Analysts note Bitcoin’s low volatility. What does this mean for the cryptocurrency’s near-term prospects?

This week started with uncertainty for Bitcoin, as the major cryptocurrency continued to balance just below the $19K level amid a dire macro environment, which is worsened by geopolitical issues, the energy crisis in Europe and the US Federal Reserve’s constant key rate hikes. And although today BTC among other things was jumping above 20 thousand, it’s too early to talk about any trend reversal. Then, what to expect from BTC in the next few days?

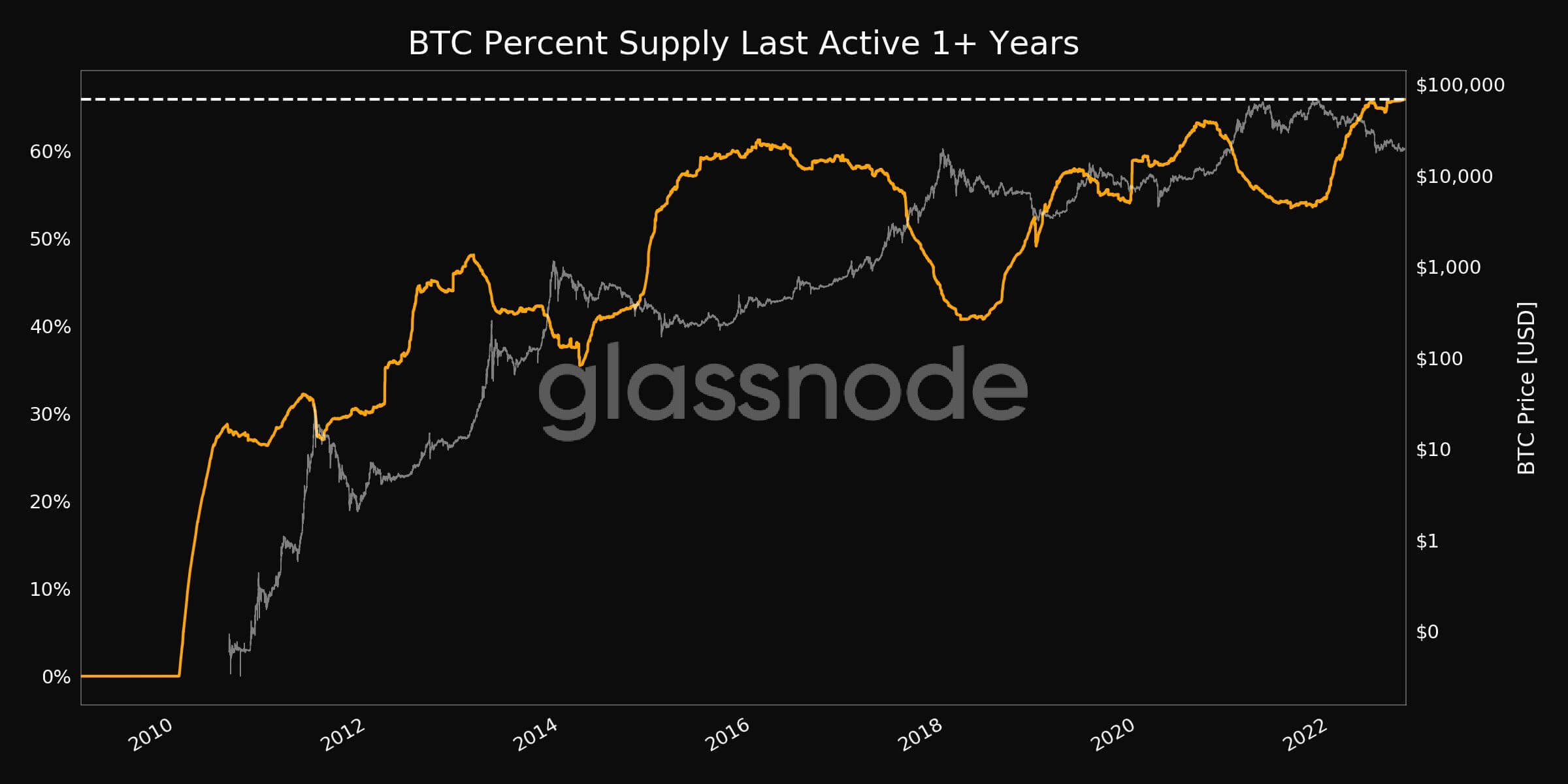

It should be noted that in case of Bitcoin right now, there are some curious changes in fundamentals. In particular, today set a record for the volume of BTC that has not moved from its wallets for at least a year. According to analysts at Glassnode, we are talking about 65.92 percent of all bitcoins in circulation.

Volume of bitcoins that have not been active for a year

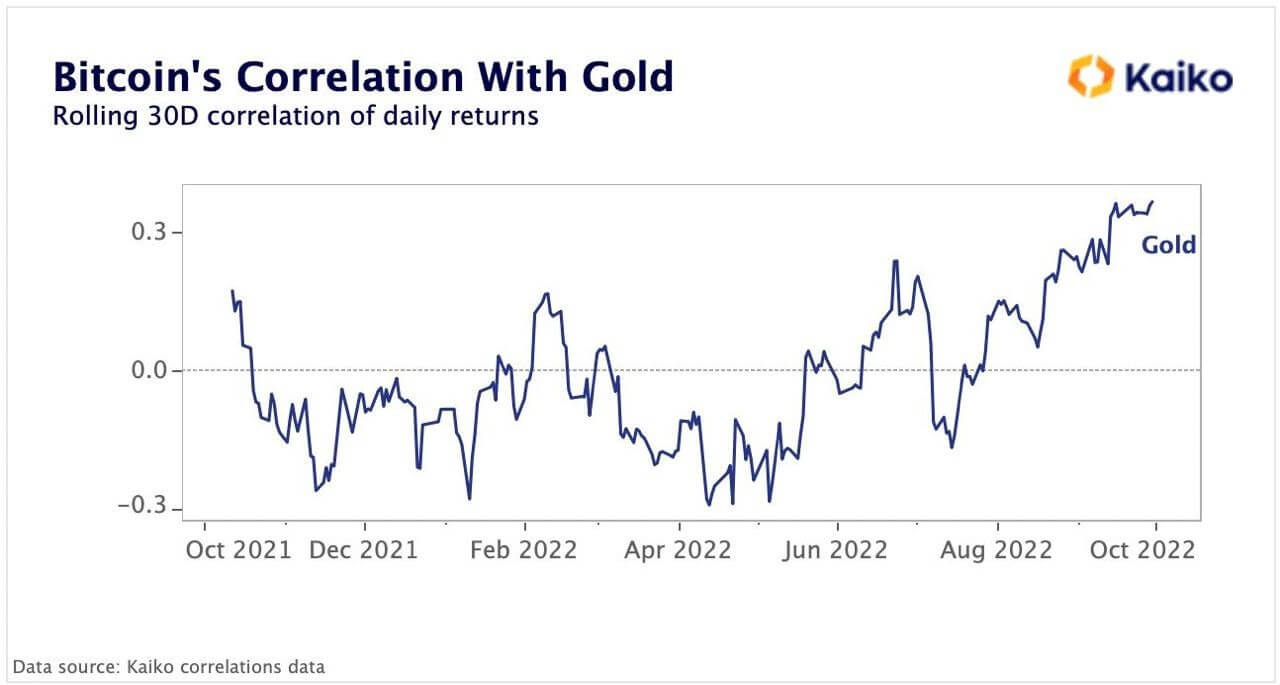

At the same time, the correlation between the price of BTC and the value of gold – that is, the correlation of these indicators – has reached a maximum for the year. This means that the said assets are very similar in their rate changes.

Bitcoin and gold correlation

What will happen to Bitcoin’s exchange rate?

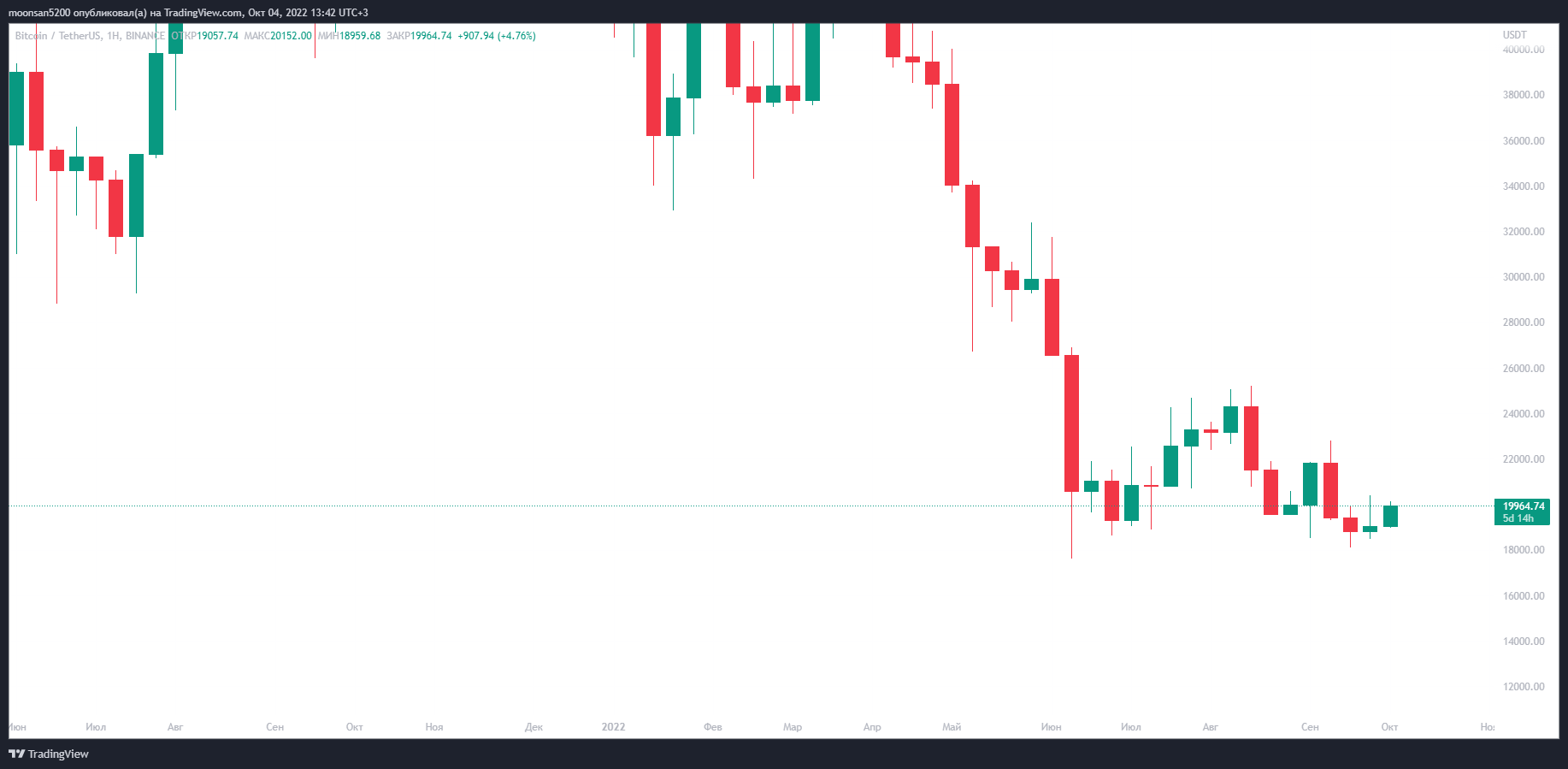

Despite a tough market, BTC was able to close the previous candle on the scale of the 1-week chart almost $250 above the cryptocurrency’s low of the past two years. However, many traders are wary that the situation could still worsen in the foreseeable future.

Bitcoin’s 1-week chart

Here’s what a popular cryptocurrency enthusiast under the nickname Crypto Tony wrote on Twitter about it.

The bears maintained their strength last night during the Asian session, while the bulls failed to give us any good rally to open long positions.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.DEN!

In general, many agree that Bitcoin is now in a low volatility zone, meaning that its exchange rate appears to be fairly stable. Sooner or later, such situations on the chart lead to a sharp movement of the asset’s price in one direction – up or down. The trader Doctor Profit believes that the first scenario is the most probable. Here is his commentary on this.

Don’t share the skin of an unkilled bear. The weekly chart of Bitcoin shows a serious increase in trading volume since the start of the third quarter of this year, plus there is a bullish divergence on one of the most reliable scales. Bitcoin’s price rise is just a matter of time.

Doctor Profit forecast

But a crypto-enthusiast under a pseudonym il Capo of Crypto is more pessimistic – over the weekend he published a chart that predicts a Bitcoin sinking to the area from 14 to 16 thousand dollars. And this level was called the main target, i.e. the hypothetical absolute bottom in this cycle of market collapse.

Forecast il Capo of Crypto

In other words, traders assess what is happening in the market in their own way. What they do agree on, though, is that such stability in the coin industry should be followed by a sharp surge in value in some direction. That said, these versions are just a possibility for the market to develop further, so they should be treated accordingly and investment decisions should be made on their own.

What is happening with Credit Suisse

In addition to the crypto market, investors’ attention is focused on the fate of the world’s largest banks, represented by Credit Suisse and Deutsche Bank. Concerns over liquidity have led to urgent public assurances from Credit Suisse CEO Thomas Gottstein that the bank is doing well financially.

According to Cointelegraph sources, the banking collapse is a sore subject for many. And it was the global financial crisis and government bailout of lenders in 2008 that prompted the creation of Bitcoin amid the problems in the economy at the time. With history almost repeating itself nearly 15 years later, Credit Suisse’s problems are causing notable turmoil in the traditional markets on which Bitcoin depends.

However, according to JAN3 CEO Samson Mouw, Bitcoin can survive these tough times as well.

Bitcoin’s price has already been pushed back to lows, well below its 200-week moving average line. We have already witnessed the collapse of major crypto projects. BTC is being shorted en masse as a hedge. Even if Credit Suisse and Deutsche Bank collapse and trigger a financial crisis, crypto cannot fall much lower.

The meta-universe and the real world

However, the problems with the big banks should hardly be written off after all. The macroeconomic situation is already tough, which means another hit from the banking sector could send the Bitcoin price in search of a new bottom.

Current Bitcoin mining profitability

Meanwhile, the profitability of BTC mining by miners is on the verge of falling to its all-time low. It’s all about rising hash rates, i.e. the total processing power in the network. While the price of BTC remains relatively stable, the hash rate is growing, which means miners’ profits are shrinking in the face of more difficult mining.

Return on 1 terahesh of power for miners

According to analysts, in such a situation we should not exclude the prospect of another round of capitulation of miners – due to low profitability they will be forced to sell their coins en masse again and stop mining. Recall that in September alone, miners withdrew more than 8,500 BTC to exchanges.

We believe that the bearish trend in the cryptocurrency market has managed to show its power, given the 70-90 per cent drop in most coins. However, the situation in the global economy and the world at large is now too difficult to predict the outlook for coins - both in the short and long term. Therefore, cryptocurrency investors who believe in the future of the blockchain industry and their chosen projects are left to develop a plan and stick to it, while being prepared to wait a year or two. At least such a strategy has worked before.

What do you think about it? Share your opinion in our Millionaires Crypto Chat, where we discuss what’s happening in the niche.