Cryptocurrency analysts tell how ETH’s Etherium exchange rate could behave after the network switches to PoS

The value of Etherium ETH may become more independent of other cryptocurrency price movements after the cryptocurrency network switches to the Proof-of-Stake (PoS) consensus algorithm. This statement was made the day before by Chainalysis analysts in their report. According to them, after the merger, ETH will become similar to traditional bonds, which will contribute to the influx of institutional investors, i.e. professionals. We tell you more about what’s happening.

With the move to PoS, validators will confirm transactions and look for new blocks. They will block their coins in a special deposit smart contract of Etherium, which is the proof of their integrity. Validators will receive an annual percentage return, which according to Chainalysis calculations could be as high as 15 percent. At the moment, the annual return on staking is around 4 per cent per annum. Given the low risk, the business as a validator does become very similar to investing in government bonds.

It is important to note that Etherium’s move to PoS will have a significant impact on key blockchain and cryptocurrency metrics. In particular, issuance – that is, the volume of new ETH issued as a reward for creating blocks with new transactions – would drop by approximately 90 percent from current rates. In addition, the amount of electricity required to keep the blockchain running will drop by 99.95 percent.

Etherium and other cryptocurrencies

A change of this magnitude for a major cryptocurrency project could have a good impact on its price. What’s more, what’s happening to the price of ETH is even able to “decouple” from other major coins, analysts believe. That is, to stop depending on the situation with it.

What will happen to ETH Ether after the merger (PoS)

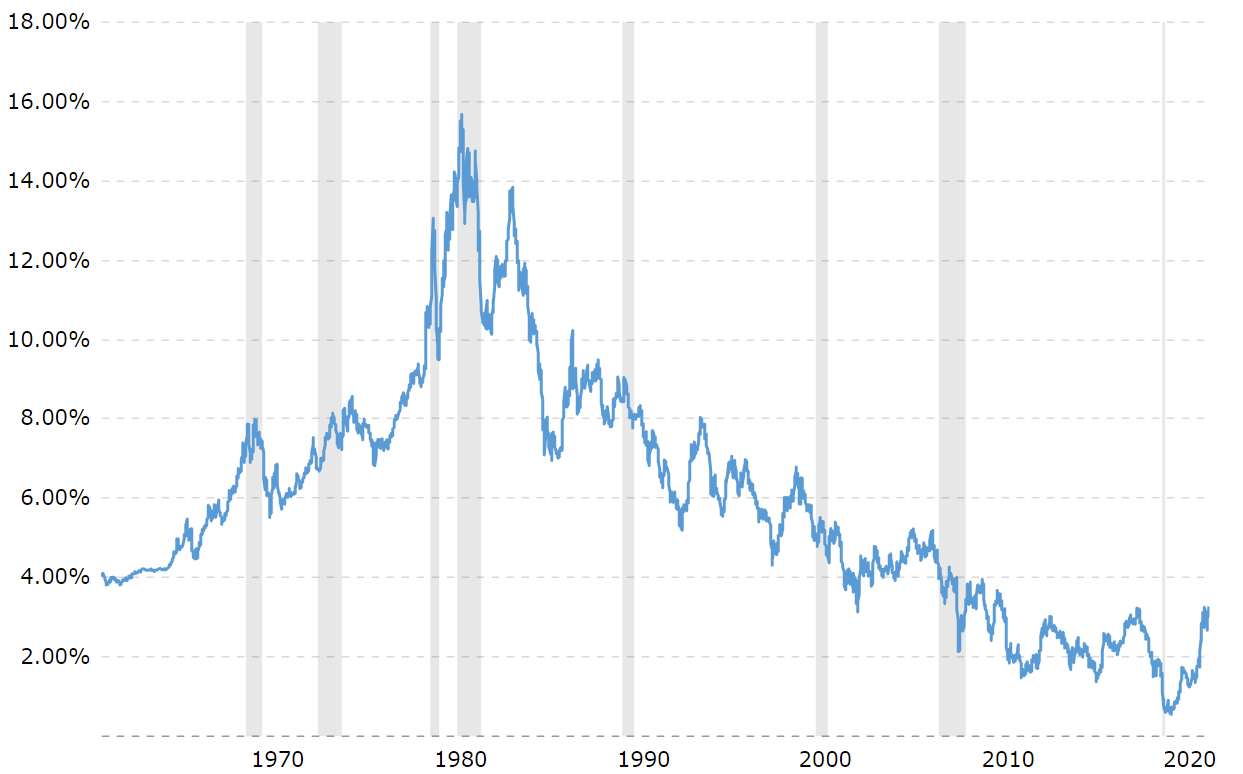

If large investors tolerate the risks of investing in ETH, its role as an alternative to government bonds will become very popular. For example, ten-year US Treasury securities are currently yielding 3.2 per cent. The exact profitability of staking in ETH after the switch to PoS is still unknown, but it is unlikely to be lower.

The yield of 10-year US Treasury securities

It is already possible to at least roughly calculate the potential profitability of staking in Ethereum 2.0. Three factors are important for this: the number of validators, the amount of gas commissions and the percentage of commissions burned. In addition, immediately after the merger, the profitability of the steering should increase by around 66 per cent.

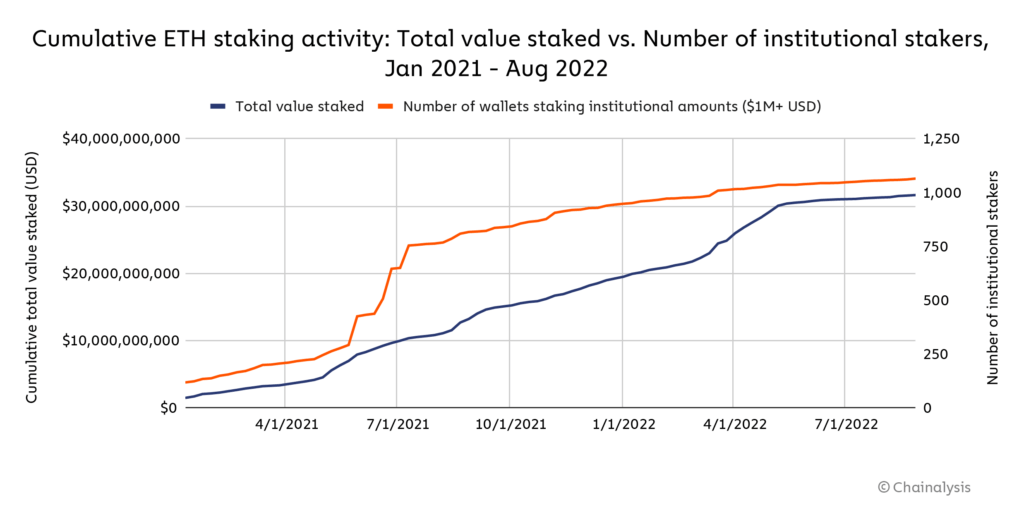

According to Cointelegraph’s sources, the number of professional institutional class players in steking grew from 200 to more than 1,100 between January 2021 and August 2022. This growth has only accelerated by the merger procedure, meaning that large investors are indeed expecting good news from the upgrade to Proof-of-Stake and expect to capitalise on it going forward.

Growth in the number of institutional investors in ETH stacking

Another positive factor for ETH is the already mentioned 99.95 per cent reduction in the coin’s network power consumption. In other words, the altcoin will become much more environmentally friendly, which is also important for investors outside the crypto market. The day before, Dan Held of the Kraken exchange noted this detail and suggested that the pressure on Bitcoin miners is likely to increase once the Etherium network moves to PoS.

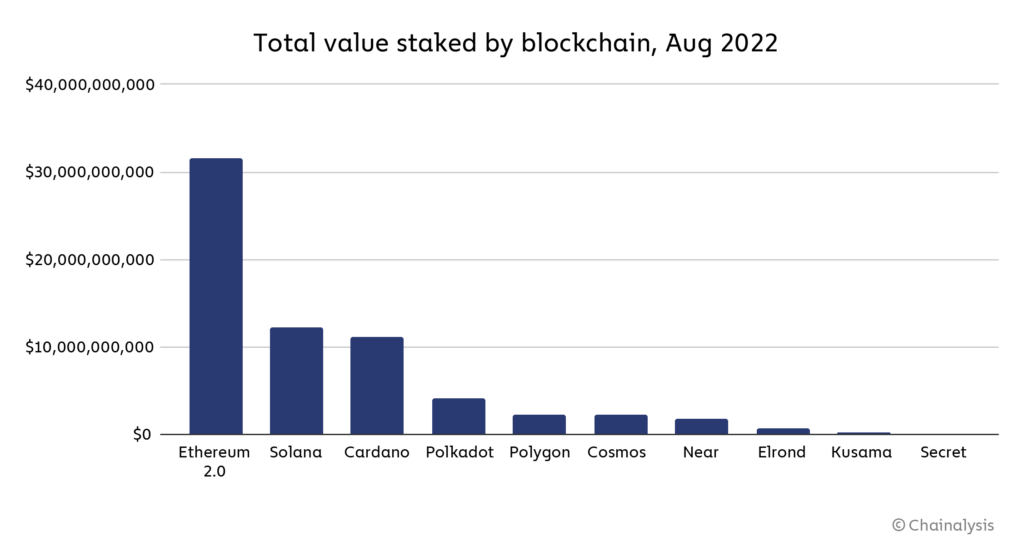

Stacking volume across different cryptocurrencies

So what could be the ceiling on the value of Etherium for the foreseeable future? Earlier in his blog, former BitMEX cryptocurrency exchange CEO Arthur Hayes said that with a successful merger, ETH could well reach the $5,000 bar. However, it is important to understand that this is only a version of the situation that may well not come true. At the very least, Hayes had previously assumed that Ether was unlikely to fall below $1,300, and he was seriously wrong about that.

Etherium exchange rate

Read also: Expert tells how to maximize possible earnings thanks to the transition of Etherium to Proof-of-Stake

But Bitcoin should surpass the profitability of traditional stocks as soon as the cryptocurrency market reaches its bottom. That’s the view voiced by Bloomberg analyst Mike McGlone.

Bitcoin is a bargaining chip that is more likely to outperform stocks in terms of profitability once the market bottoms out. At the moment, however, it looks more like gold or bonds.

Bitcoin exchange rate

The process of bottom forming in the markets now depends on the US Federal Reserve. For the time being, it is regularly hiking the base lending rate to fight domestic inflation. Once this strategy is exhausted, Bitcoin will be one of the first assets to show strong growth, McGlone believes. Many analysts expect to see a sharp reversal in the US Federal Reserve’s actions “sometime in 2023”. That is, while investors still have time to accumulate Bitcoin, the expert suggests.

More positive news from macroeconomics could bring more positivity to the crypto market. For example, it could be encouraging forecasts about the energy crisis in Europe or stabilization of the geopolitical situation in the world.

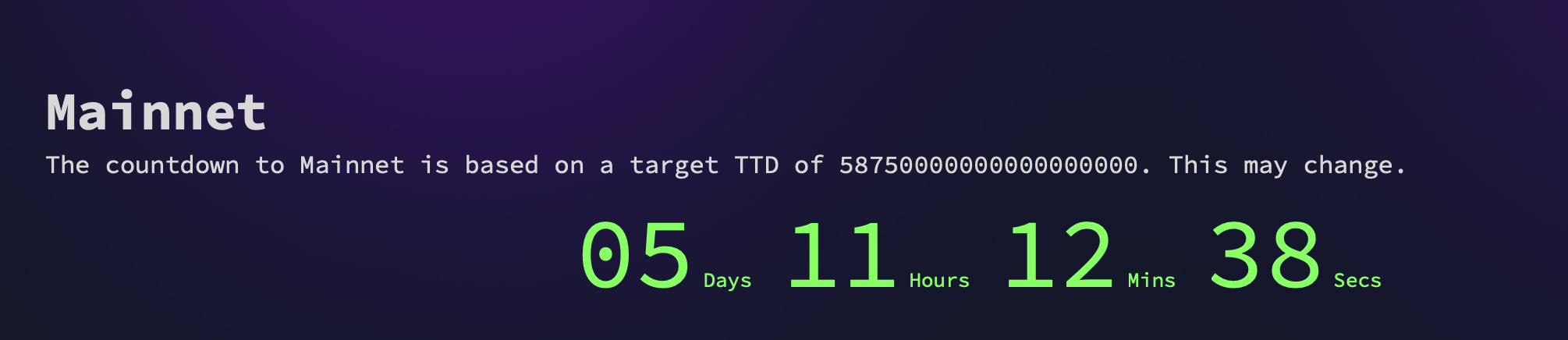

Meanwhile, the Efirium merger is getting closer. As of noon today, the Wen Merge platform is targeting 5 days to the event.

Countdown to the Etherium network merger

We believe that ETH has already in a way managed to become less dependent on the rest of the cryptocurrency market, because after reaching its local bottom at $881 in June, the coin has also managed to reach the $2030 mark, that is, to grow 2.3 times. At the same time, Bitcoin and other coins with a large market capitalization showed much more restrained results. It can be assumed that this trend will at least not be weakened by the news of a successful transition to PoS.

However, ETH will obviously not be able to isolate itself completely from the markets, so it would be too risky to hope for eternal growth. Investors will have to keep an eye on the financial sector, the Fed and other factors, which can affect the coin niche.

To make sure you don’t miss all the important news, join our millionaires’ cryptochat. There we discuss other important news related to blockchain and decentralisation.