Why big investors are afraid to invest in cryptocurrencies: Bloomberg analyst’s answer

Bloomberg Intelligence crypto analyst Jamie Coutts has stated the main reason why large investors, who are predominantly involved in traditional markets, have so far refrained from investing heavily in cryptocurrencies. In his view, there are “false beliefs” that “there is no intrinsic value in blockchain”. This myth has been circulating almost since the early years of Bitcoin’s existence and still carries weight in the eyes of traditional “whales”. We tell you more about the situation.

It should be noted that there is no surprise in Bloomberg experts’ comments about what is happening in the cryptocurrency industry. Specifically, in December 2021, Bloomberg analyst Mike McGlone predicted that next year would be a challenging one for the coin industry. Despite this, he thought it was possible for BTC to rise to the $100,000 mark given the cryptocurrency’s advantages.

Gold or Bitcoin

Judging by the current situation, the forecast can probably already be considered a failure. However, such comments are affecting the popularity of digital assets in any case.

A popular myth about cryptocurrency

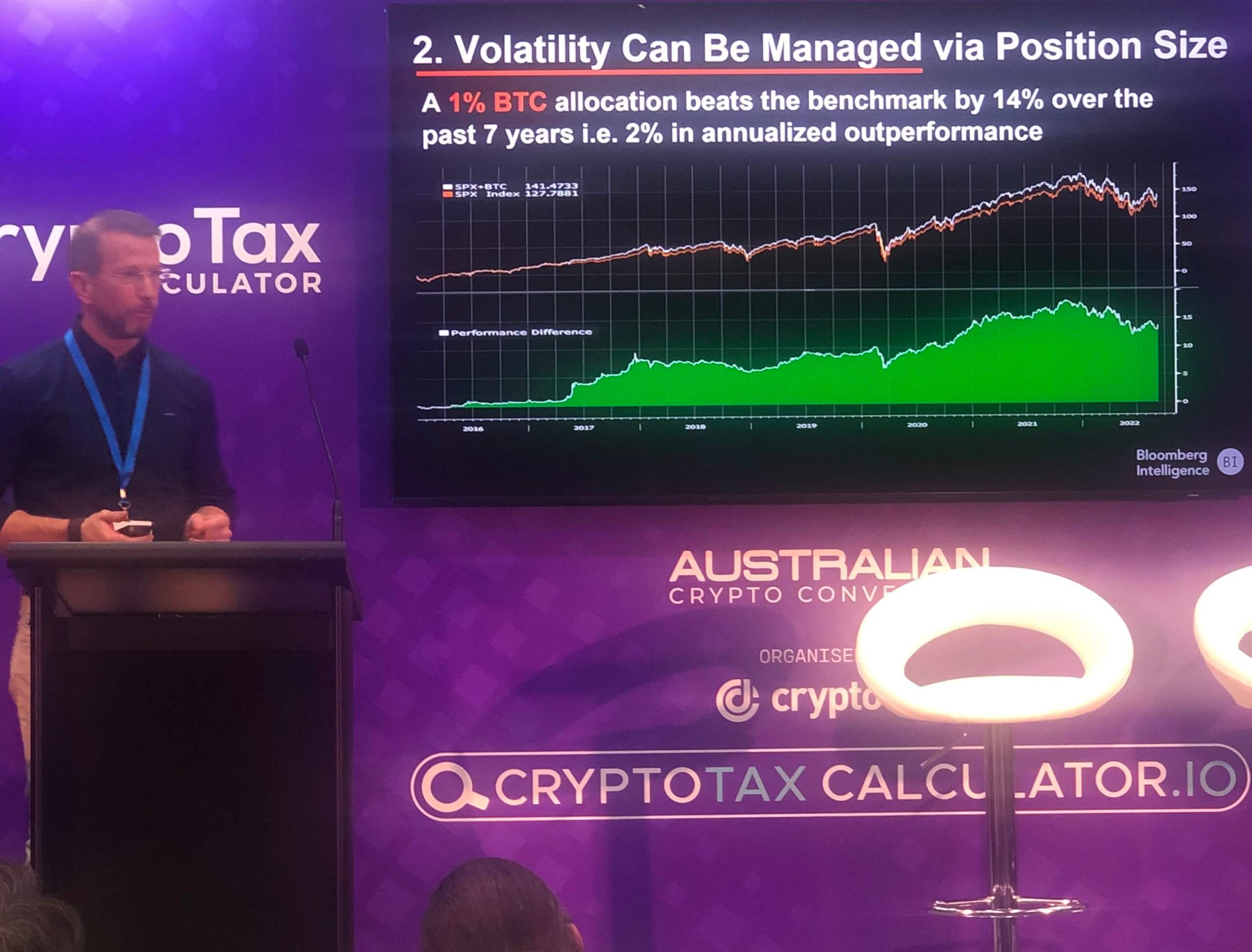

Here’s Cutts’ quote from an interview with Cointelegraph during the recent Australian Crypto Convention event.

Asset managers hold stocks like Amazon and Facebook that did not generate income for the first few years. Facebook had no profits or intrinsic value in its early stages of development. However, its investors could understand that network effects were important in the company, and the value of the asset was derived from how many people used Facebook’s products.

In other words, investors in the traditional industry have developed their own vision of a useful product in which to invest. And because many of them are not familiar with crypto in practice, some are beginning to believe in myths about the lack of value in blockchain and other such arguments.

By the way, the main value of blockchain is that none of the regulators, judges or governments can influence its content or change the data within the network in any way. From this comes the strength of cryptocurrency powered by this technology. With blockchain, users of coins truly and completely own them, and in the vast majority of cases, the money cannot be withdrawn.

Bloomberg Intelligence crypto analyst Jamie Coutts

Many blockchains operate on a similar principle – the more people use them, the more valuable the cryptocurrency ecosystem becomes, especially when the native token is used as a commission payment tool for transactions. They should not be compared to traditional company metrics like profitability and financial strength.

And the alleged lack of regulation of the crypto market is not considered a significant problem by the expert – moreover, the main digital asset is already in the legal field. He continues.

Regulation cannot be one of the reasons for the lack of investment. Let me explain. Regulation is always a concern, but Bitcoin is already controlled.

Bitcoin exchange rate graph over the last year

That is, “there’s really no regulatory risk” because cryptocurrency became regulated “the moment it began to be considered a taxable entity”. Recall that income from cryptocurrency transactions is taxed in many countries around the world, including the US.

In addition, it is important to understand that the legal use of digital assets is guarded by exchanges, which comply with existing operating frameworks and will disclose a particular user’s data or block their wallet if necessary. So to consider coins as a completely unregulated niche is really wrong.

🤩 SUBSCRIBE TO US ON YANDEX.ZEN FOR MORE INTERESTING NEWS!

Coutts believes that many big investors are simply stopped by the “fear of the unknown” from investing heavily in cryptocurrency. That is, they have had no experience with it, so crypto is still perceived as something incomprehensible and abstract. Admittedly, those who are hesitant to invest in Bitcoin should pay attention not only to the volatility of the market, but also to what the cryptocurrency actually provides.

The best thing we can do is to understand the global trends that exist – the depreciation and technological innovation that cryptocurrency is at the intersection of. This accelerates the acceptance of cryptocurrencies as an asset class that should be considered for some allocation of a share of one’s portfolio.

Cryptocurrency investor with Ledger hardware wallet

We believe that this reason does play an important role in the rate of adoption of digital assets by professional investors. As we know from our own experience, before learning the basics of blockchain, experience interacting with decentralised applications and using hardware wallets, it is really scary to invest relatively decent amounts in crypto. Therefore, we want to believe that the traditional finance sector will still have time to conduct small experiments like blockchain transactions, swaps on decentralized exchanges, and so on. That will definitely change the view of crypto for the better.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we discuss other important news in the world of blockchain industry.