The number of cryptocurrency developers is actively growing. Which projects are attracting them the most?

Over the past few years, the crypto market has traditionally been extremely volatile: the price of Bitcoin, for example, has made more than one all-time high and experienced many falls. However, this has not deterred active contrarians from the cryptosphere, who have done much to boost it. According to analysts at investment firm Telstra Ventures, their numbers have grown by an average of 71.6 per cent since January 2018. We tell you more about what’s happening.

As a reminder, contributors in this context are developers who have made changes to crypto projects' code on Github. Their number and activity can be easily tracked by the number of updates in certain repositories of the platform. And it is their activity that determines the pace of development of a particular project.

Most often developers are funded by the creators of certain projects with the help of special funds. In the case of Bitcoin, the grant system is especially popular and involves payments from various companies, both within and outside the digital asset industry.

Blockchain developers

The role of developers for a cryptocurrency project is very important, but the latter is not entirely dependent on them. As we learned the fall before last year, even if all Bitcoin developers somehow disappeared, it would still work on developing the cryptocurrency.

Which cryptocurrency developers are outnumbered?

Solana was the most attractive project for developers, with the number of active contributors to the coin up 173 per cent year-on-year since 1 January 2018. Second most popular was Etherium, with an average annual growth of 24.9 per cent in the number of developers. Finally, third place went to Bitcoin, with an average annual growth rate of 17.1 percent.

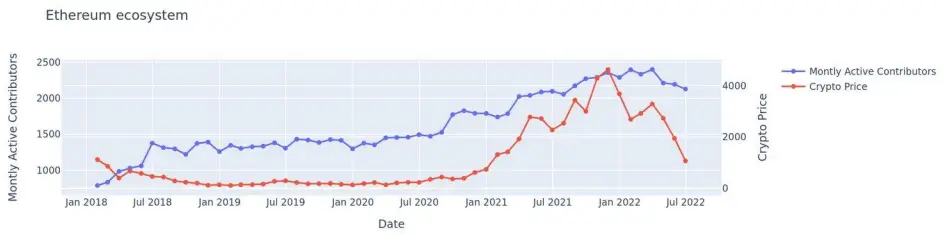

Among the three blockchains mentioned above, Etherium has the “largest and strongest” developer community. As of April 2022, the altcoin had at least 2,500 active counterparties, though by July that number had dropped to around 2,000. According to Cointelegraph’s sources, there is a correlation here with the general decline of the crypto market.

That is, the rise in the coin market is also affecting developer interest and activity. That means the value of assets does not only affect speculators, who try to make money on price changes and are traditionally associated with niche coins at the bullpen stage.

The dynamics of the number of developers in Etherium

By comparison, Bitcoin had about 400 active developers by July, while Solana had about 350. That’s almost seven times less than the number of developers on Ethereum. Although the rates mentioned indicate that Solana’s network is the most active in terms of change. And in general, the blockchain is much younger than ETH and BTC.

Such a significant number of developers are needed for a reason: very soon the altcoin will switch to a new consensus algorithm called Proof-of-Stake, which will cause miners to be replaced by validators. This is a very important event for the project, as Etherium has been heading towards PoS since its early days, but its implementation requires a huge amount of man-hours to develop due to the technical complexity of the process.

Read also: Bitcoin could have been much more useful, but it was hindered by developers.

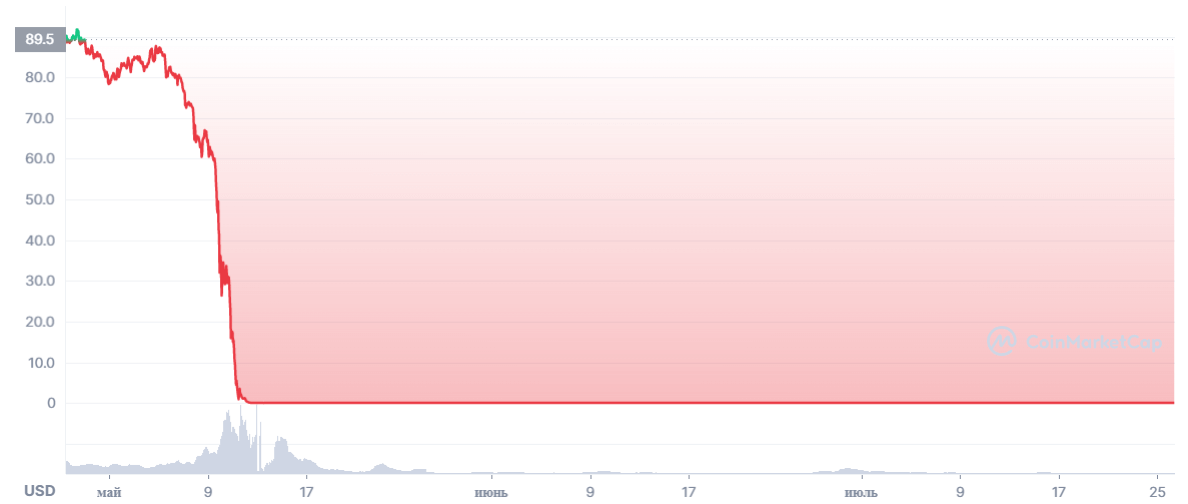

Thanks to developer activism, there is now a huge ecosystem of decentralised finance in crypto, which has proved remarkably resilient to the crisis caused by the collapse of crypto project Terra this spring. This statement was recently made by Jonathan Miller, managing director of Australian cryptocurrency exchange Kraken. According to him, the “contagion”, i.e. massive financial problems at many cryptocurrencies, has virtually bypassed decentralised finance.

Here’s the expert’s rejoinder, in which he explains the gist of what’s happening. Cointelegraph quotes.

“The contagion we’ve seen on some lending platforms has been due to the traditional crypto-based financial lending model. But here was no catastrophic failure of decentralised protocols. And I think this is an acknowledged fact.

Jonathan Miller, managing director of Australian cryptocurrency exchange Kraken

Miller hints that it was mainly centralised venues whose brand was only associated with cryptocurrencies – such as Celsius – that were affected. The service itself is fully centralised, although it deals with cryptocurrencies. Its main problem, like Terra and most failing startups, was poor risk management, i.e. failure to control risks and possible threats in the market.

The collapse of Terra

And the last few months have not been good for the DeFi protocols either. There have been at least a few hacks of major DeFi protocols during this time. And yesterday’s problems with Solana and Etherium-based wallets have not been pleasant either.

We believe that the rise in the number of cryptocurrency developers is somehow indicative of the increasing prospects for blockchain projects. At the same time, the tangible decline in the number of active developers as the market declines answers the question of why the coin industry is experiencing such a marked increase during the bull run. Obviously, these numbers will continue to increase.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we discuss other important developments in the world of blockchain and decentralisation.