The head of a cryptocurrency exchange has named the main reason for this year’s market decline. What is it?

Billionaire FTX founder and CEO Sam Bankman-Fried doesn’t see the current decline in the crypto market as anything supernatural. The day before, he was a speaker at SALT conference in New York, where he shared his thoughts on the macroeconomic situation and its impact on crypto. At the same time, Bankman-Fried has previously actively advocated financial support for the digital asset sector amid massive bankruptcies of major crypto funds and platforms. We tell you more about the situation.

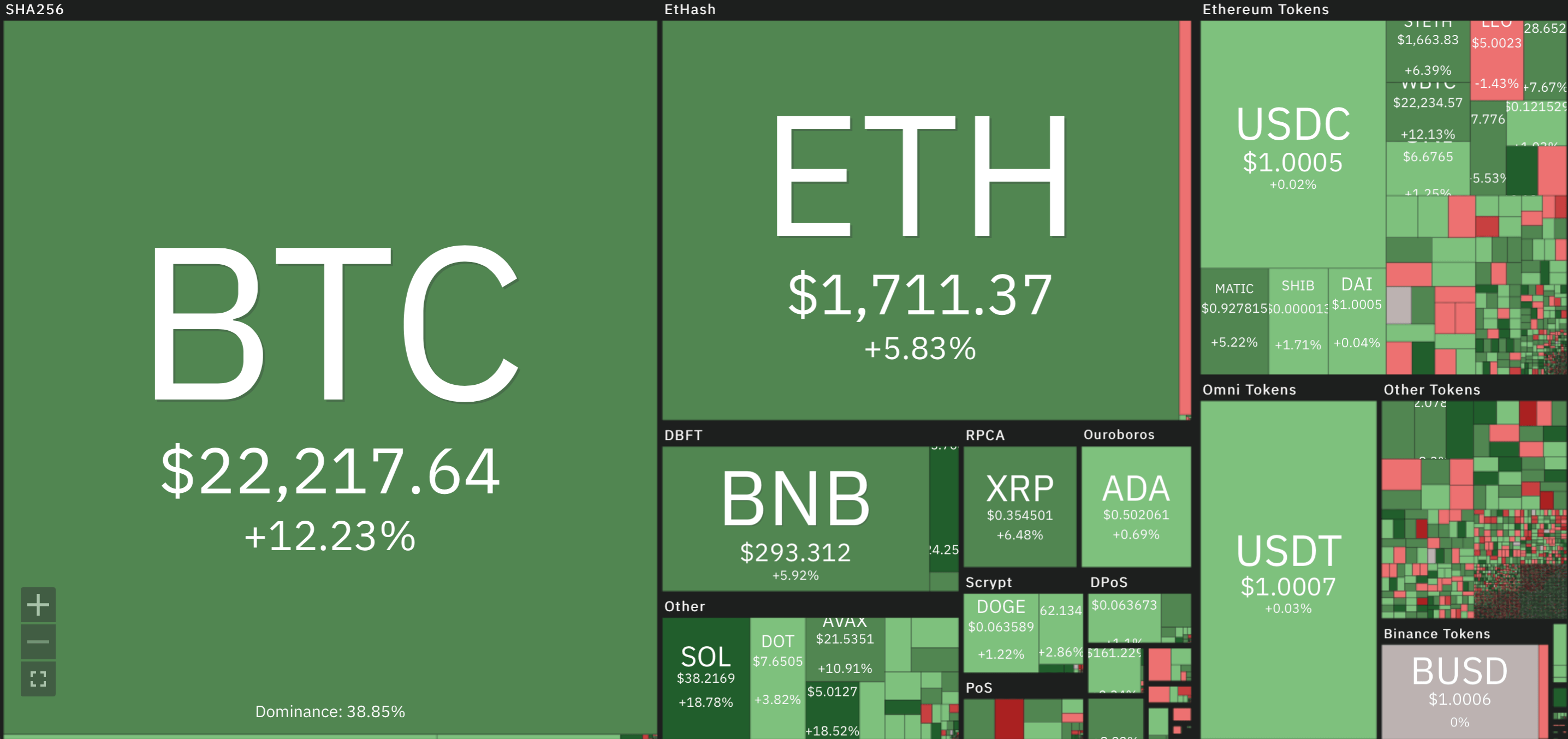

It should be noted that the coin market has been showing good growth lately, which is probably due to the approaching transition of Ethereum to PoS. In particular, here is the result of coin price movements over the past week.

Changes in cryptocurrency exchange rates over the past week

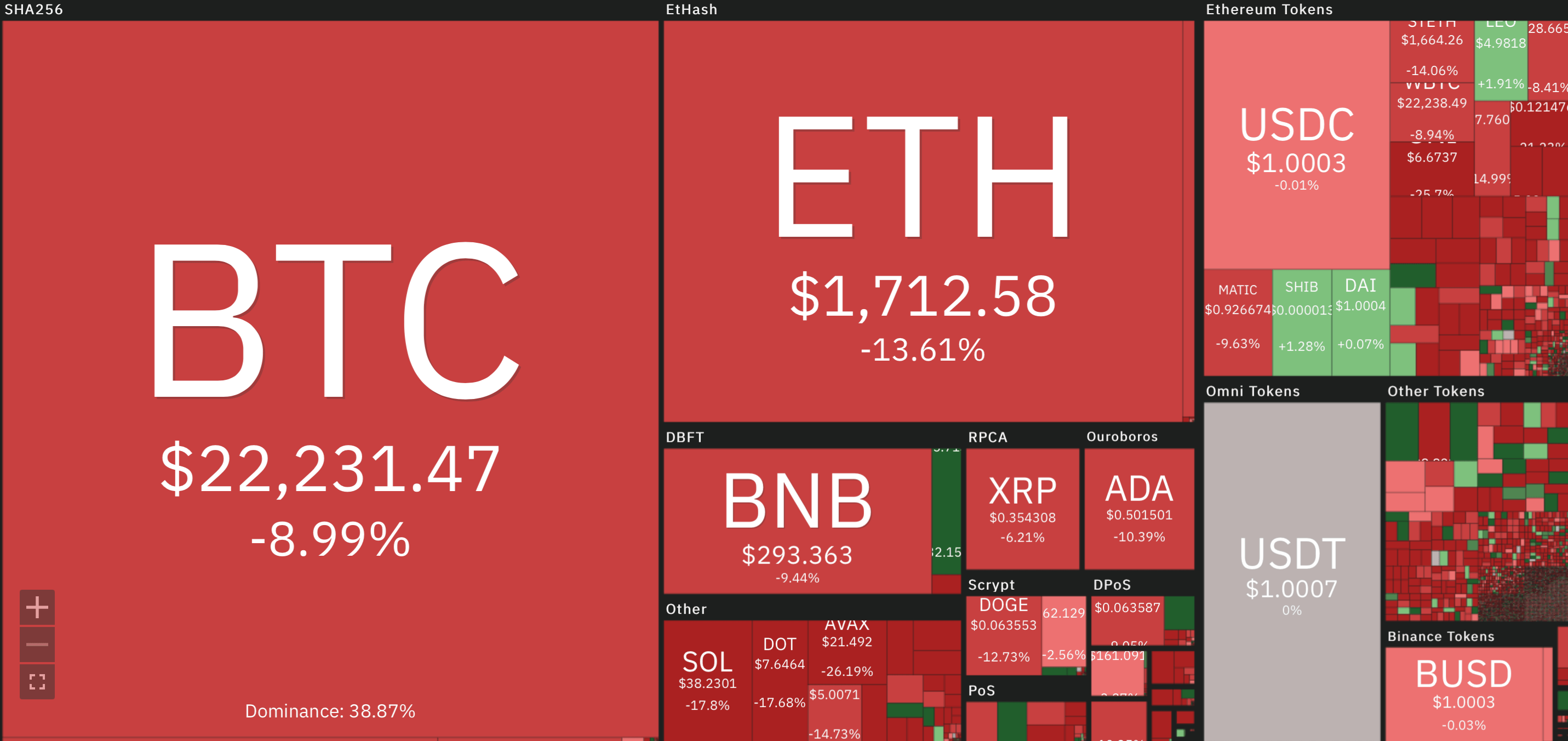

That said, on a monthly scale, the digital asset industry is showing a dip. Accordingly, the current rise is of a local nature within a large bearish trend.

Changes in cryptocurrency rates over the past month

Why have cryptocurrencies fallen?

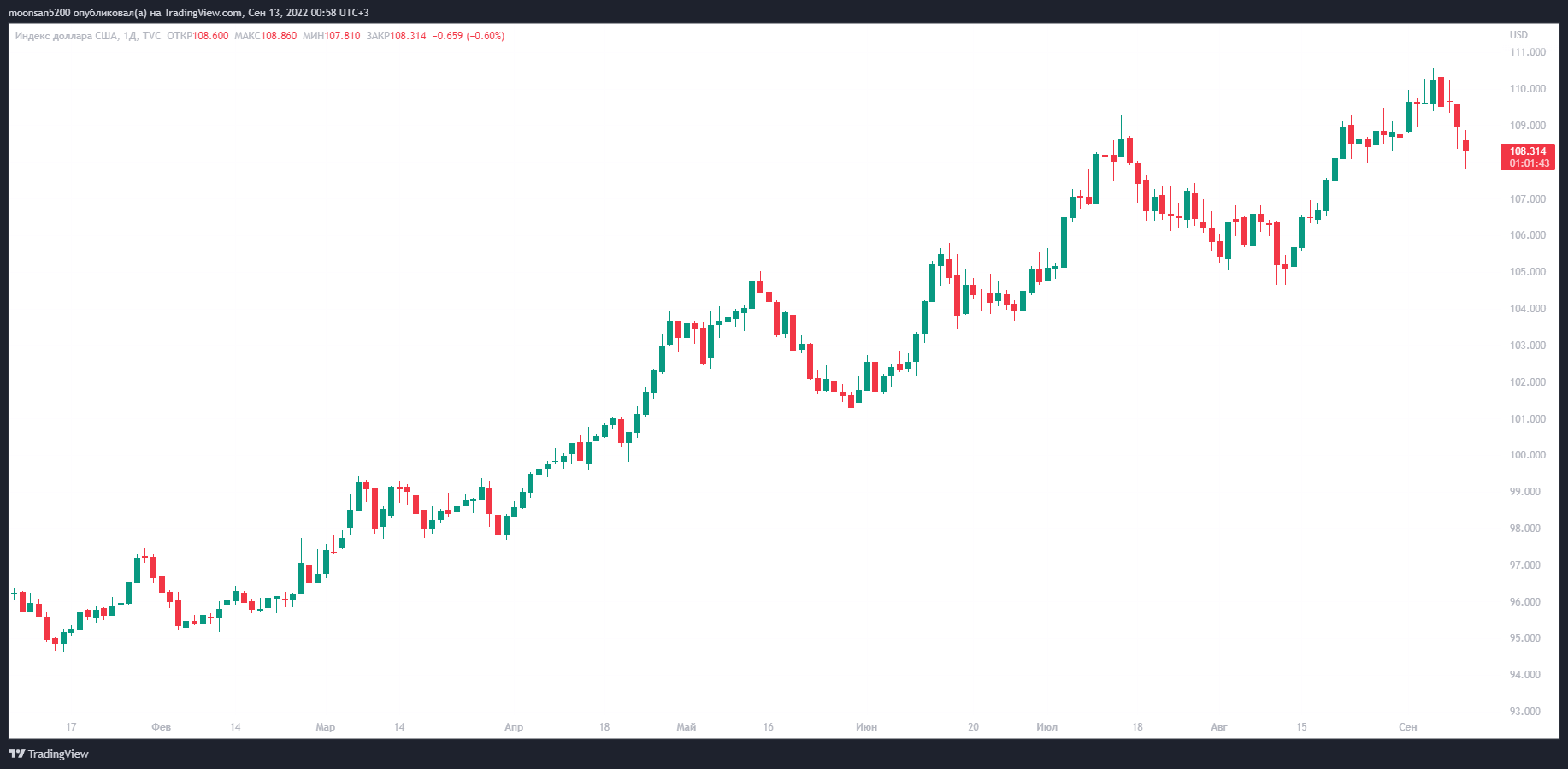

The head of FTX believes that the fall in markets this year clearly coincides with the rise of the dollar against other world currencies. That is, with the world’s main reserve currency showing strength, investors are selling their own assets to get into the dollar, further exacerbating the trend.

Indeed, the Dollar Index (DXY), which shows the ratio of the US dollar to the world’s six other most popular fiat currencies, has recently hit its highest value in decades. This means the currency really shows strength and attracts investors accordingly.

DXY index chart

Bachmann-Fried made the point that the US Federal Reserve’s policy of raising the benchmark lending rate to fight inflation has hit any high-risk assets. Here’s his statement to that effect.

It happens. But that doesn’t change the point or the fact that blockchain still has huge potential for use in financial settlements, payments, decentralised social media and other things.

Recall that Fed officials raised the interest rate twice in the summer by 75 basis points, the first time this has happened since 1994. A rise in the benchmark interest rate means more expensive credit and less money in circulation. Because of this, investors quite predictably reduce their appetites and withdraw money from assets - hence the falls in rates of popular coins and other asset categories.

Sam Bankman-Fried, head of FTX

The next round of base lending rate hikes will take place in nine days. This time it is also expected to be raised by 75 basis points or 0.75 per cent, Decrypt reports. Earlier, Fed chief Jerome Powell has repeatedly hinted that the US economy is “going to have a tough time” for at least the rest of this year, meaning the rate hike policy is sure to continue for the next few months. This is additional pressure on the cryptocurrency market and a factor that is keeping crypto from the bull run for now.

Read also: MicroStrategy wants to buy more bitcoins. How much are we talking about?

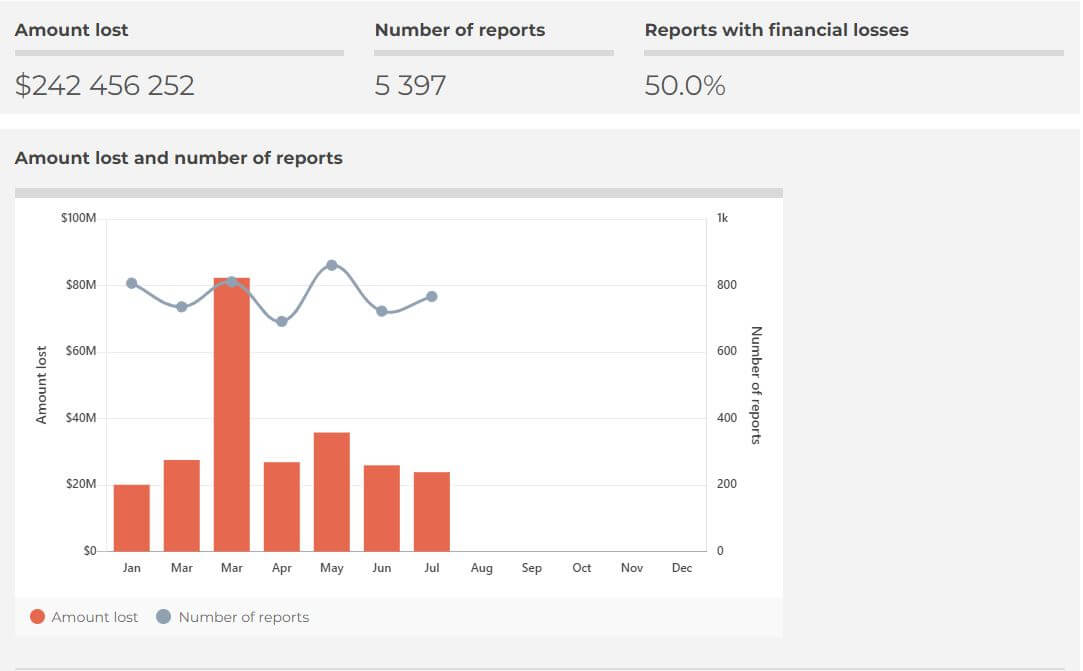

The fall in cryptocurrency prices isn’t the only headache for investors, though. The problem of hacking and fraudulent schemes that result in millions of dollars in losses has not lost its relevance. In Australia, for example, crypto investors have lost more than A$242.5 million since the beginning of this year due to the activities of all sorts of malefactors.

From January to July, the majority of all funds were lost due to fake investment schemes. This includes both “romance scams”, in which cryptocurrencies are lured from victims through online trading, and classic pyramid schemes. Meanwhile, the amount of losses since the beginning of 2022 alone is already 36 percent higher than for the whole of 2021: at that time the figure was A$178.2 million.

Data on cryptocurrency fraud in Australia

The threat of mass crypto-fraud has prompted local consumer advocates to push for banks to be more responsible for compensating losses. This, in turn, should draw attention to the problem at various levels. According to Cointelegraph sources, consumer advocacy groups are pushing for reforms requiring banks to verify that the name of the recipient matches the name of the account when making online payments.

The Australian government is also gradually getting involved in discussions about protecting the rights of cryptocurrency holders. On Sunday, Australian Securities and Investments Commission commissioner Sean Hughes urged investors to understand that investing in crypto-assets is a form of “extreme risk”. Here’s his rejoinder.

We want to be very clear and unambiguous in our messages to consumers of the cryptocurrency market. We believe that crypto-assets are highly volatile, inherently risky and complex.

In addition, in August, the Australian Federal Police established a special team to monitor cryptocurrency-related transactions. These measures should reduce the volume of losses from fraudulent transactions, but the deciding factor is still the crypto-investors themselves.

We believe that to reduce fraudsters' activity and effectiveness, we need to pay attention to educational programs about cybersecurity issues closely related to digital assets. Still, the more a person understands the details of blockchain, private keys and other related terms, the harder it will be to trick them into revealing, for example, a coded phrase. For the time being, therefore, it is worthwhile for novice investors to educate themselves. And then it will be possible to go to the bull market.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we will discuss other important events for the coin industry.