Analysts reveal which coin dominates cryptopayments

The global bearish trend in the crypto market has affected all areas of the market – including payments. However, all the negativity over the past few months has failed to dislodge Bitcoin from its dominant position in overall cryptotransactions. This was announced the day before by analysts at payments platform BitPay. According to them, BTC’s share of the total number of payments has indeed decreased, but the coin is still more popular than all other digital assets. We tell you more about what’s going on.

As a reminder, BitPay is a so-called payment solution provider. It is essentially a company whose infrastructure allows it to process crypto payments for other businesses. Accordingly, the giant’s representatives know which coins are preferred by cryptocurrency users.

BitPay website home page

Which cryptocurrency is best to use?

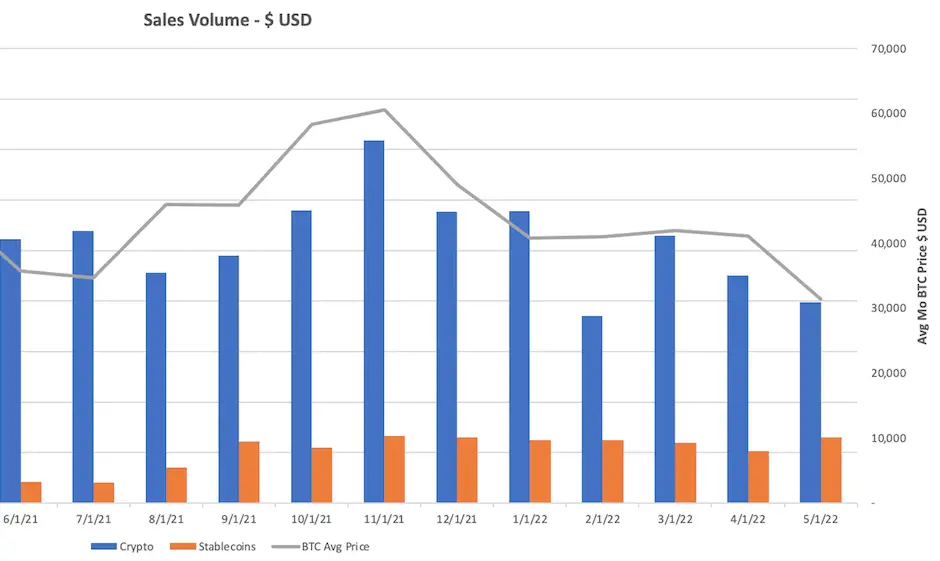

BTC payments accounted for 87 percent of BitPay’s sales last year. In the first quarter of 2022, that figure dropped to 52 percent. However, Bitcoin still dominates the aforementioned sphere, Merrick Theobald, vice president of marketing for BitPay platform, told Cointelegraph. In the context of the company’s report, sales volume is the total value of Bitcoin cryptopayments.

BitPay sales volumes

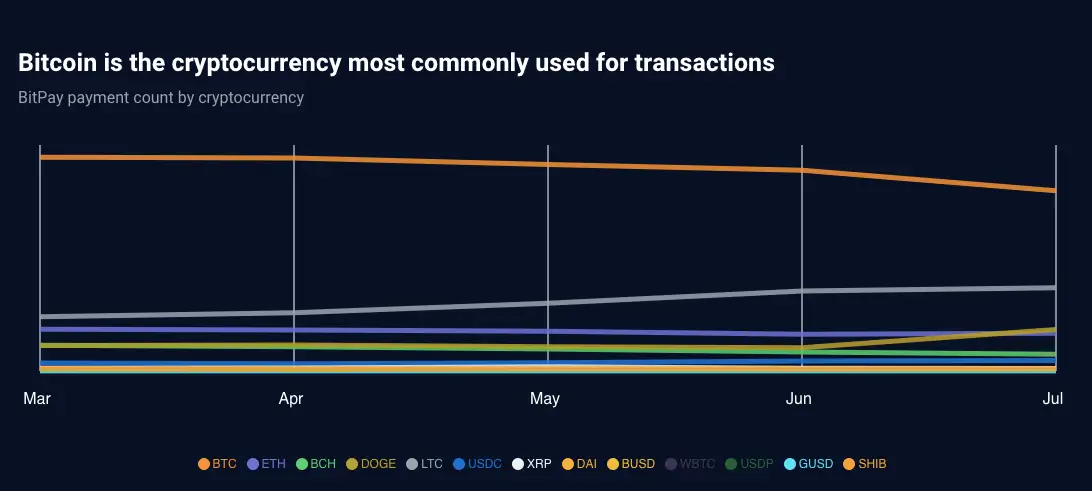

Theobald also highlighted that BitPay’s transaction volume has remained stable despite the market downturn, with the number of monthly transfers rising from around 58,000 in 2021 to 67,000 transactions in 2022. The popularity of some altcoins on the platform has also increased, with BitPay users paying more often in LTC, for example. The coin received an increase from 14 per cent to 22 per cent in the total number of payments during the aforementioned period.

Share of different cryptocurrencies in BitPay transaction volume

Almost 14 years ago, Satoshi Nakamoto, the anonymous creator of the major cryptocurrency, referred to Bitcoin’s Whitepaper as an “electronic payment system”. According to Theobald, BTC still lives up to that claim.

People still use BTC on BitPay more often than other coins because it is the oldest and best-known cryptocurrency, it has the largest market capitalisation, and it has proven over the years to be a great digital payment tool.

That said, using Bitcoin for payments today is a rather unobvious choice. The fact is that it takes at least ten minutes to conduct a BTC transaction, in which time an average block is created on the network. In addition, many platforms have to wait a few extra blocks to make sure the transaction is irreversible.

At the same time, there are blockchains like Solana and Avalanche that allow near-instant transactions. The USDT stabelcoin, based on the Tron network, is also suitable for payments, providing reasonably fast transfers.

One of the reasons why BitPay users pay so actively in BTC may be the fact that selling bitcoins on the exchange and then withdrawing money involve relatively high fees. That is, it is cheaper to pay in BTC directly – although this is relevant in the context of a single transaction. BitPay’s homepage has clear information about commissions: the user pays 1 per cent on each transaction.

The amount of BitPay commissions

🤩 LOOK FOR MORE INTERESTING INFORMATION ON US AT YANDEX.ZEN!

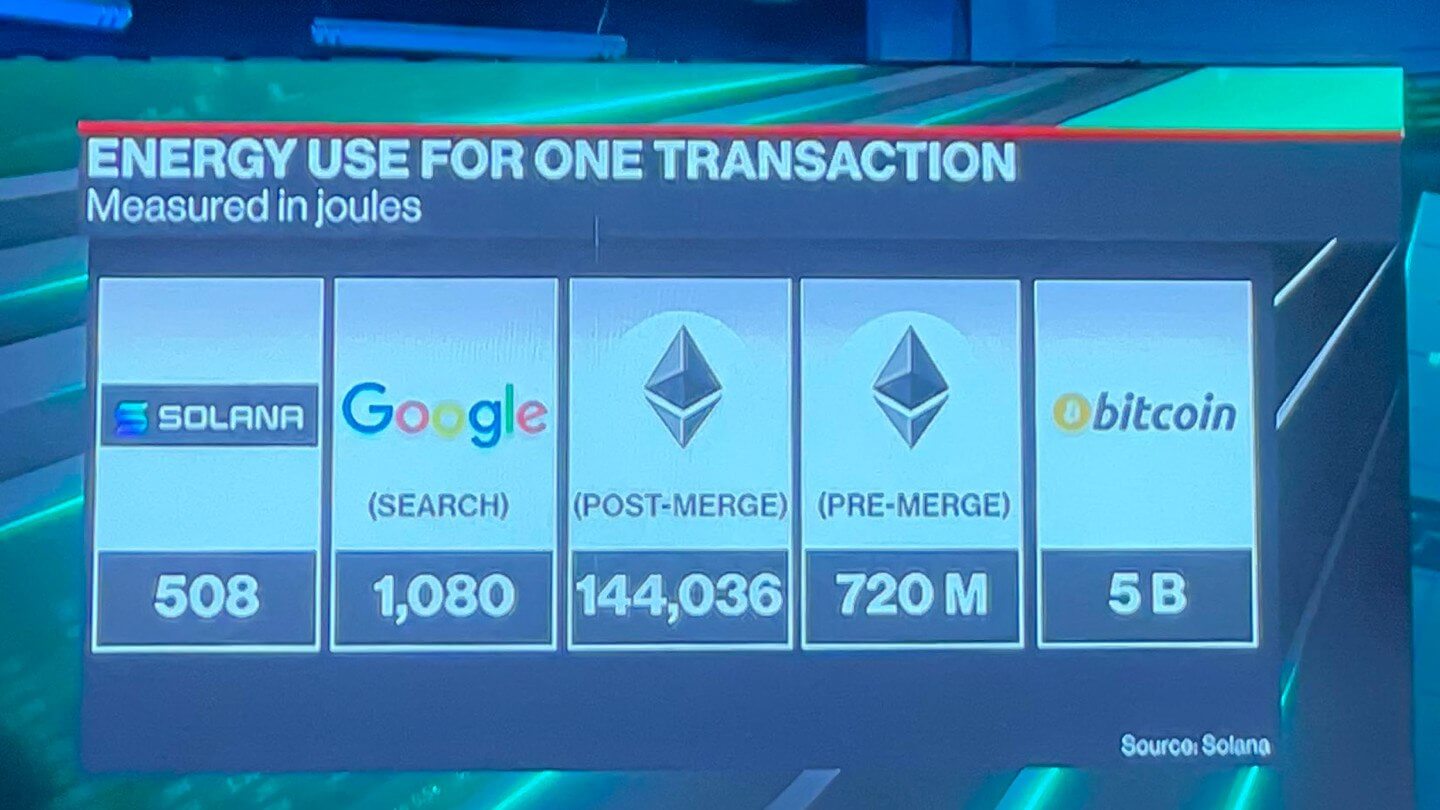

Here it is also important to pay attention to the energy consumption of such transactions. Bitcoin consumes far more energy for transfers compared to transactions on Solana networks, as well as the PoW and PoS networks of Etherium. Here’s a visual comparison, where the numbers mean joules. For clarity, Google’s network search costs are also shown here.

A comparison of the energy costs of transactions on different blockchains

Just about all of Bitcoin’s benefits have been publicly announced by MicroStrategy’s CEO Michael Saylor before today. He announced yesterday that the company is making another round of buying 301 BTC worth $6 million at an average price of $19,851 per coin.

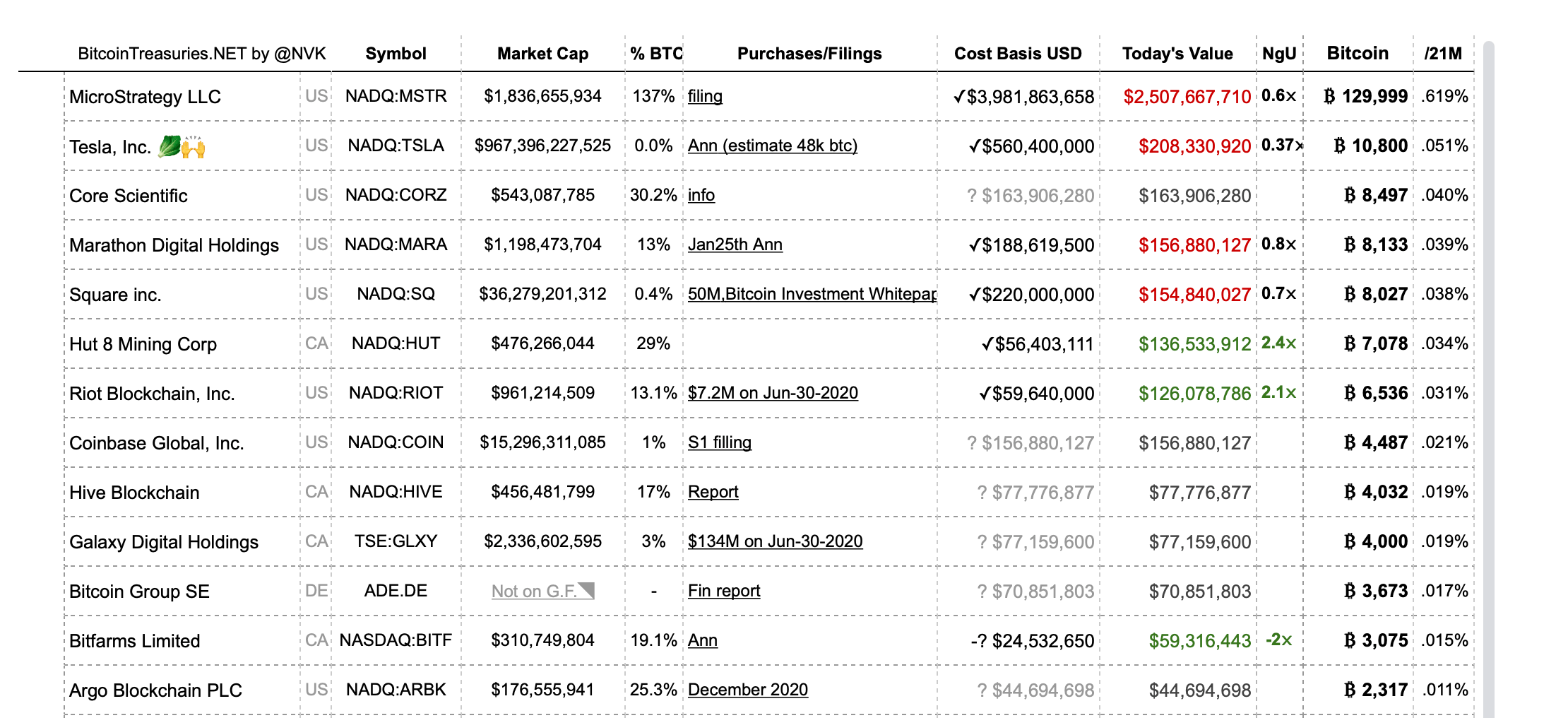

MicroStrategy now has 130,000 bitcoins

This means that MicroStrategy’s total amount of bitcoins in reserve is already 130 thousand BTC, or about 0.62 percent of the maximum number of coins.

MicroStrategy ranks first in terms of crypto reserves among all public companies

The company’s total BTC investments amount to $3.98 billion and the average purchase price of each coin is $30,639. At today’s exchange rate, the giant’s unrealised loss is $1.47 billion, or 37 per cent.

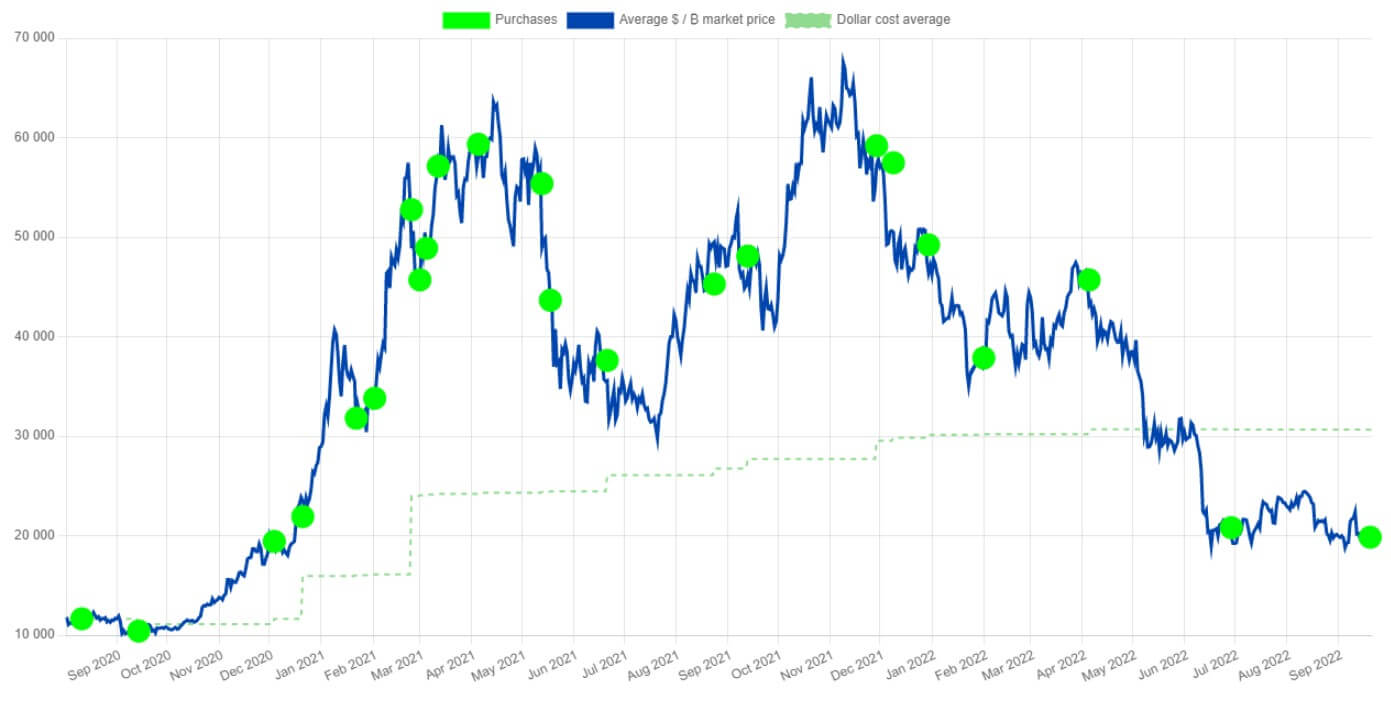

The green line on the Bitcoin price chart shows MicroStrategy’s BTC buying rounds, the dotted line shows the average price to enter the market

How successful was this decision? Time will tell. However, it was made in rather risky period, i.e. just before next base rate hike in USA and new round of geopolitical tensions in Europe.

We believe that over time, cryptocurrency enthusiasts will use Bitcoin less often to make payments and will move to more modern alternatives. In doing so, BTC will cement its reputation as digital gold, used to store value over long periods of time. It fulfils that role quite well - especially if you don't buy crypto at market peaks.

Share your views on what’s happening in our Millionaires Crypto Chat. We discuss other important topics there as well.