Etherium (ETH) has become much more popular among crypto investors over the past month. What has this got to do with it?

The volume of funds in Etherium-based investment products increased by 2.36 percent to $6.81 billion in August. The altcoin surpassed Bitcoin in this regard, with the main cryptocurrency recording a 7.16 percent outflow of funds last month. As a result, the amount invested in various BTC-based instruments now reaches $17.4 billion. According to analysts at CryptoCompare, Etherium is also outperforming Bitcoin in terms of growth in trading activity, which can be attributed to market players’ expectations regarding ETH’s impending transition to the Proof-of-Stake (PoS) consensus algorithm. We will talk more about what is happening.

It should be noted that the transition of the Etherium network from PoW to PoS is a very important event and a prerequisite for the further development of the blockchain. For example, after the update, developers will start implementing sharding, which could really increase blockchain throughput and affect transaction fees.

Cryptocurrency miners will be the first to feel the effects of the Ethi network update, as they will no longer be able to receive ethers for running their own video cards and ASICs. However, there will be enough profitable coins to mine even without Etherium. Read more about this in a separate article.

Cryptocurrency miner

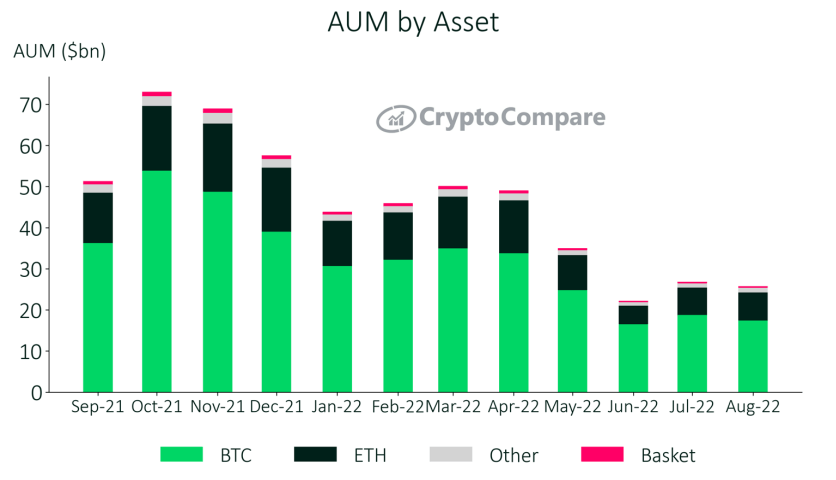

Which cryptocurrencies are investors buying

One of the most popular trading instruments for Bitcoin, represented by Grayscale or GBTC fund units, saw volumes drop 24.4 per cent in August. At the same time, a similar product for Etherium under the ticker symbol GETH posted a 23.2 percent increase. Here’s analysts’ take on the trend.

Indeed, even at a more detailed level, none of the Bitcoin-based investment products discussed in this report showed an increase in investment or trading volume in August. In the short term, we may see a drop in interest in BTC, as Etherium-based products are getting much more attention on the back of the long-awaited merger.

It's worth noting that it's been the consensus proof-of-ownership algorithm that the Ethereum developers have been planning since the early days of the network - and that's part of the reason for the interest in what's happening. In addition, ETH is the world's second largest cryptocurrency in terms of market capitalisation, i.e. the product of the exchange rate by the number of coins in circulation. Therefore, the scale of the update is enormous, which also draws attention to what is happening.

Investment product volumes of the most popular cryptocurrencies

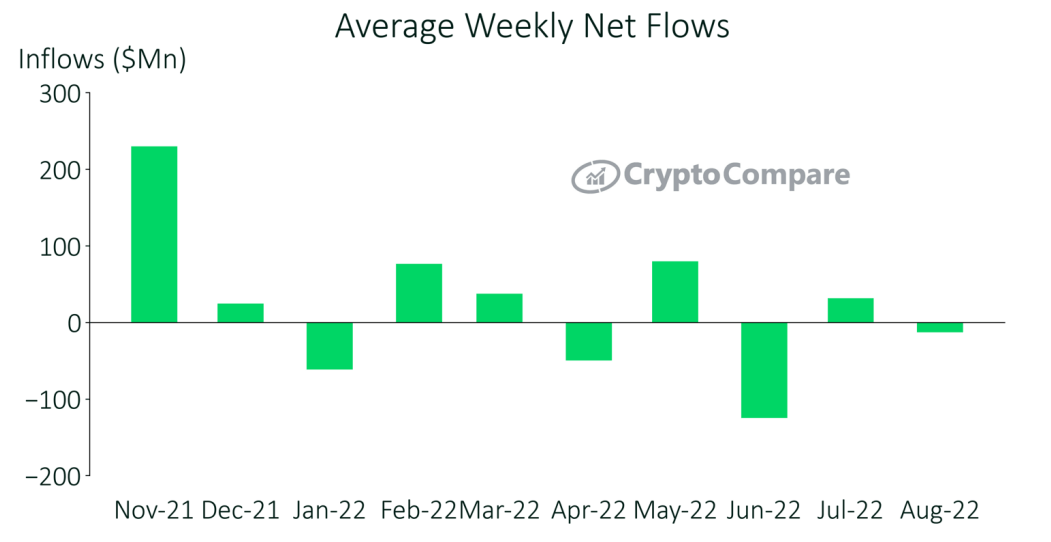

According to Cointelegraph’s sources, overall for all digital assets, there was an outflow of 4 per cent in August. The reason for this is obvious – it’s about a global bearish trend in the crypto market, which many experts are not yet predicting an end in the near future. However, even despite the bearish trend, a number of high-profile financial institutions launched their crypto-investment products during August. These include exchange-traded funds (ETFs), exchange-traded certificates (ETCs), exchange-traded notes (ETNs) and trust products.

Cash inflows/outflows by different months

🤩 FIND MORE USEFUL INFORMATION ABOUT CRYPTO ON OUR YANDEX.ZEN!

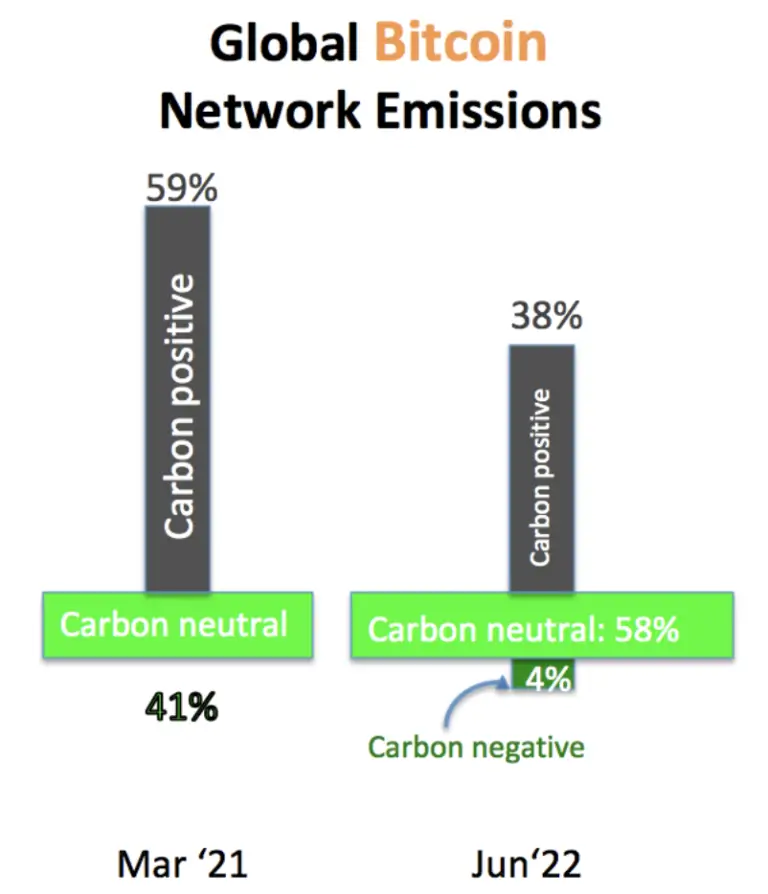

Bitcoin still set a new record, albeit over a longer period of time, but in a different area. According to research firm Batcoinz, the main cryptocurrency’s network is now 62 percent powered by energy sources that do not produce additional greenhouse gases. Meanwhile, around 4.2 percent of BTC’s energy consumption is at all provided by atmospherically harmful compounds, according to CryptoSlate.

Comparison of greenhouse gas emissions from Bitcoin mining

In ecology, this is referred to as a carbon-neutral phenomenon. This usually refers to the use of carbon dioxide as a raw material.

That is, at the moment, only 38 percent of the Bitcoin network’s energy consumption results in greenhouse gas emissions. The situation for the environment has improved considerably since March 2021, when the same figure was 59 percent. At the same time, Bitcoin’s hash rate just recently reached a new all-time high, meaning that this trend is clearly gaining momentum, despite an increase in the number of computing devices for BTC mining.

Bitcoin network hash rate

Interesting data was also found in a study by DePaul University in Chicago. Its analysts found that Bitcoin consumes about 113 terawatt hours of electricity per year and causes about 70 megatons of emissions into the atmosphere. By comparison, the banking sector consumes 700 terawatt hours per year and causes 400 megatons of greenhouse gas emissions over the same period.

Caring for the environment is gradually becoming one of the top priorities for mining companies. This is important because the trend towards sustainability is also being taken into account by big investors. For example, in the spring of 2021, Tesla CEO Ilon Musk said he would be willing to return BTC as a means of payment for his electric cars if Bitcoin mining became more environmentally friendly. With all of the above in mind, we can assume that cars can soon be bought for Bitcoins again.

The refresh of Etherium will be an important event for the entire cryptocurrency industry, as ETH will prove to be the most massive crypto-asset based on the PoS consensus algorithm. This will benefit all such projects and will surely soften regulators' attitudes towards coins. Some of them, recall, were ready to ban PoW-mining of crypto in certain regions not so long ago. Now such sentiments are clearly going to go down.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we discuss other important news related to the blockchain and decentralisation industry.