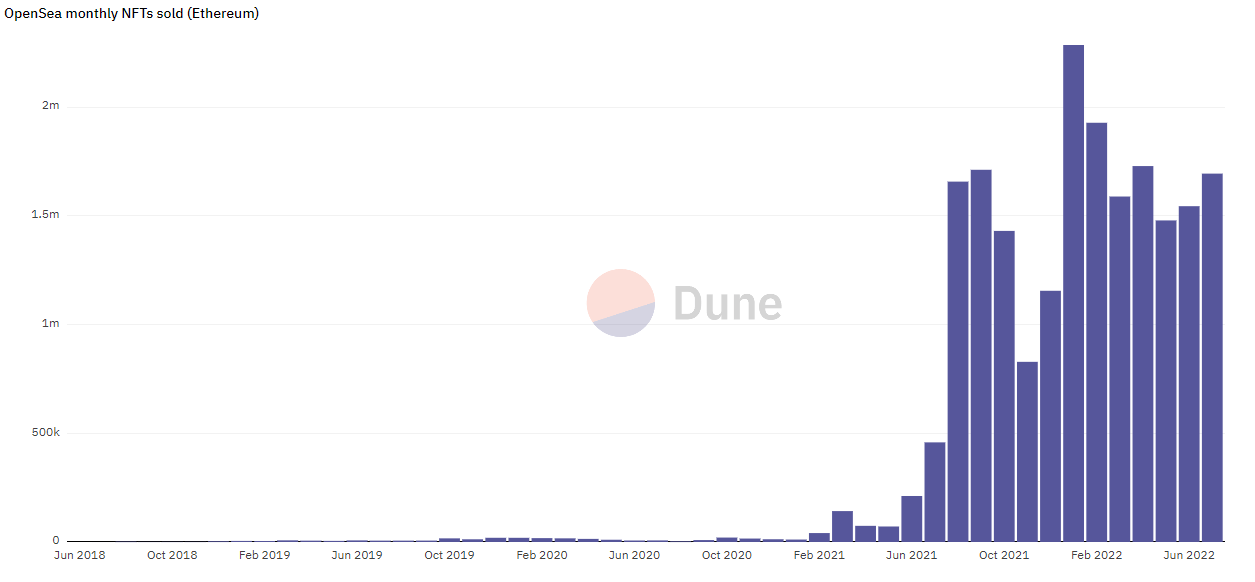

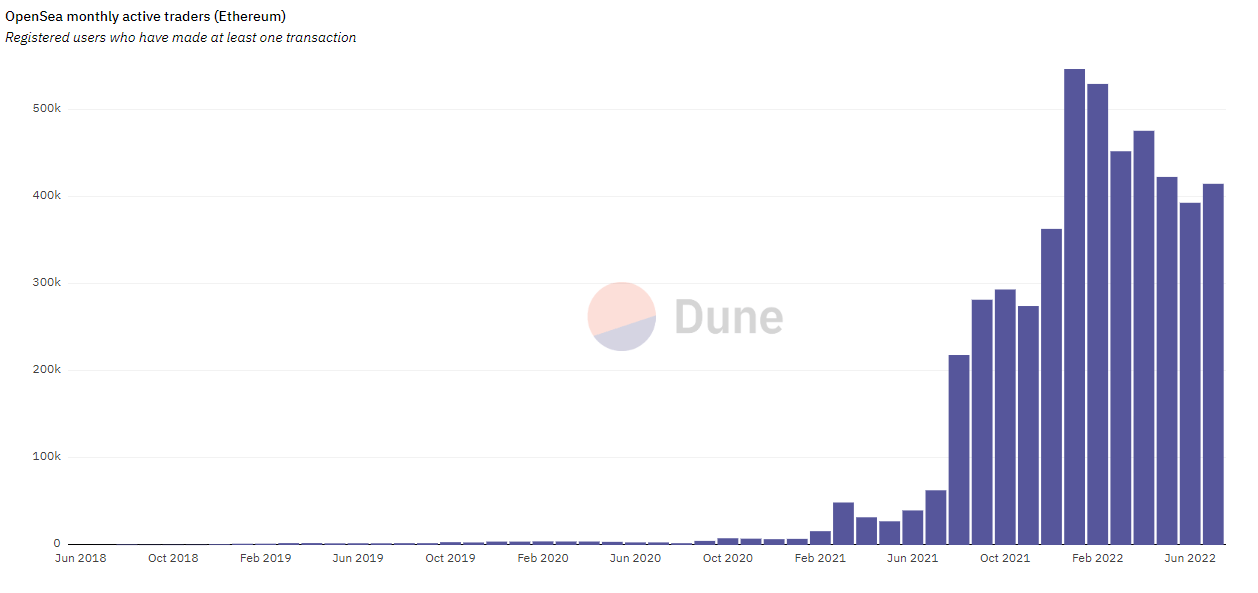

NFT tokens are also showing a calmer performance. In particular, trading activity for unique tokens on the popular OpenSea platform in July remained relatively stable in terms of the number of transactions and unique bidders. However, in dollar terms, NFT trading volumes slumped this month – all due to the overall decline in the crypto market.

What’s going on with NFT tokens?

According to Decrypt analysts, around 1.61 million unique Etherium-based tokens were traded on OpenSea this July. By comparison, the same figure for June was 1.54 million NFTs sold. Meanwhile, the number of NFT traders grew from 393 to almost 400,000 in those two months.

Number of NFTs sold on OpenSea

In dollar terms, trading volumes have dropped markedly. While the total amount of NFT transactions on OpenSea in June reached $695 million, in July this figure dropped to $495 million. That is a drop of about 29 percent.

Number of active OpenSea users

There is a reason why the data analysis considers OpenSea. It is far from the only platform for trading NFT tokens, but it is the most popular and the largest in terms of the volume of transactions. According to analysts, OpenSea accounts for approximately 82 percent of all unique token trading in the crypto industry.

Read also: Miami government to launch NFT collection in collaboration with TIME and Mastercard. Why it matters.

While the field of unique tokens in general is in a stagnant phase, individual popular NFT collections are still very successful among investors. One of them is the Bored Ape Yacht Club (BAYC) series. Its ecosystem includes its own ApeCoin (APE) token, which will soon get a separate news portal called The Bored Ape Gazette.

ApeCoin exchange rate.

Its creation as part of the AIP-70 proposal was voted on the day before by members of the ApeCoin DAO, the decentralised autonomous organisation that manages the project. The vote passed with an overwhelming majority “for” represented by 1.1 million APE tokens and a minority of 149,000 APEs “against”.

The AIP-70 proposal would create a fund of $150,000 to finance a news portal that would produce exclusive stories about the BAYC ecosystem. The money would be used to pay the sole journalist and editor, Kyle Swenson, $7,000 a month. Notably, some of the money has been set aside for possibly hiring freelancers and even expanding the portal’s staff in the future.

We think that all these developments give a clear indication of how active some projects are in a bearish trend. Obviously, their sagging rates are not embarrassing, so developers are now using the challenging times to take their minds off asset values and focus on creating new features, offshoots and other innovations. That way, they will be much better prepared for the bullrun than others, which will eventually attract the attention of users.

What do you think about it? Share your opinion in our Millionaire Cryptochat. There we discuss other important developments related to blockchain and digital assets.