Three cryptocurrencies that benefit from Etherium’s impending move to Proof-of-Stake. What are they?

After several years of waiting, Etherium is finally preparing for the final stage of the transition to the Proof-of-Stake consensus algorithm. The event itself, called the merger, is expected to happen on September 15-16, with the date dependent on the network’s hash rate. That said, ETH isn’t the only one reacting positively to the news of the update: there are at least three other coins on the market that would benefit from the second cryptocurrency upgrade in terms of market capitalization. Here’s information on them, along with the reasons for the rise.

Note that Etherium’s move to Proof-of-Stake is one of the most important developments in the cryptocurrency world this year. After all, ETH is an incredibly large-scale project, so the success of the upgrade could be a positive for the entire market.

The closer the update comes, the more misunderstandings about the process arise. To understand them and get the right idea about the upcoming update, our separate article will help.

Contents

- 1 What will happen with Etherium?

- 2 Lido DAO (LDO)

- 3 Ethereum Classic (ETC)

- 4 Optimism (OP)

What’s going to happen to Ethereum?

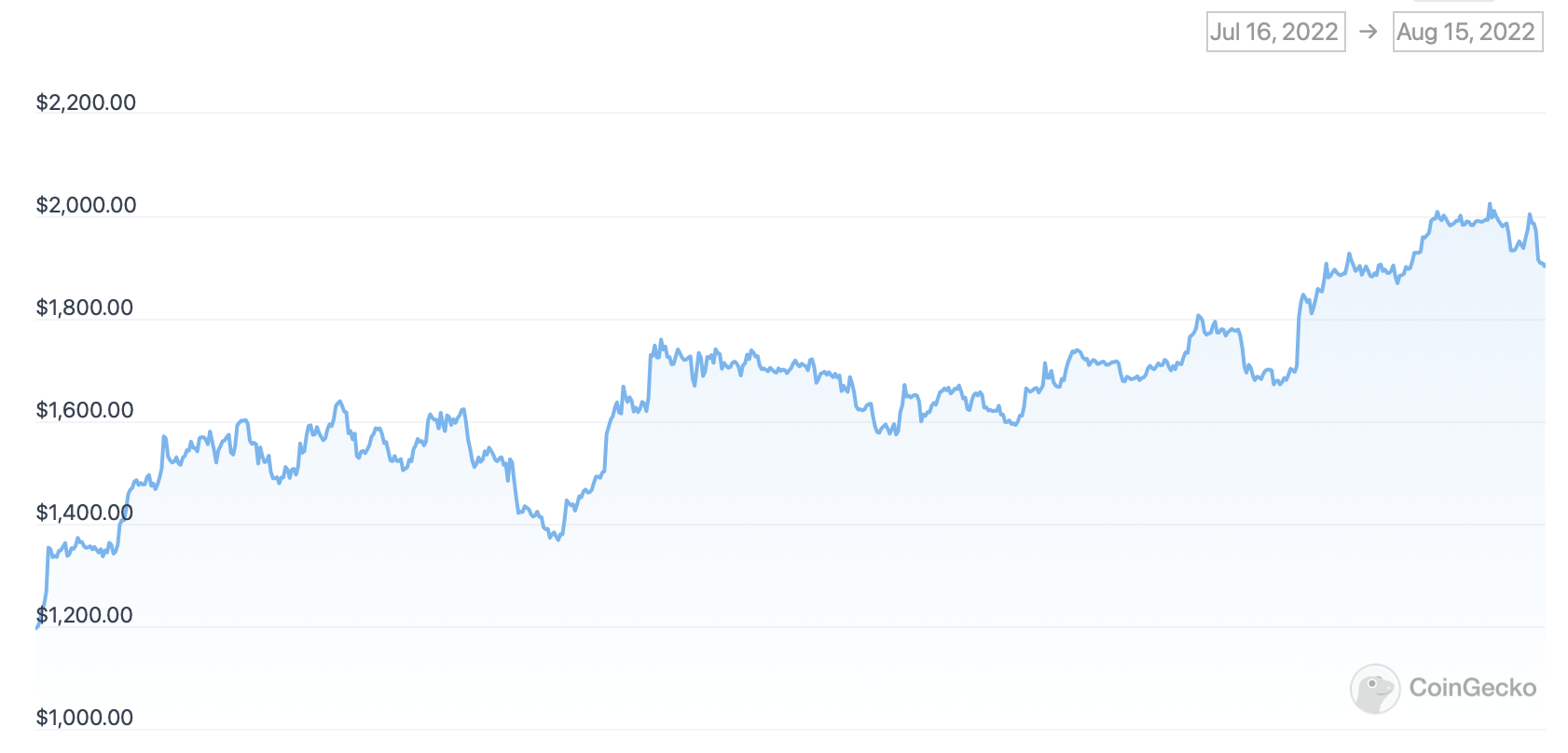

The altcoin traded above $2,000 over the weekend, although it slipped to the $1,900 zone on Monday. Accordingly, ETH has so far failed to gain a firm foothold above the important $2,000 psychological resistance level. That said, over the past 30 days alone, the value of Etherium has risen by 54 percent.

While the cryptocurrency is hovering around its highs in the last few months, in terms of fundamentals, Ether is doing just fine. More recently, the project's development team successfully completed a merger test on the Goerli testnet, meaning there should not be any push-backs with the move to Proof-of-Stake on the main network.

Chart of the Etherium exchange rate over the last month

But there is another important point: we should not forget about the rule of selling the asset on the news, which is followed by investors even in traditional markets. That is, Etherium may well go into a correction soon after the merger, even if the procedure itself goes without any problems. However, this is just a theory, which may not turn out to be relevant.

So, which cryptocurrencies could benefit from an Etherium update?

Lido DAO (LDO)

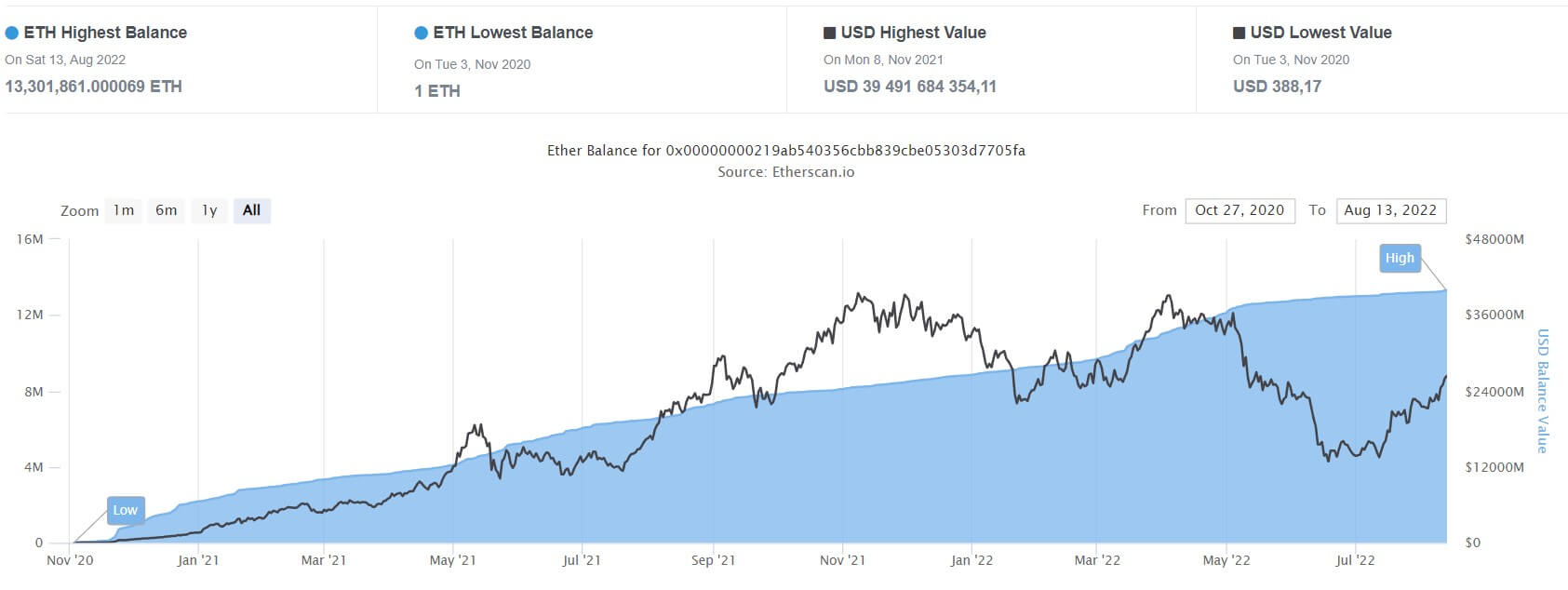

As a reminder, the move to Proof-of-Stake implies a complete rejection of the concept of mining ETH using video cards and computing power in general. Network support, issuance and transaction validation will now be handled by validators. To get this role, you need to deposit 32 ETH, or about $61,000 at the coin’s current exchange rate, into a special deposit smart contract for Etherium.

ETH growth dynamics in the deposit smart contract

Not everyone has that amount of money, so the services of intermediaries in this process have become particularly popular. These are staking platforms that allow their clients to earn as validators, even if their investment amount is much less than the coveted 32 ETH. The most popular of these platforms is Lido.

Lido ranks first among its competitors in terms of deposited smart coins. According to Cointelegraph's sources, the platform holds 4.15 million ETH of its customers in stacks. In comparison, Coinbase, the largest US cryptocurrency exchange, provides the same service, but it only has 1.55 million ETH deposited into a smart contract under its management.

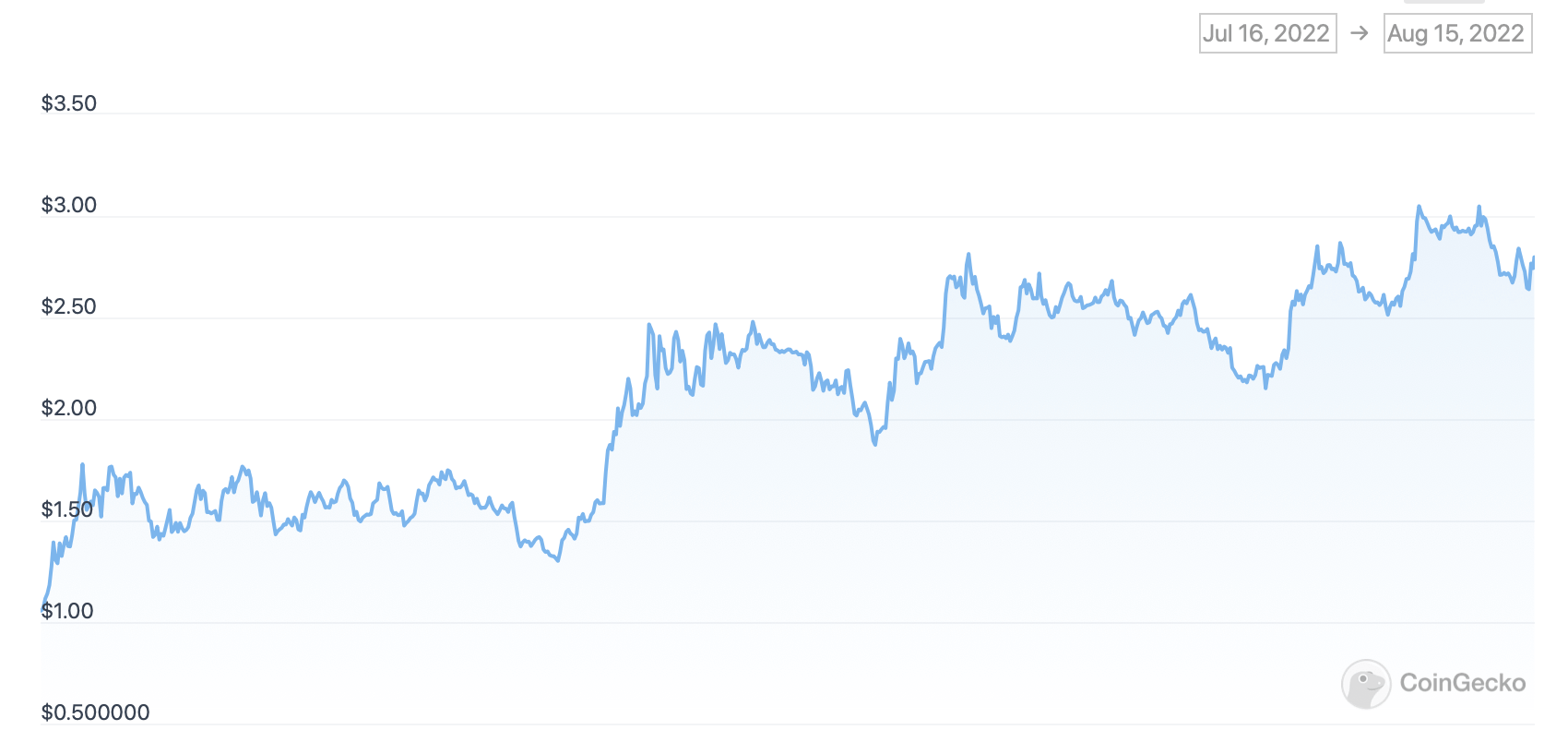

Lido has its own management token with the ticker LDO. In the last 30 days it has risen by almost 138 per cent, although it is still 61 per cent below its all-time high set in August 2021.

Chart of the Lido DAO rate over the past month

A successful merger is great news for the Lido team, as if all goes well and validators have an acceptable passive source of income, demand for the platform’s services could grow by leaps and bounds. Because of the hype, the LDO token is also in a position to give out growth, experts believe. It will essentially reflect the platform’s popularity among users.

Ethereum Classic (ETC)

Ethereum may very soon have forks, i.e. offshoots of the blockchain. All because of miners, who benefit from maintaining the existence of PoW-based ETH because of the opportunity to make money on it. However, if the Ether blockchain does not split, miners will have to look for other coins to mine. One of the most likely candidates is Ethereum Classic (ETC).

As a reminder, ETC itself is a fork that emerged from the infamous hacker attack on The DAO in 2016. Technically, the coin is very similar to the current Etherium and will still be mined by miners after its transition to PoS. You too can get involved, and you can do it now with at least one video card. In order to do that, you must go to 2Miners pool and read mining settings.

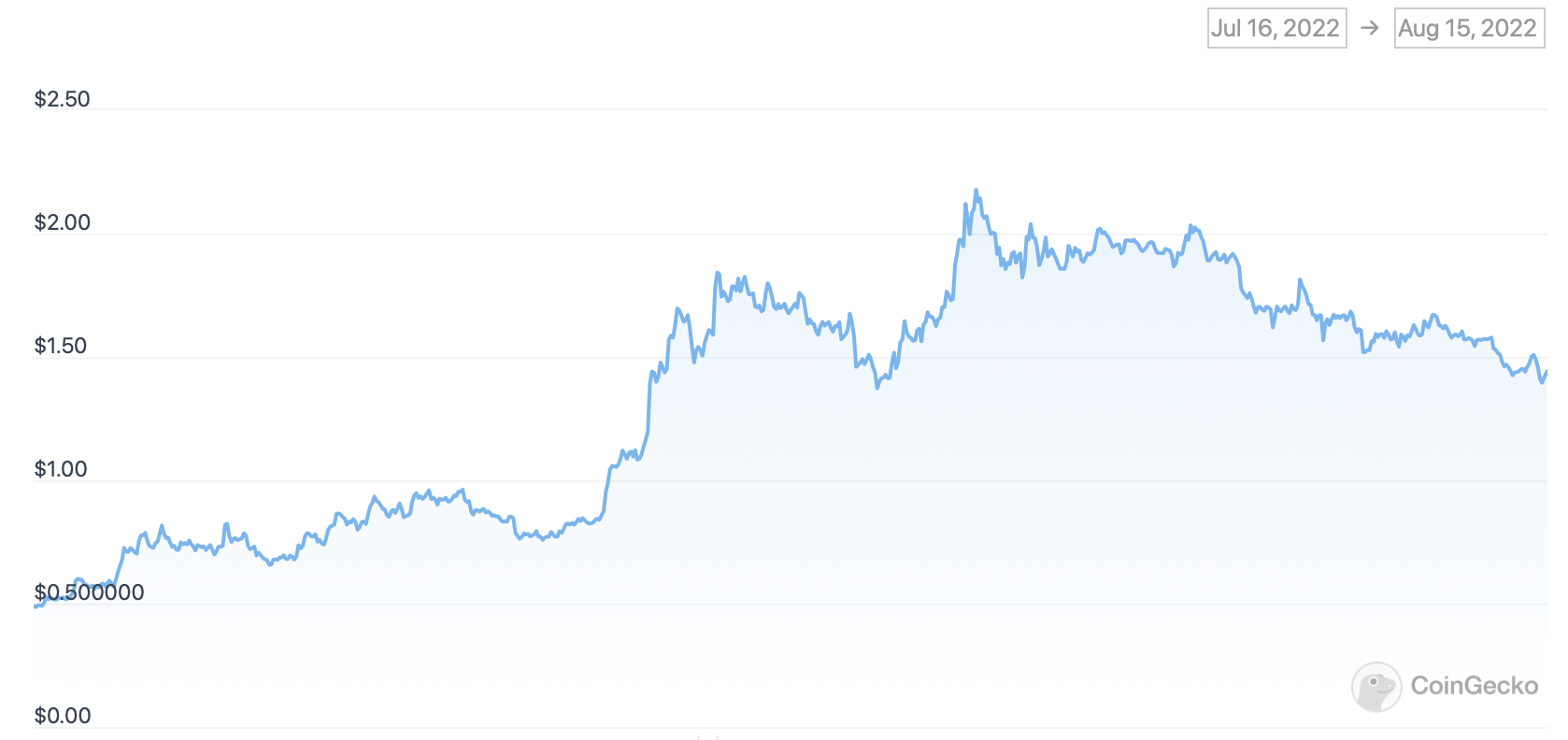

Ethereum Classic rate chart for the last month

As you can see from the chart above, this fact was realized by some investors back in late July. That’s when the price of the altcoin started to rise very quickly, and in the last month its yield was 175 percent. There are not many resistance levels above the ETC, and with the proper setup, the coin might well become one of the good investments.

Optimism (OP)

Optimism is a tier two solution based on Etherium, designed to handle transaction data, which in theory should increase the transaction efficiency of the ETH network. With the transition of Ether to Proof-of-Stake, projects like Optimism have a special role to play: their development will be one of the priorities within the roadmap for the development of so-called rollups.

Incidentally, the Optimism management token with the ticker OP was one of the most profitable investments this summer. In just the last month it has risen by 200 per cent, reaching a new all-time high at the beginning of August. Having gained a foothold in its current positions, the price of OP may well continue to rise after the merger, as the project is an important part of the further development of the Etherium ecosystem.

Optimism rate chart from last month

We believe that the PoS-based Etherium will benefit not only the listed coins, but also cryptocurrencies based on the Proof-of-Stake algorithm in general. Still, in this case, critics of Proof-of-Stake will surely reconsider their views and make sure that the giants can be quite successful on it as well. And if Solana, Avalanche and the rest of the PoS consensus haven't convinced them of that, Ethyl will surely be able to rectify such a thing.

Find more useful information about crypto market in our Telegram chat. There we will discuss other important developments in the world of digital assets.