Bitcoin has some important developments ahead this week. How will the cryptocurrency price react to them?

In this market cycle, Bitcoin continues to break known patterns formed around it by investors. For example, October has traditionally been considered one of the best months for the major cryptocurrency in terms of returns. However, now the last week of the month has already started, and the price of BTC still continues to walk in a narrow channel below the $20,000 level. Will Bitcoin be able to distinguish itself in the coming days at least? Let’s take a look at the key factors in trading at the moment and in the near future.

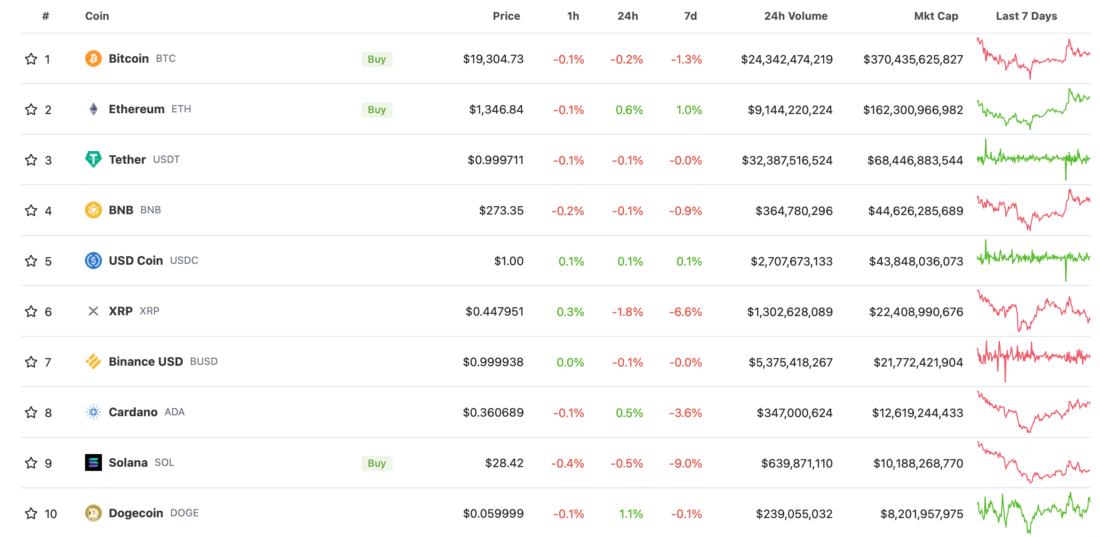

It should be noted that cryptocurrency market started this week with relative stability. In particular, over the past 24 hours, the value of the top coins by market capitalization has remained almost unchanged, and Bitcoin is still above $19,000. Here is the market situation as of this morning.

Cryptocurrency market situation today

The stability of digital assets has caused buyers to continue to add to their own holdings of coins over the past few months. As we found out yesterday, owners of relatively smaller capital in particular have been buying up BTC from the summer to October. You can read more about the statistics here.

When will Bitcoin start to rise

In the table below you can see Bitcoin’s returns by month since 2013. There are only three red lines in the October column, meaning the BTC price only fell in this month in 2014 and 2018. For now, we will not take this year’s results into account, as there is still a week to go until the end of this segment.

Bitcoin returns by month

The table also gives an indication of how much Bitcoin’s volatility has fallen from what has been happening in previous years: compared to October 1, today its price has fallen by just 0.61 percent. The cryptocurrency has already become more stable than a large number of popular stocks in the stock market – let’s break down its fluctuations in recent weeks.

What’s going on with Bitcoin?

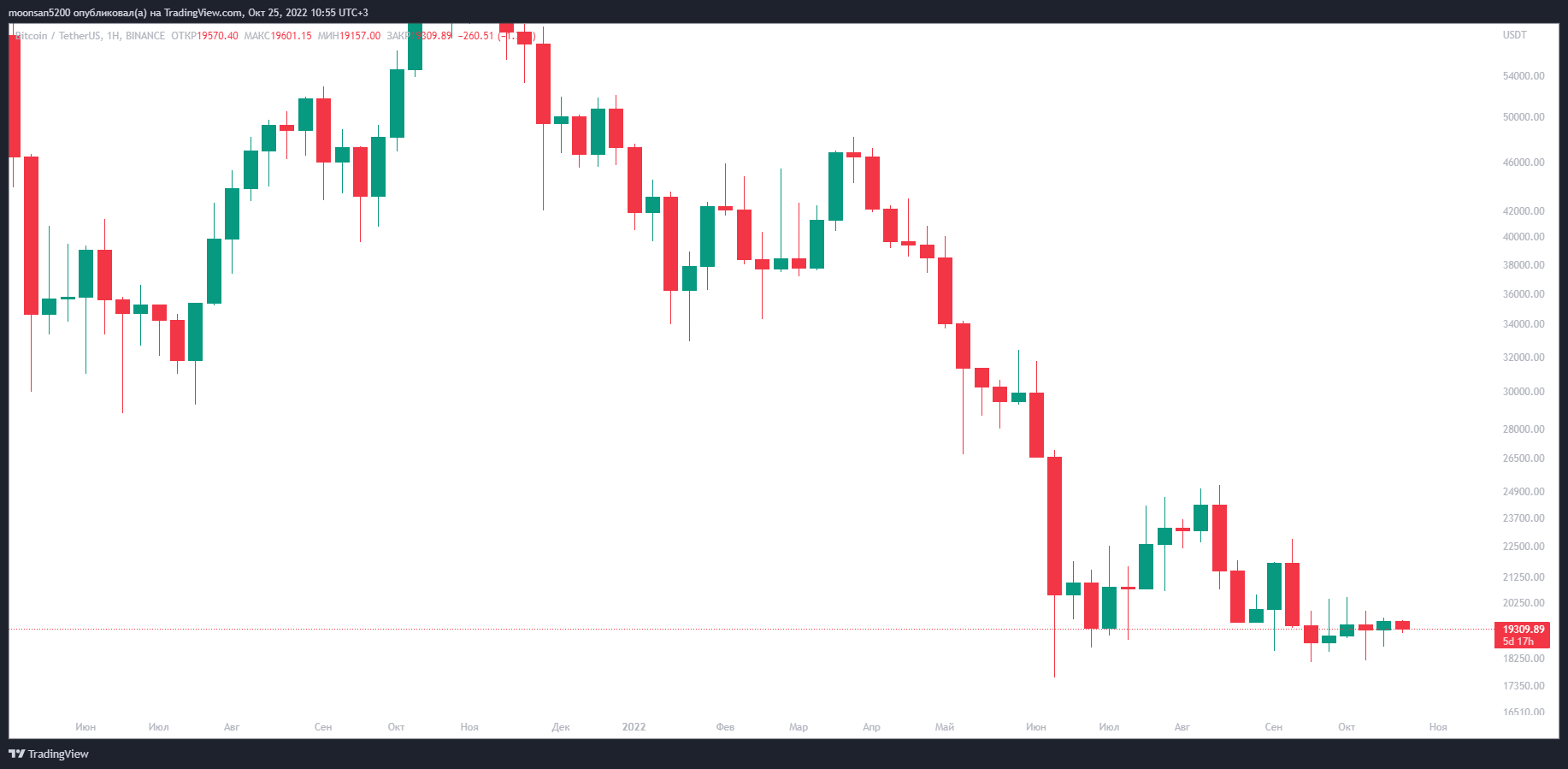

On October 23, another candle closed on Bitcoin’s 1-week chart – a record close since early September. BTC briefly reached the $19,700 line, but then quickly rolled back down. The lack of activity on the scale of the 1-week chart still looks like a series of candles with almost no bodies.

Bitcoin exchange rate on the scale of the 1-week chart

If these terms are a bit confusing, reread our material on the basics of charting in trading. There are explanations of candlesticks, their variations and so on.

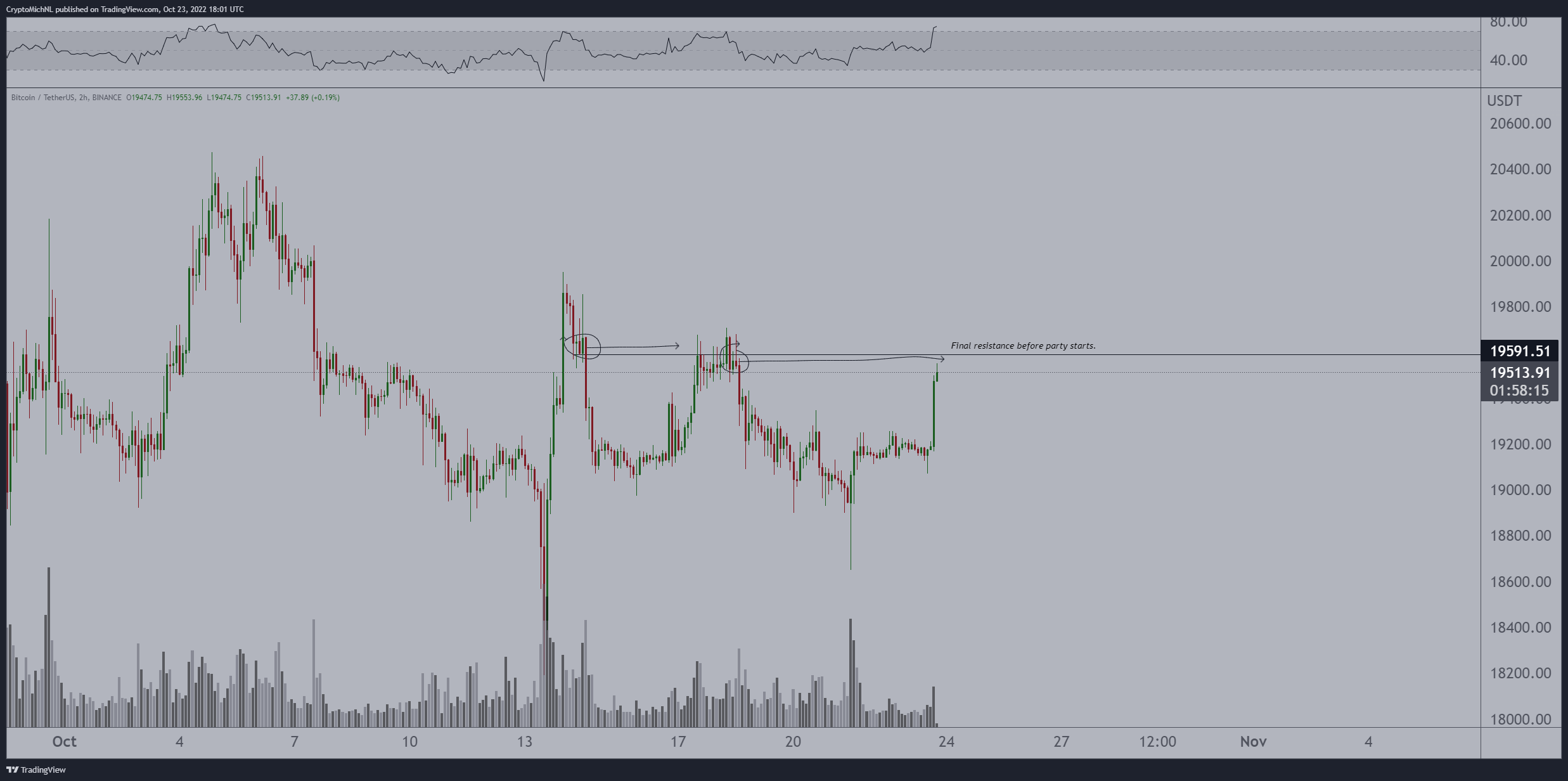

Popular crypto enthusiast and Eight leader Michael van de Poppe is confident that the period of low volatility could be coming to an end as soon as this week. Here’s a quote from his Twitter.

Bitcoin is still stuck in this channel. The coming week is rich with all sorts of events that will inevitably lead to a breakout of the lines. I am watching for the last resistance level. It needs to be broken and then the real party will begin.

It should be noted that it is not the first time that experts predict sharp changes on the BTC chart, but they still do not happen. The reason for this stance is that Bitcoin price is really stuck in a narrow price channel, which usually cannot last for too long.

Final resistance on Bitcoin’s chart to be broken before rising

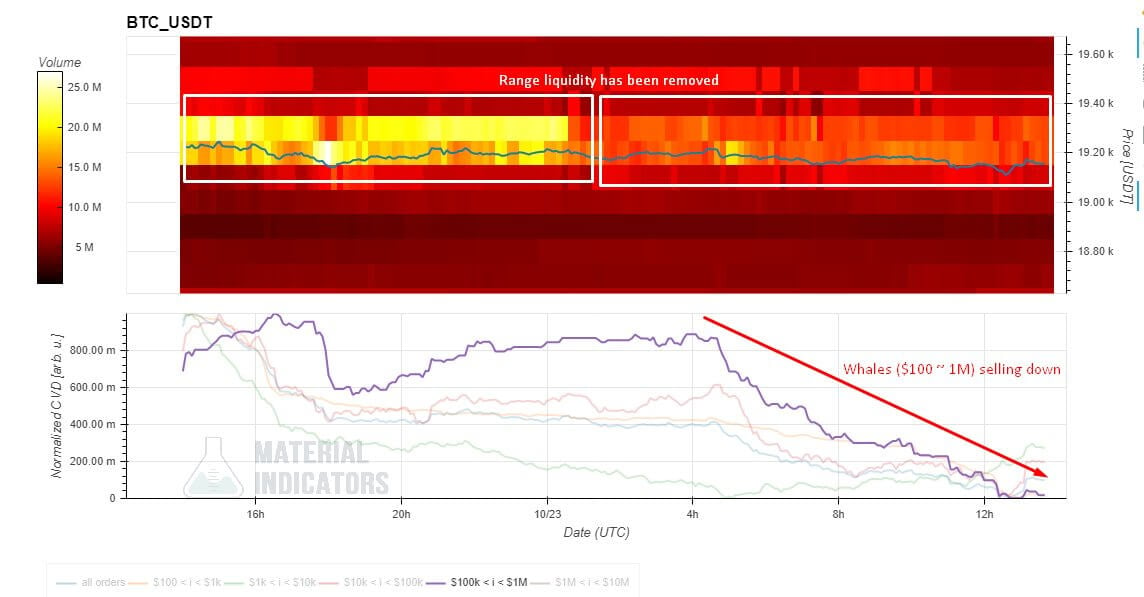

Poppe’s assumption is confirmed by a crypto analyst nicknamed Maartunn, who works with the CryptoQuant platform. He noted that “whales”, i.e. market players with large capital, are actively picking up liquidity in Bitcoin’s current trading area. In other words, they are buying coins at current prices from traders with smaller capital.

Acquiring liquidity from “whales”

In theory, a long period of low volatility almost always leads to a price explosion - the value of the asset starts either rising rapidly in a short period of time or falling. Therefore, traders need to be prepared for all possible scenarios and also consider the fundamental factors in the macroeconomy.

What is happening in the macro economy

The aforementioned promise of “significant developments” this week relates to October 28 – when the US Personal Consumption Expenditure Index (PCE) for September will be released. It is similar to the Consumer Price Index (CPI) and is an important indicator for inflation in the American economy.

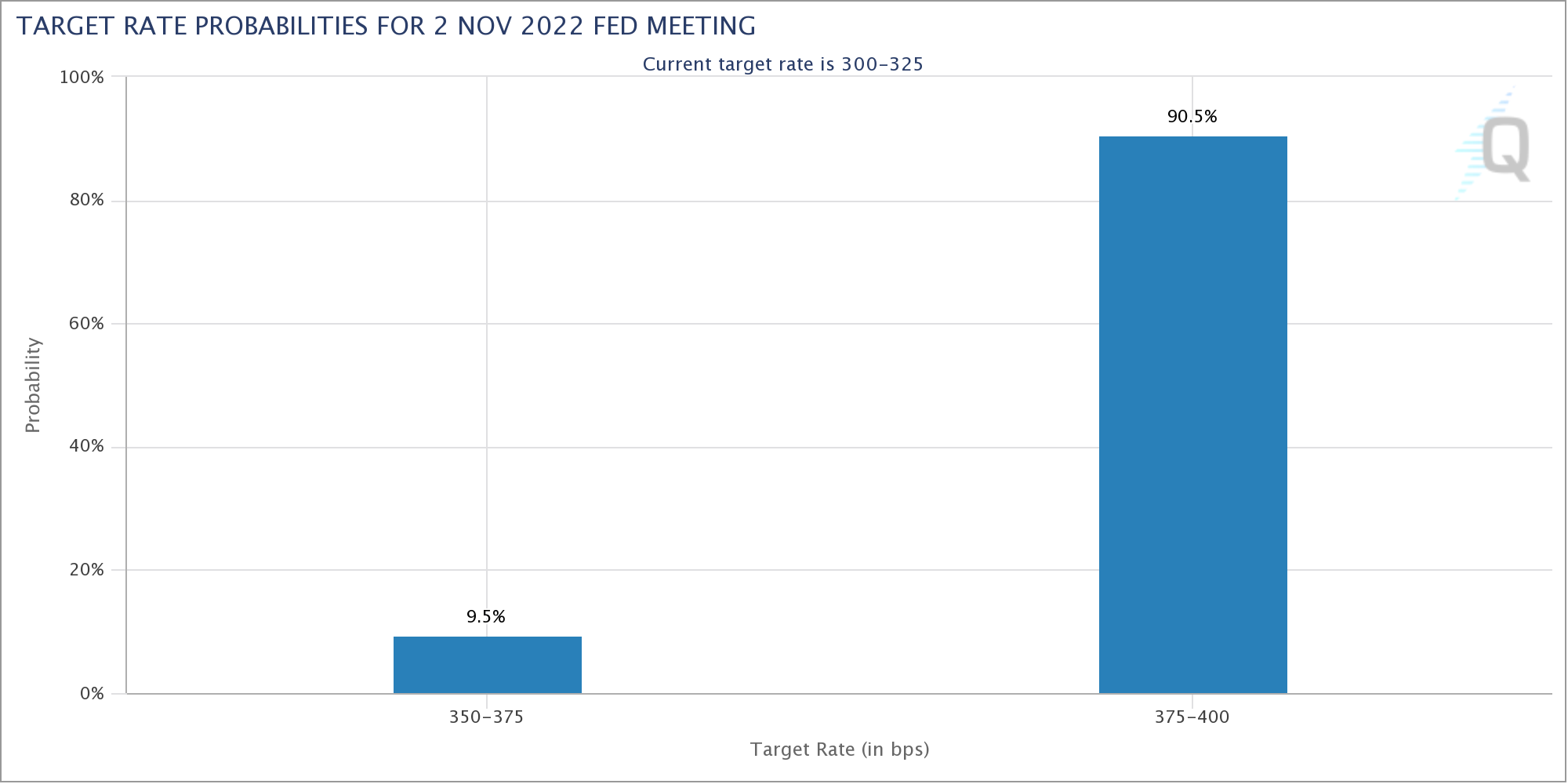

Next week, the US Federal Reserve should come to a consensus on the next base lending rate increase based on data from the PCE and CPI. Experts are now predicting a 75 basis points or 0.75 per cent rate hike, but there are also reports that the US Federal Reserve may raise the rate by a smaller value this time. This could have a positive effect on the markets and Bitcoin’s price, as essentially a rate hike of a notional 50 basis points would mean a loosening of the bankers’ grip.

Crypto-enthusiast James Bull posted his prediction on Twitter regarding the situation. He noted that Bitcoin’s bearish trend is averaging 12.5 months. We’re already at month 11 – and if at the tipping point the Fed loosens its tight inflation policies, then we can supposedly really expect a marked rise in the markets.

Bitcoin’s bullish cycles

According to Cointelegraph sources, analysts are laying down a 75 basis point rate hike in November with a 90.5 per cent probability. Perhaps positive data from the PCE will change that figure.

Predicted probability of a US Federal Reserve rate hike

There will also be important events outside the United States: the European Central Bank will hold a press conference on 27 October at which its president Christine Lagarde will give a speech. The eurozone is also currently dealing with record inflation, which in some EU countries has exceeded 20 percent a year. The ECB is, however, more liberal in its rate hike policy. Lagarde’s speech could therefore provide more clarity.

We believe that a rise in digital asset volatility would be logical after such a long period of stability. However, the current conditions in the global economy are highly unusual, which means something new could be waiting for us. Accordingly, experts' predictions may not come true, but the market is still worth watching closely. However, with cryptocurrencies now stable and fiat currency inflation, people may see coins as a store of value and start to get involved with them en masse. Whether this is the case or not, the near future will show.

And what predictions do you have for the coming weeks? Share them in our Millionaire Crypto Chat. There we will discuss other important developments from the blockchain world.