A string of US reports and the prospect of a collapse: what to expect from Bitcoin this week?

Every Monday is becoming more of a Groundhog Day for crypto traders – earlier this week, Bitcoin again failed to break above the $20,000 level, and today it has fallen to the $19,000 line. There is almost no volatility in trading in the main cryptocurrency, and a similar situation is observed in trading pairs with altcoins. However, this week we have several important events that can move the market from the dead point. We tell about them in details.

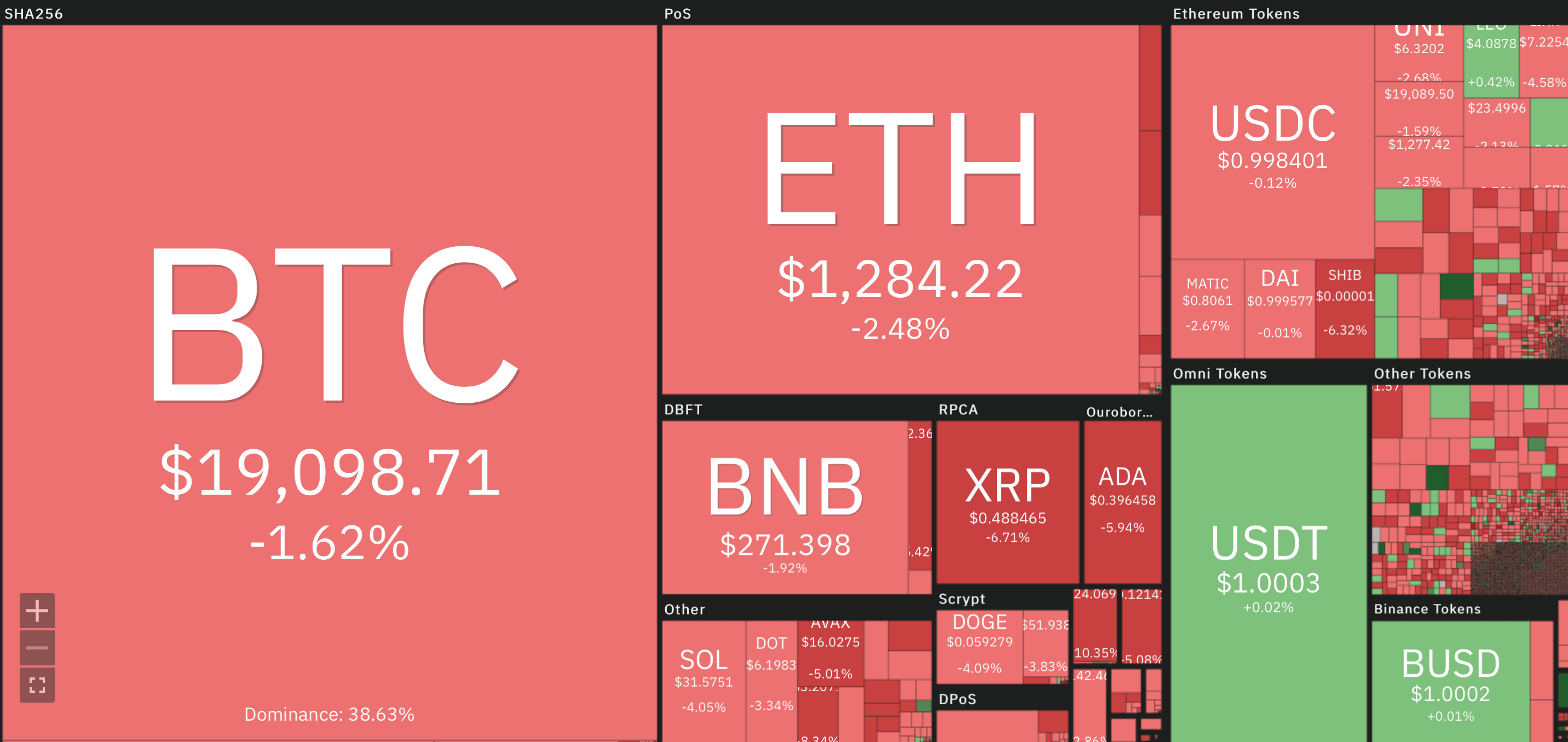

We note that the situation in the cryptocurrency market seems to be weak right now. In particular, Bitcoin is at $19,000, while Etherium has fallen below $1,300.

Cryptocurrency market situation as of this morning

XRP and ADA sagged the most on the scale of the day in the top ten coins. The magnitude of the slump was 6.2 per cent and 6 per cent respectively.

Why isn’t Bitcoin growing?

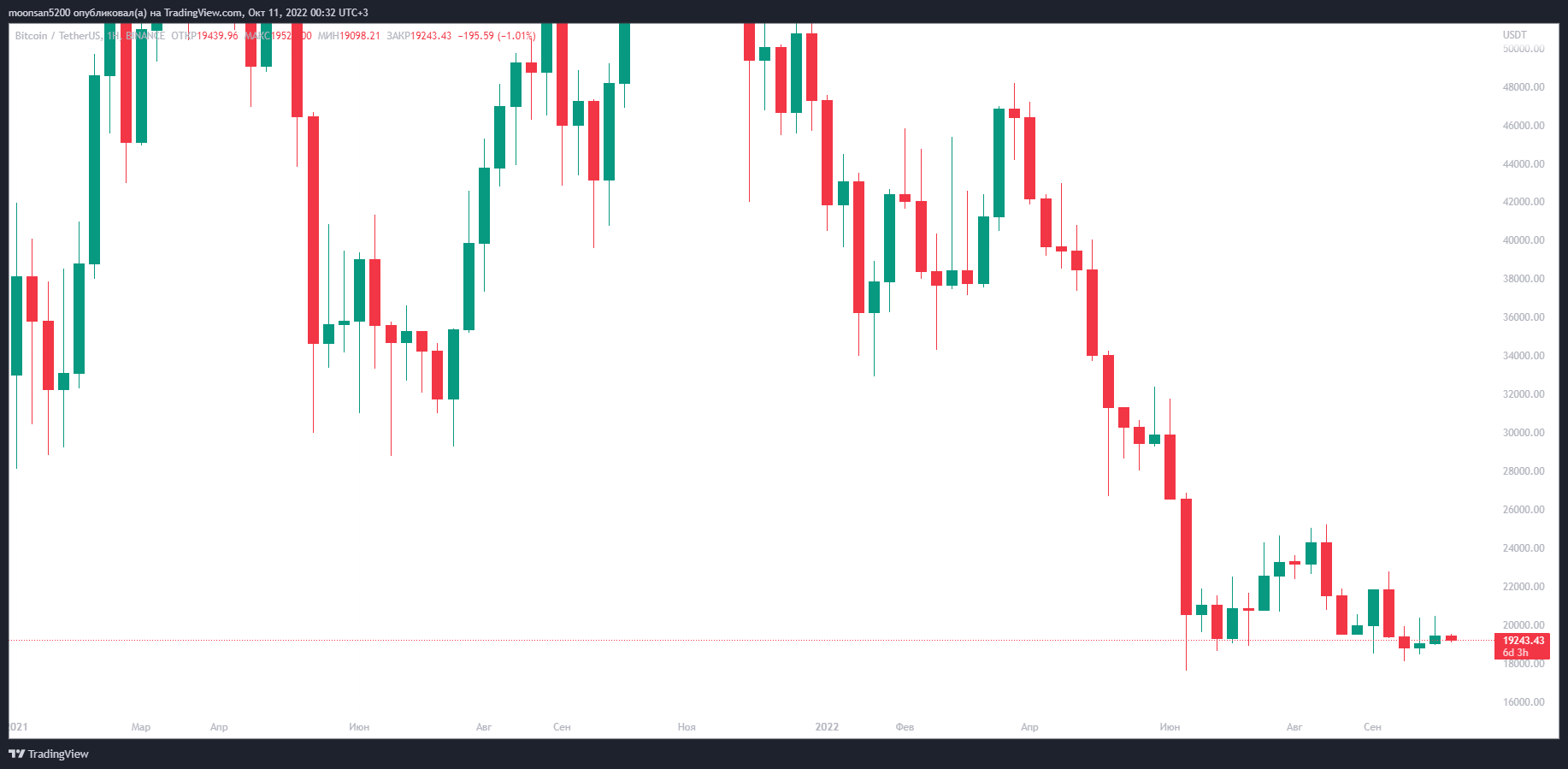

On the scale of the 1-week chart, Bitcoin continues to form its fourth candle without a noticeable body – a clear sign of a lack of volatility, i.e. any noticeable volatility in the exchange rate. The cryptocurrency closed the previous week at just above $19,400.

1-week chart of Bitcoin

Trader Jordan Lindsey on his Twitter noticed an interesting feature on the Bitcoin chart considering what’s going on.

It is very unusual to see the Bitcoin price so compressed against a backdrop of rising trading volume. A big price move up or down is coming very soon.

That is, the expert believes that such behaviour of Bitcoin and its being at roughly the same price level should end in a sharp change. Naturally, the expert does not choose the side of the movements in such economic conditions, although in the same crypto-twitter many representatives of the blockchain community are waiting for the market collapse.

Bitcoin chart on a large scale

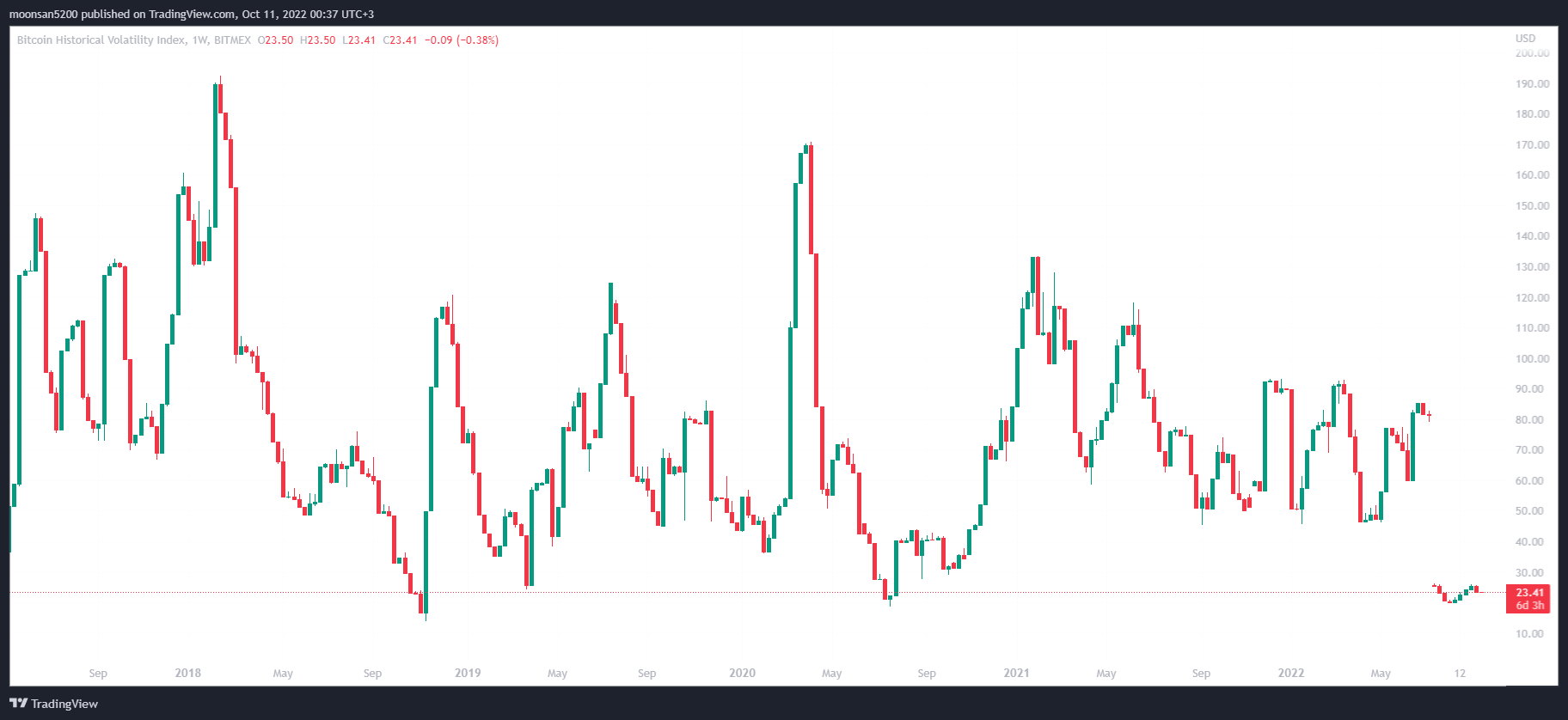

At the same time, a username under the nickname Crypto Viking posted a graph of BVOL – the historical fluctuations of Bitcoin’s volatility index. According to Cointelegraph sources, the publication received the following commentary.

BVOL has been below the 36-point level on two occasions in its history that preceded major market moves. It has now fallen below the 36 point level again. This suggests that another pullback could happen either this month or in November.

Note that such a statement does not guarantee anything and the market can behave as it sees fit. That said, analysts continue to look for similarities in the chart today and in the past, because sometimes trends repeat themselves.

The BVOL chart

That is, the volatility trend doesn’t give you a chance to predict the direction of Bitcoin’s price spurt. The only thing that is known is the fact that this leap will happen soon. This means that traders need to be prepared for both bearish and bullish developments.

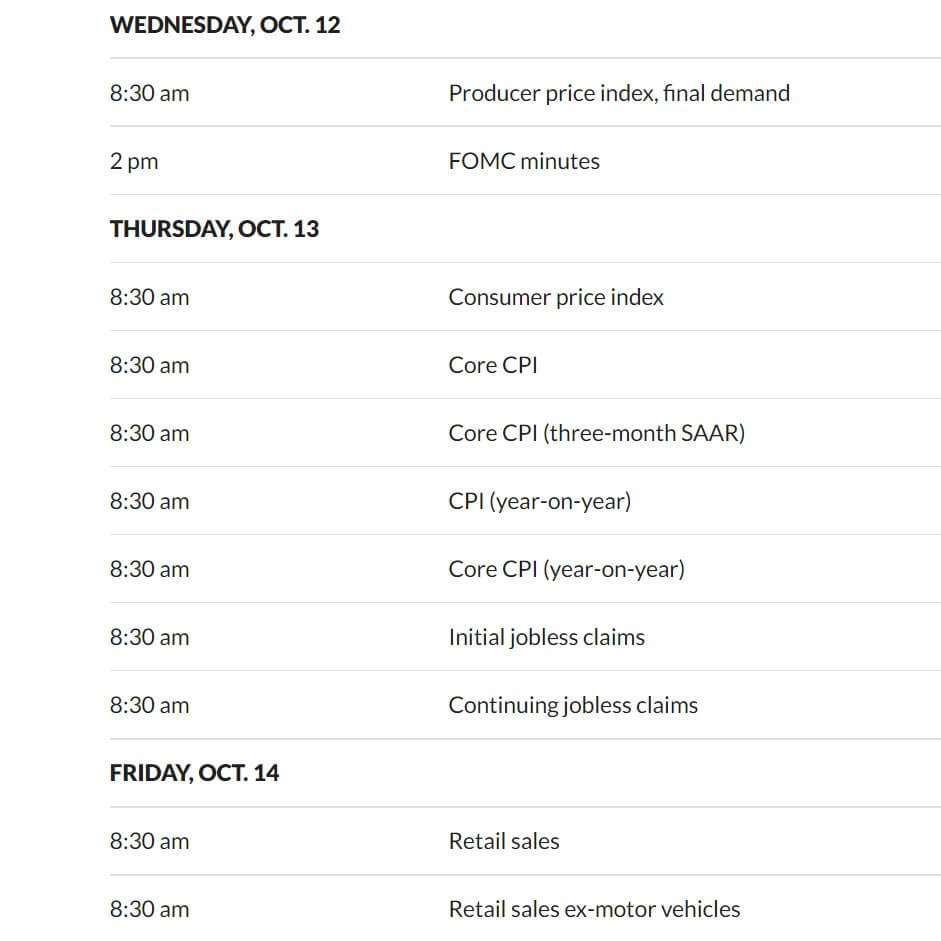

Reporting season in the USA

On October 12 a real “harvest” of important financials will start to take place in the USA. Some of them are industrial inflation (PPI), consumer inflation (CPI), FOMC meeting minutes, unemployment and retail sales. There are more than enough numbers to cause serious turbulence in traditional markets – and the digital asset world at the same time.

Important events for the economy in the US this week

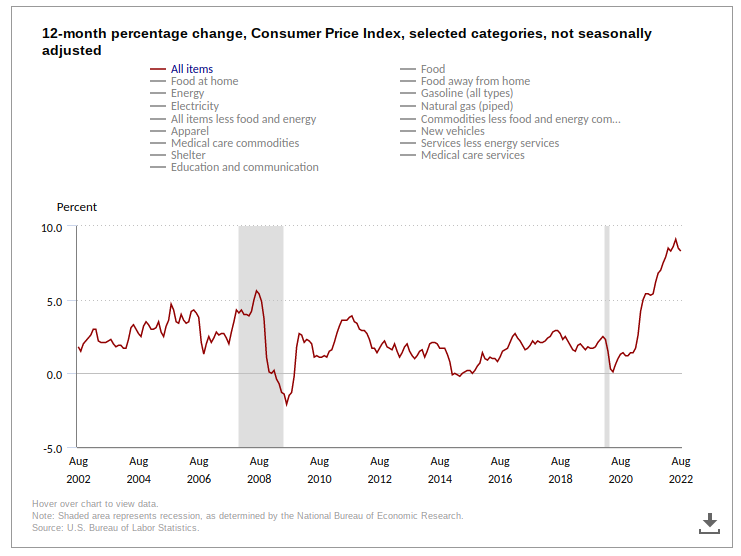

According to William Clemente, co-founder of research firm Reflexivity Research, the CPI index is of particular interest to crypto enthusiasts. It is referred to by the US Federal Reserve when announcing a new lending rate hike. If consumer inflation is higher than expected this time, the Fed may also raise the rate above experts’ expectations, which will traditionally lead to a short-term collapse of markets.

US consumer inflation data

It should be noted that there is some relatively good news in the market forecasts. In particular, yesterday Goldman Sachs analysts said that they expect the Fed representatives to increase key rate by 75 basis points in November. However, already in December and February the increase could be 50 and 25 basis points respectively – which would mean a weakening effect on the economy.

When will Bitcoin bottom out?

Charles Edwards, CEO of investment firm Capriole, said on Twitter that Bitcoin has entered a 90-day period window during which a cryptocurrency bottom should form. This is about the length of time since the global decline began that the coin has bottomed in the previous two bearish cycles.

Time it took BTC to reach the bottom in each cycle

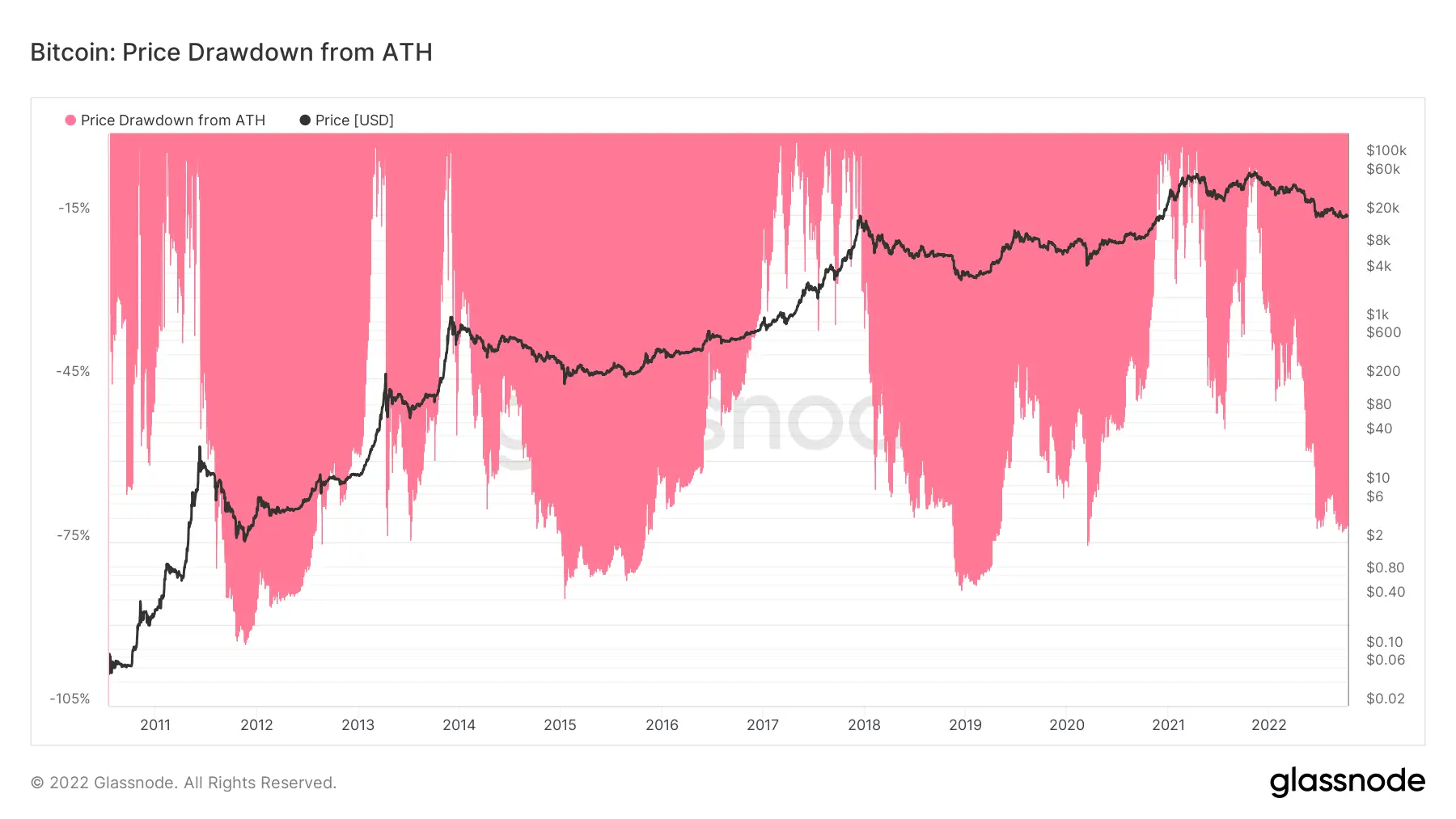

However, in terms of deviation from its all-time high, Bitcoin still has room to fall. BTC’s collapse as a percentage of its peak is clearly shown in the chart below.

BTC’s fall as a percentage of its all-time high

Considering what’s happening, experts say that even the line of $17,600, to which Bitcoin fell in July, is too early to be considered a “final low” of the bearish trend. In other words, the fall is likely to continue, but will it be this week?

We believe that the upcoming reports may indeed cause panic among cryptocurrency holders. In addition, analysts at Goldman Sachs have already concluded that another key rate hike of 75 basis points is on the horizon, which would be the fourth such increase in the index. With that in mind, we can assume that the market has not yet priced in such expectations, which will come later.

Share your opinion in our millionaires’ cryptochat. There we discuss other important developments in the world of blockchain and decentralisation.