What will happen to the cryptocurrency market after the economic crisis? Forecast by the head of the cryptocurrency fund

The macroeconomic situation now looks bleak: markets are falling, energy costs in Europe are breaking records, and the geopolitical crisis has escalated with periodic threats of nuclear weapons. That said, the bad news is unlikely to significantly impact blockchain development going forward, according to Pantera Capital CEO Dan Morehead. He said in a recent interview that the digital-asset industry will evolve primarily on the basis of internal fundamentals. Accordingly, the process is unlikely to be halted.

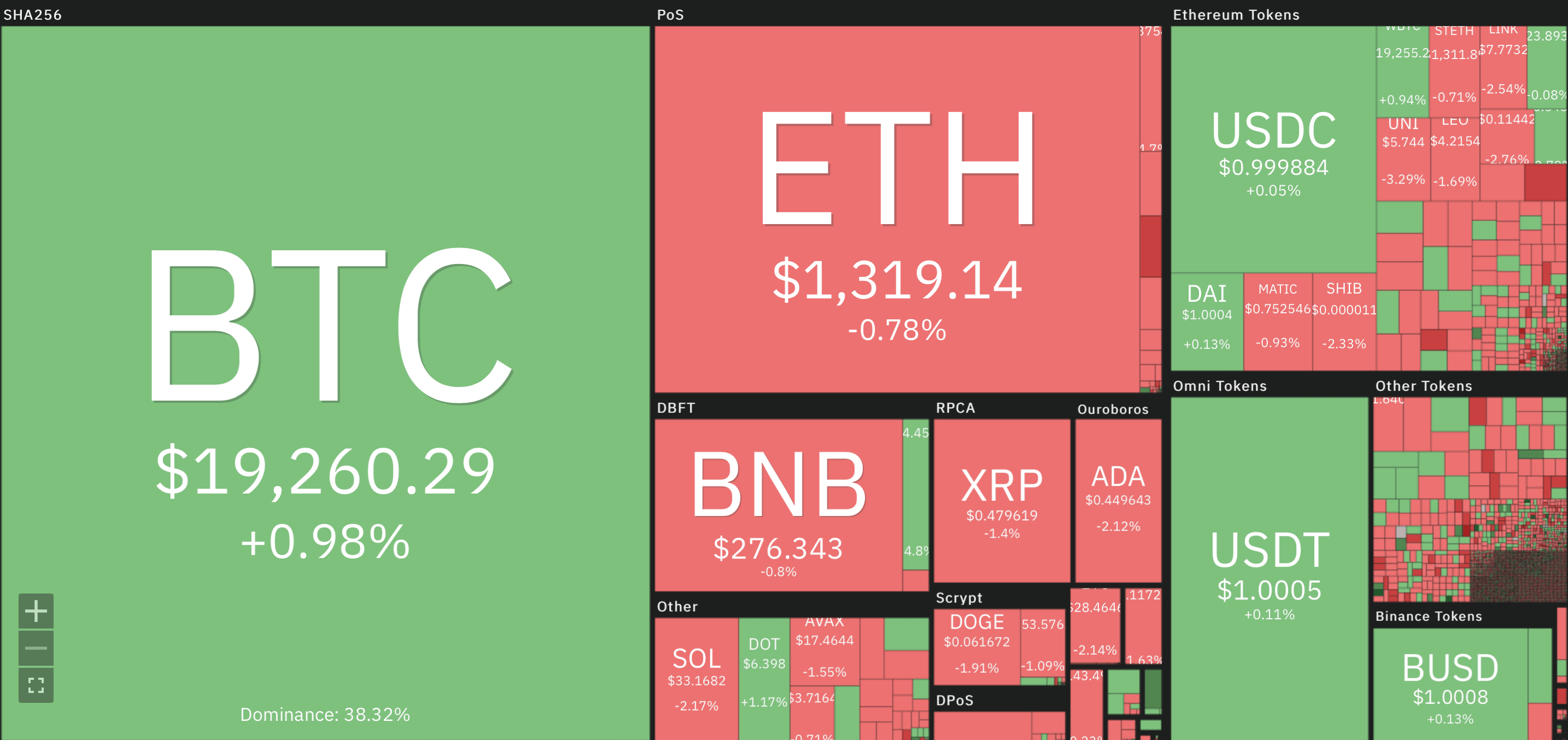

The weekend was relatively stable for the cryptocurrency industry. In particular, Bitcoin, Etherium, Solana and other major coins were almost flat in terms of market capitalisation over the day. Here is the corresponding chart of changes.

Chart of cryptocurrency rate changes over the past 24 hours

What will happen to cryptocurrency in the future?

Here’s one of Morehead’s quotes published by news outlet Cointelegraph, in which he shares his perspective on what’s happening.

As with any pioneering thing like Apple or Amazon stock, there are short periods of time when they correlate with the S&P 500 stock index or other risk metric. But over the last twenty years, Apple and Amazon have done their thing. And that’s what I think will happen with blockchains over the next decade or more – they will fulfill their purpose through their own fundamentals.

That is, the expert suggests that digital assets have enough important advantages that will allow them to evolve in the future, despite the overall global environment. The basic advantages of crypto include decentralisation, blockchain security, limited inflation of some coins with periodic supply shrinkage and so on.

Pantera Capital fund CEO Dan Morehead

In the first half of this year, Pantera Capital raised around $1.3 billion in capital for its crypto fund, focusing on scalability, the decentralised finance industry and gaming projects. Morehead continues.

Over the last few years we’ve had a big focus on DeFi – it’s about creating a parallel financial system. Now gaming is coming online and we have several hundred million people using blockchain.

Note that the gaming industry is indeed linking to blockchain little by little. The argument for such was made last week when cryptocurrency startup Zilliqa announced its desire to launch a gaming console. We wrote more about this in a separate piece.

However, in a variety of positive notes of many well-known industry personalities, there are also skeptics who state not the most pleasant facts. For example, Symbolic Capital managing partner Sandeep Nailwal noted the day before that the bearish trend in crypto has alienated even the biggest institutional players from the industry. Here’s his quote.

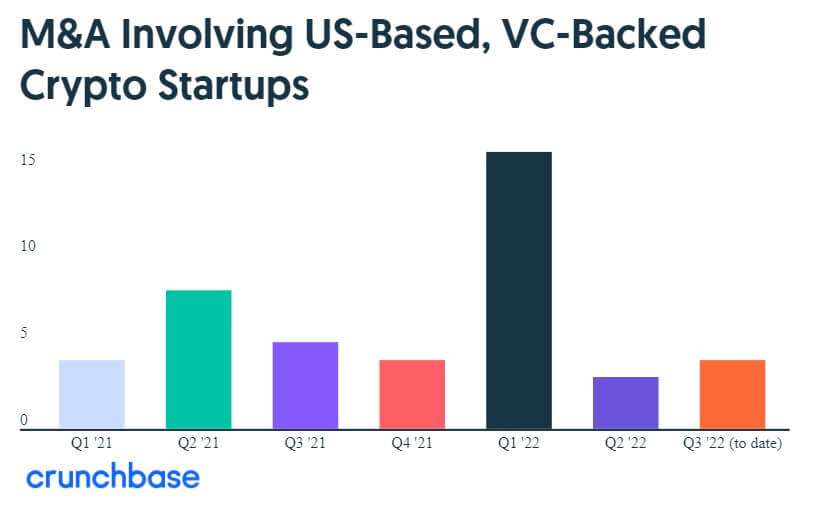

Everyone expected the number of mergers and acquisitions of cryptocurrencies to skyrocket before the bearish trend started, but so far it hasn’t happened. I think the downturn in the industry happened so quickly and so intensely that even the big companies set up as aggressive acquirers were so shaken by it that they had to get their portfolio balances in order first before looking for new business opportunities.

Note that mergers and acquisitions could still take place. As Sam Bankman-Fried, chief executive of cryptocurrency exchange FTX, recently said, the company is willing to shell out around a billion dollars to acquire other organisations that are facing a crisis in the current market environment.

M&A deals with crypto start-ups by big investors

This is a perfectly normal reaction for institutional investors, and even for those with a long-term planning horizon. The exact opposite is how they will react in the next bull run, when the price of Bitcoin and other coins goes up. So their activity should not be cause for panic among ordinary investors.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

As Morehead pointed out, what matters is the fundamental upside within the crypto industry itself and the active development of projects around blockchain. Incidentally, there could be some interesting news in this area soon – at least for the creator of Etherium, Vitalik Buterin. Late last week he said that altcoins Dogecoin and Zcash should switch to the new Proof-of-Stake (PoS) consensus algorithm. At the very least he hopes so.

Here’s a statement from the popular developer, cited by Decrypt.

I expect that as PoS evolves, its legitimacy will only increase over time. I hope that Zcash moves to a new algorithm. I also really hope that the Dogecoin team will do the same soon.

Vitalik Buterin, the creator of Etherium

As a reminder, earlier this month, Etherium successfully completed the merger process – the final transition of the altcoin to the Proof-of-Stake consensus algorithm. The event went off without any significant problems, giving the entire industry a good precedent. Ether’s transition to PoS has made the coin more energy efficient, on top of which the supply of new ETH has seriously decreased.

If the transition of Dogecoin or other altcoins to Proof-of-Stake does appear in the plans of their developers, such an event itself is unlikely to happen soon. Still, a lot of work needs to be done on the code of the projects, as well as for testing. In the long run, however, the PoS trend does have a right to live on.

We believe that Pantera Capital representatives' opinion is true. Still, the underlying advantages of cryptocurrencies are very strong, so even that should be enough to drive the industry forward. Obviously, a possible financial crisis will not stop progress, and blockchain developers will find new ways to use digital assets effectively.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we discuss other important developments in the blockchain and decentralisation industry.