Hundreds of bitcoins that haven’t moved in a decade come on the move. What does this mean?

The Bitcoin price has fallen to its lowest level in two years, with long-dormant BTCs “waking up” amid a new market collapse. In particular, the day before, LookIntoBitcoin analytics platform creator Philip Swift recorded 510.65 BTC moving on the blockchain, which were last involved in transactions back in 2012. An analysis of such bitcoin flows may provide more clarity on the reaction of the cryptocurrency’s long-term holders to Bitcoin’s current trend. We tell you more about what’s going on.

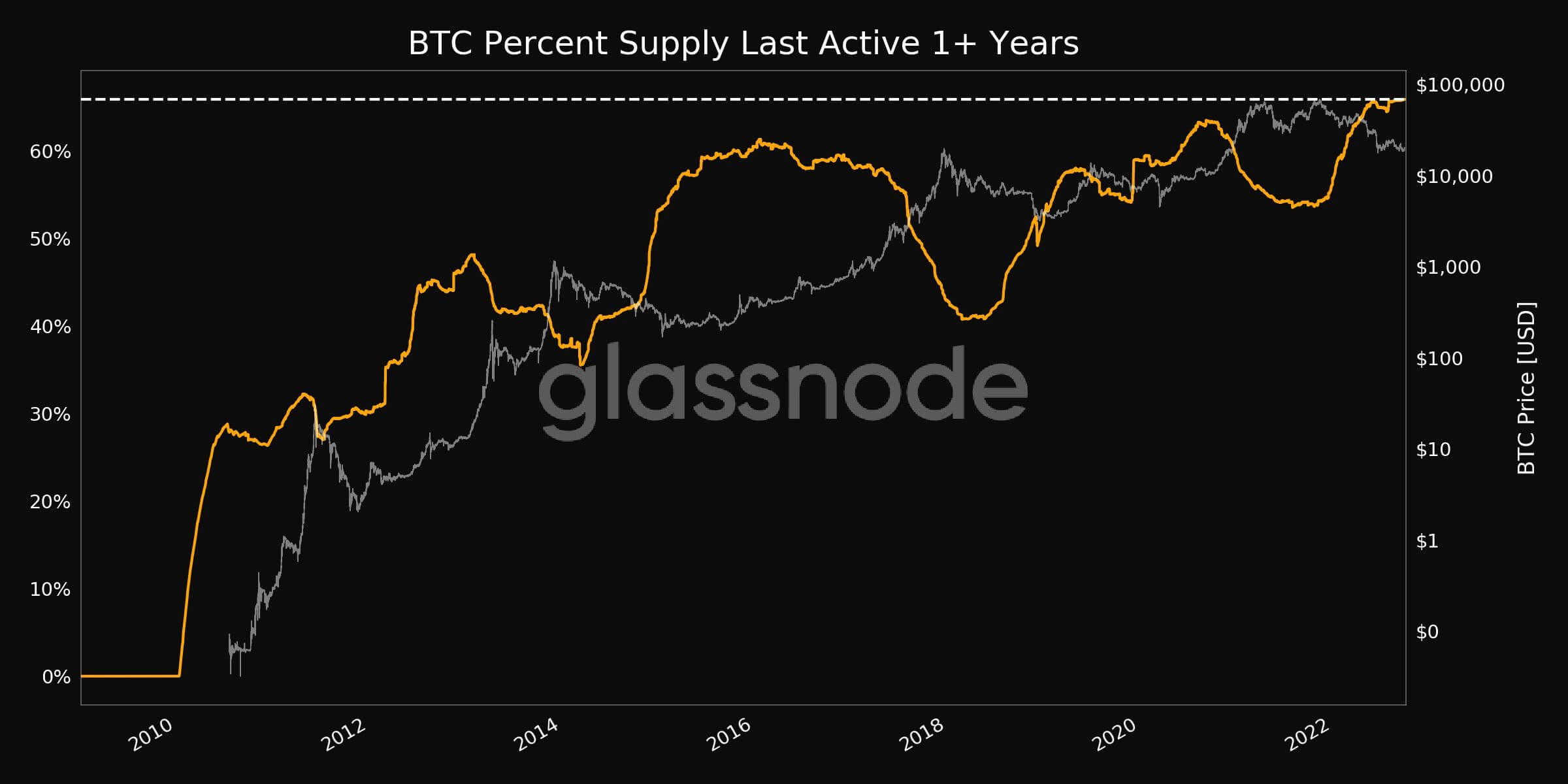

Note that the trend of long-term holding of bitcoins and other cryptocurrencies is quite popular right now. For example, yesterday a record was set by the share of BTCs that have not moved for at least a year. We are talking about almost 66 percent of all bitcoins in circulation.

Graph of the share of bitcoins that haven’t moved in at least a year

Accordingly, only a third of the entire cryptocurrency supply has been traded for a year. So the so-called hodge-podge is a relevant strategy for many crypto holders.

How are old bitcoins being used?

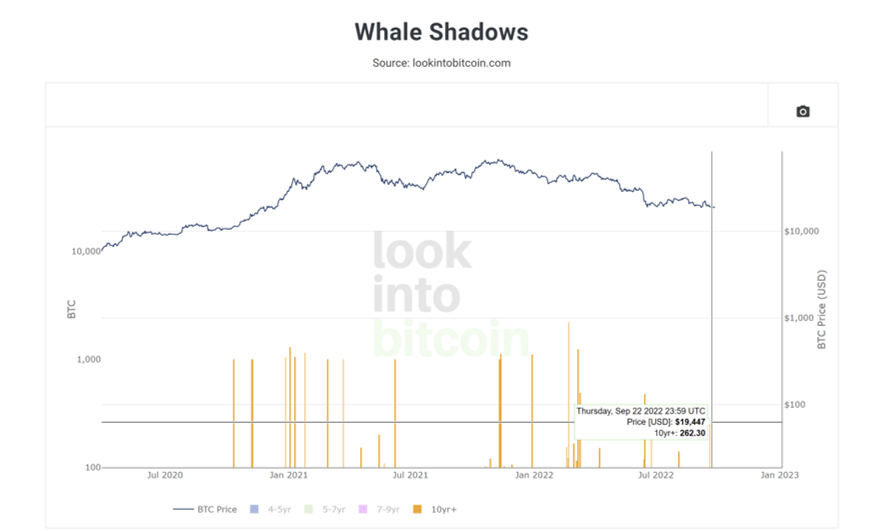

Until the previous week, the aforementioned coins had been sitting idle in their wallets for at least a decade. Swift shared statistics on the movement of large volumes of BTCs from the oldest age category on his Twitter, which sparked a lot of speculation among commenters. Unfortunately, it is almost impossible to determine the exact purpose of such transactions, as each cryptocurrency owner’s motive may be different.

However, it is important to understand that BTC holders who have been storing it for more than a decade are in some way or another at a significant profit, even at the current exchange rate. That said, their decision could mean a lack of faith in further market growth, which sometimes coincides with its price bottom. Be that as it may, these investors have certainly made a profit thanks to their persistence and patience.

Moving BTCs from ten years old

On the other hand, the coins may belong to long-term investors, who must have a fair amount of experience with the history of the crypto market. Consequently, they probably know about market cycles, which means that such people are unlikely to sell BTC right during a bearish trend when they could just wait for the next bull run after a decade of waiting. So chances are that the coins have simply been moved to a new address, or it’s some lucky person who found a long-forgotten cryptocurrency wallet in their possession.

An example of quite a few lost bitcoins is the story of Briton James Howells, who accidentally threw away a hard drive containing the keys to an address with 7,500 BTC worth millions of dollars at today's exchange rate. As it became known over the summer, he now wants to use robot dogs to find the device in a landfill. Read more about the story in a separate piece.

Robot dog Spot from Boston Dynamics

In 2012, the value of Bitcoin ranged from around $4.80 to $13.40. If we take the cryptocurrency’s average price for the year to be around $9.10, then 510.65 BTC in dollar terms were worth around $4,600. Now, however, the value of the coins reaches the $10 million level.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

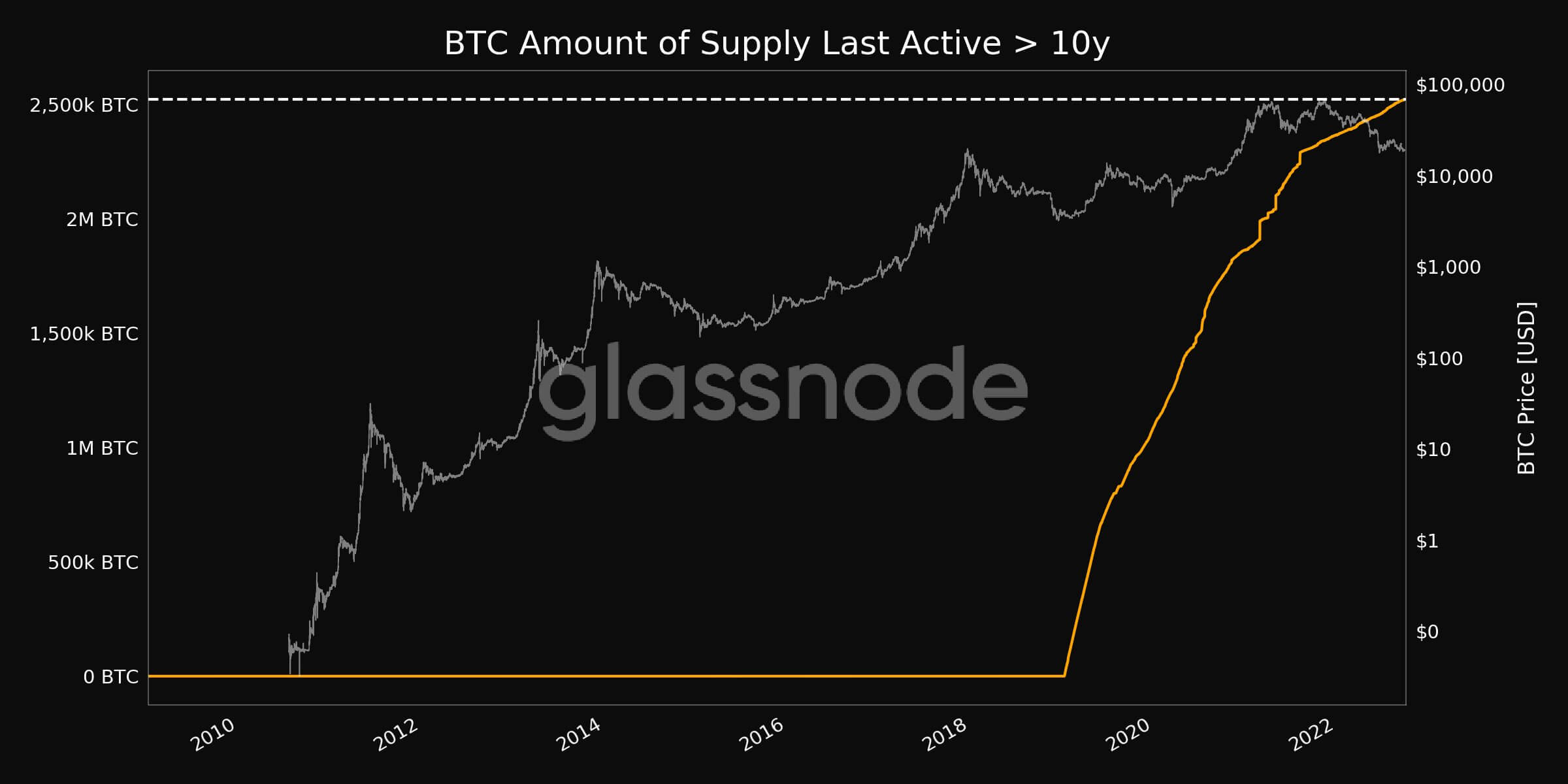

According to Cointelegraph sources, the ‘awakening’ of old bitcoins is a rare occurrence today. Analyst platform Glassnode recently shared a report on Twitter about a record number of BTCs left unmoved for a decade or more. As of September 27, that’s at least 2.52 million BTCs.

Growth in the number of BTCs with an age of ten years or more

A record number of ten-year old BTCs were moved in a single day on June 14: 477.80 BTCs in one day.

Recent BTC moves of ten years or older

The fall of the crypto market has not only led to the awakening of old wallets: the bearish trend has also caused the bankruptcy of some major cryptocurrency companies. Among them is investment firm Voyager Digital, which declared bankruptcy back in July.

In a recent auction, its remaining assets were bought out by cryptocurrency exchange FTX for $1.4 billion. Details of the deal were published in an announcement of the trading platform. Here’s the replica that Decrypt cites.

Voyager received several offers containing sale and reorganisation alternatives, conducted an auction and, given the results, decided that a deal to sell the company to FTX was the best alternative for interested parties.

FTX CEO Sam Bankman-Fried

Most interestingly, in June FTX CEO Sam Bankman-Fried said that the exchange was prepared to financially help promising companies that were experiencing serious financial problems due to the market downturn. A month later, Voyager Digital accused the FTX chief of PR and turned down his offer. It seems that they later had to reconsider their decision.

Voyager Digital is not the only cryptocurrency company facing financial problems. The Celsius platform, rumoured to be in trouble since 2019, also filed for bankruptcy in July. At the time, the company said it owed creditors and customers $5.5 billion, but Celsius was $1.2 billion short of settling its obligations. In addition, it became known yesterday that Celsius CEO Alex Maszynski has left his position.

We don't think there's anything wrong with what's happening. Even if a seasoned Bitcoin investor decided to get rid of coins, it does not mean that he has stopped believing in the prospects of cryptocurrencies. Perhaps, the owner of old BTCs got tired of watching the market and decided to cash out his earnings. In any case, this situation confirms the benefits of the hodla strategy. However, it is only relevant for serious blockchain projects that are able to survive bearish trends.

Look for even more interesting news in our millionaires’ cryptochat. There we talk about other important topics related to the blockchain industry.