A cryptocurrency exchange has withdrawn a record number of bitcoins in 24 hours. What does that tell you?

The Bitcoin price has returned to its highest level in six weeks over the past few days, and the local bull run itself coincided with a marked increase in buying activity. At the same time, Binance, the largest cryptocurrency exchange, saw its balance shrink by more than 55,000 BTC on October 26, which was the largest daily coin withdrawal from the trading platform. CryptoQuant analysts published a more detailed report on the reasons and consequences of the massive bitcoin withdrawal. We are talking about the situation in more detail.

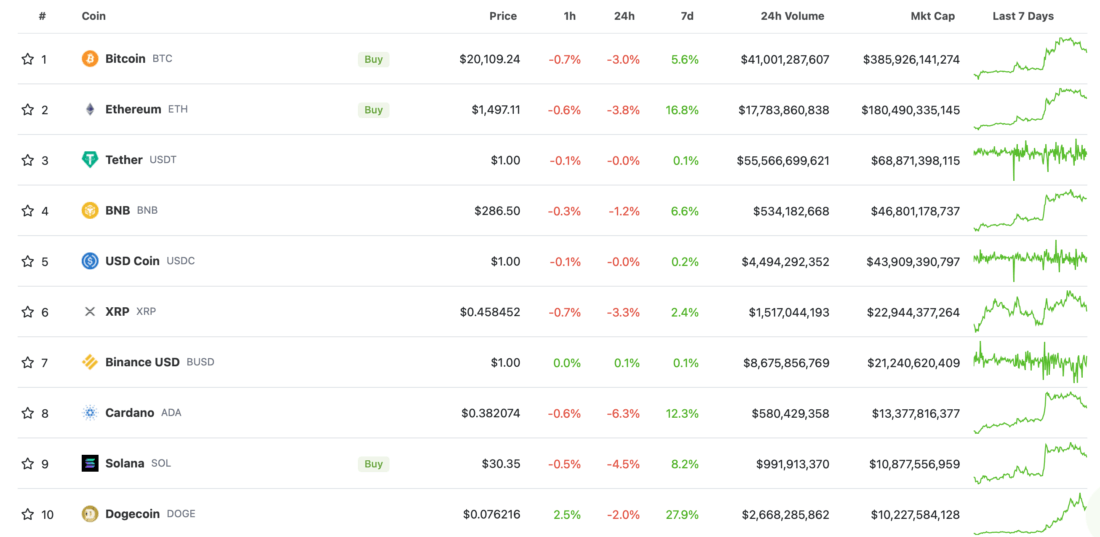

Note that Bitcoin and other cryptocurrencies have stabilized slightly after the recent rise. For example, BTC is valued at $20,109 this morning, which means its decline overnight is equivalent to 3 percent.

Ranking of top cryptocurrencies as of today

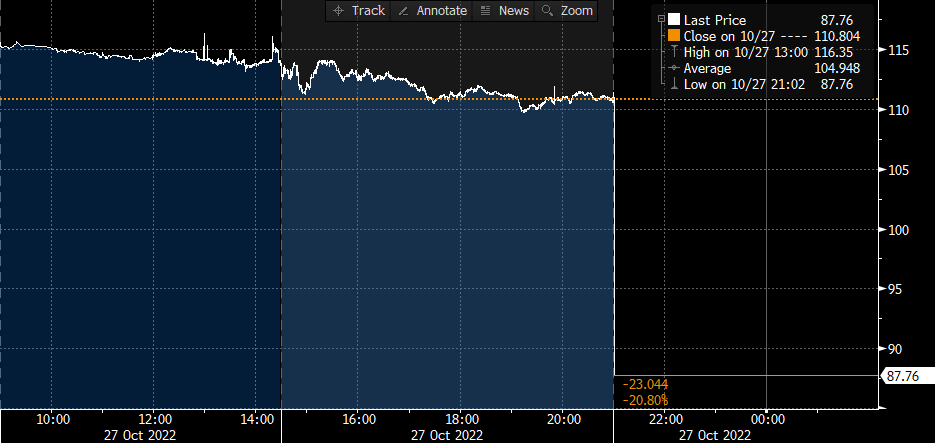

This is quite a good result considering what is happening in the market. The fact is that Amazon reported weaker financial results for its AWS division tonight, and also shared a poor outlook for the fourth quarter. As a result, the giant’s shares sank 20 per cent in the moment.

Amazon’s share price plunge

The company is valued at $1.1 trillion, so such a collapse is a serious event. And cryptocurrencies have shown quite a bit of resilience in such circumstances.

Why are bitcoins being withdrawn from exchanges?

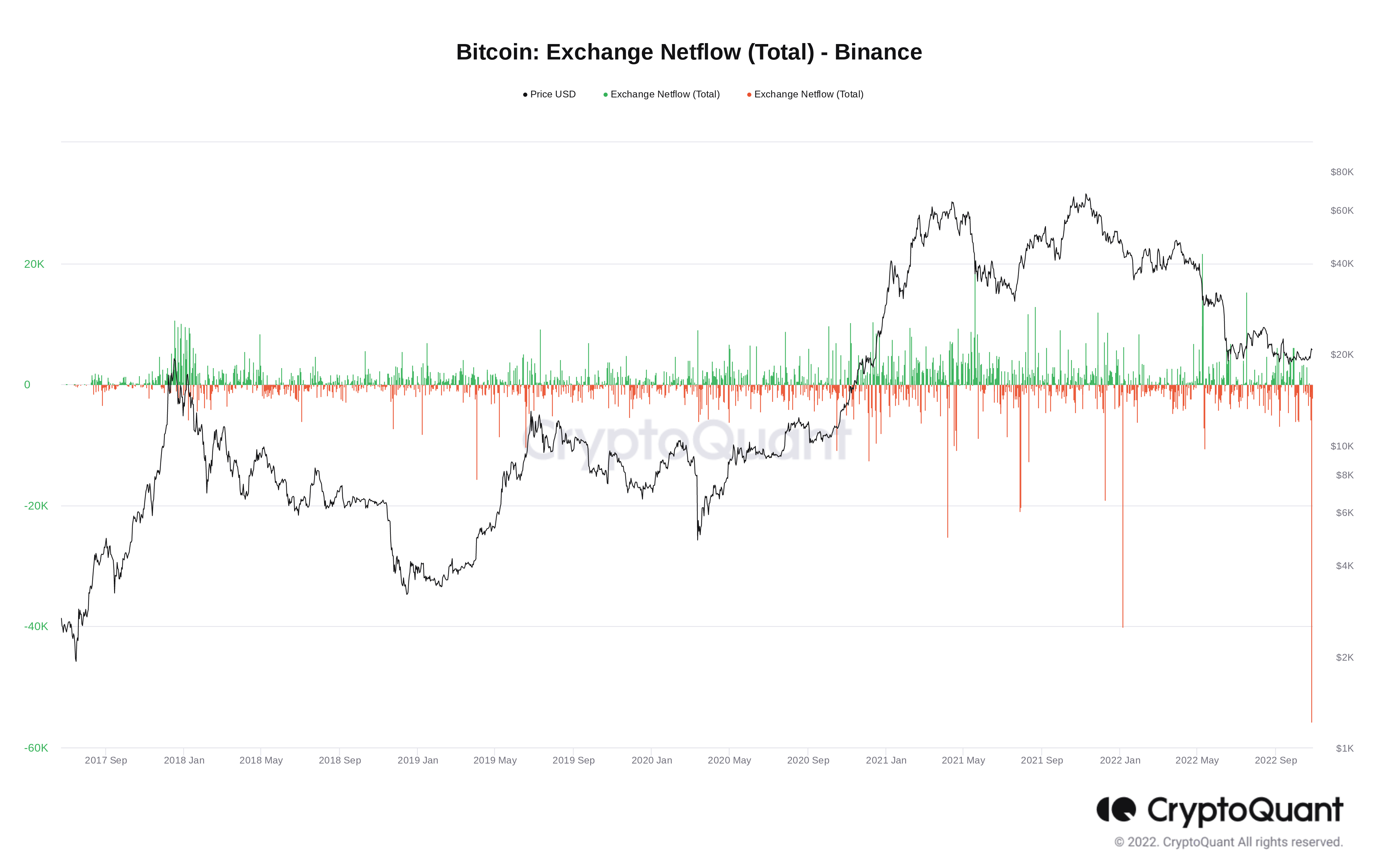

The chart below shows the history of coin outflows and inflows on Binance over time. As a result, the massive withdrawal of crypto on October 26 broke all records in terms of both bitcoin outflows and inflows.

BTC outflows/inflows on Binance

CryptoQuant analyst under the nickname BinhDang commented on what is happening. Here is his rejoinder in which the expert shares his view of the situation. The quote is quoted by Cointelegraph.

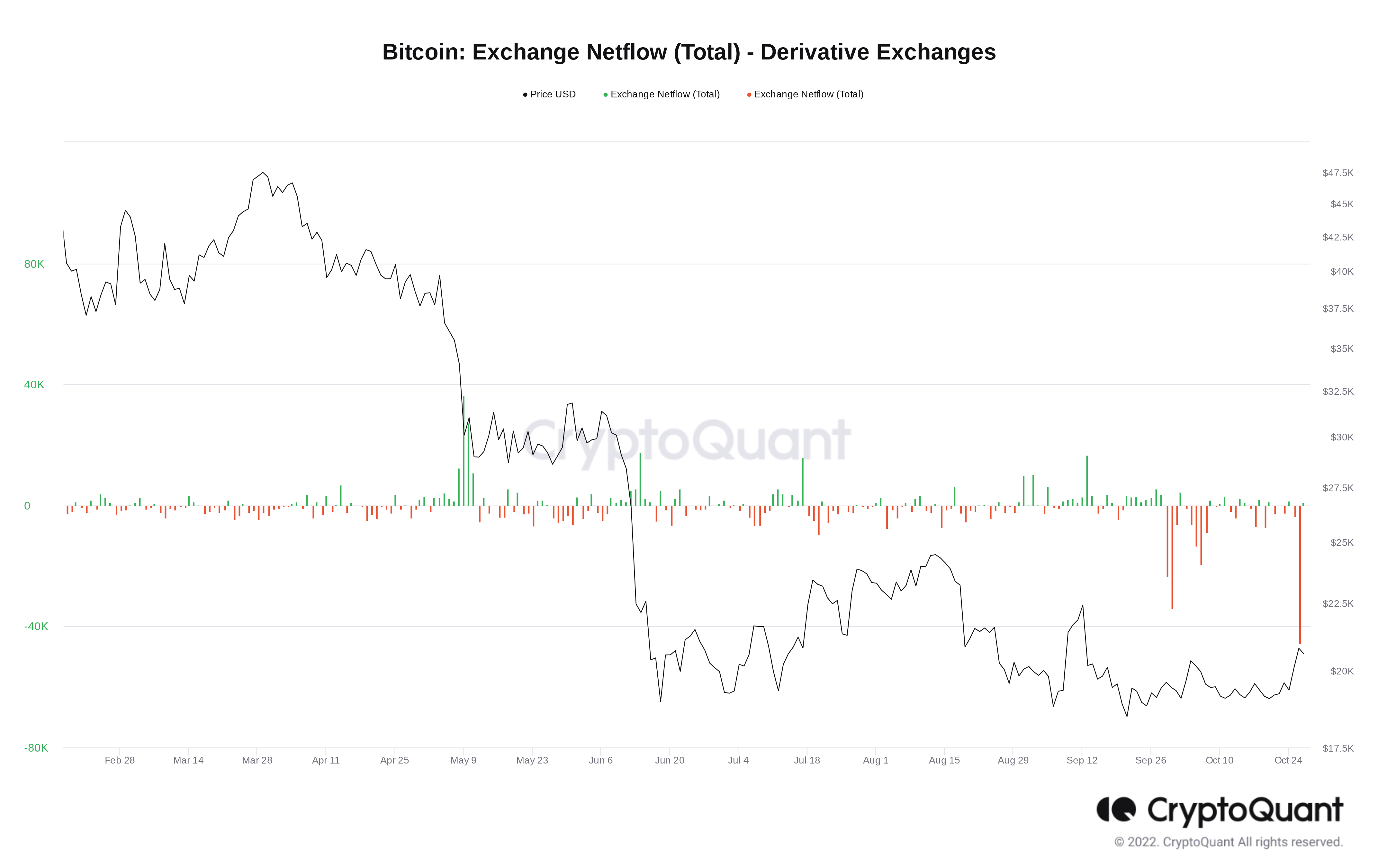

Yesterday a record was set for the volume of coins withdrawn from the Binance derivatives exchange: 71,579 BTC. This number comes in line with the volume of 94,024 BTC withdrawn from all derivatives exchanges over the same period. This is the highest figure since July. What has happened has helped sharply reduce overall reserves on derivatives exchanges after their rise since May this year.

The expert added that usually mass crypto outflows are associated with reduced pressure on the market from sellers. That is, they are trivializing cryptocurrencies for long-term storage and usually have no plans to return the coins to the trading floor anytime soon.

While there is not yet enough confirmation that Bitcoin has bottomed out, when comparing it to the same market in late 2018, we can see the difference. In the strongest price falls in the two years to 2020 and in 2021, each collapse in the volume of reserves was accompanied by a reduction in pressure on the market. How about this time?

BTC outflows/inflows to derivatives exchanges

BTC outflows from an exchange should really be associated with a drop in sellers’ activity. That makes sense – the less bitcoins there are on an exchange, the less you can sell quickly. Conversely, if exchanges’ reserves rise markedly, one should prepare for a collapse in Bitcoin’s value.

😈 YOU CAN FIND MORE INTERESTING INFORMATION ON US AT YANDEX.ZEN!

That said, the positive movement of funds in the ecosystem could be overshadowed by another piece of negative news. The largest publicly traded Bitcoin miner called Core Scientific announced the day before that it is likely to go bankrupt as early as this year. The severe collapse in the Bitcoin price has put unprecedented pressure on its business and depleted cash resources, which could run out in the next two months. Rising power costs and a legal battle with Celsius Networks LLC are also having an impact.

In a statement to shareholders, company representatives said they are exploring a number of options to resolve the situation. That said, Core Scientific will not be paying its creditors in late October and early November, while the payment includes cryptocurrency mining equipment. Here’s the relevant rejoinder.

Given the uncertainty surrounding the company’s financial condition, there are significant doubts about its ability to continue operating for a reasonable period of time.

Core Scientific now has 24 BTC and $26.6 million in cash at its disposal. And while the amount looks serious, the company's debts could also be substantial. As analysts point out, Core management got rid of $7,202 BTC worth $167 million, meaning it sold coins for an average of $23,000 each. Apparently, most of that amount is already gone.

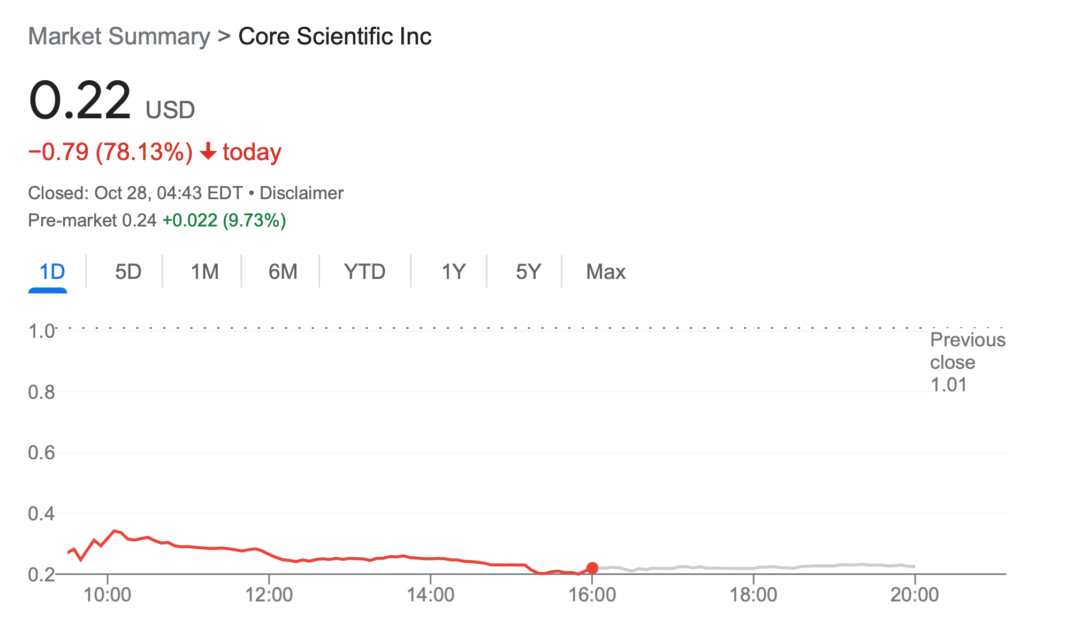

The company’s shares on the Nasdaq are down 78 per cent in just one day.

Core Scientific’s stock price overnight

According to court documents from earlier this month, bankrupt cryptocurrency platform Celsius owes Core Scienific millions of dollars for unpaid electricity rates. The mining company noted in a court filing that it is losing about $53,000 a day to cover what Celsius refuses to pay.

Exactly how and with what funds Core Scientific expects to close all issues with its creditors is not yet clear. According to Decrypt, the company had 24 BTC, or just under $495,000 at today’s exchange rate, and about $26.6 million in cash as of Wednesday. At the same time, the company had 1,051 BTC or $21.6 million and $29.5 million in cash on reserve as recently as September 30.

Many cryptocurrency companies that are now failing in business are closely tied to the current bankrupts, and Celsius’ debt to Core Scientific is a prime example of this. This provokes a kind of domino effect, which means bankruptcies of other major cryptocurrencies are likely to happen in the future.

We believe that this trend shows the enormous potential of cryptocurrencies and investors' faith in them. Today, shares of the world's largest corporations are losing dozens of percent a day, while Bitcoin and other coins manage to show good growth even in such conditions. Of course, this trend will be noticed by the owners of capital, which will certainly arouse their interest.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important developments in the blockchain world.