How Satoshi Nakamoto wanted to name Bitcoin originally: researchers’ version

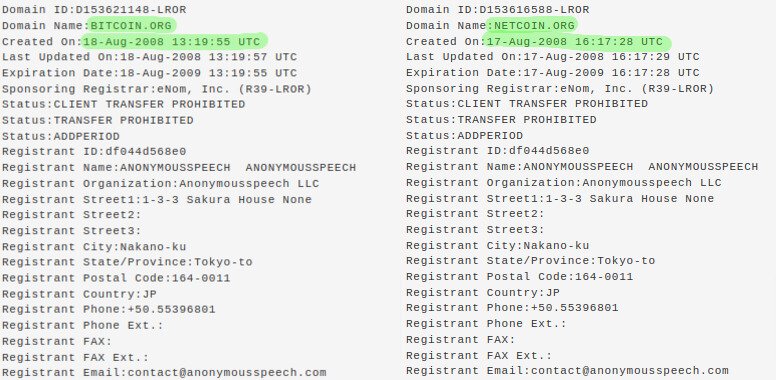

Choosing a name for a project is one of the important tasks in the development process. That said, it may not have taken an anonymous cryptocurrency creator Satoshi Nakamoto long to come up with the term “Bitcoin”. As Japan’s AnonymousSpeech domain registration history shows, “Bitcoin” could have been called “Netcoin”. According to sources, Nakamoto had an alternative name that never made it into the coin’s Whitepaper and did not become the official name of the project. We tell you more about the situation.

Satoshi Nakamoto is the anonymous creator or group of developers of Bitcoin that was ultimately never revealed. According to analysts, this is a good thing, because in this way it was possible to eliminate possible pressure on the developer and allow the cryptocurrency to develop.

There is not much known about Satoshi. For example, in July 2020, cryptocurrency enthusiasts tried to answer the question of how many mining devices Nakamoto had and how much BTC they brought him. In the autumn of the same year, journalists even tried to identify which city the developer was from.

Satoshi Nakamoto is being portrayed as the identity of Dorian Nakamoto

In general, researchers are constantly studying the developer’s activities and sometimes come to new conclusions.

What Bitcoin’s name might have been

AnonymousSpeech is a platform that allows users to register new Internet domain names anonymously. With its help, Bitcoin.org appeared on 18 August 2008. The cryptocurrency community later came to believe that Satoshi Nakamoto himself was behind its registration. However, the day before AnonymousSpeech registered the domain Netcoin.org.

According to Cointelegraph’s sources, an interesting fact was discovered the day before by Or Weinberg, an expert in recovering lost cryptocurrencies. On his Twitter account, Weinberg confirmed that no content was hosted on Netcoin.org and that the domain name was later acquired by another anonymous buyer. Netcoin.org was later deleted and re-registered to a subsidiary of the Web.com platform in 2010.

Domain name registration data

In a comment on Weinberg’s Twitter post, a crypto-enthusiast nicknamed Gergs noted that “Bitcoin” sounds better than “Netcoin”. Here’s his rejoinder.

Interesting. I’m glad Satoshi Nakamoto chose the term “Bitcoin”, it sounds much better.

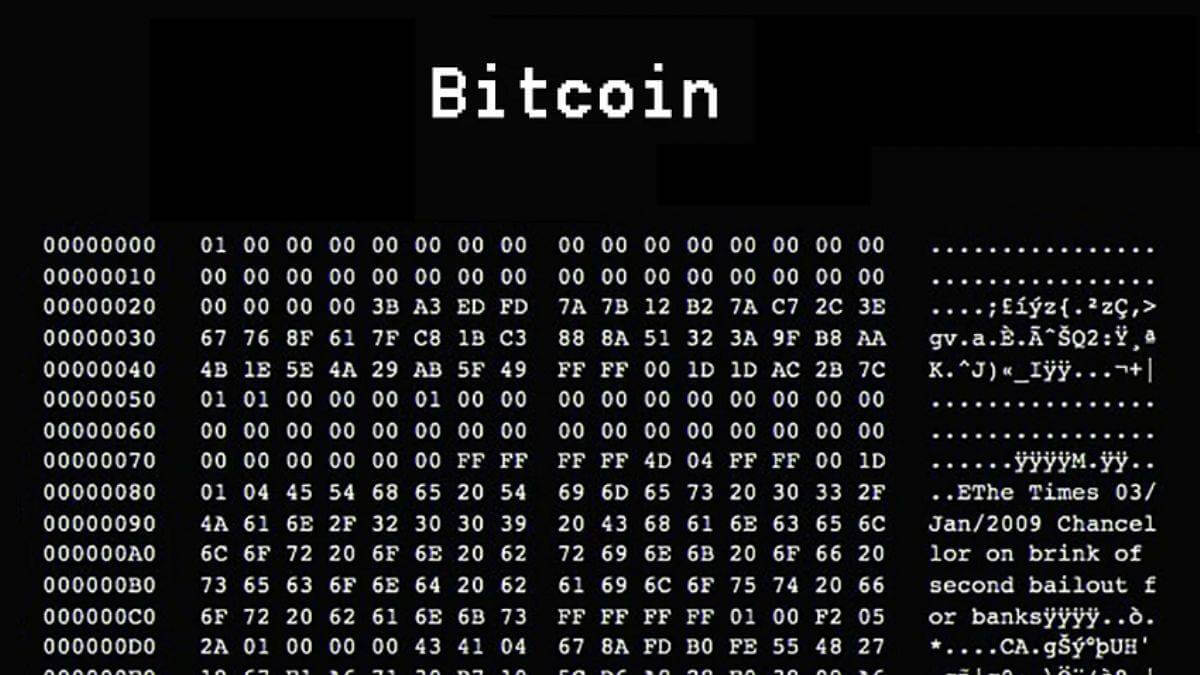

Bitcoin’s first block

The identity of Satoshi Nakamoto himself, fourteen years after the emergence of Bitcoin, has still not been established. There are many myths and theories surrounding his real name on the internet, some of which we wrote about in our previous piece. There’s also the latest post shared by Satoshi using his known account.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.ZEN!

I wonder if Satoshi expected his project to reach such a huge scale that transactions worth hundreds of millions of dollars within the Bitcoin ecosystem would become commonplace. One of the most recent such transactions was the purchase of 25 million shares of Australian mining company Iris Energy by B. Riley Financial Inc.

According to a filing with the US Securities and Exchange Commission (SEC) on Friday, Iris Energy has entered into an agreement with B. Riley for a “potential offer and sale” of up to 25 million ordinary shares in the company worth $100 million. The statement said that B. Riley has a period of 24 months to complete the transaction, starting “as soon as possible” after the effective date of the registration statement.

Because Iris Energy qualifies as a “foreign private issuer” under US securities laws, the company said it intends to follow “Nasdaq corporate governance listing standards” while adhering to Australian law. In addition, Iris Energy had previously intended to issue 198,174 shares to B. Riley “as compensation for its irrevocable undertaking” to acquire additional securities.

Iris Energy share price chart from the beginning of the year

According to a recent statement from the company, it plans to use the proceeds of the sale to fund the expansion of its operations – acquiring mining equipment and developing data centres. Here’s the relevant cue.

As of the current prospectus, we cannot state with certainty all of the specific uses of the funds and the corresponding amounts that are realistically available for these purposes. Accordingly, we will have wide discretion as to how we will use these revenues.

As a reminder, the idea of selling shares to redistribute profits to the cryptocurrency industry is not new. In particular, earlier this month it became known that MicroStrategy's management wanted to get rid of the equivalent of $500 million worth of shares, some of which should go towards the acquisition of bitcoins.

MicroStrategy has since reported the purchase of 301 BTC worth $6 million. Accordingly, there may be enough available funds to replenish the bitcoins in the event of any eventuality.

Buying cryptocurrencies by investors

Iris Energy shares were listed on the Nasdaq in November 2021 after a $200 million funding round. Unfortunately, other US industry firms can’t boast the same level of success amid the crypto market’s bearish trend – for example, US provider Compute North recently reported $500 million in debt and filed for bankruptcy.

We think the final name Bitcoin instantly gives the right impression of the cryptocurrency as a digital asset, while Netcoin - or network coin - sounds more fuzzy. However, BTC, given its basic features, would clearly succeed with either name. So the choice of an anonymous developer is worth agreeing with.