The countries with the toughest taxation for crypto investors. What are they?

Cryptocurrency taxation rules vary significantly from one region of the world to another. While some countries are more liberal towards digital assets, others don’t welcome crypto traders. The day before, analytics firm Coincub released a report examining trends in this area and named the five worst countries in terms of taxation measures for cryptocurrency owners. Most interestingly, the first place of the anti-rating was taken by Belgium. We tell you more about what’s going on.

It should be noted that on the eve there was a scandal in the cryptocurrency industry on the subject of taxation. The former head of MicroStrategy, Michael Saylor, was involved in it. In this case, we are talking about a public company that is the leader in bitcoin savings among its peers. As of today, the giant has 129,698 BTC at its disposal.

Now, Sailor is being sued for possible tax evasion, which could be worth tens of millions of dollars. The cause of the trouble was Michael’s place of residence. He was allegedly a resident of Florida, where there is no income tax, but in fact the entrepreneur seems to reside in Washington.

MicroStrategy CEO Michael Saylor

According to Karl Racine, the Attorney General of the Capital District of Columbia who announced the case, Saylor may have avoided paying taxes because of it even though he had to. Read more about the story in a separate piece.

Where cryptocurrency is taxed

In Belgium, capital gains tax on cryptocurrency transactions is 33 per cent, and up to 50 per cent tax is withheld on professional income from cryptocurrency transactions. Such strict cryptocurrency taxation rules were adopted by the country’s government back in 2017.

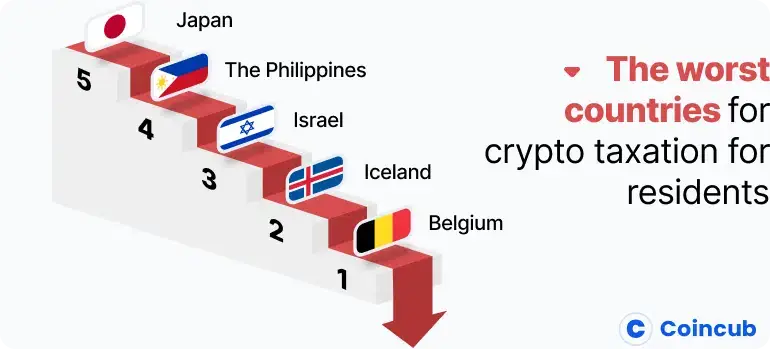

According to Cointelegraph sources, the published Coincub ranking also mentions countries such as Iceland, Israel, the Philippines and Japan. These too are the most unfavourable regions for crypto investors in terms of taxes.

Top 5 countries with the worst tax laws for crypto-enthusiasts

For example, in Iceland, any cryptocurrency income up to $7,000 is taxed at up to 40 percent, while larger income is taxed at 46 percent. Under Israeli tax law, the sale of cryptocurrencies is usually subject to a capital gains tax of up to 33 per cent. On the other hand, if cryptocurrency trading involves business income tax, it can be as high as 50 per cent.

In the Philippines, there is no tax on any crypto income up to $4,500, but above that bar, any income is taxed up to 35 percent. The country’s government is also discussing new taxes on cryptocurrencies by 2024. Japan rounds out the top five worst countries for digital asset owners. It has a system of progressive tax rates for income from the “other” section. The tax rate ranges from 5 to 45 per cent depending on the amount of total income.

Top 5 countries with the best tax laws for crypto-enthusiasts

Among other countries with strict taxation of cryptocurrencies, Coincub also mentioned India, Austria, the US, Norway, Denmark and France. That said, the report also includes a number of countries that provide income tax breaks to citizens. Germany tops the list of the best countries for crypto investors, as anyone who owns a cryptocurrency there for at least a year will not pay capital gains tax on the sale or conversion of coins. Other countries with favourable tax conditions for cryptocurrencies include Italy, Switzerland, Singapore and Slovenia.

It is important to note that in some areas it will be possible to pay taxes directly in cryptocurrencies, and for quite some time. For example, in November 2018, it became known about this possibility in Ohio. The state was the first to accept BTC for tax payments.

The power of Bitcoin

Over time, we believe the tax situation for cryptocurrencies around the world will become clearer and flatter. Although the Bitcoin network has been in operation since 2009, even now blockchain-based coins are a relatively new asset class that governments have not had time to interact with. Over time, what is happening will clearly change in the direction of greater transparency.