Bitcoin miners’ stocks have fallen to their lowest in twelve years. What does this tell us?

The number of bitcoins in miners’ reserves has fallen to its lowest level since February 2010. According to analysts at IntoTheBlock, this low figure has persisted for most of this year. At the same time, the lower miners’ reserves turn out to be, the more BTC they sell due to unfavourable market conditions. In some cases, there is a tendency that the number of coins sold per month exceeds the number of mined during the same period, which is also a serious indicator. We tell you more about the situation.

The decline in miners’ reserves means that they are forced to sell more cryptocurrency to get the same amount of fiat money, which usually goes to pay electricity bills and equipment rental. In Bitcoin’s case, this is not only helped by the cryptocurrency’s sagging exchange rate, but also by growing competition among miners.

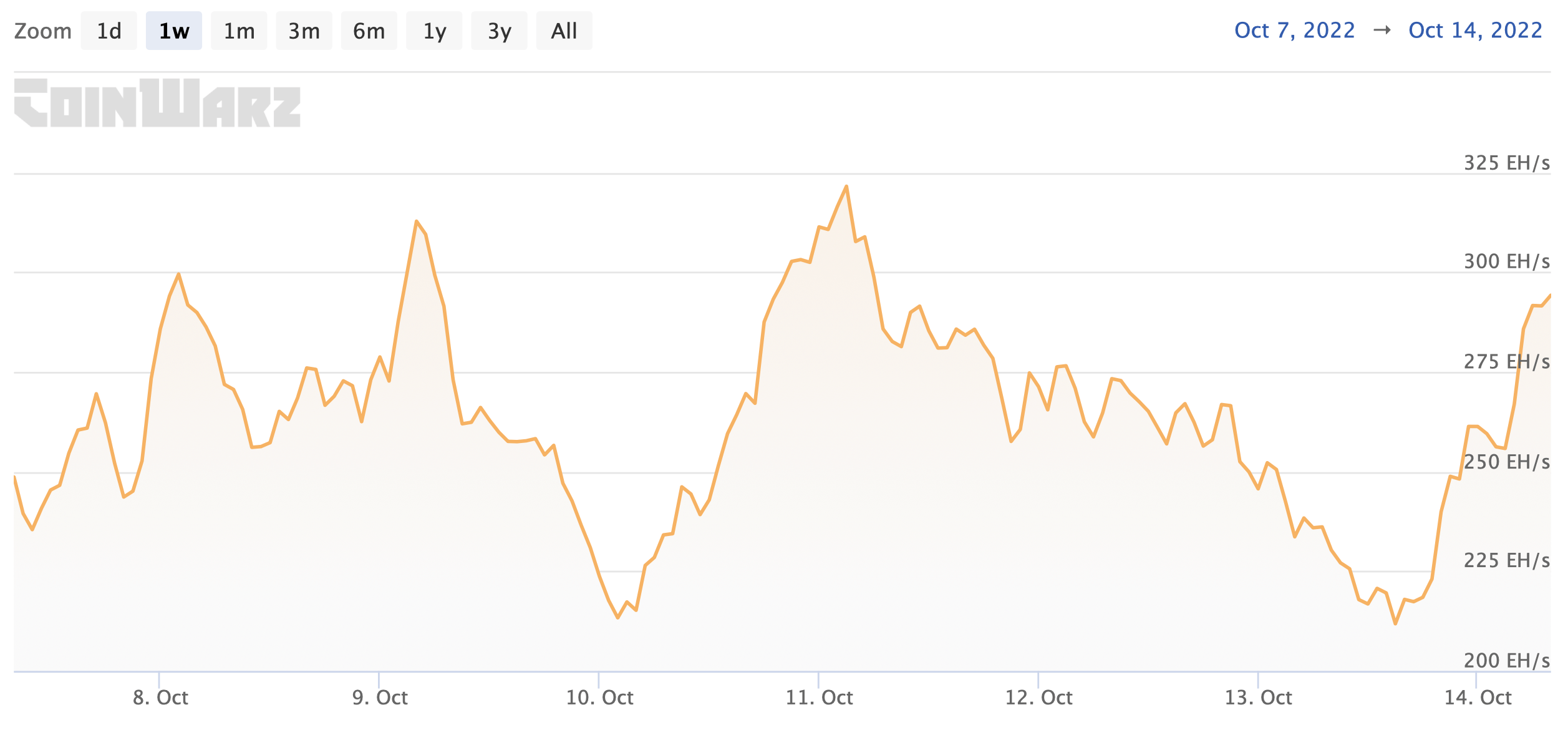

On Tuesday in particular, the BTC network’s hash rate – that is, the amount of computing equipment within the blockchain – set a new record. It stood at 321 hashes per second, which has never been done before.

Bitcoin network hash rate graph for the past week

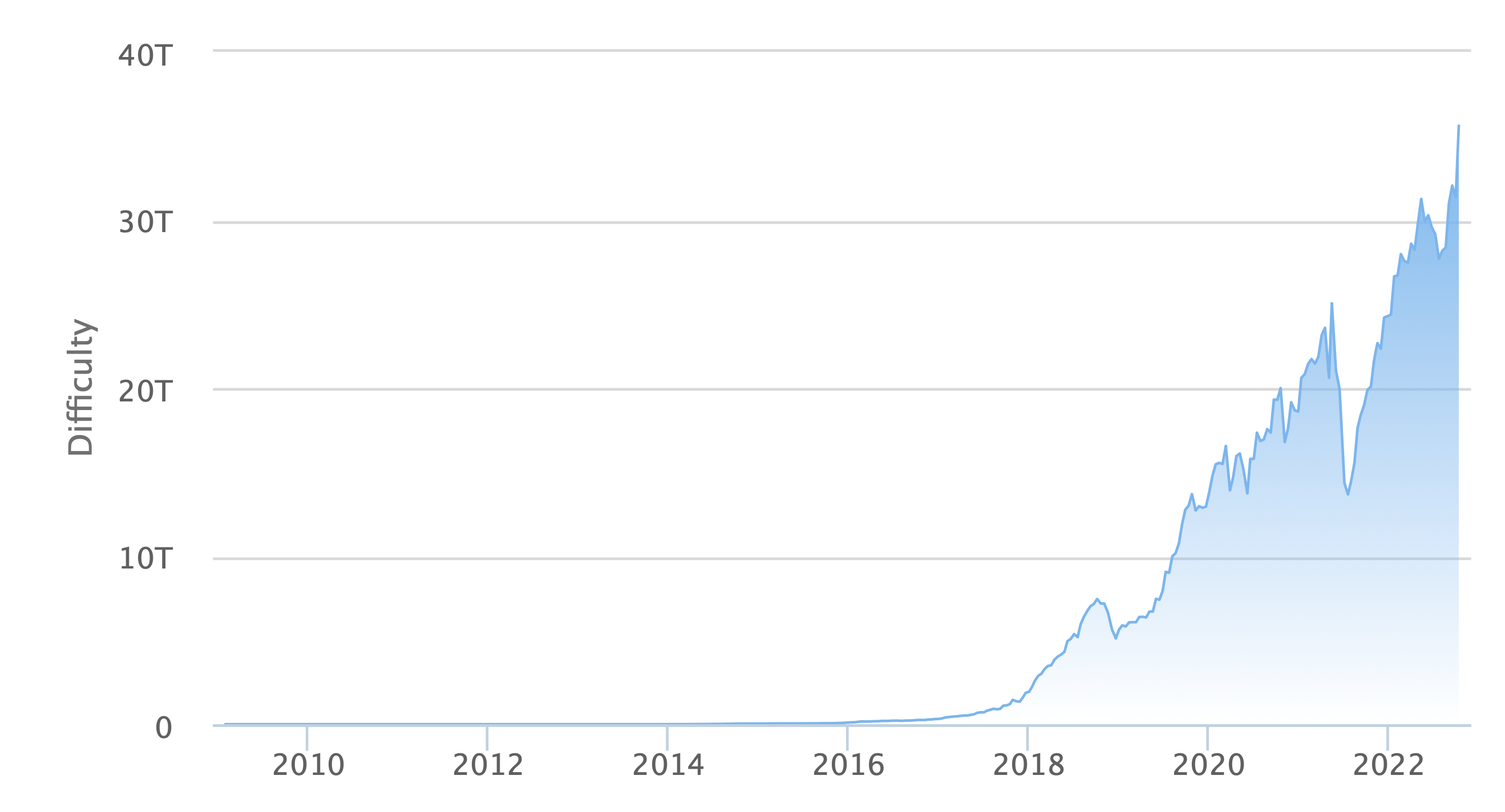

With these records in mind, Bitcoin’s mining complexity also reached a new high. This means that the same bitcoin mining equipment has never brought in so little revenue in terms of BTC.

Bitcoin mining complexity graph

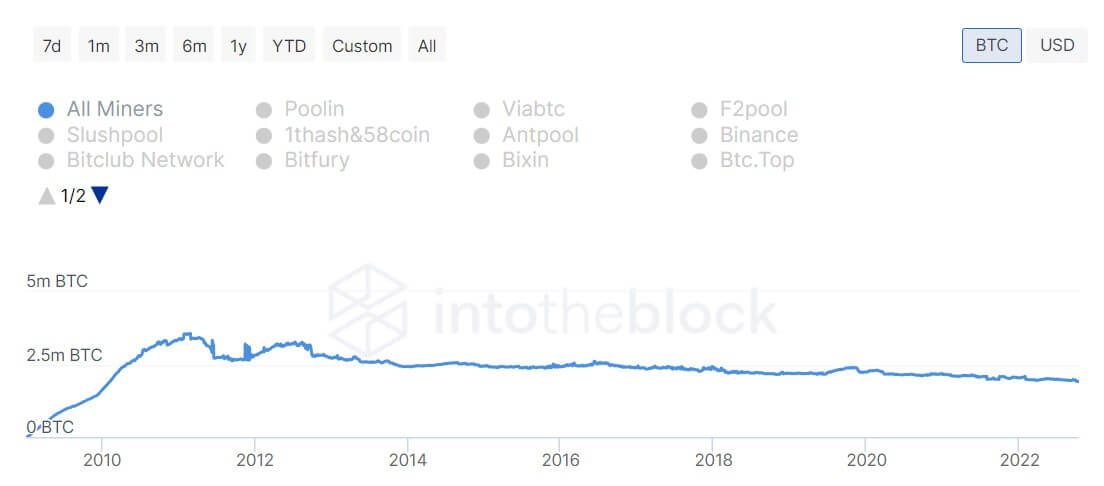

Against this backdrop, the number of BTC in miners’ inventories is decreasing markedly.

How many bitcoins miners have

Today, miners’ holdings stand at 1.91 million BTC, with only 46 days above 2 million bitcoins since the beginning of 2022. That figure was first reached back in February 2010 and has been steadily declining over several market cycles, Decrypt reports.

Reserves first dipped below 2 million BTC in July last year when the Chinese government banned mining. However, even that ban hasn’t stopped some Chinese miners from continuing their business through grey schemes, although the country itself has lost the lead in hash rate share in its territory among all regions of the world.

Miners’ reserves in BTC

IntoTheBlock analysts use a machine learning algorithm to identify miners’ wallet addresses and track their reserves. They also monitor the situation of wallets associated with miners or mining pools that accumulate BTC but do not actively mine them. The aggregate amount of bitcoins stored in all these wallets is the total reserves of the miners.

This year has been marked primarily by the bankruptcies of numerous cryptocurrency companies, including some major miners. For example, earlier, data centre provider for mining Compute North announced debts of $500 million, and large mining firm Compass Mining was forced to wind down its business in the US state of Georgia.

😈 MORE INTERESTING STUFF CAN BE FOUND ON US AT YANDEX.ZEN!

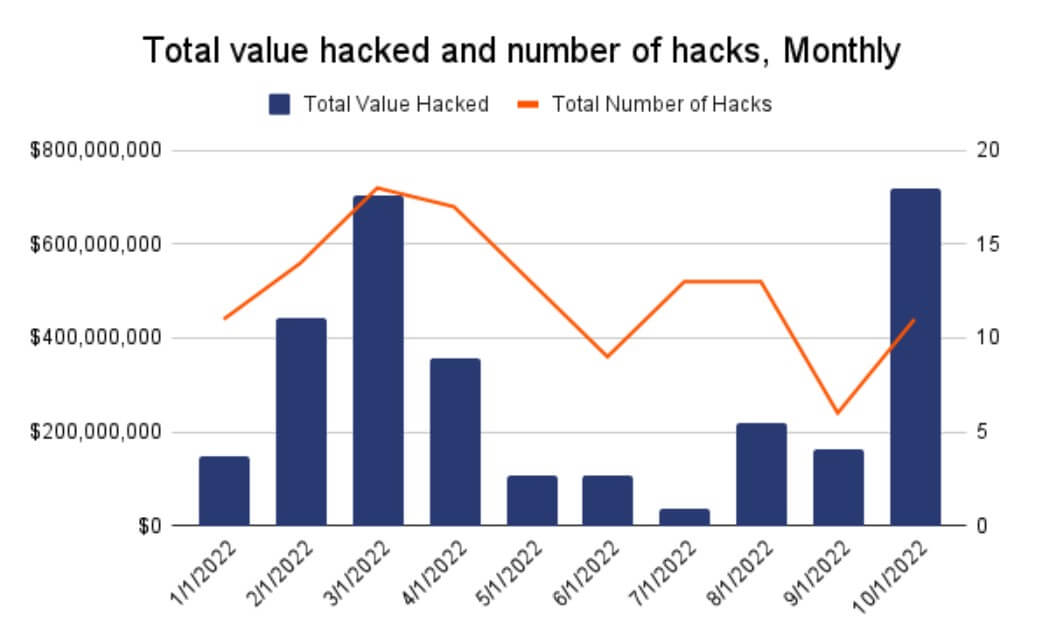

According to Cointelegraph sources, this particular month will not only be remembered for the difficulties of the miners. Analysts at the firm Chainalysis determined the day before that October is in a position to set an anti-record for the amount of losses from hacking attacks in the crypto industry. In the last two weeks alone, the figure has already reached $718 million. There have been 11 major hacks of decentralised protocols in 14 days.

On October 11, there were four hacking attacks with a loss of about $122 million. Hackers stole the equivalent of $200,000 in crypto from the Rabby Wallet cryptocurrency, $1.89 million from the QANplatform blockchain bridge, $2 million from TempleDAO and $118 million from the Mango Markets platform.

Hacking losses by year

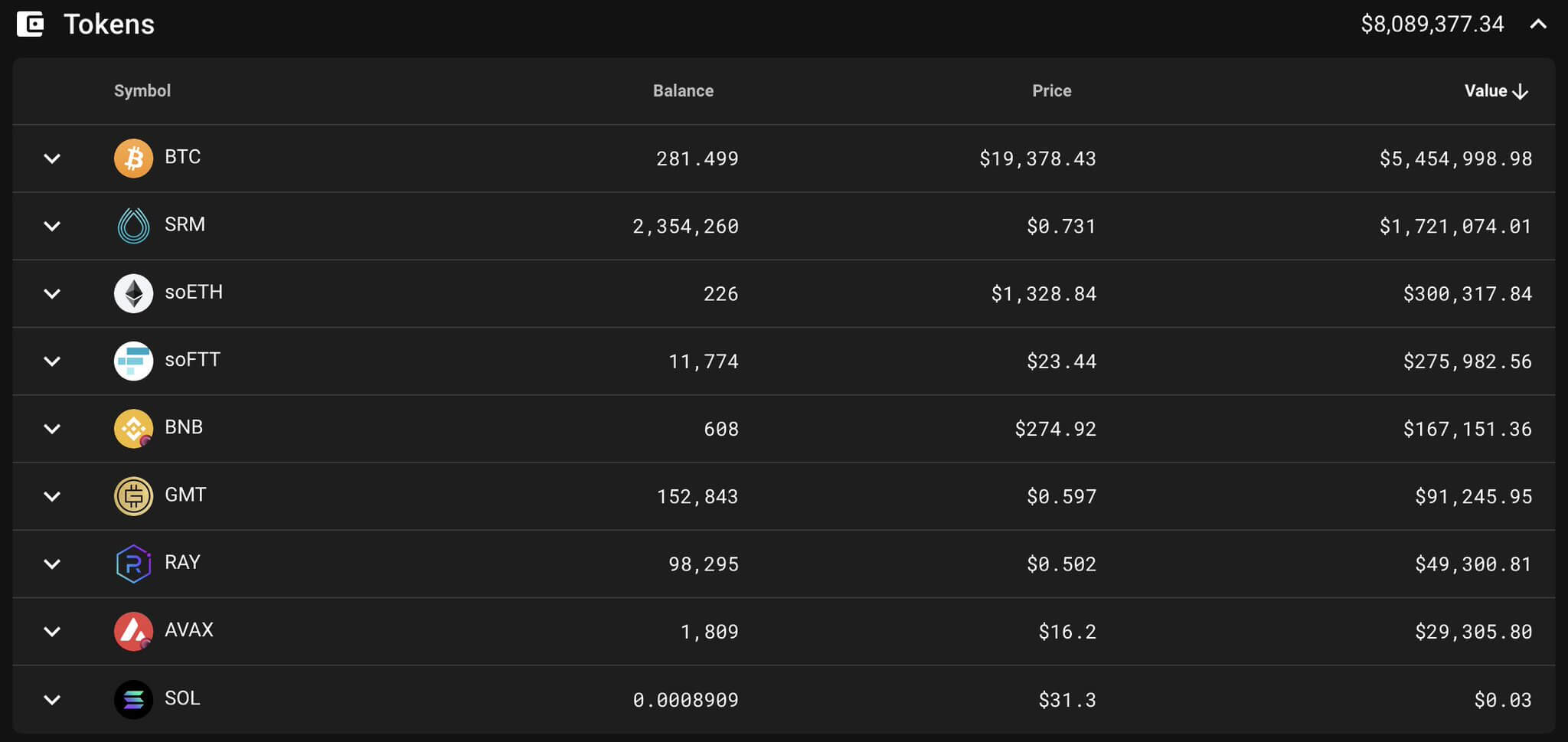

It is important to note that the hacker responsible for the Mango Markets hack has recovered the equivalent of $8 million from the project today. Accordingly, negotiations with him have yielded the first positive result.

Crypto-assets refunded by the hacker who hacked the Mango Markets platform

So far in 2021, a major anti-record has been set in terms of the amount of losses from various types of attacks on crypto projects, as well as their number. However, at the current pace, 2022 could “likely surpass” last year’s figures, as 125 hacks have so far resulted in more than $3 billion in damages.

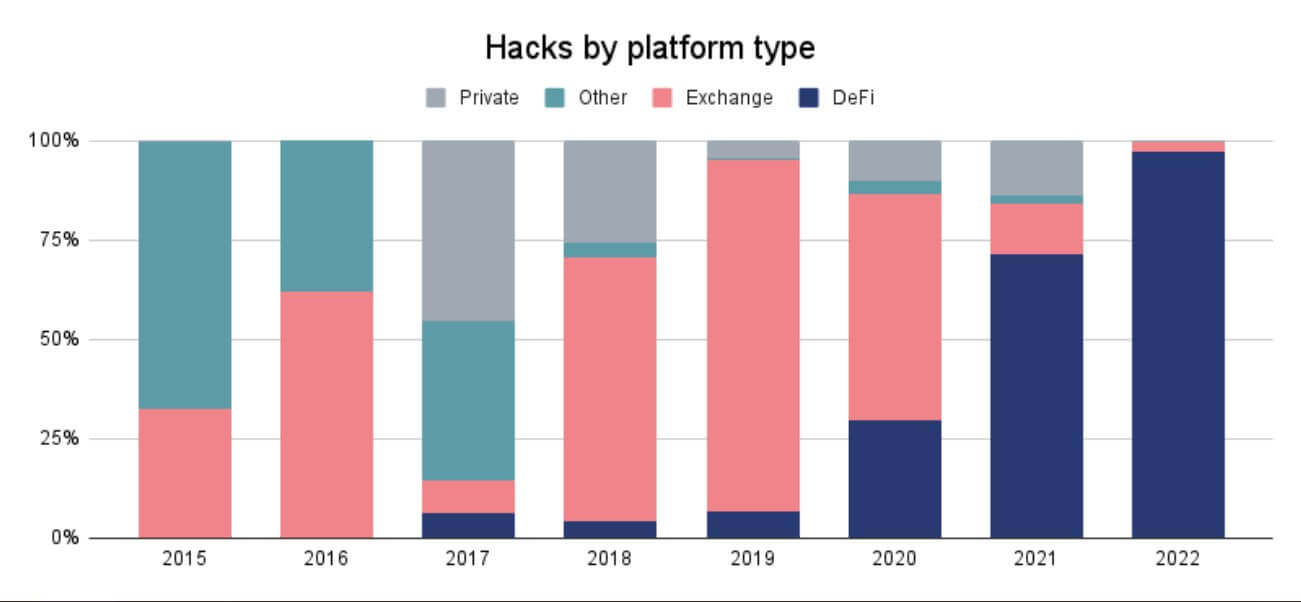

Furthermore, Chainalysis has also noticed a shift in the priority of hackers’ top targets. Whereas a couple of years ago most of the losses were incurred by centralized exchanges, now 90 percent of hacking incidents involve decentralized protocols. So one of the benchmarks for the next bullrun should be DeFi security work.

Loss volumes across different areas of the crypto industry

Unfortunately, it is impossible to eliminate cybercrime in the crypto industry, as various smart contracts are created by people who are prone to making mistakes. Hacking is also a common phenomenon in traditional finance, although there is much more funding available to combat it.

We think the situation with miners of Bitcoin and other cryptocurrencies is fairly typical of a bearish trend in the coin niche. It clearly demonstrates the decline of digital assets, which causes the earnings of the owners of computing equipment to sag. Consequently, they are forced to sell more coins to maintain their operating costs like space and power to get the same fiat equivalent. However, it is important to remember that sooner or later the situation will change, the collapse period will plateau, and then the same miners and other blockchain industry participants will begin to increase their profitability.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. We also talk about other important topics there.